From: Terry Reilly

Sent: Monday, August 13, 2018 5:53:17 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/13/18

PDF attached

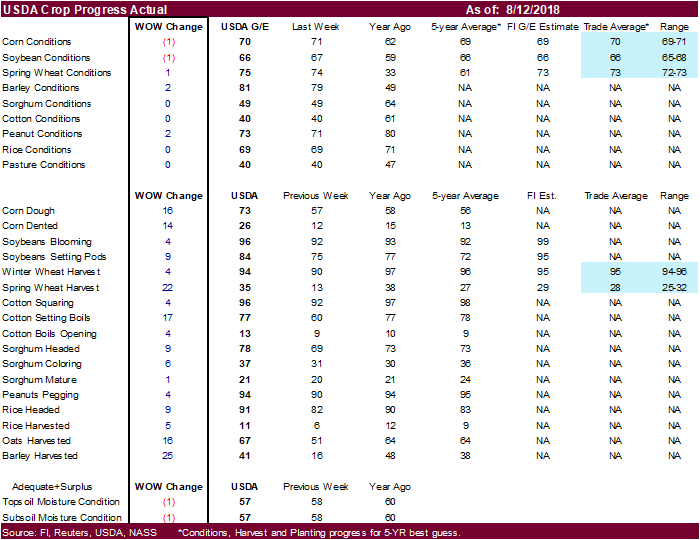

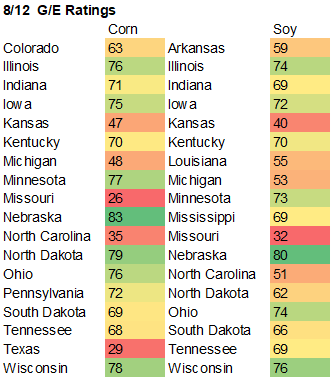

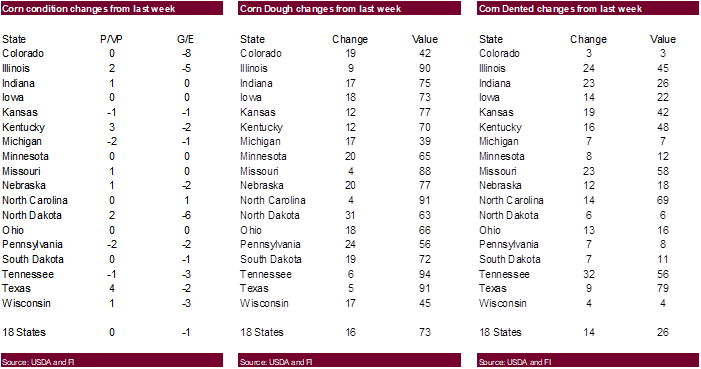

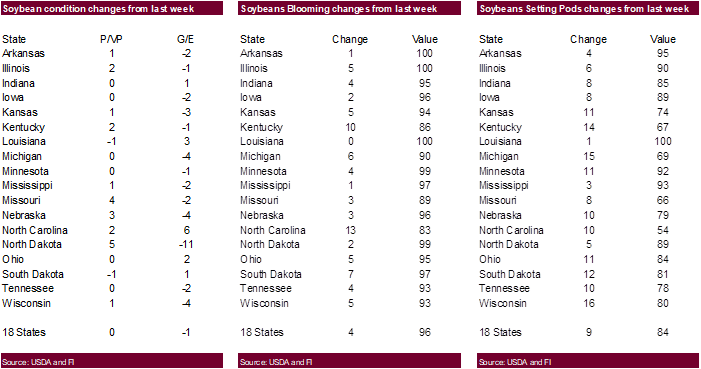

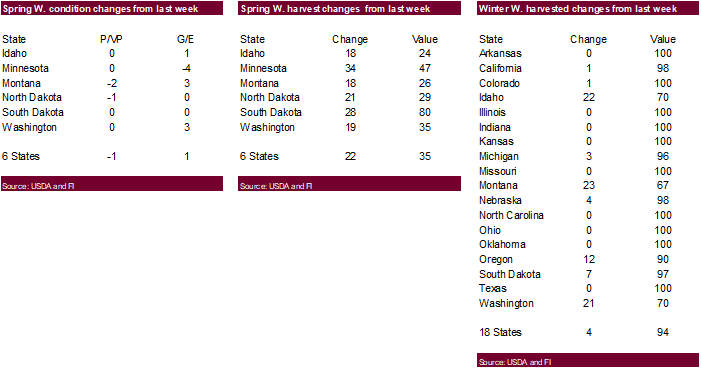

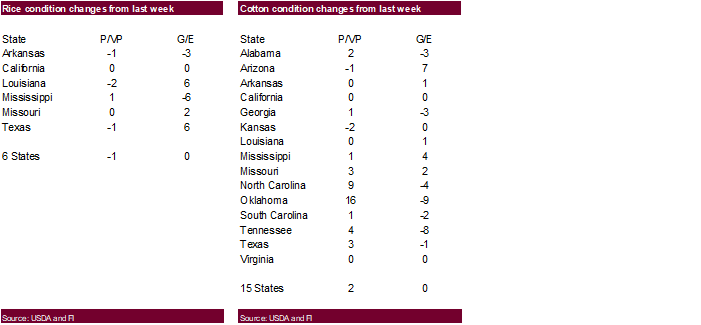

· USDA US crop conditions declined one point in the combined good and excellent categories for corn and soybeans.

· US barley conditions were up 2 in the G/E categories. Sorghum was unchanged. Oats were not reported.

· US spring wheat conditions improved one point (+2 good and -1 excellent)

· US rice conditions were down one point in the excellent and up one point in the good.

· US cotton conditions were unchanged.

It was hot over the weekend across the northwestern United States and the Canada’s Prairies

o 110 degrees Fahrenheit at Boise, Idaho

o 107 in southeastern Saskatchewan

o 105 in southern British Columbia

o 104 in southern Alberta

o 107 in northeastern Montana

· US weather will turn favorable this week with less threatening temperatures and forecasts for rain in some dry areas.

· Forecast for US rainfall this week calls for scattered showers and thunderstorms from Texas to Nebraska and east through the Midwest, Delta and Tennessee River Basin.

· Rainfall in the heart of the Midwest will vary from 0.50 to 1.50 inches by Sunday.

· Northern Plains rainfall will vary from 0.10 to 0.60 inch and local totals to 0.75 inch, but most of the region will experience net drying until next weekend when greater rain falls in the east.

· The Delta will see daily rounds of showers and thunderstorms through the next 7 days.

· Upcoming Thomson Reuters crop tours: August 6-8: U.S. corn & soybeans

· Two waves of rain will move through northwestern portions of the CIS during the coming week. Most of the precipitation will occur from western Ukraine, Belarus and Baltic States across northwestern Russia to the Volga-Vyatsk.

· India’s monsoon is not likely to resume normally in the west or far south for another 5 days and that will continue of some concern.

· Canada’s Prairies continues to suffer from drought. Some rain may develop this weekend.

· Western Australia, South Australia and Victoria may see rain this week, but New South Wales and Queensland remain dry.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Wed 75% cvg of 0.50-2.0”

and local amts over 3.50”

in most areas from east-

central and SE Neb. and

east Ks. to east-central

and NE Mo. with up to

0.50” and locally more

elsewhere; far NW

driest

Tue-Thu 90% cvg of 0.15-1.0”

and local amts over 2.0”;

south Il. to central In.

wettest

Thu-Fri 10-25% daily cvg of

up to 0.50” and locally

more each day; central

and south wettest

Fri-Sat 10-25% daily cvg of

up to 0.50” and locally

more each day

Sat-Aug 20 75% cvg of up to 0.75”

and local amts over 1.75”

Sun-Aug 20 70% cvg of up to 0.75”

and local amts over 1.75”;

wettest west

Aug 21 60% cvg of up to 0.60” 50% cvg of up to 0.50”

and locally more; and locally more;

driest NW wettest south

Aug 22-23 Up to 20% daily cvg of Up to 20% daily cvg of

up to 0.20” and locally up to 0.20” and locally

more each day more each day

Aug 24-27 10-25% daily cvg of 10-25% daily cvg of

up to 0.35” and locally up to 0.35” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Tue 15-25% daily cvg of

up to 0.50” and locally

more each day;

wettest north

Tdy-Wed 10-25% daily cvg of

up to 0.40” and locally

more each day

Wed-Fri 60% cvg of 0.35-1.50”

and local amts to 3.0”

north with up to 0.35”

and locally more in

central and southern

areas

Thu-Sat 65% cvg of up to 0.75”

and local amts to 1.75”;

driest SE

Sat-Aug 20 65% cvg of up to 0.75”

and local amts to 1.75”;

driest south

Sun-Aug 20 60% cvg of up to 0.50”

and local amts to 1.10”

Aug 21-22 40% cvg of up to 0.50”

and locally more;

wettest north

Aug 21-23 60% cvg of up to 0.65”

and locally more

Aug 23-27 10-25% daily cvg of

up to 0.35” and locally

more each day

Aug 24-27 15-35% daily cvg of

up to 0.50” and locally

more each day

Source: World Weather and FI

Bloomberg weekly agenda

MONDAY, AUG. 13:

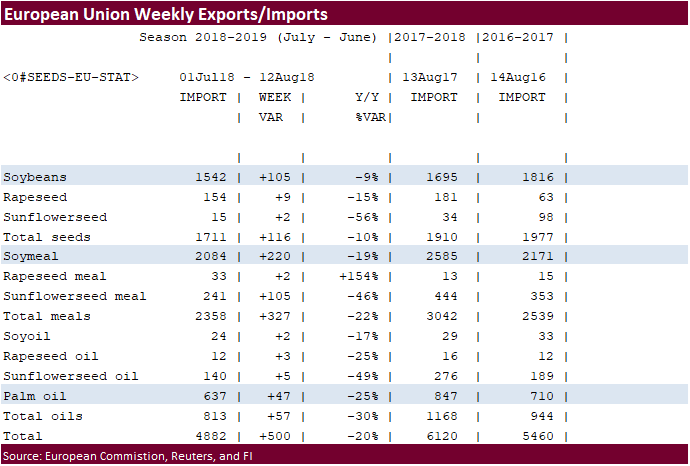

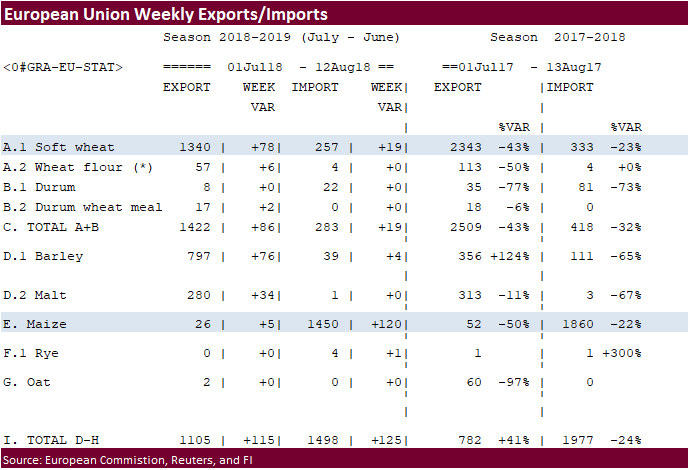

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

- Malaysia announces crude palm oil export tax for September

- EARNINGS: Wilmar International, Ros Agro, Sao Martinho

TUESDAY, AUG. 14:

- Secretary Perdue in California and Wednesday

- Olam International media briefing on earnings, 10:30am Singapore Aug. 14 (10:30pm ET Aug. 13)

- EARNINGS: JBS, Golden Agri- Resources, Olam International, WH Group, Marfrig

WEDNESDAY, AUG. 15:

- India on holiday

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-15 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday)

- SGS data for same period, 3am ET Wednesday (3pm Kuala Lumpur Wednesday)

- EIA U.S. weekly ethanol inventories, output, 10:30am

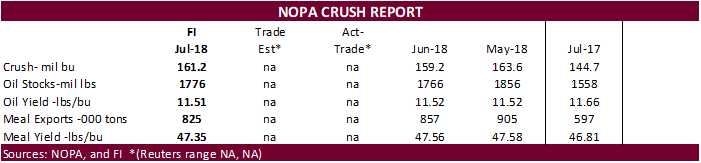

- National Oilseed Processors Association report on U.S. soybean processing data, noon

- The Salvadoran coffee council releases monthly El Salvador export data

THURSDAY, AUG. 16:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 17:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: Deere & Co.

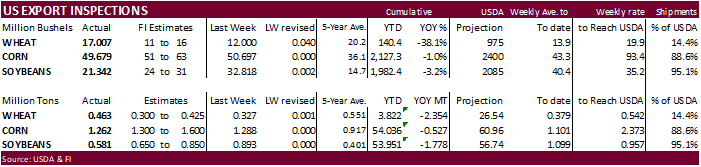

USDA inspections versus Reuters trade range

Wheat 462,854 versus 300,000-450,000

Corn 1,261,900 versus 800,000-1,600,000

Soybeans 580,824 versus 600,000-900,000

Corn.

- Corn ended 1.25-1.75 cents lower on US weather returning to a more favorable pattern, higher soybeans and lower wheat. Our short-term outlook is for corn to remain in a sideways trading range.

- The funds sold an estimated net 2,000 corn contracts.

- Domestic end users and importers are attracted to back month corn prices. USDA’s announcement system reported corn was bought by Mexico for 2019-20 arrival.

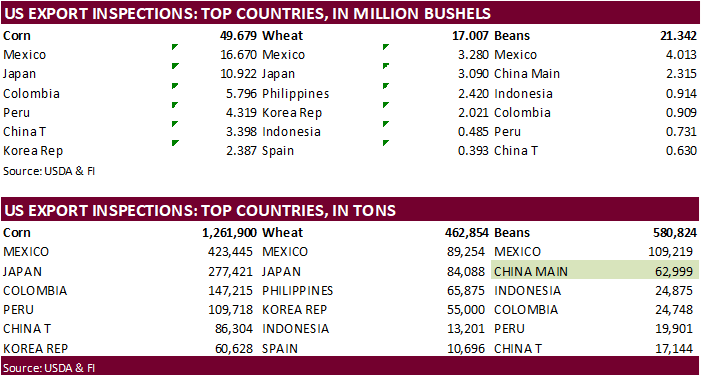

· USDA US corn export inspections as of August 09, 2018 were 1,261,900 tons, within a range of trade expectations, below 1,287,772 tons previous week and compares to 761,317 tons year ago. Major countries included Mexico for 423,445 tons, Japan for 277,421 tons, and Colombia for 147,215 tons.

· USDA US crop conditions declined one point in the combined good and excellent categories for corn.

· US barley conditions were up 2 in the G/E categories. Sorghum was unchanged. Oats were not reported.

- Recall USDA on Friday increased their corn production outlooks for 2018 Ukraine and Russia. This added pressure to CBOT corn on Monday.

- Argentina is still struggling with low river levels (lowest in decade) and it continues to disrupt shipping. Grain ships in the Rosario metro area will continue to load beneath capacity -Rosario Exchange.

- Today was the last day of the Goldman Roll.

- African swine fever was discovered in Ghana.

- Turkey’s currency hot another all-time low.

· Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 213,372 metric tons of corn for delivery to Mexico. Of the total 142,248 metric tons is for delivery during the 2018/2019 marketing year and 71,124 metric tons is for delivery during the 2019/2020 marketing year; and

· China sold about 61.4 million tons of corn out of reserves this season. Another 8 million tons will be offered this week.

Soybean complex.

· A couple positive developments on the US exports reversed the negative undertone in CBOT soybeans as prices saw nearly a 20-point swing in the September contract. A wide two-sided trade was also realized in soybean meal and soybean oil. US export inspections this week included a cargo for China and under the 24-hour announcement system US exporters sold soybeans to Mexico. Soybeans initially extended losses early Monday from follow through selling on record ending stocks for US and world as predicted by USDA and mostly favorable US weather. Good rains fell in the southern US Great Plains. This pressured wheat as well, but that market never recovered like the soybean complex. The northern part of the US Corn Belt had rain over the weekend but rain that fell last week boosted soil moisture levels.

· The volatility has prompted the CME to raise soybean futures margins by 14.6 percent to $2,350 per contract from $2,050 for August and September 2018 futures, effective August 14. Other margin changes by month were changed as well. https://www.cmegroup.com/notices/clearing/2018/08/Chadv18-321.html#pageNumber=1

· Funds bought an estimated net 4,000 soybeans, bought 2,000 soybean meal and bought 2,000 soybean oil.

· New-crop soybeans were sold to Mexico.

· US temperatures this week are nonthreatening.

· Some traders are looking for China to purchase US soybeans in coming weeks to make up for a Q4 shortfall in supplies. There is one 70,000-ton US soybean cargo unloading at Dalian, according to Reuters. It’s been parked there for a month. Port congestion was one of the reasons for the delay. Sinograin will pay the tariff on the delayed 70,000-ton cargo of about $6 million (USD).

· USDA US soybean export inspections as of August 09, 2018 were 580,824 tons, below a range of trade expectations, below 893,158 tons previous week and compares to 590,887 tons year ago. Major countries included Mexico for 109,219 tons, China Main for 62,999 tons, and Indonesia for 24,875 tons.

· USDA US crop conditions declined one point in the combined good and excellent categories for soybeans.

· NOPA is due out on Wednesday with the July crush. Look for a record for the month, but down slightly on a daily adjusted basis from June due to downtime.

· The Argentine peso weakened to a new low. The central bank raised its main interest rate to 45 percent and will leave it at that level until October.

· Malaysia’s CPO export tax was set at zero percent for September, down from 4.5 percent in August.

· Germany plans to end the use of glyphosate. A major ag company recently lost a case in California and some SA countries are looking to end the use as well.

- Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 142,500 metric tons of soybeans for delivery to Mexico during the 2018/2019 marketing year.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold 1.091 million tons of soybeans out of reserves so far, this season.

· US wheat futures fell on improving US weather and spring wheat harvesting pressure. The long fund position in wheat is starting to come off and that added to the negative undertone.

· Funds sold an estimated net 8,000 SRW wheat contracts.

· EU December wheat was 6.00 euros lower at 206.75 euros.

· US wheat inspections were second highest season to date.

· USDA US all-wheat export inspections as of August 09, 2018 were 462,854 tons, above a range of trade expectations, above 326,584 tons previous week and compares to 511,624 tons year ago. Major countries included Mexico for 89,254 tons, Japan for 84,088 tons, and Philippines for 65,875 tons.

· US spring wheat conditions improved one point (+2 good and -1 excellent)

· US spring wheat harvest progress was reported up 22 points to 35 percent, 7 points above a Reuters trade guess and compares to 27 percent for the 5-year average.

· US winter wheat harvest progress was reported up 4 points to 94 percent, one point above a Reuters trade guess and compares to 96 percent for the 5-year average.

· After the close Egypt announced they are in for wheat for September 21-30 and October 1-10 shipment.

· Egypt extended their timeframe allowing wheat imports continuing up to 13.5 percent moisture through early March. They extended it 9 months retroactive July 3.

· Ukraine’s AgMin said the wheat harvest is nearly complete at 24.4 million tons, 98 percent of the planned area.

· Russian cash wheat prices for export posted its first weekly decline in 7 weeks. IKAR reported $230/ton.

· FC Stone estimated the Australia wheat crop at 18.77 million tons, a drop from 20.27 million tons from June and well below ABARES’s 21.9 million tons and USDA’s 22.0MMT. NAB is at 18.4MMT. Look for USDA to lower Ausi production and exports (16MMT currently) in September.

· Egypt is in for wheat for September 21-30 and October 1-10 shipment.

· Iraq seeks 50,000 tons of milling wheat on 8/15.

· Jordan issued an import tender for 120,000 tons of hard milling wheat on August 15.

· China sold 1,303 tons of imported wheat at auction at an average price of 2351 yuan/ton ($341.79/ton), 0.07% of what was offered.

· China sold 2,070 tons of 2012 wheat at auction at an average price of 2360 yuan/ton 2% of what was offered.

· Jordan issued an import tender for 120,000 tons of feed barley on August 14.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

Rice/Other

· US rice conditions were down one point in the excellent and up one point in the good.

· US cotton conditions were unchanged.

· China sold 26,191 tons of rice at auction at an average price of 2642 yuan/ton ($384.29/ton), 3% of what was offered.

· Results awaited: Iraq seeks 30,000 tons of rice on August 12, open until Aug 16. Lowest offer was $449.50/ton c&f from Thailand.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.