From: Terry Reilly

Sent: Friday, September 14, 2018 5:32:19 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 09/14/18

PDF attached

- We look for soybean crop conditions to be up 1 in the combined G/E categories and corn to be unchanged. Winter wheat planting progress could advance 10-15 points and corn harvesting may end up 6-7 points. Soybean harvest is expected at 4-5 percent, given the large amount that will collected this year.

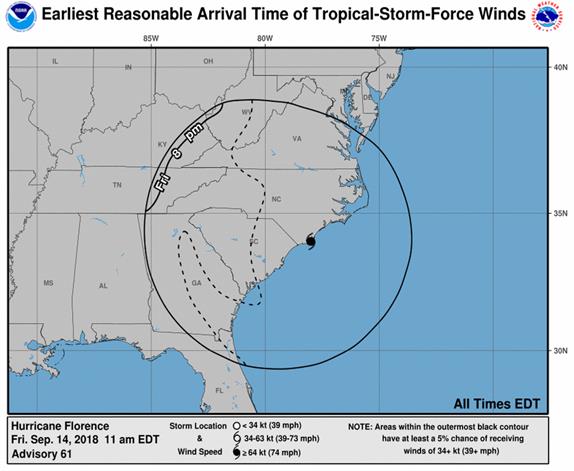

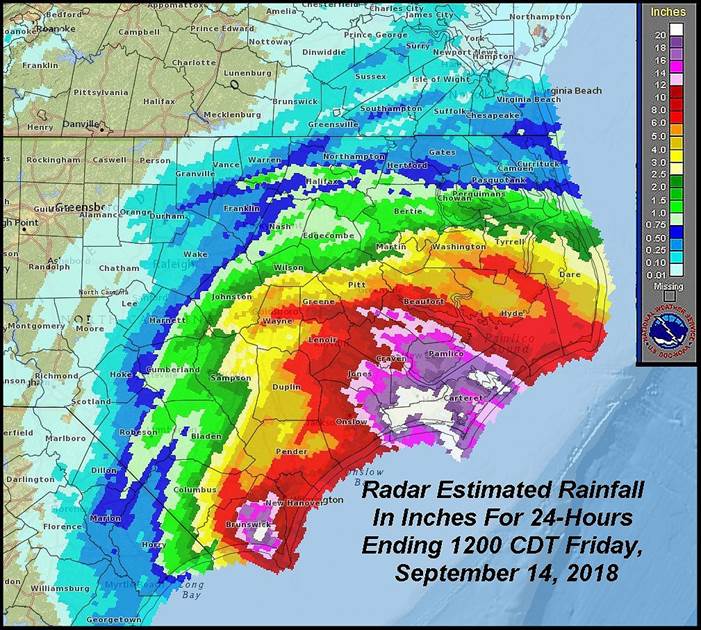

- Hurricane Florence weakened before it made landfall this morning.

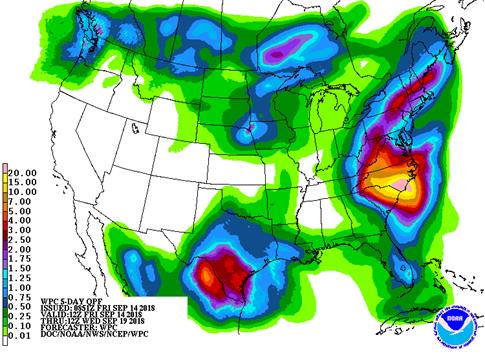

- Models turned drier for the US.

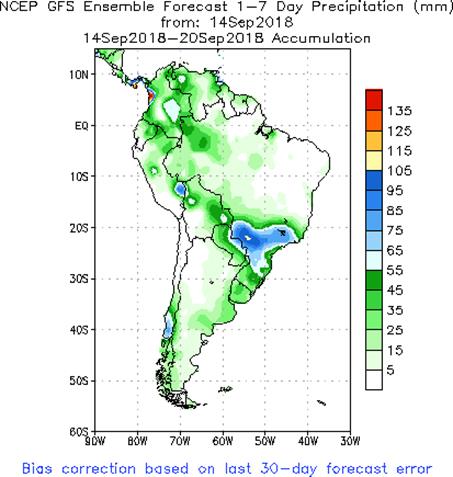

- SA was a little drier.

- Most WCB areas will be dry through Sunday with exceptions in the northwestern Corn Belt.

- The eastern Midwest will see only little to no rain of significance through Sunday with portions of Ohio and eastern Kentucky seeing some rain from the remnants of Hurricane Florence Monday into Tuesday.

- The central and southern US Great Plains need rain.

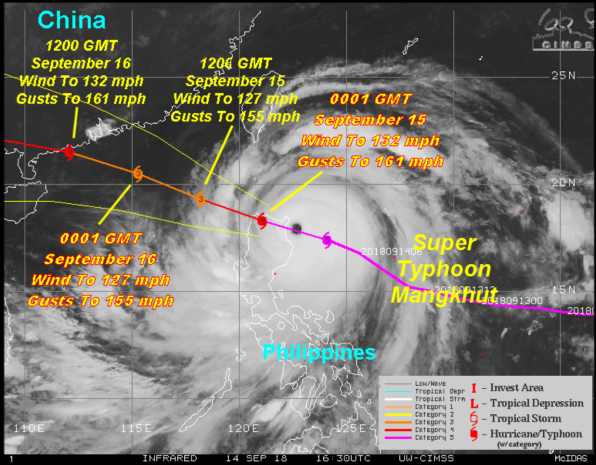

- This Philippines are awaiting a massive super typhoon predicted to impact 5.2 million people plus.

- Brazil’s weather outlook looks favorable for soybean and corn planting progress, which already started.

- Argentina will see additional rain by the end of the week.

- Alberta, Canada will get heavy snow (Thursday, Saturday and Sunday) and then a hard freeze which may negatively impact some immature crops.

- US HRW wheat country will see below average rainfall in the first week of the outlook.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Sat 5-20% daily cvg of up

to 0.25” and locally

more each day;

wettest east

Tdy-Sun 15-20% daily cvg of

up to 0.60” and locally

more each day;

wettest NW

Sun-Mon 30% cvg of up to 0.75”

and local amts to 1.50”;

wettest east

Mon-Tue 65% cvg of up to 0.75”

and local amts to 2.0”;

east Neb. to north Ia.

and central and south

Mn.; far NW and far

south driest

Tue 20% cvg of up to 0.40”

and locally more;

wettest NW

Wed-Thu 85% cvg of up to 0.75”

and local amts to 2.0”;

east S.D. to north Ia.

and Wisc. wettest;

far NW driest

Wed-Sep 21 85% cvg of up to 0.75”

and local amts to 1.75”

Sep 21-23 10-25% daily cvg of

up to 0.30” and locally

more each day

Sep 22-24 5-20% daily cvg of up

to 0.25” and locally

more each day

Sep 24-26 70% cvg of up to 0.70”

and locally more

Sep 25-26 75% cvg of up to 0.70”

and locally more

Sep 27-28 5-20% daily cvg of up 5-20% daily cvg of up

to 0.30” and locally to 0.30” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Sat-Sun Mostly dry with a few

insignificant showers

Mon-Thu Up to 20% daily cvg of

up to 0.30” and locally

more each day; some

days may be dry

Tdy-Mon 50% cvg of 10.0-20.0”

and locally more from

east-central N.C. through

the north S.C. coast to the

N.C. and S.C. border and

1.50-7.0” and locally more

elsewhere in the Carolinas

and south Va. Ga. with up

to 1.50” and locally more

elsewhere; Rain is from

Hurricane Florence

Tue-Thu 10-25% daily cvg of

up to 0.35” and locally

more each day

Sep 21-22 80% cvg of up to 0.75”

and local amts to 1.50”

Sep 21-23 80% cvg of up to 0.75”

and local amts to 2.0

Sep 23-24 5-20% daily cvg of up

to 0.25” and locally

more each day

Sep 24 15% cvg of up to 0.25”

and locally more

Sep 25-26 60% cvg of up to 0.50”

and locally more

Sep 25-27 65% cvg of up to 0.50”

and locally more

Sep 27-28 10-25% daily cvg of

up to 0.30” and locally

more each day

Source: World Weather and FI

Source: World Weather INC and FI

Bloomberg weekly agenda

FRIDAY, SEPT. 14:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- Malaysia to announce crude palm oil export tax for October

MONDAY, SEPT. 17:

- Japan, Malaysia on public holidays

- Rubber futures trading on Tokyo Commodity Exchange as well as palm oil on Bursa Malaysia will be halted

- EU’s monthly Monitoring Agricultural Resources (MARS) bulletin on crop progress and weather conditions in Europe

- UN FAO releases report on agricultural commodity markets, with focus on trade, climate change and food security

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

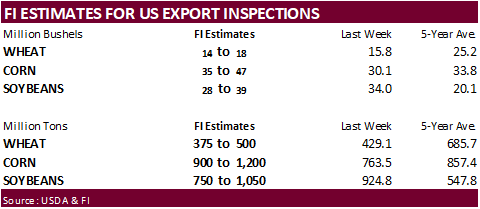

- USDA weekly corn, soybean, wheat export inspections, 11am

- U.S. National Oilseed Processors Association data on soy processing, noon

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

TUESDAY, SEPT. 18:

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- Brazil’s crop agency Conab releases its 3rd estimate for 2018 coffee crop

- Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) releases agricultural commodities report

- The United Nations General Assembly opens, with general debate to begin Sept. 25, including speeches from numerous world leaders

- EARNINGS: General Mills Inc.

WEDNESDAY, SEPT. 19:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA milk production data for August, 3pm

- Malaysian Palm Oil Council (MPOC) holds Intl Palm Oil Sustainability Conference in Kota Kinabalu, Malaysia, Sept. 19-20; Executives from FAO, Nestle, Olam, Sime Darby, MPOB expected to attend

- INTL FCStone holds agribusiness conference in Sao Paulo, with Finance Minister Eduardo Guardia and BRF CEO Pedro Parente due to speak

THURSDAY, SEPT. 20:

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-20 palm oil exports, 11pm ET Wednesday (11am Kuala Lumpur Thursday)

- SGS data for same period, 3am ET Thursday (3pm Kuala Lumpur Thursday)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for August, 3pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Intl Palm Oil Sustainability Conference in Kota Kinabalu, final day

FRIDAY, SEPT. 21:

- Ghana public holiday

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA cattle-on-feed report for August, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

· Note the oats positions were removed from the weekly CFTC report.

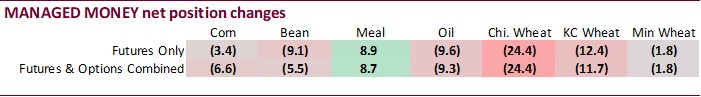

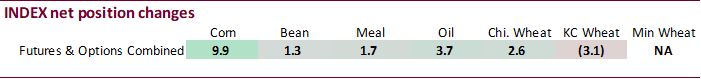

· Managed money established a new record short position in soybean oil for futures only and futures and options combined as of last Tuesday, at 97,265 and 97,356 contracts, respectively.

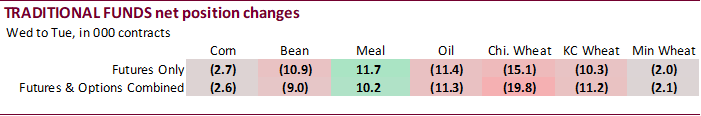

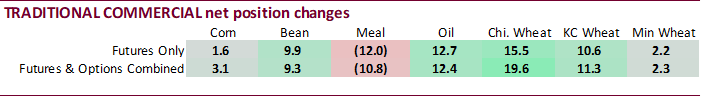

· Traditional funds were heavier sellers in corn, soybeans, wheat and soybean oil than what the trade expected.

· USD traded higher

· US Retail Sales (M/M) Aug: 0.1% (est 0.4% ; prevR 0.7% ; prev 0.5%)

– US Retail Sales Ex-Autos (M/M) Aug: 0.3% (est 0.5%; prevR 0.9% ; prev 0.6%)

– US Retail Sales Ex Gas/Autos Aug: 0.2% (prevR 0.9% ; prev 0.6%)

– US Retail Control Aug: 0.1% (est 0.4% ; prevR 0.8% ; prev 0.5%)

· US Import Prices (M/M) Aug: -0.6% (est -0.2% ; prevR -0.1% ; prev 0.0%)

· US Export Prices (M/M) Aug: -0.1% (est 0.0% ; prev -0.5%)

CME 2019 delivery differentials

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2018/09/SER-8235.pdf

Corn.

- Corn traded two-sided as higher wheat and lower soybeans left the market in limbo. Prices settled higher, in part to strength in wheat.

- Corn prices erased all 2018 gains.

- December corn hit a fresh contract low, and traders remain bearish rolling into harvest.

· Funds bought an estimated net 5,000 corn contracts.

- US officials reported a mild case of bird flu in California.

- Traders should not be looking for widespread crop losses from the current hurricane. Georgia, North Caroline and South Carolina make up 4.0% of the US corn crop.

- China reported at least two more outbreaks of African swine fever, including Inner Mongolia.

- China reported an outbreak of foot and mouth disease in Xinjiang.

· China sold 1,026,049 tons of corn at auction from state reserves at an average price of 1,444 yuan ($210.70) per ton, 26 percent of total corn available at the auction.

· Yesterday China sold 2,902,204 tons of corn at auction from state reserves at an average price of 1,567 yuan ($228.81) per ton, 73.28 percent of total corn available at the auction.

· China will sell another 8 million tons of corn next week.

· China sold about 80 million tons of corn out of reserves this season.

· Soybeans started higher on light technical buying but turned lower on chatter soybean yields in the Delta are good, and large US supply prospects. USD was more than 40 points higher in early afternoon trading.

· Earlier today we learned President Trump instructed aides to proceed with tariffs on about $200 billion more in Chinese products.

· November soybeans closed 2.75 cents lower. December meal was down $6.20/short ton and December soybean oil was 3 points lower. Offshore values this morning were suggesting a higher lead for US soybean meal by $0.90 ($2.00 lower for the week to date) and higher lead for soybean oil by 19 points (94 higher for the week).

· Funds sold 3,000 soybeans, sold 7,000 meal and were even in soybean oil.

· Argentina’s Bourse Exchange said Argentina’s soybean area may rise rather than fall this season.

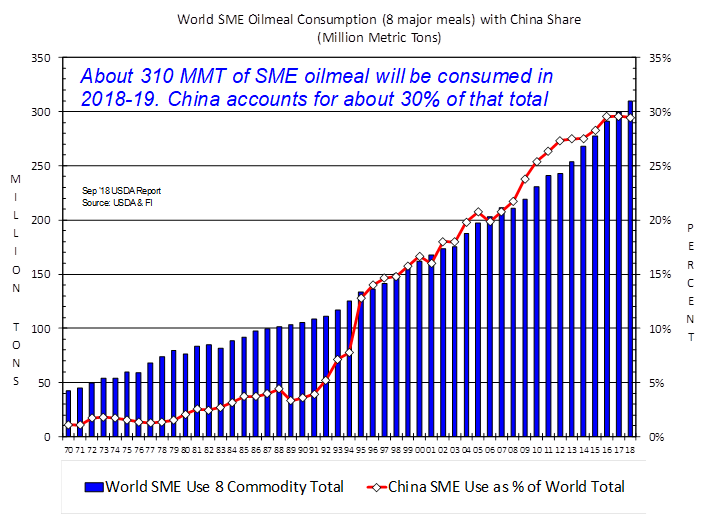

· Argentina bought at least 2 US soybean cargos late this week, which should bring outstanding US soybean export sales to at least 880,000 tons. Some traders think Argentina so far about over one million tons from the US. Questions we have is will Brazil do the same? Buying US soybeans and crushing them in SA is not a bad idea, especially if China ramps up oilmeal imports from several exporting countries.

· Gulf soybean basis remains historically low.

· India imported 1.5 million tons of vegetable oils in August, up 11 percent from a year ago and palm oil accounted for 920,894 tons of the total. Soybean oil imports were 312,049 tons, better than previous month amounts.

· Malaysia November palm fell to a two-week low.

Brazil’s AgMin updated reporters on trade stats. As Reuters picked up they “exported 50.9 million tons of soybeans to China from January to August, or 78.8 percent of its total exports of the oilseed, as a trade war with the U.S. drives up the Asian nation’s demand for soy from alternative sources. That compares with 44.1 million tons of soybeans that Brazil exported to China in the same period last year, accounting for 77.5 percent of the country’s total exports of the commodity, the agriculture ministry reported on Friday.

Brazil’s overall soybean exports are up 20 percent year-on-year to $25.72 billion by value, for the period, hitting a record of 64.6 million tons by volume.”

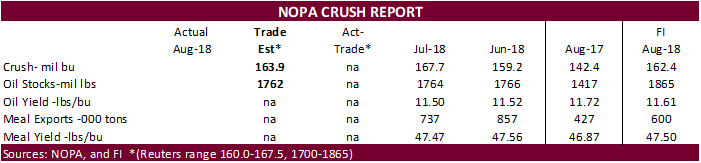

NOPA is due out Monday. Reuters has 163.9 average and Bloomberg is at 163.5. Reuters stocks 1762 and Bloomberg 1751, both close enough for government work. However, we heard at least three other estimates that were not polled have the crush below 160, with two in the 156-157 range.

· The CCC seeks 1540 tons of fully refined vegetable oil on September 18 for carious countries for Oct/Nov delivery.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold about 2.29 MMT of soybeans out of reserves this season.

· US wheat traded higher on speculation Russia will have to curb wheat exports given the rapid pace of current exports and quality problems. We are hearing importers are complaining about foreign materials in their shipments. There was talk about one country possibly turning down a cargo.

· Funds bought an estimated net 6,000 Chicago wheat contracts.

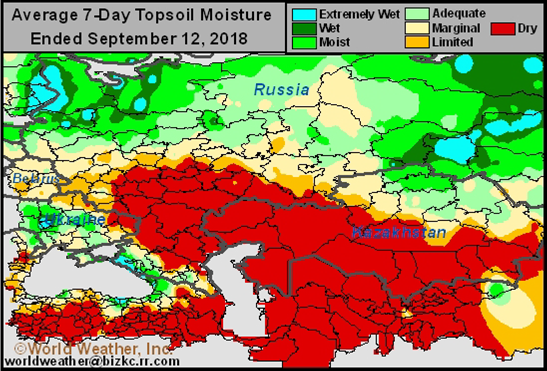

· Russian winter grain plantings have stalled or yet to start in drought affected areas, but several disturbances will occur across the CIS over the next week.

· December Paris wheat increased 1.00 euro to 197.75 euros.

- Asia is shopping for Argentina wheat in the wake of lower Australian wheat production.

- Western Australia Wheat Output Seen Higher at 10.1M Tons: GIWA (Bloomberg)

· China sold 5,143 tons of imported 2013 wheat at auction of state reserves at an average price of 2,188 yuan per ton, 0.5 percent of the total wheat available at the auction.

- Iraq seeks 50,000 tons of wheat on September 23, with offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

- Tunisia bought 67,000 tons of milling wheat, 75,000 tons of durum and 50,000 tons of barley for Oct/Dec shipment.

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 19 for arrival by late February.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

· Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.