From: Terry Reilly

Sent: Monday, September 17, 2018 6:51:51 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 09/17/18

PDF attached includes our US soybean complex update with adjusted yield

Corn.

- Corn futures traded lower on large US crop prospects and US/China trade fears. December corn hit a new contract low, settling 3.75 cents lower at $3.48.

· Funds sold an estimated net 12,000 corn contracts.

· USDA reported US corn harvesting progress at 9 percent, one point below a Reuters trade guess, up 4 points from the previous week and compares to 7 last year and 6 average.

· USDA reported US corn crop conditions at 68 percent, unchanged from the previous week (trade was looking for unchanged) and compares to 61 last year and 66 average.

· Our weighted crop index for US corn crop conditions ended up at 82.4 percent (82.4/100), unchanged from the previous week, above 80.7 a year ago and 82.0 a year ago. Using this index against a 10-year trend yield history against FI crop conditions as of or near October 1, the US yield could end up around 182.5 bushels per acres (+8.0/bu above a 174.5 ten-year trend yield), 1.2 bushels above USDA and compares to 176.6 bushels a year ago, the current record. Using 81.795 million acres for the US corn harvested area, production could end up near 14.982 billion bushels, 101,000 bushels above USDA, assuming ratings remain unchanged from now until October 1.

- USDA US corn export inspections as of September 13, 2018 were 1,030,267 tons, within a range of trade expectations, above 783,495 tons previous week and compares to 687,996 tons year ago. Major countries included Mexico for 270,761 tons, Japan for 150,135 tons, and Peru for 106,319 tons. 1,861 tons of corn out of the interior were included for China.

· The EU crop monitor MARS lowered its yield projection on corn to 7.48 tons/hectare from 7.57 last month.

- China reported its 16th outbreak of African swine fever, this time on a farm in northern China’s Inner Mongolia.

- China’s Ministry of Commerce apparently request from local authorities to control the spread of African swine fever, and secure supplies of pork during for the upcoming holidays.

- US hog futures fell after the hurricane/tropical storm did not have a devastating impact on the industry across the US SE.

· The soybean complex traded lower on large US crop prospects, slowing US demand, and China/US trade fears.

· US barge freight bids were down again.

· Funds sold 5,000 soybeans, sold 3,000 meal and sold 1,000 soybean oil.

· USDA reported US soybean harvesting progress at 6 percent, 1 point above a Reuters trade guess, and compares to 4 last year and 3 average.

· USDA reported US soybean crop conditions at 67 percent, down one point from the previous week (trade was looking for unchanged) and compares to 59 last year and 63 average.

· Our weighted crop index for US soybean crop conditions is running at 82.2 percent (82.2/100), above 80.3 a year ago and 81.4 average. Using this index against a 15-year trend yield history against FI crop conditions as of or near October 1, the US yield could end up near 53.1 bushels per acres (3.4/bu above the 49.7 fifteen-year trend yield), 0.3 bushel above USDA and compares to 49.1 bushels a year ago. Using 88.733 million acre soybean harvested area, production could end up near 4.712 billion bushels, if ratings remain unchanged from now until October 1. Our production estimate is 19 bushels above USDA.

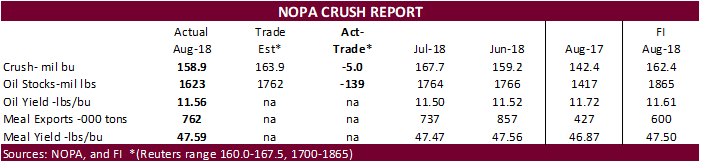

· NOPA reported the US soybean crush at 158.9 million bushels for the month of August below expectations. Soybean oil stocks were reported below expectations as well. Soybean meal shipments were good last month (see table below and supporting graphs in the PDF).

· Argentina may have bought 8-10 cargoes of US soybeans last week. At least 2 were confirmed. Note in USDA’s export inspection report last week showed 29,639 tons were reported for Argentina. At 30,000 ton increments, about 8 cargos would equate to about 240,000 tons, near the amount USDA reported under the 24-hour reporting system this morning (241k to unknown). On Thursday we look for USDA to report US outstanding soybean export sales for Argentina at least 880,000 tons, possibly up to 1.06 million tons if switched from unknown.

· Malaysia was on holiday. Palm prices could appreciate on Tuesday after AmSpec and ITS reported good palm shipments during the first 15 days of the month. AmSpec and ITS reported a 79 and 77 percent rise from the previous month.

- China’s AgMin reported the recent frost in Heilongjiang province will lead to a soybean output loss of about 275,000 tons, 4.5 percent of the overall crop in the province. 40 percent of the 14.5MMT soybean crop in China is grown in Heilongjiang.

· NOPA reported the August crush at 158.9 million bushels, 5.0 bushels below a Reuters trade guess, down 8 million from the previous month and up 16.5 million from the previous year. The daily crush rate fell 5.3% from the previous month and is up 11.6% from August 2017.

· US September 1 NOPA soybean oil stocks came in at 1.623 billion pounds, 139 million below an average trade guess, 140 million below the end of August and 206 million above August 2017. Given the decline in soybean crush, soybean oil demand was not all that bad during August, but the discrepancy between the average trade guess and actual was perceived as bullish. The soybean yield in August came in below our expectations.

· US soybean meal exports reported by NOPA were very good at 762,000 short tons, 24,000 above the previous month and 335,000 above the previous period year ago. The August meal exports were a record for the month.

· US wheat settled lower in Chicago and KC and higher in MN.

· Funds sold an estimated net 7,000 Chicago wheat contracts.

· USDA reported US winter wheat planting at 13 percent, up 8 points from the previous week, 6 points below a trade average and compares to 12 last year and 14 average.

· USDA reported US spring wheat harvesting progress at 97 percent, one point below a Reuters trade guess, up 4 from the previous week and compares to 98 last year and 92 average.

· Widespread frost hit Australia’s western growing areas over the weekend, raising concerns wheat production will drop below the 12-13 million tons from people predicted. Additional cold weather could occur this week.

· Parts of Victoria and South Australia saw cold temperatures that may impact wheat and canola production.

· Note ABARES is at 19.1 million tons for Australia’s all wheat production, a 10-year low.

· Egypt seeks wheat for November shipment.

· December Paris wheat increased 0.25 euro to 199.00 euros.

· The EU crop monitor MARS left its yield projection on soft wheat unchanged at 5.70 tons/hectare from last month.

· Russian wheat export prices increased for the week ending September 14. Russian wheat 12.5 percent protein was last $217 a ton FOB, up $2 on the week, according to IKAR. SovEcon FOB wheat was last $218/ton.

· Russia’s AgMin reported harvest progress reached 88.2 million tons of grain with an average yield of 2.73 tons per hectare from 69.6 percent of the harvesting area. Last year 110.4 million tons were collected with an average yield of 3.17 tons.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.