From: Terry Reilly

Sent: Wednesday, August 29, 2018 4:26:42 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/29/18

PDF attached includes FI export sales estimates

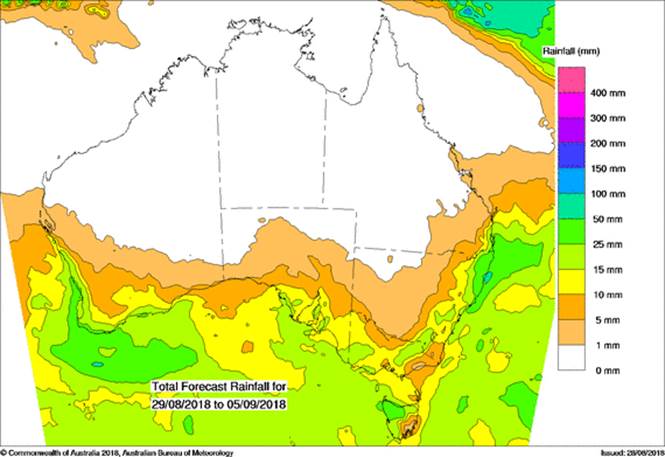

· Decent rain fell across Western Australia. Not much follow up rain is expected in Western Australia this weekend or next week. New South Wales and southeastern Queensland will get rain Thursday into Friday with a few showers early next week.

· Northern Missouri and the northwest half of Illinois into Minnesota, Wisconsin and Michigan all saw rain into Wednesday.

· Rain this week will slow crop maturation rates and delay some early harvesting. Next week flooding is possible in parts of Iowa, northern Missouri, Minnesota and Wisconsin.

· A mix of rain and sunshine is expected across the Delta and southeastern states through September 7.

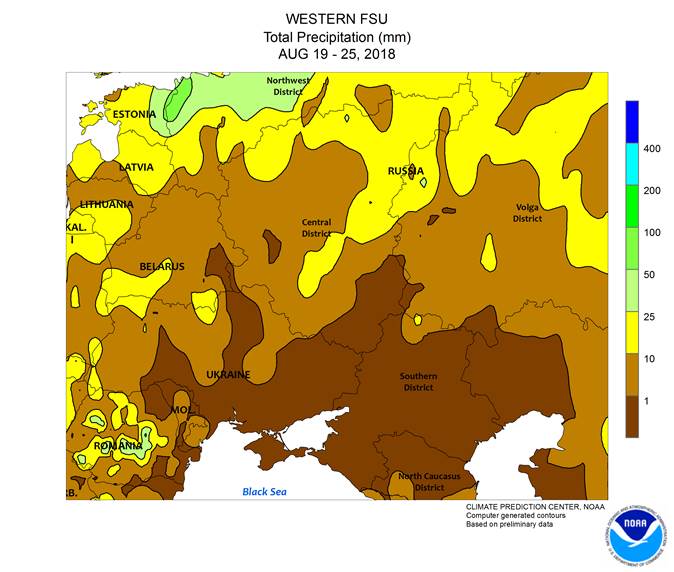

· Dry conditions are raising planting and establishment concerns for central and eastern Ukraine into the middle and lower Volga River Basin, Kazakhstan and Russia’s Southern Region.

· Canada’s Prairies will remain dry from southeastern Alberta through central and southern Saskatchewan through September 7.

· Northern and western Europe weather will see below normal precipitation through early September.

· Argentina will receive rain through Friday.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Thu 15% cvg of up to 0.20”

and local amts to 0.40”;

wettest SE

Thu-Fri 75% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-4.0”

amts in the south; far

NW driest; south Ia.

wettest

Fri-Sat 80% cvg of up to 0.60”

and local amts to 1.20”

with some 1.20-3.50”

amts in the west

Sat-Sun 60% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-3.0”

amts in the south

Sun-Mon 60% cvg of up to 0.55”

and local amts to 1.20”

Mon-Tue 75% cvg of up to 0.75”

and local amts to 1.75”

Tue-Sep 6 60% cvg of up to 0.60”

and local amts to 1.30”;

driest south

Sep 5-6 70% cvg of up to 0.65”

and local amts to 1.40”

Sep 7 15% cvg of up to 0.25”

and locally more

Sep 7-9 80% cvg of up to 0.75”

and local amts to 1.50”

Sep 8-10 80% cvg of up to 0.65”

and local amts to 1.30”

Sep 10-12 10-25% daily cvg of

up to 0.30” and locally

more each day

Sep 11-12 10-25% daily cvg of

up to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Thu 90% cvg of up to 0.75”

and local amts to 1.50”;

wettest north

Tdy-Fri 60% cvg of up to 0.75”

and local amts to 2.0”;

Carolinas and Va.

driest

Fri-Sun 5-20% daily cvg of up

to 0.30” and locally

more each day

Sat-Tue 15-30% daily cvg of

up to 0.40” and locally

more each day

Mon-Tue 55% cvg of up to 0.75”

and local amts to 1.50”;

wettest south

Sep 5-8 5-20% daily cvg of up 5-20% daily cvg of up

0.30” and locally up to 0.35” and locally

more each day more each day

Sep 9-12 5-20% daily cvg of up 15-35% daily cvg of

up to 0.30” and locally up to 0.50” and locally

more each day more each day

Source: World Weather and FI

Bloomberg weekly agenda

THURSDAY, AUG. 30:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 31:

- Malaysia on holiday; No palm oil futures trading on Bursa Malaysia Derivatives

- Statistics Canada’s domestic crop production report for July, 8:30am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

StatsCan production survey via Bloomberg

================================================================

|——–Survey Results———|StatsCan|

Production: | Avg | Low | High | 2017| YOY%

================================================================

All-Wheat | 30.418| 29.315| 31.100| 29.984| 1.4%

Durum Wheat | 6.028| 5.400| 7.400| 4.962| 21.5%

Canola | 20.723| 20.444| 21.270| 21.313| -2.8%

Barley | 8.289| 7.911| 8.600| 7.891| 5.0%

Soybeans | 7.120| 6.900| 7.260| 7.717| -7.7%

Oats | 3.378| 3.310| 3.450| 3.724| -9.3%

Source: Bloomberg and FI

· US GDP Annualized (Q/Q) Q2 S: 4.2% (est 4.0%; prev 4.1%)

– GDP Price Index (Q/Q) Q2 S: 3.0% (est 3.0%; prev 3.0%)

– Personal Consumption (Q/Q) Q2 S: 3.8% (est 3.9%; prev 4.0%)

– Core PCE (Q/Q) Q2 S: 2.0% (est 2.0%; prev 2.0%)

· US Pending Home Sales (M/M) Jul: -0.7% (est 0.3%; prevR 1.0%)

Pending Home Sales (Y/Y) Jul: -0.5% (est -2.5%; prev -4.0%)

Corn.

- Corn ended higher but well-off session highs. A two-sided trade occurred as traders had little fresh news to digest, even though US wheat futures surged roughly 14-20 higher. Some positioning could be noted ahead of the long US holiday weekend.

- Funds sold an estimated net 1,000 contracts.

- Canada said by Friday they could reach a trade deal agreement with the US.

- China mentioned they cannot rule out additional cases of African swine fever outbreaks, and stated the disease came from another country. Four Chinese cases have been confirmed.

- The USDA Broiler Reports showed eggs set in the US up slightly from a year ago and broiler-type chicks placed in the US up 1 percent. Cumulative placements from the week ending January 6, 2018 through August 25, 2018 for the United States were 6.26 billion. Cumulative placements were up 1 percent from the same period a year earlier.

- A atypical case of mad cow disease was found in a 6-year-old beef cow in Florida. No threat was seen.

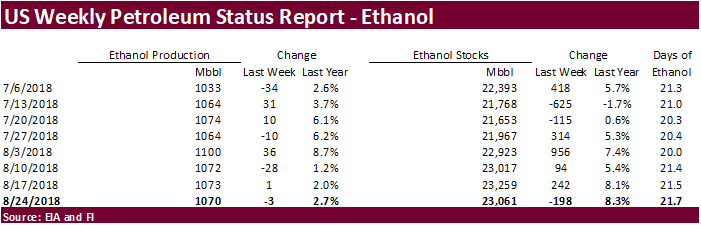

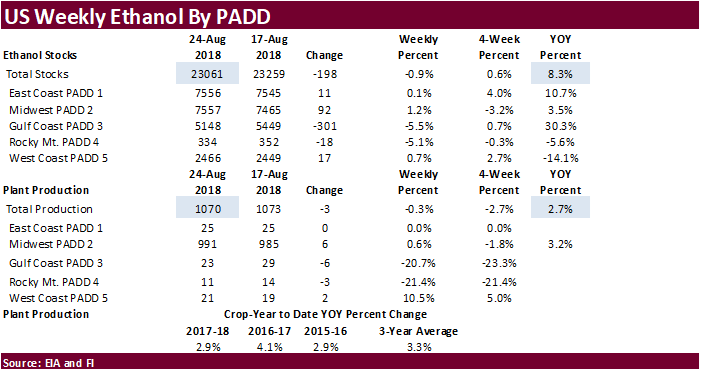

- US ethanol production decreased 3,000 barrels per day to 1.07 million and stocks fell 198,000 to 23.06 million (first stocks decrease since July 20). Traders were looking for a 1,000 barrel/day increase in production and 44,000-barrel decrease in stocks.

· Another 4 million tons of China corn reserves will be offered on Thursday and Friday. China sold about 65.4 million tons of corn out of reserves this season.

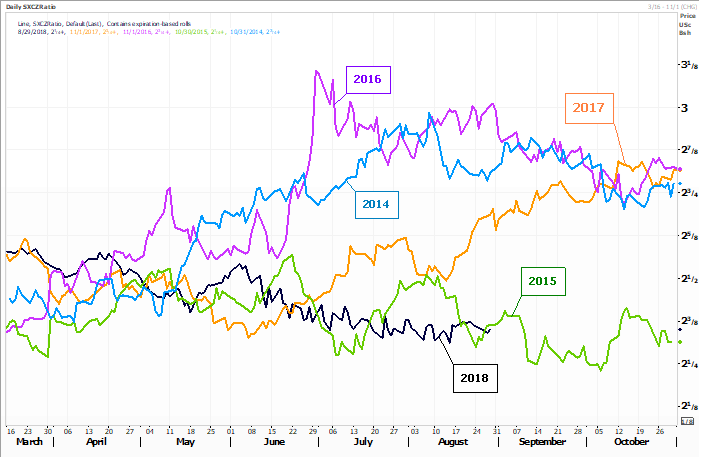

SX8/CZ8 ratio

Source: Reuters and FI

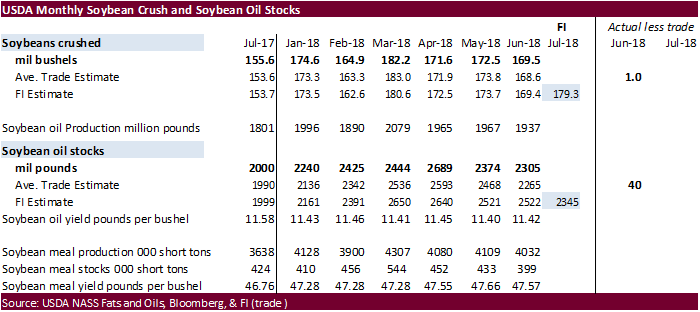

· Soybeans and meal traded higher on short covering but gains were trimmed on light profit taking. Soybeans ended 2.40-2.75 cents higher, soybean meal unchanged to $1.40 (led by nearby) and soybean oil lower on follow through selling after we learned yesterday that Argentina is loading a China-bound 29,000-ton cargo of soybean oil in Timbues, along the Parana River. This is the first large Argentine SBO cargo in three years for China. According to the vessel line-up published by NABSA there are two more due to load the first week of September and a fourth cargo may set sail after additional two cargoes. A sharply higher trade in WTI limited losses in soybean oil.

· Funds bought 5,000 soybeans, sold 1,000 soybean meal and sold 2,000 soybean oil.

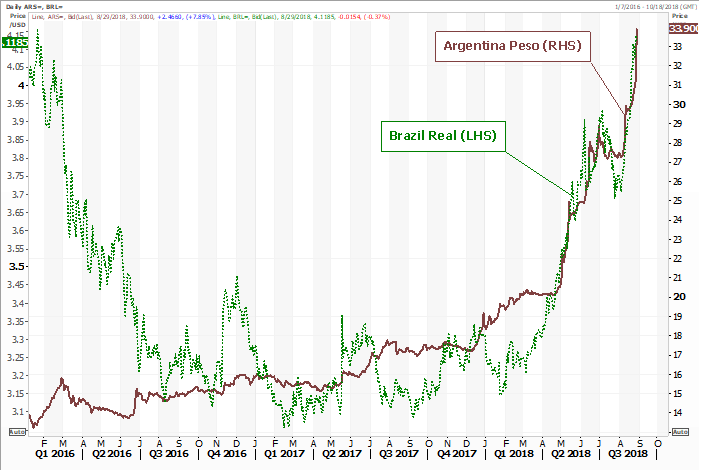

· The Brazil real was under pressure again. The currency soon could test a multiyear low set mid-September 2015.

· Argentina’s peso fell today by most since May.

Source: Reuters and FI

Source: Reuters and FI

· A worker strike started at a Bunge crush plant in Argentina.

· One analyst out there has a US 2018-19 carryout over 1 billion bushels.

· Bloomberg noted the spread between soybeans and corn narrowed to a 10-year low on Wednesday.

· India’s SEA has a 10 million ton plus soybean production for 2018-19 (starts October), about a 20 percent increase from last year, making the country a little less dependent on soybean oil imports.

· Dorab Mistry expects palm prices to fall to 2100/ton (MYR) in the next six months and that stocks could rise to between 3.0 and 3.3MMT by the end of December. This is opposite to Oil World’s outlook whom lowered the Malaysian palm oil production estimate for 2018 to 19.8 million tons and set a price target of 2500MRY. James Fry has a target of 2,200 MYR/ton based on a steady price of $75/barrel Brent crude oil.

· GAPKI estimated palm oil production for Indonesia between 40 and 42 million tons in 2018, up 4-6 million tons from adverse weather production year of 2017.

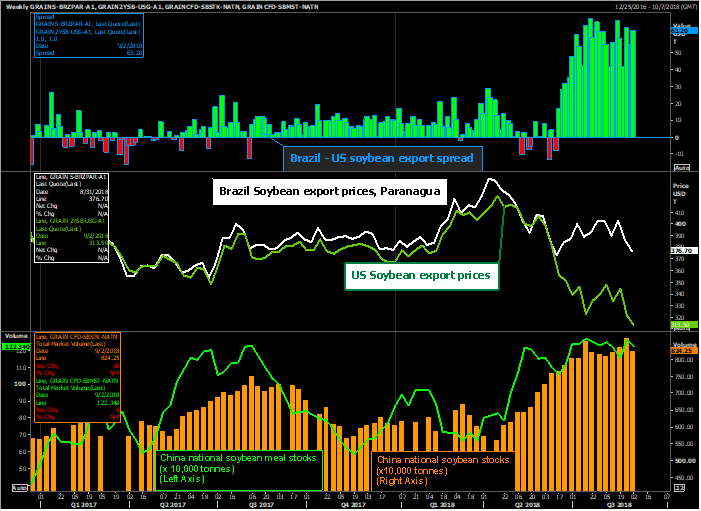

· Cofeed estimated China soybean imports in August at 8.5MMT and 8.0MMT in September and will need to source more soybeans for the November through December period.

· China plans to suspend rapeseed oil sales from reserves on September 10. The remaining stocks of imported rapeseed and soybean oil will be auction off through September 6.

· A China trade group is touring the US as part of the U.S. Soybean Export Council’s (USSEC) annual Global Trade Exchange conference.

· Egypt’s GASC bought 21,500 tons of soybean oil and 10,000 tons of sunflower oil.

o 10,000 tons of sunflower oil at $736.00 per ton

o 10,000 tons of soyoil at 12,200 Egyptian pounds per ton ($681.55)

o 11,500 tons of sunflower oil at $736.00 per ton

· China sold 40,266 tons of 2013 soybeans at 3,002 yuan per ton ($436.72/ton), 13.36 percent of what was offered.

- China sold about 1.35MMT of soybeans out of reserves this season.

· China sold 24,730 tons of 2011 soybean oil at 5,000 yuan per ton ($727.38/ton), 45.81 percent of what was offered.

· China sold 1,780 tons of rapeseed oil at 6,000 yuan per ton ($872.85/ton), 2.96 percent of what was offered.

· China plans to suspend rapeseed oil sales from reserves on September 10. The remaining stocks of imported rapeseed and soybean oil will be auction off through September 6.

· Results awaited: The CCC seeks 15,610 tons of crude degummed soybean oil for export to Pakistan. Shipment was for Sep 27 to Oct 7.

· South Korea seeks 15,000 tons of non-GMO soybeans on September 4 for Nov/Dec arrival.

- USDA seeks 5,000 tons of refined oil for the export program on September 5 for October shipment.

- Iran seeks 30,000 tons of sunflower oil on September 24.

November soybeans $8.00-$9.50 range.

December meal $280-$350 range.

December soybean oil 27.50-30.50 range.

- US wheat futures traded higher from strength in Paris wheat and technical buying on rumors Russia could limit 2018-19 Russia wheat exports. The initial rumor circulated said Russia lowered their export forecast for wheat during the 2018-19 crop year to 25 million tons. USDA is using 35 million tons. Later sources told newswires that Russia’s AgMin plans to meet with grain exporters on September 3 to talk about market conditions, but the AgMin declined comment.

- Matif wheat ended 4.50 euros higher at 203.25 euros.

· Funds were net buyers of an estimated 11,000 contracts.

· Ukraine’s AgMin reported producers harvested 34.4 million tons of grain as of Wednesday, with a yield of 3.46 tons per hectare compared with 37.4 million at the same date in 2017. This was on 9.95 million hectares, out of a projected total area of 14.85 million hectares. Wheat harvest is complete with 25.1 million tons, with an average yield of 3.80 tons per hectare.

- Ukraine exported 5 million tons of grain year to date, 700,00 lower than a year ago.

· Romania’s PM estimated the 2018 wheat crop at 10.2 million tons, up from 9.9MMT in 2017.

· FranceAgriMer estimated 85 percent of this year’s French soft wheat crop had a protein content of 11.5 percent or above, six percentage points lower than last week. 48 percent of the wheat crop is above 12%.

Export Developments.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

- Japan in a SBS import tender bought 21,395 tons of feed wheat and 41,160 tons of barley for arrival by January 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 5 for arrival by January 31.

· China sold 1,102 tons of 2013 imported wheat at 2,370 yuan per ton ($347.45/ton), 0.06 percent of what was offered.

· Jordan bought 60,000 tons of hard milling at $258.90/ton c&f for shipment in the first half of November.

· Taiwan seeks 110,500 tons of US milling wheat from the US on August 31 fir October/November shipment.

Rice/Other

· The Philippines will imports 132,000 tons of rice soon.

· South Korea seeks 92,783 tons of rice on Aug. 31 for Nov/Dec arrival.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

10,000 Brown medium Nov 30/Gwangyang

10,000 Brown medium Dec 31/Busan

20,000 Brown medium Dec 31/Gunsan

20,000 Brown medium Dec 31/Mokpo

20,000 Brown medium Dec 31/Donghae

12,783 Brown long Nov 30/Masan

- December Chicago wheat $4.95-$5.65 range.

- December KC $4.80-$5.60 range.

- December MN $5.60-$6.40 range.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.