From: Terry Reilly

Sent: Thursday, August 16, 2018 5:02:31 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/16/18

PDF attached

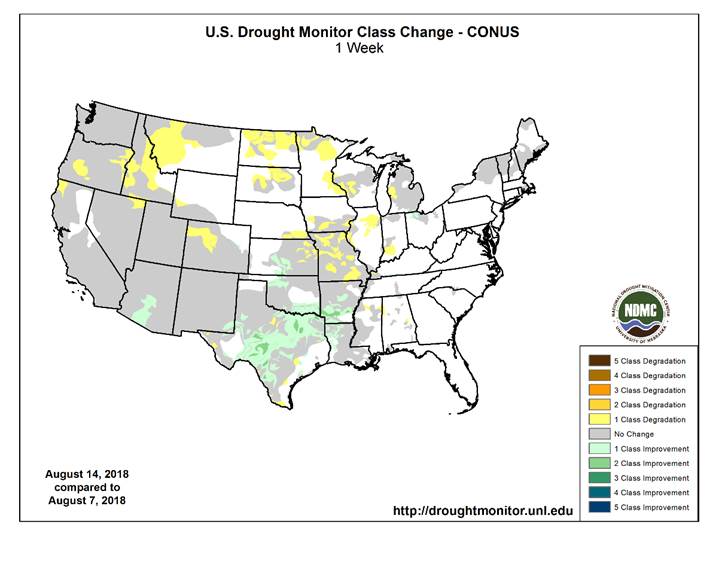

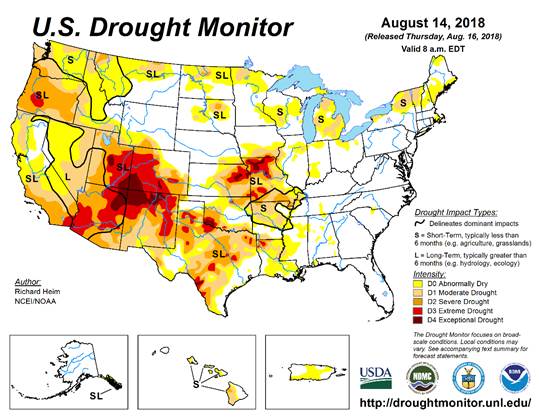

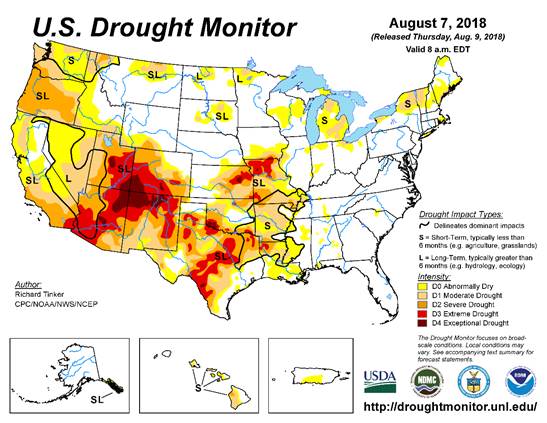

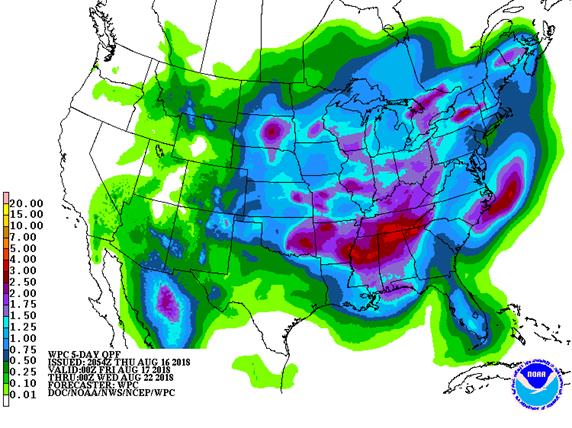

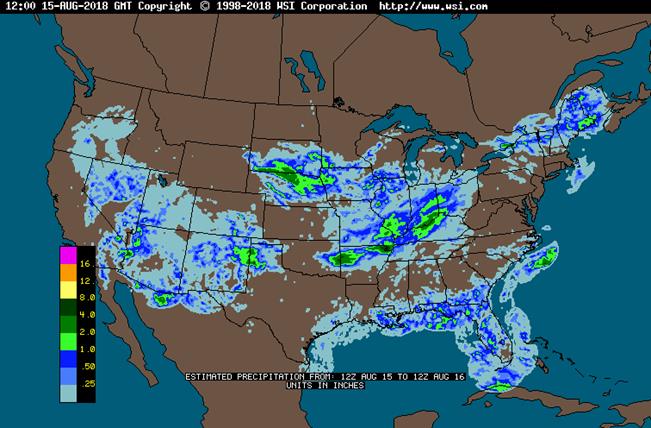

· The upper U.S. Midwest is wetter today in the European and GFS model runs.

· US weather will remain favorable this week into next week with timely rainfall and less threatening temperatures.

· The Northern U.S. Delta and Tennessee River Basin will see good rains.

· West Texas will see rain this weekend.

· Canada’s Prairies will receive scattered showers and thunderstorms during the coming week.

· Argentina will receive rain in the central and east this weekend.

· Western Australia will see limited rain in northern and eastern parts of the production region during the next ten days.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy 60% cvg of up to 0.75”

and local amts to 2.0”;

wettest NE; far NW

driest

Tdy-Fri 90-100% cvg of 0.15-0.90”

and local amts over 2.0”;

west Ky. to south In.

wettest

Fri-Sat 10-15% daily cvg of

up to 0.25” and locally

more each day; wettest

east Friday and wettest

west Saturday

Sat 30% cvg of up to 0.40”

and local amts to 1.10”;

south and east wettest

Sun 10% cvg of up to 0.20”

and locally more

Sun-Mon 80% cvg of up to 0.75”

and local amts over 2.0”;

far NW driest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 1.50”

Tue 10% cvg of up to 0.20”

and locally more

Wed-Aug 23 50% cvg of up to 0.40”

and local amts to 1.0”;

far NW driest

Wed-Aug 24 5-20% daily cvg of up

to 0.25” and locally

more each day

Aug 24-25 45% cvg of up to 0.75”

and locally more;

wettest north

Aug 25-26 50% cvg of up to 0.60”

and locally more

Aug 26-28 65% cvg of up to 0.70”

and locally more

Aug 27-28 70% cvg of up to 0.50”

and locally more

Aug 29-31 5-20% daily cvg of up 10-25% daily cvg of

to 0.25” and locally up to 0.25” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy 25% cvg of up to 0.75”

and locally more;

wettest south

Tdy-Fri 75% cvg of 0.60-1.50”

and local amts to 3.0”

north with up to 0.60”

and locally more in

central and southern

areas

Fri-Sun 85% cvg of 0.35-1.50”

and local amts over 3.0”

from east Ms.to west

Ga. with up to 0.75”

and local amts to 2.0”

elsewhere

Sat-Sun 80% cvg of up to 0.75”

and local amts to 2.75”;

far north and far south

driest

Mon-Tue 75% cvg of up to 0.55”

and local amts to 1.20”

Mon-Wed 80% cvg of up to 0.75”

and local amts to 2.0”

Wed-Aug 24 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 23-25 60% cvg of up to 0.75”

and local amts to 1.50”;

driest west

Aug 25-26 60% cvg of up to 0.65”

and local amts to 1.40”;

wettest north

Aug 26-30 15-35% daily cvg of

up to 0.60” and locally

more each day

Aug 27-30 5-20% daily cvg of up

to 0.30” and locally

more each day

Source: World Weather and FI

Bloomberg weekly agenda

THURSDAY, AUG. 16:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 17:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: Deere & Co.

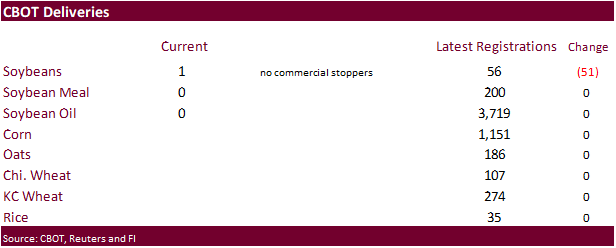

- Soybeans down 51 to 56, Cofco Chicago

Weekly Bloomberg Bull/Bear survey (taken Wed)

· Soybeans: Bullish: 1 Bearish: 7 Neutral: 3

· Wheat: Bullish: 2 Bearish: 3 Neutral: 6

· Corn: Bullish: 5 Bearish: 1 Neutral: 5

· Raw Sugar : Bullish: 1 Bearish:3 Neutral: 3

· White sugar: Bullish: 2 Bearish: 3 Neutral: 2

· White-sugar premium: Widen: 1 Narrow: 4 Neutral: 2

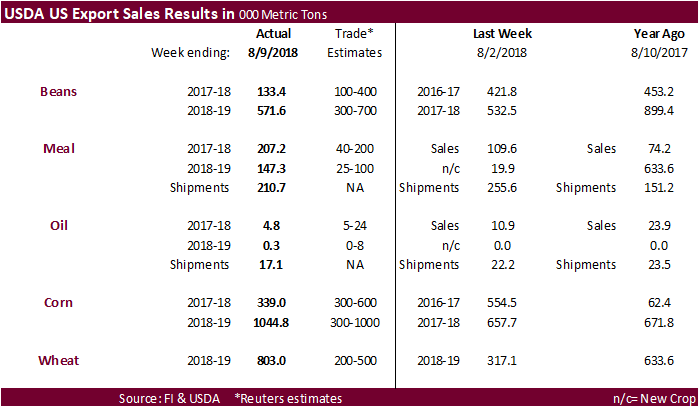

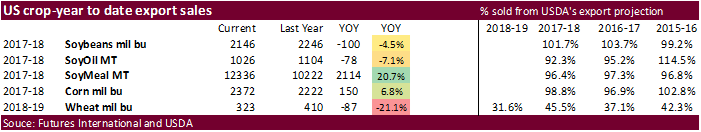

USDA Export Sales were within expectations for soybeans, above for soybean meal, below for soybean oil, within when combining old and new-crop for corn and well above for all-wheat.

· US stocks were higher, USD lower, WTI crude higher.

· Larry Kudlow Tells Fox China Delegation Coming To US For Talks. US Also Making Progress In Mexico Talks

· US Housing Starts (Jul): 1168K (est 1260K, prevR 1158K)

US Housing Starts (M/M) (Jul): 0.9% (est 7.4%, prevR -12.9%)

· US Building Permits (Jul): 1311K (est 1310K, prevR 1292K)

US Building Permits Change (M/M) (Jul): 1.5% (est 1.4%, prevR -0.7%)

· Philadelphia Fed Manufacturing Survey (Aug): 11.9 (est 22.0, prev 25.7)

· Canada Manufacturing Sales (M/M) (Jun): 1.1 (est 1.0%, prevR 1.5%)

· US Initial Jobless Claims (Aug 11): 212K (est 215K, prevR 214K)

US Continuing Claims (Aug4): 1721K (est 1740K, prevR 1760K)

· Canada June Manufacturing Sales Ex-Autos +0.9 Pct Vs May +2.7 Pct (REVISED From +2.6 Pct)

Canada June Factory New Orders -1.8 Pct Vs May +5.2 Pct (REVISED From +4.9 Pct)

Canada June Unfilled Orders +1.7 Pct; Inventories +0.5 Pct; Inventory-To-Sales Ratio 1.41

· ADP Says Canada Employment Increased 11,600 In July

Corn.

- Corn ended higher following soybeans and wheat.

- September and December ended above their respective 20 and 50-day MA. RIS basis Dec is at 54.72.

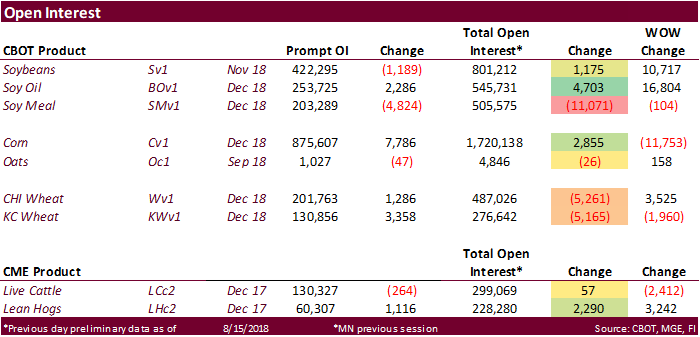

- The funds bought an estimated net 14,000 corn contracts.

- USDA export sales were within expectations for old-crop corn (339k) and above expectations for new-crop (1.045MMT). Shipments were 1.220 million tons.

- The US will see cool temperatures next week which should benefit crop development.

- The EPA reported 1.37 billion ethanol (D6) blending credits were generated in July, up from 1.26 billion in June, and up from 1.274 billion in July 2017.

· China sold 1.53 million tons of corn out of auction at an average price of 1544 yuan per ton, 38.4 percent of wheat was offered.

· China sold about 62.9 million tons of corn out of reserves this season.

· Another 4 million tons will be offered Friday.

Export Sales Highlights

· Corn: Net sales of 339,000 MT for 2017/2018 were down 39 percent from the previous week and 26 percent from the prior 4-week average. Increases were reported for Japan (263,100 MT, including 50,800 MT switched from unknown destinations), Colombia (133,300 MT, including 125,000 MT switched from unknown destinations and decreases of 3,100 MT), Mexico (61,400 MT, including decreases of 14,900 MT), Peru (43,300 MT, including 38,000 MT switched from unknown destinations and decreases of 600 MT), and El Salvador (13,300 MT). Reductions were primarily for unknown destinations (157,700 MT) and Vietnam (60,000 MT). For 2018/2019, net sales of 1,044,800 MT were reported for unknown destinations (320,000 MT), Mexico (298,100 MT), South Korea (126,000 MT), Japan (70,500 MT), and Taiwan (58,600 MT). Exports of 1,220,000 MT were down 15 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Mexico (463,100 MT), Japan (290,700 MT), Colombia (147,200 MT), Peru (109,700 MT), and Egypt (44,000 MT). Optional Origin Sales: For 2018/2019, new optional origin sales were reported for unknown destinations (244,000 MT) and Malaysia (55,000 MT). Decreases totaling 54,000 MT were reported for unknown destinations. The current outstanding balance of 965,000 MT is for unknown destinations (298,000 MT), South Korea (412,000 MT), Vietnam (130,000 MT), Saudi Arabia (70,000 MT), and Malaysia (55,000 MT).

· Barley: There were no net sales or exports reported during the week.

· Sorghum: Net sales of 30,100 MT for 2017/2018 were for Spain (30,000 MT) and South Korea (100 MT). There were no exports reported during the week.

Soybean complex.

· Renewed hope on a resolution to the China/US trade dispute sent a positive shock wave in commodities.

· The soybean complex ended sharply higher on news of a meeting between the US and China. China’s vice commerce minister will visit the US August 22-23.

· If any deal involving soybeans could be reached, we initially look for a 50-100 cent pop in soybeans over a 2-3 day period. We speculate November could rebound to nearly $10, but large US stocks may limit any appreciation beyond that level.

· Funds bought an estimated net 20,000 soybeans, bought 5,000 soybean meal, and bought 2,000 soybean oil.

· USDA reported new-crop soybean sales to Mexico.

· USD traded lower and US stocks were sharply higher.

· The supportive NOPA crush was noted in today trade. We look for USDA to boost old crop crush by 5-10 million bushels in September.

· USDA export sales for soybeans were on the lower side of a range of expectations but shipments were low at 586,600 tons. Soybean meal sales were good as they topped expectations. Soybean oil export sales were poor.

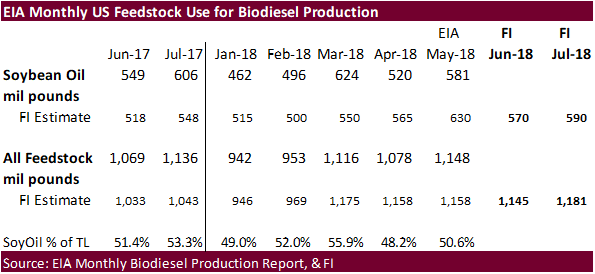

- The EPA reported 310 million biodiesel (D4) blending credits were generated in July, versus 318 million in June but well down from 372 million in July 2017. We look for soybean oil for biodiesel use to end up around 590 million pounds in July, up slightly from our June estimate (due out at the end of the month) but below 606 million pounds a year ago. See table below.

· US cash prices at the Gulf remain in a weaker state as US river basis soften in part to lack of producer selling.

· Shipping data from Bloomberg and Reuters shows another cargo of US soybeans entered China’s Dalian port.

· China bought at least 5 Argentina soybean cargos in recent days following the government’s move to freeze the gradual reduction in product export taxes.

· Ukraine rapeseed exports were projected by APK-Inform at 2.38 million tons this season, up 12 percent from 2017-18. Ukraine started rapeseed plantings for 2019 harvest.

· Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 154,404 metric tons of soybeans for delivery to Mexico during the 2018/2019 marketing year

- Iran seeks 30,000 tons of sunflower oil on September 24.

Export Sales Highlights

· Soybeans: Net sales of 133,400 MT for 2017/2018 were down 68 percent from the previous week and 52 percent from the prior 4-week average. Increases were reported for Iran (133,500 MT, including 131,000 MT switched from unknown destinations), the Netherlands (108,600 MT, including 95,500 MT switched from unknown destinations), Peru (19,900 MT, switched from unknown destinations and decreases of 100 MT), Colombia (18,200 MT, including 14,000 MT switched from unknown destinations), and Indonesia (18,000 MT, including decreases of 200 MT). Reductions were for unknown destinations (205,500 MT) and China (3,000 MT). For 2018/2019, net sales of 571,600 MT were reported for unknown destinations (373,200 MT), Mexico (102,000 MT), Turkey (30,000 MT), and Canada (20,000 MT). Exports of 586,600 MT were down 42 percent from the previous week and 24 percent from the prior 4-week average. The destinations included Iran (133,500 MT), the Netherlands (108,600 MT), Mexico (98,300 MT), China (63,300 MT), and Argentina (33,000 MT). Optional Origin Sales: For 2017/2018, the current optional origin outstanding balance of 66,000 MT is for unknown destinations. For 2018/2019, the current outstanding balance of 63,000 MT is for unknown destinations. Export for Own Account: The current exports for own account outstanding balance is 130,900 MT, all Canada.

· Soybean Cake and Meal: Net sales of 207,200 MT for 2017/2018 were up 89 percent from the previous week and 71 percent from the prior 4-week average. Increases were reported for Colombia (48,000 MT), the Philippines (47,200 MT), Romania (32,300 MT, including 30,000MT switched from unknown destinations), Morocco (25,700 MT), and Mexico (24,300 MT, including decreases of 100 MT). Reductions were reported for unknown destinations (28,400 MT), El Salvador (2,100 MT), and Costa Rica (2,000 MT). For 2018/2019, net sales of 147,300 MT reported for the Philippines (135,900 MT), Jamaica (6,000 MT), and Canada (5,500 MT), were partially offset by reductions for Mexico (100 MT). Exports of 210,700 MT were down 18 percent from the previous week and 21 percent from the prior 4-week average. The primary destinations were the Philippines (48,300 MT), Romania (32,300 MT), Morocco (31,000 MT), Colombia (25,000 MT), and the Dominican Republic (16,900 MT).

· Soybean Oil: Net sales of 4,800 MT for 2017/2018 were down 56 percent from the previous week and 39 percent from the prior 4-week average. Increases were primarily for Colombia (2,500 MT), Mexico (1,400 MT), and Nicaragua (800 MT). For 2018/2019, net sales of 300 MT were reported for Canada. Exports of 17,100 MT were down 23 percent from the previous week and 25 percent from the prior 4-week average. The primary destinations were the Dominican Republic (13,600 MT) and Mexico (3,000 MT).

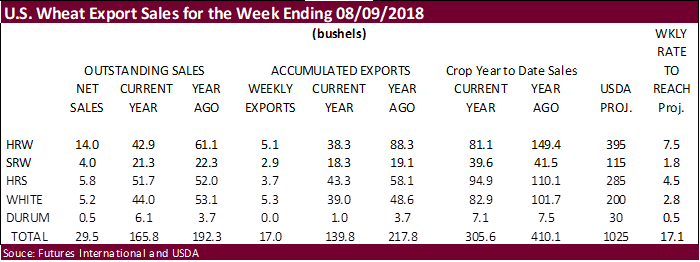

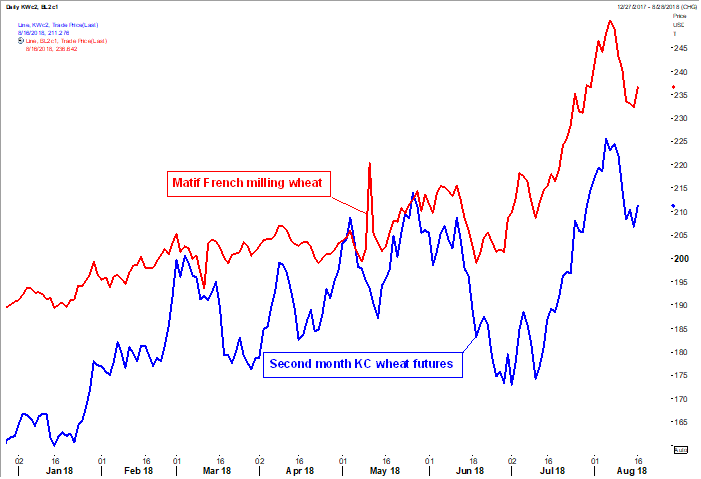

· US wheat ended higher on technical buying, great US export sales, China/US trade talk, and ongoing weather problems with Australia in focus. An easing USD added to the positive undertone.

· A US trade official mentioned they see a “breakthrough” in NAFTA soon.

· September and December Chicago wheat poked above its 20-day MA but settled below it. The same happened in KC and MN, in the front months. Technically wheat looks like it could break out to the upside soon.

· Funds bought an estimated net 4,000 SRW wheat contracts.

· EU December wheat was 2.75 euros higher at 210.75 euros. (using settlement)

· Australia is battling wildfires that are fueled by drought conditions. LT weather forecasts call for below-average rainfall for large parts of Australia until November.

· The EU awarded 82,000 tons of reduced tariff wheat imports of various origins.

· Egypt wheat reserves are running at about 4 months of consumption.

· Black sea wheat basis SEP settled -1.50 yesterday at 233.00. This marks the 5th consecutive lower close for this market. Look for reversal momentum today (MPI).

· USDA announced HRW wheat was sold to Iraq.

· USDA export sales for all-wheat of 803,000 tons were above expectations.

Export Developments.

· Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 200,000 metric tons of hard red winter wheat for delivery to Iraq during the 2018/2019 marketing year.

· The newswires reported 300,000 tons of wheat was sold to Iraq of NA origin at $324-$334/ton. USDA’s announcement confirm dome of it was US.

· China sold 1,000 tons of imported 2013 wheat out of auction at an average price of 2380 yuan per ton, or $344.40/ton, 0.06 percent of wheat was offered.

· Jordan seeks 120,000 tons of hard milling wheat on Aug 29 for Nov/Dec shipment.

· Jordan seeks 120,000 tons of feed barley on August 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

Rice/Other

· Iraq bought 60,000 tons of rice. 30,000 tons was thought to be from the United States at around $655 a ton c&f and 30,000 tons from Uruguay at $568.75 a ton c&f free out.

· Egypt’s ESIIC seeks 100,000 tons (150k previously_ of raw sugar on Aug 18 for shipment within the first half of September and two 50,000-ton shipments from September 15-Oct 15.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

Export Sales Highlights

· Wheat: Net sales of 803,000 MT for 2018/2019–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases were reported for Mexico (247,800 MT, including decreases of 100 MT), the Philippines (177,900 MT, including 60,000 MT switched from unknown destinations), Nigeria (140,000 MT), Japan (60,500 MT, including decreases of 16,000 MT), and Thailand (24,100 MT, including 24,000 MT switched from unknown destinations). Exports of 461,600 MT–a marketing-year high–were up 34 percent from the previous week and 17 percent from the prior 4-week average. The destinations were primarily to Mexico (101,300 MT), Japan (84,100 MT), the Philippines (65,900 MT), South Korea (55,200 MT), and Iraq (52,500 MT).

· Rice: Net sales of 27,600 MT for 2018/2019 were reported for Costa Rica (10,700 MT), Saudi Arabia (5,200 MT), Mexico (3,600 MT), Canada (3,600 MT), and Honduras (3,100 MT). Reductions were reported for Jordan (200 MT) and Panama (100 MT). Exports of 44,200 MT were primarily to Mexico (25,900 MT), El Salvador (5,300 MT), Canada (4,300 MT), Haiti (1,700 MT), and Panama (1,500 MT). Exports for Own Account: The current exports for own account outstanding balance is 100 MT, all Canada.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.