From: Terry Reilly

Sent: Thursday, September 06, 2018 5:51:51 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 09/06/18

PDF attached includes an updated US soybean meal S&D (2017-18 & 2018-19)

Selected World Weather bullet points:

- Weather in Brazil and Argentina should be favorable during their spring and summer season if El Nino evolves as suggested by NOAA and the Australian Bureau of Meteorology, but if it (El Nino) does not evolve there may be more room for changes in the outlook that might not be as favorable for summer crop production. – World Weather Inc.

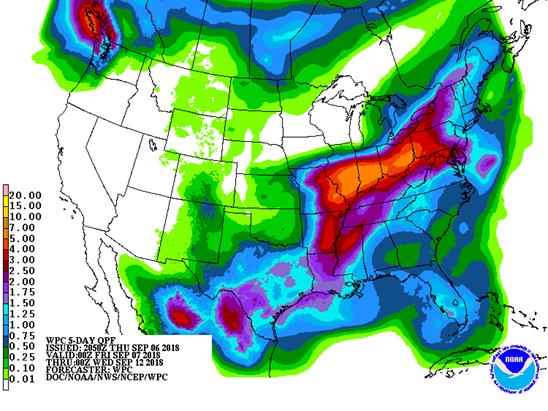

- The tropical storm that impacted the southern US shifted more east than thought. Delta producers in the west may have the opportunity to harvest later this week.

- Frequent rain will occur in the Delta through Monday with much of the Southeast.

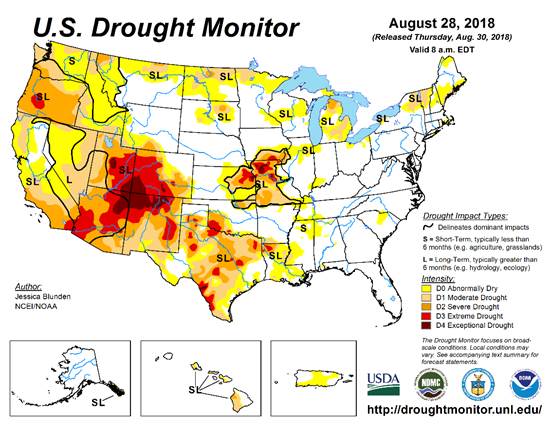

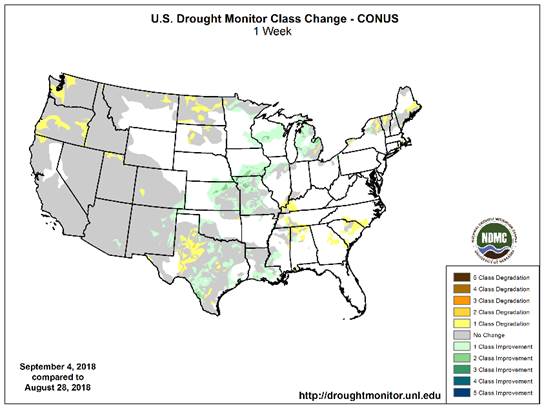

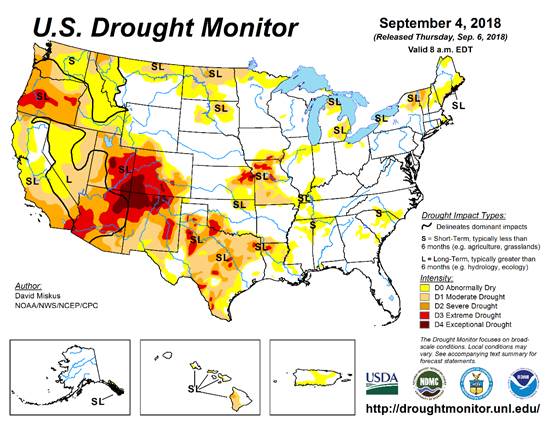

- U.S. Midwest flooding will raise concern over crop conditions from Kansas and southeastern Nebraska to southern Michigan and northern Ohio.

- Drought continues in western CIS, but relief is likely for central and southeastern Ukraine Thursday into the weekend with daily showers expected.

- Drought in Canada’s Prairies will prevail through the next ten days

- Eastern Australia will get some additional rainfall in the coming week

- Western Australia will dry out over the next ten days

- Brazil weather will be drier this week until the weekend and early next week when rain returns to the south

- Argentina weather will stay dry into Saturday this week and then may get some light showers Sunday into Tuesday of next week

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Thu 25% cvg of up to 0.75” 85% cvg of up to 0.75”

and local amts to 1.75”; and local amts to 1.75”;

SE Mo. wettest wettest SW

Fri-Sat 20% cvg of 0.75-3.0”

and local amts over 4.0”

from central to east Mo.

with up to 0.75” and

locally more elsewhere

Fri-Sun 65% cvg of 1.50-4.50”

and local amts over 6.0”

from south Il. to central

and south Oh. with up

to 0.75” and locally

more elsewhere; driest

NW

Sun-Tue 10-25% daily cvg of

up to 0.50” and locally

more each day;

wettest NW

Mon 15% cvg of up to 0.75”

and locally more;

wettest east

Wed-Sep 13 5-20% daily cvg of up

to 0.30” and locally

more each day;

wettest NW

Tue-Sep 13 5-20% daily cvg of up

to 0.30” and locally

more each day;

wettest south

Sep 14 20% cvg of up to 0.40”

and locally more;

wettest SW

Sep 14-16 65% cvg of up to 0.50”

and local amts to 1.10”

Sep 15-17 70% cvg of up to 0.50”

and local amts to 1.10”

Sep 17-20 5-20% daily cvg of up

to 0.25” and locally

more each day

Sep 18-20 5-20% daily cvg of up

to 0.25” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri 90-100% cvg of 0.60-2.0”

and local amts over 3.0”

north with up to 0.60”

and locally more south

Fri 20% cvg of up to 0.30”

and locally more

Sat-Mon 90-100% cvg of 0.20-1.0” 85% cvg of up to 0.75”

and local amts over 2.0” and local amts over 2.0”;

wettest west

Tue 15% cvg of up to 0.40”

and locally more;

mostly south

Tue-Sep 13 75% cvg of up to 0.75”

and local amts to 2.0”;

wettest west

Wed 15% cvg of up to 0.15”

and locally more

Sep 13-15 10-25% daily cvg of

up to 0.35” and locally

more each day

Sep 14-15 10-25% daily cvg of

up to 0.35” and locally

more each day

Sep 16-17 60% cvg of up to 0.50”

and locally more

Sep 16-18 65% cvg of up to 0.60”

and locally more

Sep 18-20 Up to 20% daily cvg of

up to 0.30” and locally

more each day

Sep 19-20 5-20% daily cvg of up

to 0.30” and locally

more each day

Source: World Weather and FI

THURSDAY, SEPT. 6:

- Trump administration awaits Sept. 6 end of public comment period before it potentially proceeds with next round of tariffs on $200b Chinese goods; China expected to retaliate

- EIA U.S. weekly ethanol inventories, output, 11am (delayed from Wednesday because of Labor Day holiday)

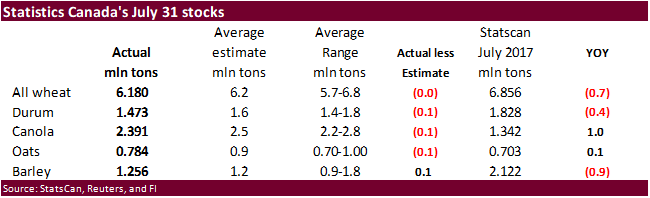

- Statistics Canada’s domestic crop stockpile report for July, 8:30am ET

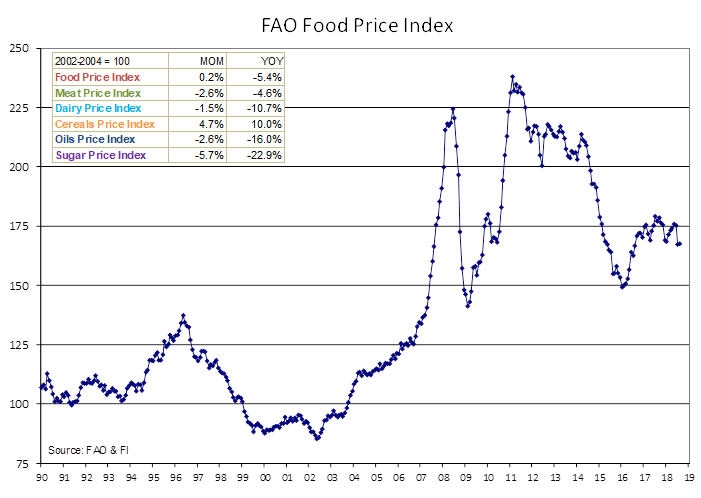

- FAO Food Price Index for August, 4am

- The Russian Grain Union hosts conference in Moscow

- Agriculture Ministry’s director for food markets Anatoly Kutsenko, director of crop department Pyotr Chekmarev expected to attend

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- UN Climate Change Conference in Bangkok, Day 3

- Kingsman Asia Sugar Conference in New Delhi, final day

- Intl Rubber Glove Conference in Kuala Lumpur, final day

FRIDAY, SEPT. 7:

- Brazil on public holiday

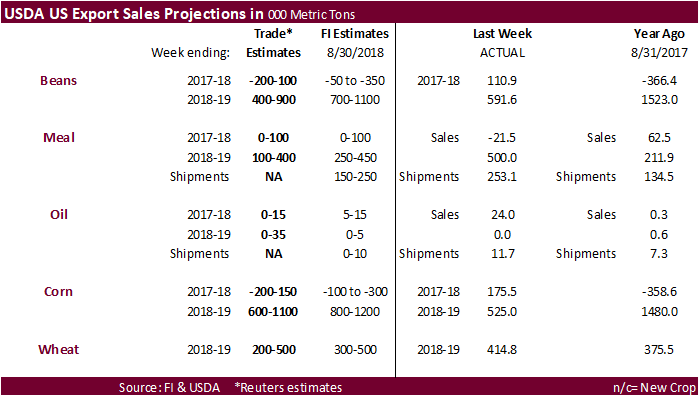

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday because of Labor Day holiday)

- Guatemala’s National Coffee Association’s export data for August

- FranceAgriMer weekly updates on French crop conditions

- UN Climate Change Conference in Bangkok, Day 4

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SATURDAY, SEPT. 8:

- China’s General Administration of Customs releases agricultural commodity trade data for August (preliminary), including soybean imports

- UN Climate Change Conference in Bangkok, Day 5

Bloomberg estimates for September USDA reports

US supply

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Aug.

Corn | 14,516| 14,225| 14,750| 14,586

Corn Yield | 177.6| 174.0| 180.0| 178.4

Soybeans | 4,643| 4,523| 4,781| 4,586

Soybean Yield | 52.3| 50.9| 53.8| 51.6

Analyst |——-Corn——–|Soybean

Estimates: | Output | Yield | Output | Yield

Futures Int’l | 14,351| 175.5| 4,523| 50.9

US ending stocks

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Aug.

Corn | 1,614| 1,210| 1,785| 1,684

Soybeans | 828| 722| 1,000| 785

Wheat | 949| 885| 1,077| 935

2017-18 Crop: |

Corn | 2,022| 1,953| 2,154| 2,027

Soybeans | 426| 397| 506| 430

| 2018-19|2017-18

Analyst Estimates: | Corn | Soybeans |Wheat | Corn |Soybeans |

Futures Int’l | 1,538| 722| 910| 2,024| 400|

World stocks

|———-Survey Results———–|USDA

2018-19 Ending | | | |

Stocks: | Avg | Low | High | Aug.

Corn | 154.3| 152.0| 159.0| 155.5

Soybeans | 107.3| 104.0| 111.1| 105.9

Wheat | 257.4| 252.0| 261.4| 259.0

2017-18 Ending |

Stocks: |

Corn | 192.0| 188.0| 193.8| 193.3

Soybeans | 95.5| 94.0| 97.2| 95.6

Analyst | 2018-19|2017-18

Estimates: | Corn | Soybean | Wheat | Corn |Soybean

Futures Int’l | 152.5| 104.0| 256.0| 193.0| 96.5

Source: Bloomberg and FI

Selected crop estimates:

· Informa SEP: 178.8 / 14.621 corn; 52.9 / 4.698 soybeans

· Informa AUG: 176.0 / 14.392 corn; 50.0 / 4.445 soybeans

· Allendale: 177.7 / 14.529 corn; 52.2 / 4.636 soybeans

· FC Stone: 177.7 / 14.532 corn; 53.8 / 4.782 soybeans

· FI: 175.5 / 14.355 corn; 50.9 / 4.517 soybeans

· USDA AUG 178.4 / 14.586 corn; 51.6 / 4.586 soybeans

Bloomberg weekly Bull/Bear survey (taken Wed.)

· Soybeans: Bullish: 1 Bearish: 8 Neutral: 6

· Wheat: Bullish: 4 Bearish: 3 Neutral: 8

· Corn: Bullish: 5 Bearish: 3 Neutral: 8

· Raw Sugar : Bullish: 5 Bearish: 1 Neutral: 2

· White sugar: Bullish: 5 Bearish: 1 Neutral: 2

· White-sugar premium: Widen: 2 Narrow: 4 Neutral: 2

Statistics Canada July 31 Canada stocks

· Results of the StatsCan report showed July 31 stocks all near trade expectations. There were revisions to last year but they were minor.

· US ADP Employment Change Aug: 163K (est 190K; prev R 217K)

· US Markit Services PMI Aug F: 54.8 (est 55.2; prev 55.2)

– Markit Composite PMI Aug F: 54.7 (prev 55.0)

· US ISM N-Mfg PMI (Aug): 58.5 (est 56.8, prev 55.7)

– ISM N-MFG Bus Act (Aug): 60.7 (est 56.9, prev 56.5)

– ISM N-MFG Employment Index (Aug): 56.7 (prev 56.1)

– ISM N-MFG New orders Index (Aug): 60.04 (prev 57.0)

– ISM N-MFG Price Paid Index (Aug): 62.8 (prev 63.4)

· US Factory Order MM (Jul): -0.8% (est -0.6%, prevR 0.6%)

– US Durables Ex-Def, R MM (Jul): -1.0% (prev -1.0%)US Durable Goods, R MM (Jul): -1.7% (prev -1.7%)US Durables Ex-Transpt R MM (Jul): 0.1% (prev 0.2%)US Nondef Cap Ex-Air R MM (Jul): 1.6% (prev 1.4%)US Factor Ex-Transp MM (Jul): 0.2% (prev 0.4%)

Corn.

- Corn prices traded higher by 0.50-1.25 in the non-expiring contracts despite lack of news. Losses were limited from heavy rain falling across the US Midwest. China sold nearly 3MMT of corn out of auction on Thursday.

- Funds bought an estimated net 6,000 contracts.

- Oats were higher again on cold temperatures in Canada.

- Informa reportedly estimates the US corn yield at 178.8 bushels per acre, above 176.0 previous month and above USDA’s 178.4 bu/ac.

- The northern fringes of MN saw frost Wednesday into Thursday.

- We are hearing one producer in southern IL is at 280 versus 220-240 average.

- The BA Grains Exchange estimated the Argentina corn crop unchanged at 31MMT.

· On Monday the USDA will update US corn harvest progress. We look for 3 percent complete, about in line with average.

· Ukraine’s corn crop was estimated at 30 million tons by Ukrainian Club of Agriculture Business, which would be a record.

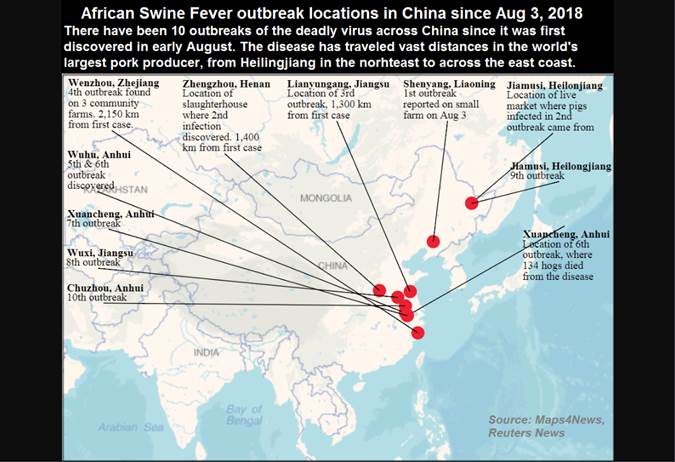

· Up to 10. China reported three more outbreaks of African swine fever in Jiamusi city in Heilongjiang in China’s northeast, and in the cities of Wuhu and Xuancheng in the eastern province of Anhui. These cities had reported previous outbreaks.

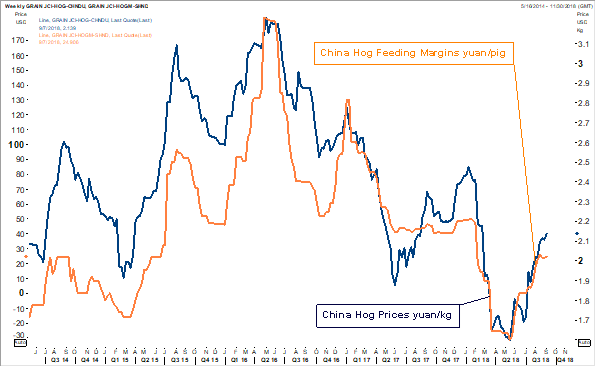

· The CNGOIC said they don’t see African swine fever having a large impact on soybean meal demand. We agree. Hog margins are good (see chart below) so as the herd rebounds later this year, good soybean meal demand should follow.

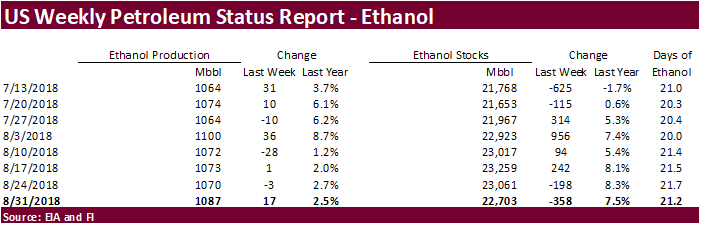

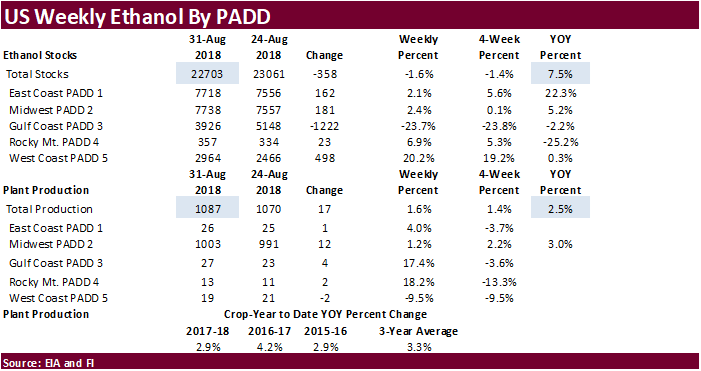

· The weekly ethanol report showed US ethanol production up 17,000 barrels per day to 1.087 million 2.5 percent higher than a year ago. Traders were looking for a 4,000 increase. Ethanol stocks decreased a large 358,000 barrels to 22.703 million. Traders were looking for a 45,000 barrel decrease.

The weekly USDA Broiler Report showed eggs set in the US up slightly and chicks placed up 1 percent. Cumulative placements from the week ending January 6, 2018 through September 1, 2018 for the United States were 6.44 billion. Cumulative placements were up 1 percent from the same period a year earlier.

Source: Reuters News and FI

Source: Reuters News and FI

Export Developments

· China sold 2,986,997 tons of corn out of auction, at an average price of 1570 yuan per ton ($229.65/ton), 75 percent of what was offered.

· China sold about 74 million tons of corn out of reserves this season. Another 4 million tons of China corn reserves will be offered on Friday.

· China will sell 8 million tons of corn September 13 and 14.

- Soybeans and soybean meal ended higher on short covering. Soybean meal was the leader by finishing $0.30 to $4.60 higher, bias nearby contracts to the upside. Soybean oil ended 1-5 points lower. News was light, and the cash trade is slow across the US Midwest. Large US production estimates and slowing demand for US soybeans by traditional buyers this week limited gains in soybean, in our opinion. Note China took 85 percent of the Brazil soybean exports in August.

- The gains in soybean meal sent CBOT crush sharply higher.

· Funds bought 2,000 soybeans, bought 5,000 soybean meal and bought 1,000 soybean oil.

· Barge US soybeans are cheap. Reuters noted: “Soybean barges loaded this month fell to a rare 5-cent-per-bushel discount to Chicago Board of Trade November futures SX8, down about 14 cents from earlier in the day. October barges traded as low as 3 cents over futures and November barges traded as low as 20 cents over futures.”

- Informa reportedly estimates the US soybean yield at 52.9 bushels per acre, above 50.0 previous month and above USDA’s 51.6 bu/ac.

· Brazil’s Lula will give up his bid for the October elections after a couple of appeals were turned down. Over the weekend the court ruled he could not run for election. Lula was the leading candidate and currently sitting in jail.

· Malaysia futures traded 14 lower and cash was down $2.50/ton. The lower trade was associated with expectations for rising palm production over the next few months. MPOB is due out September 12. Reuters poll estimated August end-stocks may increase 9 percent month-on-month to 2.41 million tons and production rising 9.9 percent to 1.65 million tons. August exports are seen up 2.3 percent to 1.23 million tons from the previous month.

· Results awaited: South Korea seeks 15,000 tons of non-GMO soybeans on September 4 for Nov/Dec arrival.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold about 1.69 MMT of soybeans out of reserves this season.

· China will sell 100,000 tons of soybeans September 12.

· US wheat futures ended lower on lack of bullish news and slowing US exports. Over the short-term, wheat prices are seen limited to the downside on tighter global high protein wheat supplies. The Russian currency fell to a March 2016 low against the USD, making that country’s wheat commodity a little cheaper against major exporting nations. Black Sea supplies are high and export demand is slowing, prompting hedging. The Black Sea region is also forecast to get rain later this month which should aid winter grain/oilseed plantings.

· Funds in Chicago wheat sold an estimated net 4,000 contracts.

· Russia’s AgMin on Thursday again said Russia had no plans to impose an export tax on wheat. We would be cautious of such statements. Changes in inflation could trigger policy changes at any moment by the government to help fight rising food prices. Traders should monitor any outbreaks of protests/demonstrations.

· The European Union granted import licenses for 129,920 tons of reduced-tariff wheat and 10,000 tons of barley.

· The FAO food price index averaged 168.4 points in August, up from a revised 161.9 points in July, and 10% above August of 2017. World wheat production was lowered to 722 million tons, smallest since 2013. Global grain stocks are seen at a 4-year low. http://www.fao.org/worldfoodsituation/foodpricesindex/en/

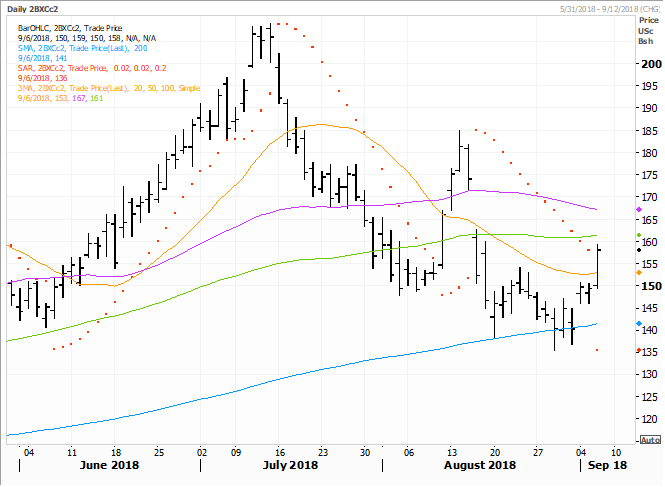

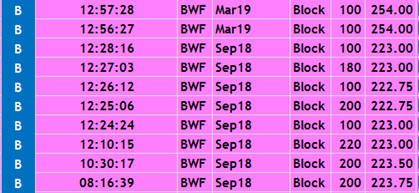

September Black Sea Wheat

· Large amount of SEP traded today.

· Open interest was 5,560 settled 225.0 yesterday

- Saudi Arabia seeks 1.02 million tons of barley for November/December delivery.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 12 for arrival by late February.

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

Rice/Other

· The Philippines seeks an extra 250k tons of rice for Q4 and Q1 2019 shipment.

· Results awaited: South Korea seeks 92,783 tons of rice on Aug. 31 for Nov/Dec arrival.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

10,000 Brown medium Nov 30/Gwangyang

10,000 Brown medium Dec 31/Busan

20,000 Brown medium Dec 31/Gunsan

20,000 Brown medium Dec 31/Mokpo

20,000 Brown medium Dec 31/Donghae

12,783 Brown long Nov 30/Masan

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.