From: Terry Reilly

Sent: Tuesday, August 21, 2018 5:37:56 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/21/18

PDF attached

· Favorable rain fell across the heart of the Midwest including the dry areas of MO, IL, and IN. Too much rain fell across parts of the WCB. Hail damage was noted across patches of NE.

· The ECB will see rain mid-week. Rain returns to the US northwestern areas Friday and Saturday.

· The Delta will see drier weather through Saturday.

· US spring wheat will see minor harvesting delays for the balance of the week.

· HRW wheat country will see showers on and off through early next week.

· A ridge of high pressure may evolve across the southeastern states, Delta, Corn Belt, and eastern Hard Red Winter Wheat Region Aug. 28 – Sep. 4.

· Eastern Australia’s rainfall potential for late this week remains very good.

· Eastern China will see net drying through at least August 29.

· Canada’s Prairies will remain on the dry side this week.

· Indonesia and Malaysia rainfall are slowing and some attribute the below normal rainfall to El Nino.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Wed 15% cvg of up to 0.20” 15% cvg of up to 0.15”

and locally more; and locally more;

wettest SW wettest east

Thu-Fri 80% cvg of up to 0.75”

and local amts over 2.0”;

wettest south; far NW

driest

Corn.

- Corn finished lower following weakness in wheat.

- The funds sold an estimated net 9,000 corn contracts.

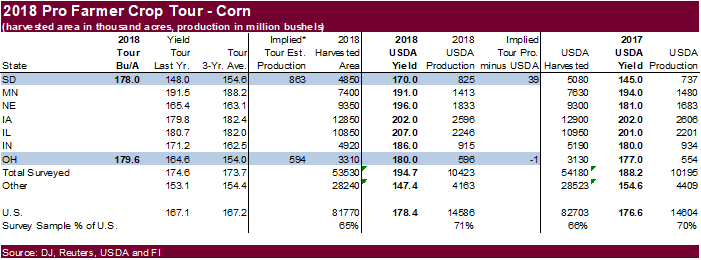

- Day 2 of the annual crop tour showed yields which were outpacing last year and the 3-year average across NE. On the ECB, scouts saw corn in Indiana maturing quickly.

- Heavy hail damage occurred across parts of NE, northwest of Omaha.

- Note most NE crop tour corn yields in the past were thought to be underestimated as many of the field stops included unirrigated areas opposed to irrigated fields. The tour measures about 40% irrigated fields and Neb. corn is about 60% irrigated.

- Day one of the US ProFarmer Crop Tour showed South Dakota corn yields up from a year ago and above average. SD was pegged at 178.0 bu/ac, up from 148.0 in 2017 and average of 154.6 bu/ac. Ohio were projected sharply higher than a year ago at 179.6 bushels per acre, above 164.6 for 2017 and average of 154.0 bu/ac.

- Final crop tour results will be out Friday, August 24.

- Soybean and Corn Advisory left their US corn yield unchanged at 178.0. USDA is at 178.4.

- August US corn exports should be relatively high at the expense of Brazil focusing on exporting soybeans.

- China pig producer Dabeinong Technology reported a loss for the April-June period, its first quarterly loss since 2013. They mentioned higher feed costs, including soybean meal.

· China sold about 63.7 million tons of corn out of reserves this season. Another 4 million tons will be offered late this week.

· Soybeans and meal were lower on light selling on improving weather and ahead of potential surprise announcements later this week. Traders will be cautious ahead of the US/China talks scheduled to start Wednesday (Aug 22-23).

· The funds sold net 3,000 soybeans, 2,000 soybean meal, and bought 2,000 contracts of soybean oil.

· Technicals suggest support in soybeans around $8.86/bu, right at the settle.

· Soybean oil was higher on unwinding of meal/oil spreads despite a lower lead in palm.

· September and December soybean oil flirted around its 50-day MA.

- A Reuters poll calls for the Brazil soybean area to expand 3.2 percent to record 36.28 million hectares. Bloomberg will be out with their poll this week.

- Brazil soybean exports during the August 13-19 period increased to 2.2MMT from 1.3MMT a year ago, bringing cumulative Aug 1-19 shipments to about 4.9MMT. It was projected Brazil Aug soybean exports could reach 8MMT from 5.95MMT year ago, with China taking 80-90 percent of that amount. China may be only be able to source 5.5-8.0 million tons of additional Brazil soybeans during the Sep-Dec period. If that is the case, China will fall short on Q4 soybean imports and will need to buy from the US through at least mid-February.

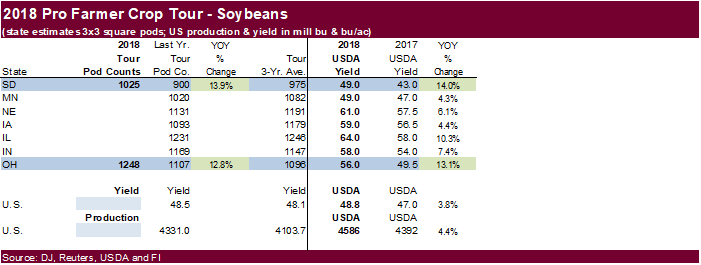

- Day 2 of the annual crop tour showed pod counts above average across NE.

- Day 1 of the US ProFarmer Crop Tour showed South Dakota soybean pods in a 3-by-3 foot area averaged 1,024.7, above 900.0 pods a year ago and the three-year average of 975.1 pods. Pods in Ohio averaged 1,248.2 pods, up from 1,107.0 pods in 2017 and the three-year average of 1,095.8.

- Final results will be out Friday, August 24. Follow the Pro Farmer Midwest Crop Tour at #pftour18

- Soybean and Corn Advisory increased their US soybean yield by 0.5 bu/ac to 51.5. USDA is at 51.6.

- India’s SEA expects China to increase rapeseed meal imports by a large amount in 2018-19 of about 400,000 tons. India alone exported 663,998 tons of rapeseed meal to neighboring countries in 2017-18. SEA noted Indian rapeseed prices are around $210 per ton free-on-board (FOB) basis, nearly $40 per ton cheaper than cargoes from other suppliers. India rapeseed meal export so far in 2018-19 are running at nearly 400,000 tons.

· China and Malaysia officials met and agreed to improve trade relations, including China importing a larger amount of palm oil from Malaysia.

·

- Under the 24-hour reporting system, private exporters reported export sales of 250,000 tons of soybean cake and meal for delivery to unknown destinations during the 2018-19 marketing year.

· Wheat futures were sharply lower on a larger Russian grain crop estimate. The AgMin also said there is no need to put an export duty on wheat at this time. Nearby Chicago appears to be headed to test its 100-day MA of nearly $5.20.

· Funds sold an estimated 8,000 contracts of Chicago wheat.

· EU December wheat was 5.00 euros lower at 206.75 euros.

· Russia’s AgMin increased 2018 grain production to 100-105 million tons from previous 100 million tons.

· Ukraine’s 2018 wheat harvest is complete at 25 million tons, with a yield average of 3.08 tons/hectare, down from 26.6MMT and 4.18 t/h last year.

· Farm adviser CRM Agri-Commodities noted Australian wheat prospects improved after recent rains, according to Bloomberg.

- Note Eastern Australia’s rainfall potential for late this week remains very good.

- Egypt was on holiday.

Export Developments.

· China sold 2,000 tons of 2013 imported wheat at 2,370 yuan per ton ($344.78/ton), 0.12 percent of what was offered.

Rice/Other

· China sold 250,881 tons of rice at 2,410 yuan per ton ($350.60/ton), 17 percent of what was offered.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.