From: Terry Reilly

Sent: Thursday, August 30, 2018 8:10:14 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/30/18

PDF attached

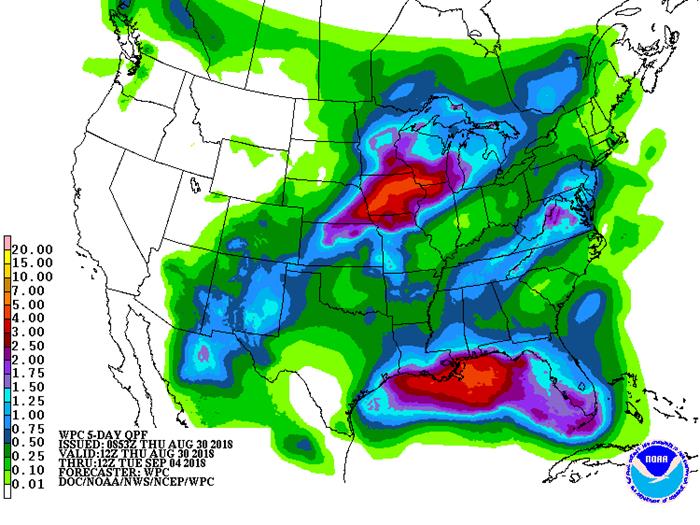

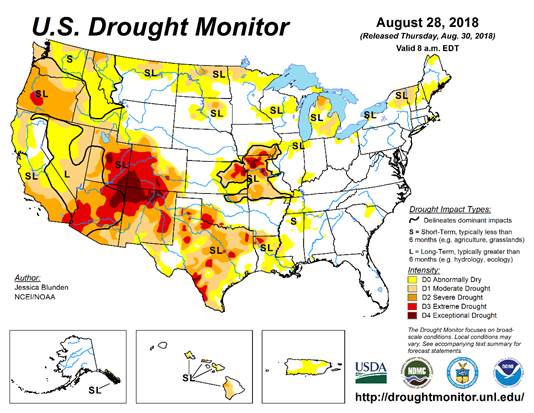

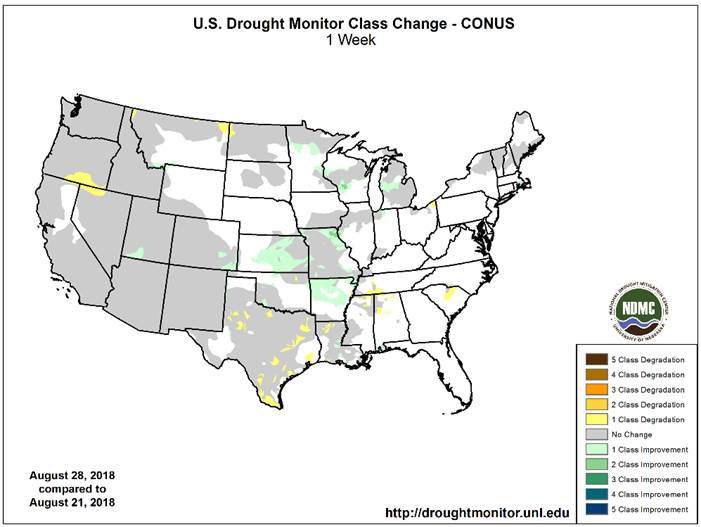

・ US drought conditions abated last week in northeastern MO and central WI.

・ 6-10 day is wetter for the southeastern Plains and 11-15 day is drier for the eastern Midwest, Delta, and southern Great Plains.

・ Not much follow up rain is expected in Western Australia this weekend or next week. New South Wales and southeastern Queensland will get rain Thursday into Friday with a few showers early next week.

・ Dry conditions are raising planting and establishment concerns for central and eastern Ukraine into the middle and lower Volga River Basin, Kazakhstan and Russia’s Southern Region.

・ A large part of the western Corn Belt and northern Illinois will see frequent rounds of showers and thunderstorms through the first ten days of September, resulting in some flooding.

・ A mix of rain and sunshine is expected across the Delta and southeastern states through September 7.

・ Canada’s Prairies will remain dry from southeastern Alberta through central and southern Saskatchewan through September 7.

・ Northern and western Europe weather will see below normal precipitation through early September.

・ Argentina will receive rain through Friday.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Fri 75% cvg of up to 0.75” and local amts to 1.50”

with some 1.50-4.0 amts from central La.

to north Mo.; far NW and far SE driest

Fri-Sat 70% cvg of up to 0.60” and local amts to 1.20”

with some 1.20-3.0’ amts in north Il.

Sat-Sun 65% cvg of up to 0.75” and local amts to 1.50”

amts from Neb. to Wi.; far NW driest

Sun-Mon 60% cvg of up to 0.65” and local amts to 1.50”;

north Il. wettest

Mon-Tue 80% cvg of up to 0.75” and local amts to 2.0”;

far NW and far SE driest

Tue-Sep 7 15-35% daily cvg of up to 0.50” and locally

more each day; wettest north

Wed-Sep 6 75% cvg of up to 0.75” and local amts to 1.75”

Sep 7 20% cvg of up to 0.30” and locally more

Sep 8 20% cvg of up to 0.30” and locally more

Sep 8-10 70% cvg of up to 0.75” and local amts to 1.50”

Sep 9-11 75% cvg of up to 0.65” and local amts to 1.30”

Sep 11-13 10-25% daily cvg of up to 0.30” and locally

more each day

Sep 12-13 10-25% daily cvg of up to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Sat 20-40% daily cvg of up to 0.40” and locally 55% cvg of up to 0.75” and local amts to 2.0”;

more each day Carolinas and Va. driest

Sun-Mon 60% cvg of up to 0.75” and local amts to 1.50”; 15-30% daily cvg of up to 0.50” and locally

wettest south more each day; south and west wettest

Tue 20% cvg of up to 0.35” and locally more

Tue-Wed 10-25% daily cvg of up to 0.30” and locally

more each day; wettest south

Wed-Sep 10 5-20% daily cvg of up to 0.30” and locally

more each day

Sep 6-10 5-20% daily cvg of up to 0.35” and locally

more each day

Sep 11-13 10-25% daily cvg of up to 0.30” and locally 10-25% daily cvg of up to 0.40” and locally

more each day more each day

Source: World Weather and FI

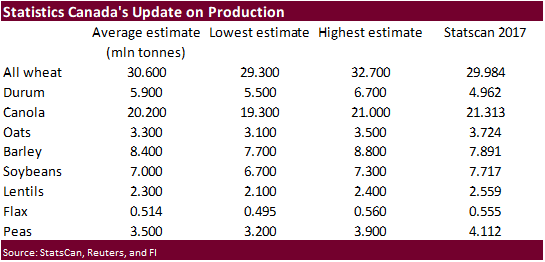

StatsCan production survey via Bloomberg

================================================================

|——–Survey Results———|StatsCan|

Production: | Avg | Low | High | 2017| YOY%

================================================================

All-Wheat | 30.418| 29.315| 31.100| 29.984| 1.4%

Durum Wheat | 6.028| 5.400| 7.400| 4.962| 21.5%

Canola | 20.723| 20.444| 21.270| 21.313| -2.8%

Barley | 8.289| 7.911| 8.600| 7.891| 5.0%

Soybeans | 7.120| 6.900| 7.260| 7.717| -7.7%

Oats | 3.378| 3.310| 3.450| 3.724| -9.3%

Source: Bloomberg and FI

・ Neutral soybeans and wheat

・ Negative corn

・ Supportive soybean products led by meal

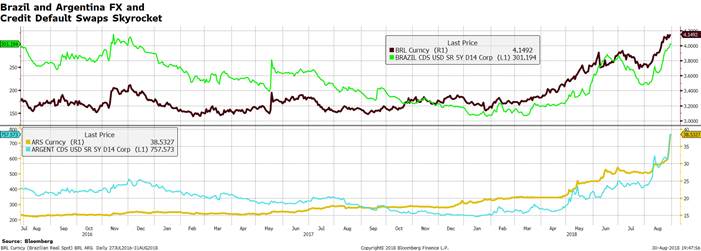

・ Argentina increased their interest rate to 60 percent from 45 percent. The rate is now the world’s highest.

・ Argentina’s central bank wanted to sell more dollars to support the drop in the peso but could not due to current conditions with the IMF, according to an insider. The Arg CB could not offer more than $500 million USD at auction due to IMF restrictions.

・ Brazil extended their FX intervention with additional 30,000 swap at auction.

Corn.

- December Corn ended unchanged as traders noted spreading against soybeans and wheat as they both ended lower.

- One bullish factor in the trade today is tightening global corn stocks.

- One bearish factor is the recent spike in put volatility in the prompt months which shows the market has downside fear for a near-term fall in prices. This does coincide with harvest so it could be just a matter of the massive crop we are expecting.

- Funds sold an estimated net 1,000 contracts.

- INTL FCStone released their September estimates ahead of the U.S. holiday for the U.S. soy and corn crop. They lowered the estimate for the U.S. 2018 corn crop to 177.7 bu/acre yield from 178.1 bu/acre last month and production to 14.532 billion bu from 14.562 billion bu.

- Under the 24-hour announcement system, USDA reported 100,611 tons of corn to Mexico for the 2018-19 marketing year.

・ A fifth confirmed case of African swine fever hit 185 pigs on a farm in Wuhu city in eastern China’s Anhui province. Look for at least 459 hogs to be culled.

- Under the 24-hour announcement system, USDA reported 100,611 tons of corn to Mexico for the 2018-19 marketing year.

・ China sold 2.615 million tons corn at 1,557 yuan per ton ($227.79/ton), 66 percent of what was offered.

・ Another 4 million tons of China corn reserves will be offered Friday. China sold about 68.0 million tons of corn out of reserves this season.

・ The soybean complex traded lower on the large U.S. crop and the continuing reports of African swine flu in China.

- INTL FCStone released their September estimates ahead of the U.S. holiday for the U.S. soy and corn crop. They raised their estimate for the U.S. 2018 soy crop to 53.8 bu/acre yield from 51.5 bu/acre last month and production to 4.782 billion bu from 4.574 billion bu.

・ After the bell, U.S. President Trump said he was ready to support $200 billion USD in tariffs as early as next week. This along with the higher FCStone numbers will further pressure the overnight trade.

・ Funds sold 5,000 soybeans, sold 5,000 soybean meal and bought 4,000 soybean oil.

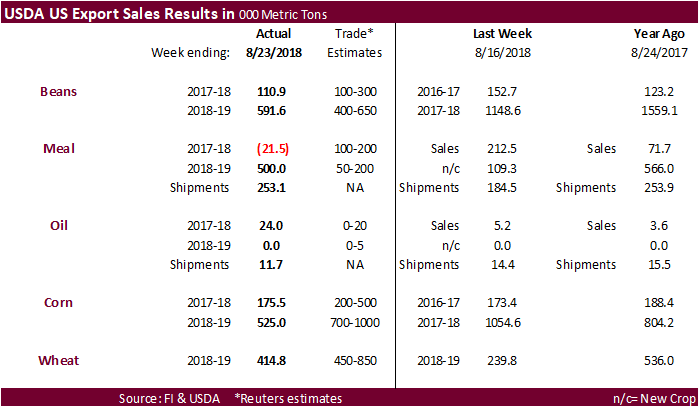

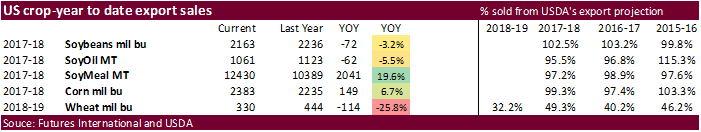

・ USDA export sales were ok for soybeans and very supportive for soybean meal and great for oil.

・ US drought conditions abated last week in northeastern MO and central WI.

・ The Brazil real and Argentina peso were again weaker.

- Argentina’s currency hit another record low against the USD after the central bank increased the interest rate up to 60 percent from 45 percent after the International Monetary Fund (IMF) called for stronger monetary and fiscal policies. Argentina asked the IMF to release some money from its $50 billion financing facility. (Reuters). Bond spreads increased, and five-year credit default swaps rose 43 bps in early trading to 696 bps.

・ A report issued by the USDA Attaché in Argentina lowering soybean production to 36 million tons on drought, USDA is at 37 million tons on the last WASDE report.

- Brazil extended their FX intervention with additional 30,000 swap auction.

・ Brazil and Argentina producers may hang onto their soybeans for inflation risk.

・ Brazil’s Supreme Court delayed their decision on the minimum freight rates, at least until after the Brazilian Presidential election in November.

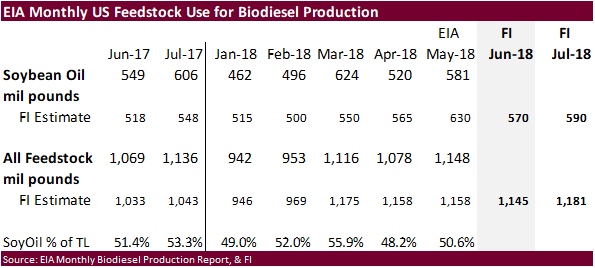

・ Indonesia Biofuels Producer Association (APROBI) put Indonesia’s biodiesel exports at around 1 million tons, up from around 300,000 tons last year, in part to exports increasing for Europe, China and India. They see production of biodiesel around 5 million tons.

・ China bought about 20 cargos of Brazilian soybeans last week.

・ The shipping lineup suggests Brazil is scheduled to ship 3.44 million tons of soybeans as of August 29.

・ China’s soybean complex traded mixed.

・ The increase in China soybean meal prices was thought to be over Q4 supply tightness.

・ A fifth confirmed case of African swine fever hit 185 pigs on a farm in Wuhu city in eastern China’s Anhui province. Look for at least 459 hogs to be culled.

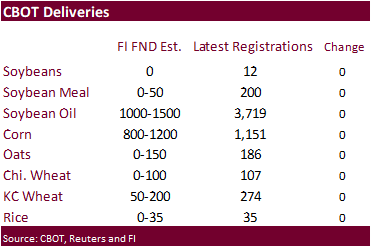

・ Note First Notice Deliveries are on Friday. There are only 12 soybean registrations, zero meal and 3,719 soybean oil. Look for 0-50 meal, no soybeans, and 1500-2000 soybean oil.

- US wheat overnight saw follow through buying on talk of Russia limiting 2018-19 wheat exports, but turned lower on profit taking.

- Russia officials plan to meet with exporters September 3. Export cap of 25MMT was speculated. Talk is anything above 25MMT in exports would strain domestic supplies and increase prices.

- Matif wheat ended 1.50 euros lower at 201.75 euros.

・ Funds were net sellers of an estimated 5,000 contracts.

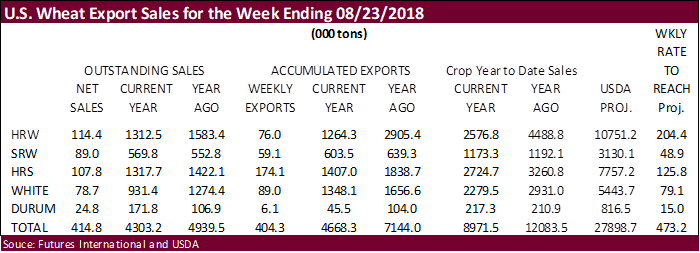

・ USDA export sales for all-wheat were ok.

・ Dry conditions are raising planting and establishment concerns for central and eastern Ukraine into the middle and lower Volga River Basin, Kazakhstan and Russia’s Southern Region.

・ Argentina’s northern wheat area will see rain through Friday. Western half of Argentina is still very dry.

・ South Dakota is nearly done with their spring wheat harvest.

Export Developments.

・ The European Union awarded 71,983 tons of wheat imports excluding United States and Canada under reduced-tariff quotas.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.