From: Terry Reilly

Sent: Tuesday, August 14, 2018 4:26:13 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/14/18

PDF attached

Corn.

- The funds bought an estimated net 15,000 corn contracts.

- Corn is higher after rebounding from yesterday’s selloff.

- Some analysts think we’ve fallen too far, too fast following the USDA WASDE report.

- USDA US crop conditions declined one point in the combined good and excellent categories for corn.

· UkrAgroConsult raised its forecast for Ukraine’s 2018 grain harvest to 62.6 million tons from previous 61.4MMT. they increased the corn output to record 28.5 million tons from 27.3 million tons previously. Grain exports were projected at 42.5 million tons from 41.0 million tons a month ago.

- China’s AgMin confirmed an outbreak of foot and mouth disease in its central province of Henan. They culled 173 pigs at a processing plant. That is the seventh case of the O-type strain of the disease found in livestock this year.

Soybean complex.

· Soybeans and meal are higher on Argentina export tax news and technical buying. Soybean oil is under pressure from meal/oil spreading.

· USDA US crop conditions declined one point in the combined good and excellent categories for corn and soybeans.

· Funds bought an estimated net 6,000 soybeans, bought 8,000 soybean meal, and net unchanged on soybean oil.

· Argentina suspended their export tax program on soybean meal and soybean oil for six months. Each month they gradually lowered export taxes by a half percent. Exports of both products are currently taxed at 23 percent, having been gradually lowered from 32 percent in 2015.

· Argentina’s economy has been struggling recently with the central bank raising its key interest rate by 5 percentage points to 45 percent until at least October.

· Reuters noted that by the end of 2019 soymeal and soybean oil export taxes should have been at 18 percent compared with the 15 percent planned before the suspension.

· US temperatures this week are nonthreatening.

· China’s provinces in the northeast, such as Jilin and Liaoning, continue to see heavy rain.

· India’s July palm oil imports fell 33 percent in July from a year earlier to 550,180 tons. 352,325 tons of soybean oil was also imported, down about 25 percent from last year. All vegetable oil imports were 1.12 million tons, off 27 percent from last year.

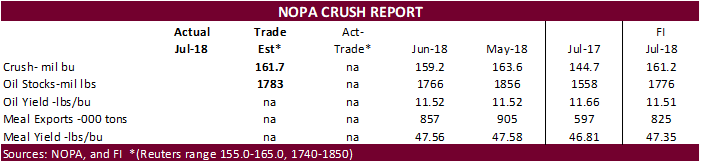

· NOPA is due out on Wednesday with the July crush. Look for a record for the month, but down slightly on a daily adjusted basis from June due to downtime.

· US wheat futures rises on technical buying and global demand.

· US spring wheat conditions improved one point (+2 good and -1 excellent)

· Funds bought an estimated net 7,000 SRW wheat contracts.

· EU December wheat was 1.25 euros higher at 208.00 euros.

· Manitoba’s crop report showed crop conditions in that Canadian province fell last week because of drought.

· Argentina’s weather is not completely ideal for early wheat establishment, but the country should still realize a large crop based on area expansion.

· Ukraine harvested 33.4 million tons of grain so far, which includes early summer grain.

Export Developments.

· Egypt bought 420,000 tons of wheat for September 21-30 and October 1-10 shipment.

o CHS: 60,000 tons of Romanian wheat at $230.99 FOB and $15.34 freight, equating to $246.33 cost and freight (C&F)

o GTCS: 60,000 tons of Russian wheat at $232 FOB and $16.60 freight, equating to $248.60 C&F

o GTCS: 60,000 tons of Russian wheat at $233 FOB and $15 freight, equating to $248 C&F

o GTCS: 60,000 tons of Russian wheat at $233 FOB and $16.60 freight, equating to $249.60 C&F

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.