From: Terry Reilly

Sent: Monday, August 20, 2018 5:15:29 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/20/18

PDF attached includes updates on FI estimates for US yields

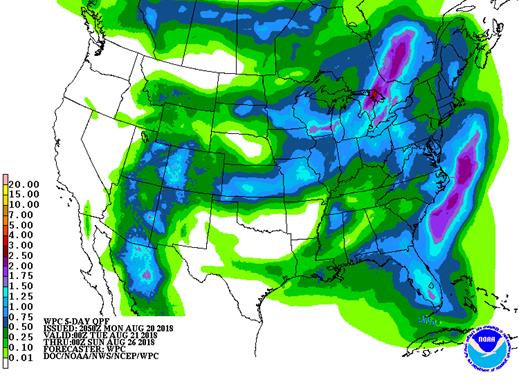

Prices could tick higher Monday night, but keep an eye on China/US trade developments and Black Sea wheat prices.

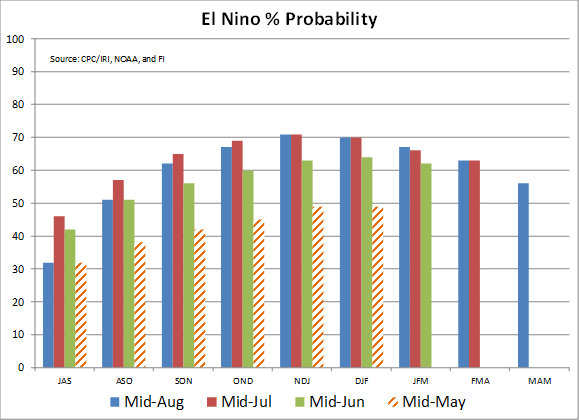

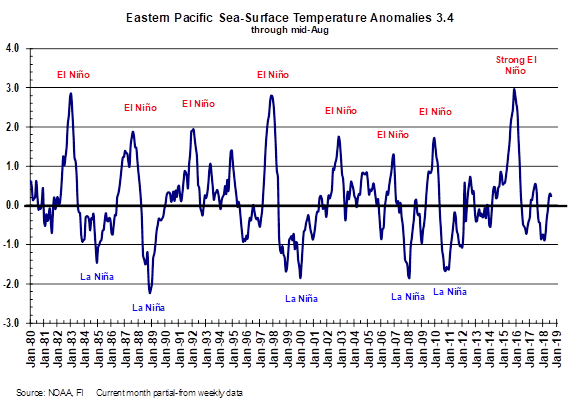

El Nino probabilities backed off over the short-term

Bloomberg weekly agenda

TUESDAY, AUG. 21:

- Egypt on Eid Al-Adha holiday

- Brazilian agency Conab’s 2nd estimate for 2018-19 sugarcane crop

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- ProFarmer U.S. crop tour, Day 2

WEDNESDAY, AUG. 22:

- India, Singapore, Malaysia, Indonesia, Egypt on holiday

- Agritel presser on French wheat harvest 2018 season, 3am ET (9am Paris)

- DBV outlook on German crop outlook

- ProFarmer U.S. crop tour, Day 3

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA cold-storage report for July, 3pm

THURSDAY, AUG. 23:

- China’s General Administration of Customs releases July agricultural commodity trade data (final), including imports of palm oil, wheat, cotton and corn, 2:30am ET (2:30pm Beijing)

- Intl Grains Council’s monthly market forecasts, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for July, 3pm

- Brazilian research foundation Fundecitrus releases report on greening incidence on oranges; Brazil is top producer, exporter

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- ProFarmer U.S. crop tour, Day 4

- U.S. is set to impose 25% tariffs on additional $16b in Chinese imports; China said it will retaliate

- EARNINGS: Sanderson Farms, Hormel Foods

FRIDAY, AUG. 24:

- ProFarmer issues final yield estimates after crop tour, 2pm

- USDA cattle-on-feed report for July, 3pm

- Unica bi-weekly report on Brazil Center-South sugar output

- Salvadoran coffee council’s El Salvador July export data

- Nicaragua’s coffee council releases July export data

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

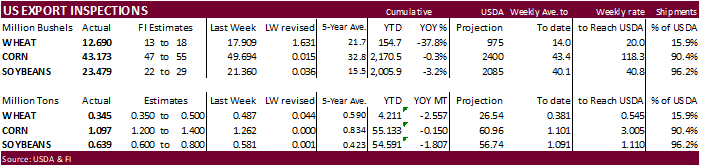

USDA inspections versus Reuters trade range

Wheat 345,375 versus 350,000-500,000 range

Corn 1,096,647 versus 800,000-1,600,000 range

Soybeans 639,001 versus 600,000-900,000 range

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 16, 2018

-- METRIC TONS --

-------------------------------------------------------------------------

CURRENT PREVIOUS

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 08/16/2018 08/09/2018 08/17/2017 TO DATE TO DATE

BARLEY 367 0 0 1,883 12,227

CORN 1,096,647 1,262,283 720,213 55,133,487 55,283,751

FLAXSEED 0 0 0 146 3,477

MIXED 0 0 0 24 24

OATS 0 0 0 1,198 1,497

RYE 0 0 0 0 0

SORGHUM 76,306 672 105,940 4,971,816 5,809,413

SOYBEANS 639,001 581,314 668,710 54,591,229 56,397,999

SUNFLOWER 0 0 0 335 383

WHEAT 345,375 487,399 592,678 4,211,424 6,768,077

Total 2,157,696 2,331,668 2,087,541 118,911,542 124,276,848

-------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

Corn.

- Corn ended 1.75-2.25 cents lower following wheat and soybean/corn spreading.

- News was light and US weather is mostly favorable.

- The funds sold an estimated net 6,000 corn contracts.

- Today was the start of the annual US ProFarmer Crop Tour. Results will be out Friday, August 24.

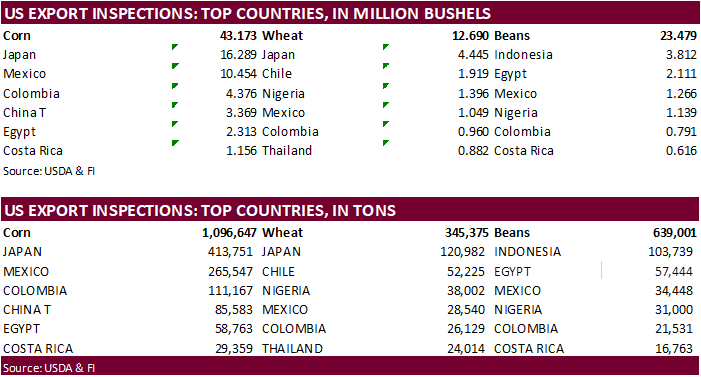

- USDA US corn export inspections as of August 16, 2018 were 1,096,647 tons, within a range of trade expectations, below 1,262,283 tons previous week and compares to 720,213 tons year ago. Major countries included Japan for 413,751 tons, Mexico for 265,547 tons, and Colombia for 111,167 tons.

· China reported its third outbreak of African Swine Fever over the weekend with 615 hogs infected in Jiangsu’s Lianyungang. As of early Monday, 88 were confirmed dead.

- Hot and dry weather in Ukraine was thought to lower late planted corn production prospects this season, and impact 2019 winter plantings. Corn harvesting is about to go into full swing. After rains fell mid-season, the AgMin increased its corn production estimate to record 28.5 million tons from 27.3 million tons previously.

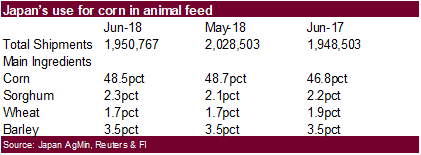

- Japan’s use of corn in animal feed declined in June from May but was slightly above a year ago.

· China sold about 63.7 million tons of corn out of reserves this season. Another 4 million tons will be offered late this week.

FI update on US yield.

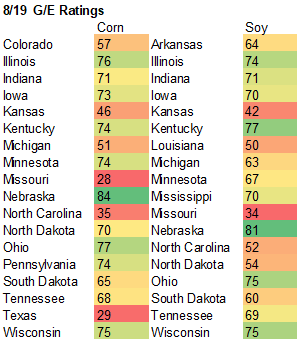

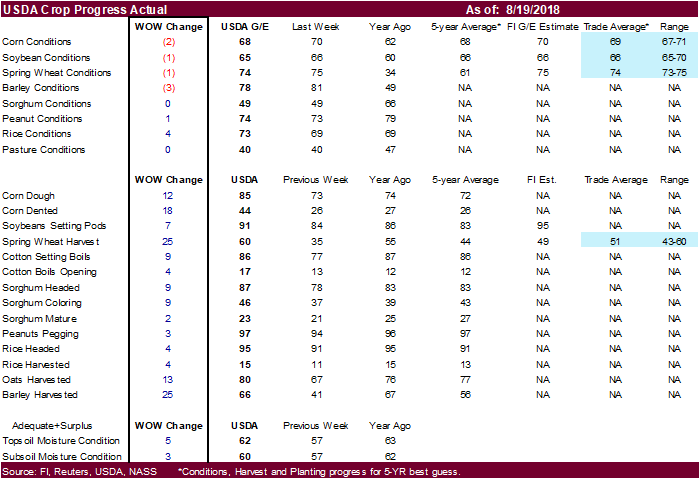

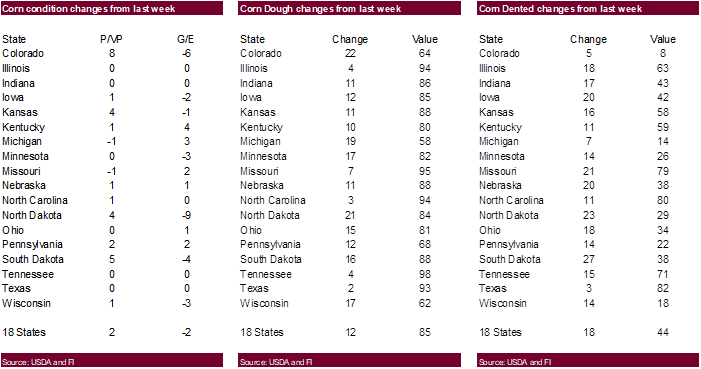

- G/E corn conditions fell two points to 68 percent, one more point than what the expected. G/E are down three consecutive weeks. On our FI weighted rating, they are down 4 consecutive weeks and lowest level since the start of 2018 weekly condition ratings.

- IL and IN were unchanged, IA down 2. Missouri improved 2.

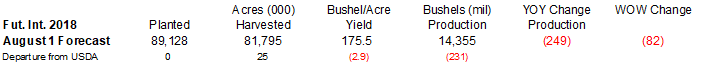

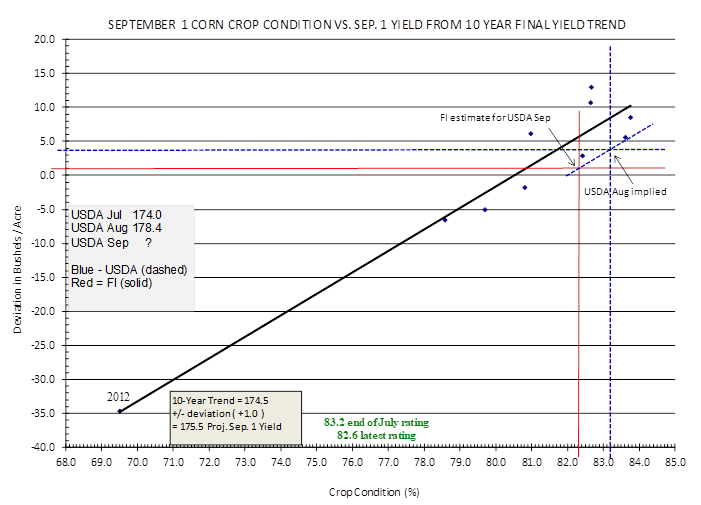

- Based on the latest FI adjust corn crop rating of 82.3, down from 82.6 last week and 83.2 at the end of July, we estimate the yield at 175.5 bushels per acre, 1.0 bushel below the previous week and 2.9 bushels below USDA. Production is projected 82 million bushels below the previous week at 14.355 million bushels, 231 below USDA and 249 million below 2017.

Soybean complex.

· Soybeans ended moderately higher in the nearby contracts and up 1-1.25 cents higher in the back months. Soybeans were sharply higher early on follow through buying on China/US trade talks scheduled next week (Aug 22-23). A downturn in soybean meal weighed on soybean prices. China soybean meal lost 1.4% overnight. CBOT soybean meal fell $0.40-$2.10/short ton. Soybean oil ended 31-33 points higher on unwinding of meal/oil spreads.

· Also weighing on soybean futures were large US production prospects.

· The funds were even in soybeans, sold 1,000 soybean meal and bought 3,000 contracts of soybean oil.

· Follow the Pro Farmer Midwest Crop Tour here on Twitter #pftour18

- USDA US soybean export inspections as of August 16, 2018 were 639,001 tons, within a range of trade expectations, above 581,314 tons previous week and compares to 668,710 tons year ago. Major countries included Indonesia for 103,739 tons, Egypt for 57,444 tons, and Mexico for 34,448 tons.

- Argentina was closed today for holiday.

- A Cofco official recently told a Chinese newspaper that they recently made inquiries on canola, cottonseed and sunflower seed meals with countries including India, Canada, and Ukraine to fill the US soybean gap. It was noted in the article that the price drop in pork has lowered soybean meal demand since May by 400,000 tons per month. China’s reserves of imported soybeans are ample now.

- Xinhua News noted China bought over 36 million tons of soybeans from South America during the May-August period and more buying will continue through November.

- A third US cargo of US soybeans sailed to China post 25 percent additional import tariff left east China’s port of Nantong near Shanghai but unloaded less than 50 percent of its load. Reuters said its headed for Australia.

· China’s growing problem with African Swine Fever is impacting domestic pork consumption and lowering the amount of available animal units, although by a fraction, but fundamentally scaring traders enough that it sent China soybean meal futures lower on Monday. China reported its third outbreak of African Swine Fever over the weekend with 615 hogs infected in Jiangsu’s Lianyungang. As of early Monday, 88 were confirmed dead. China’s soybean complex traded mixed. Soybeans were off 1.6%, soybean meal down 1.4%, while soybean oil was higher by 0.2% and palm increased 0.7%.

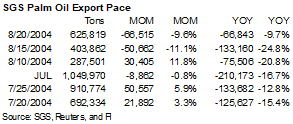

· Cargo surveyor SGS reported Aug 1-20 Malaysian palm exports at 625,819, down 66,515 tons or 10% from the same period a month ago and down 66,843 tons from the same period a year ago (10% decrease).

· AmSpec reported palm exports at 609,098 tons, down 10.6 percent from the previous period last month.

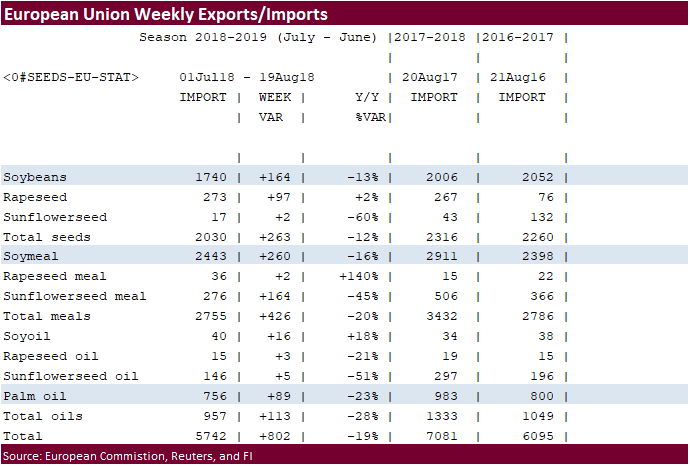

· EU granted 1.740 million tons of soybean imports so far this season starting July 1, down 13 percent from 2.006 million tons at this time last year. Traders were looking for a large increase in EU soybean imports this summer as China snapped up many of SA’s available supplies.

Export Developments

- Iran seeks 30,000 tons of sunflower oil on September 24.

FI update on US yield.

- G/E soybean conditions fell one point to 65 percent, same as what the trade expected. G/E are down three consecutive weeks. On our FI weighted rating, they are down 4 consecutive weeks and lowest level since the start of 2018 weekly condition ratings.

- IL was unchanged, IA down 2 and IN up 2.

- Based on the latest FI adjust soybean crop rating of 81.6, down from 81.7 last week and 82.5 at the end of July, we estimate the yield at 50.0 bushels per acre, 0.1 below the previous week and 1.6 bushel below USDA. Production is projected 9 million below the previous week and 149 million bushels below USDA at 4.437 billion, 45 million above 2017.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- Wheat futures set back on fund selling on expectations grain exports will soon rise out of the Black Sea region.

· Funds sold an estimated 9,000 contracts of Chicago wheat.

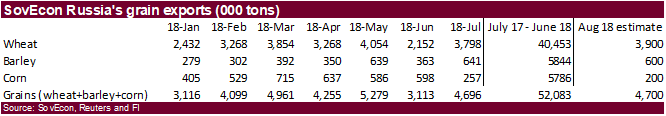

· Russia harvested 69.4 million tons of grain with an average yield of 3.12 tons per hectare from 48 percent of the harvesting area (AgMin). It had harvested 70.8 million tons with an average yield of 3.98 tons on the same date a year earlier.

· Russia plans to sell 2 million tons of grain from stocks during 2018-19. As of Aug. 17, Russia held 3.7 million tons of grain in stockpiles.

- USDA US all-wheat export inspections as of August 16, 2018 were 345,375 tons, within a range of trade expectations, below 487,399 tons previous week and compares to 592,678 tons year ago. Major countries included Japan for 120,982 tons, Chile for 52,225 tons, and Nigeria for 38,002 tons.

· Bulgaria harvested 5.3 million tons of wheat from 98.3 percent of the sown area by Aug. 20, below 5.7 million tons harvested a year earlier (AgMin).

· The Swedish Board of Agriculture estimated total cereal production 29 percent lower year-on-year at 4.2 million tons in 2018.

· EU December wheat was 3.00 euros lower at 211.75 euros.

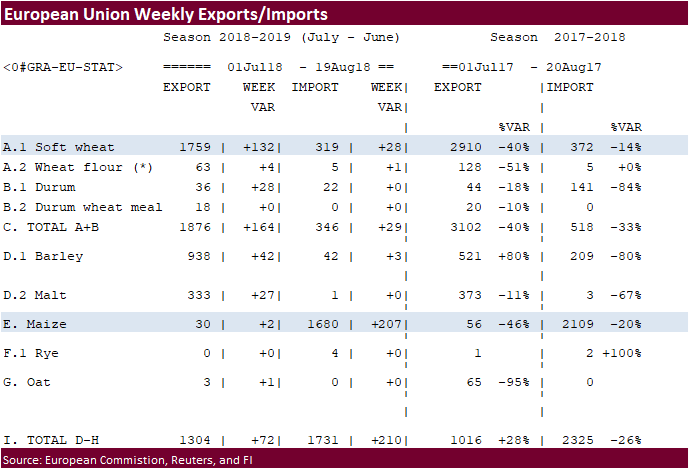

· The European Union granted export licenses for 78,000 tons of soft wheat imports, bringing cumulative 2018-19 soft wheat export commitments to 1.340 million tons, well down from 2.343 million tons committed at this time last year.

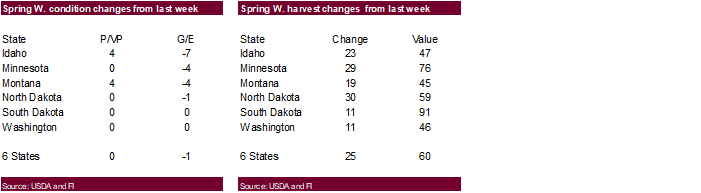

US Spring wheat update

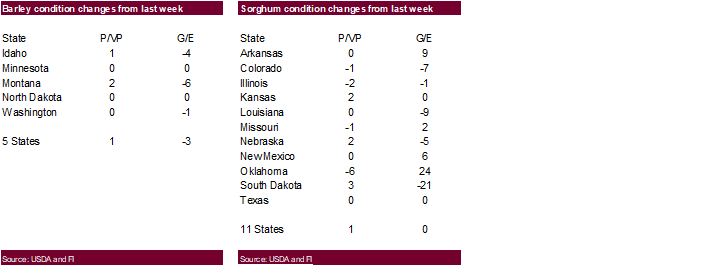

· USDA combined G/E SW rating declined one point to 74 percent from the previous week, in part to a sharp decline in ID (-7), MN (-4) and MT (-4). SW ratings are down 4 out of the past 5 weeks.

· Using our FI weighted index, SW ratings are running at 82.9, down from 83.4 last week and lowest for 2018 since June 10.

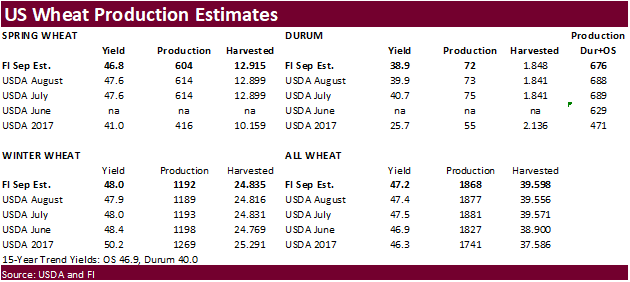

· We estimate USDA September other spring wheat yield at 46.8, down from 47.6 in August and compares to 41.0 last year.

· We estimate USDA September durum wheat yield at 38.9, down from 39.9 in August and compares to 25.7 last year.

Export Developments.

· China sold 4,055 tons of 2013 imported wheat at 2,350 yuan per ton ($341.87/ton), 0.24 percent of what was offered.

· Jordan seeks 120,000 tons of hard milling wheat on Aug 29 for Nov/Dec shipment.

· Jordan seeks 120,000 tons of feed barley on August 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

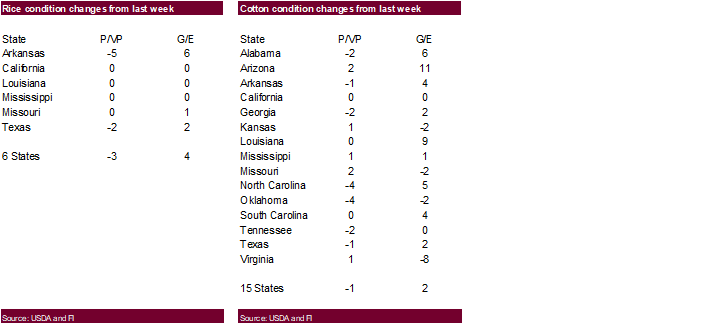

Rice/Other

· China sold 28,948 tons of rice at 2,610 yuan per ton ($379.69/ton), 3.29 percent of what was offered.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

· Egypt’s AgMin said they have enough sugar reserves for 7.5 months.

· Results awaited: Egypt’s ESIIC seeks 100,000 tons (150k previously) of raw sugar for shipment within the first half of September and two 50,000-ton shipments from September 15-Oct 15.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.