From: Terry Reilly

Sent: Wednesday, September 19, 2018 2:42:53 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 09/19/18

PDF attached

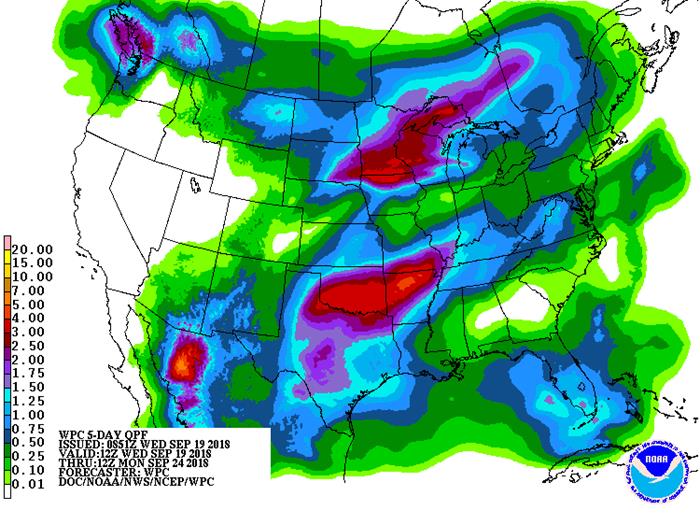

· Two more days of much warmer-than-normal temperatures and dry conditions will occur in most of the lower and eastern Midwest.

· US harvesting delays will occur in a few parts of the US this week but the majority of the US could see a large increase in corn and soybean harvesting progress.

· Frost and freezes may eventually develop in the northern most Midwest and a part of the northern Plains in late September.

· HRW wheat country will see rain delaying plantings of winter wheat but the precipitation was welcome.

· Canada’s Prairies will be cool and wet this week, delaying harvesting efforts.

· Australia’s precipitation will remain limited this week.

· Russia’s Volga River Basin could see additional rain will fall this week.

· Europe will see limited rainfall through Thursday.

· Brazil will see good rain this week from Mato Grosso do Sul and Paraguay to southern Minas Gerais, Parana, Santa Catarina and Parana.

· Argentina will see a mixture of rain and sunshine.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Thu 80% cvg of 0.40-1.65”

and local amts to 3.25”

from east S.D. and NE

Neb. to central and

north Ia. and central

and NW Wisc. with up

to 0.75” and local amts

to 1.20” elsewhere; far

south driest

Thu-Fri 70% cvg of up to 0.35”

and local amts to 0.75”

Fri-Sat 15% cvg of up to 0.50”

and local amts to 1.0”;

SE Mo. wettest

Sat-Sun 20% cvg of up to 0.40”

and local amts to 1.0”;

mostly south

Sun-Tue 85% cvg of up to 0.75”

and local amts to 1.75”;

far NW driest

Mon-Sep 26 85% cvg of up to 0.75”

and local amts to 2.0”

Sep 26-27 55% cvg of up to 0.35”

and local amts to 0.85”

Sep 27-28 60% cvg of up to 0.35”

and local amts to 0.65”

Sep 28-29 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sep 29-30 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sep 30-Oct 2 60% cvg of up to 0.70”

and locally more

Oct 1-3 70% cvg of up to 0.70”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

Tdy-Thu Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.30” and locally to 0.30” and locally

more each day; some more each day

days may be dry

Fri-Sun 85% cvg of up to 0.65” 10-20% daily cvg of

and local amts to 1.30”; up to 0.50” and locally

wettest north more each day; north

and west wettest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”

Mon-Sep 26 80% cvg of up to 0.75”

and local amts to 1.75”

Sep 26-28 80% cvg of up to 0.75”

and local amts to 2.0”

Sep 27-Oct 1 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Sep 29-Oct 1 10-25% daily cvg of

up to 0.30” and locally

more each day

Oct 2-3 40% cvg of up to 0.35”

and locally more

Oct 2-4 35% cvg of up to 0.40”

and locally more

Source: World Weather and FI

Bloomberg weekly agenda

THURSDAY, SEPT. 20:

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-20 palm oil exports, 11pm ET Wednesday (11am Kuala Lumpur Thursday)

- SGS data for same period, 3am ET Thursday (3pm Kuala Lumpur Thursday)

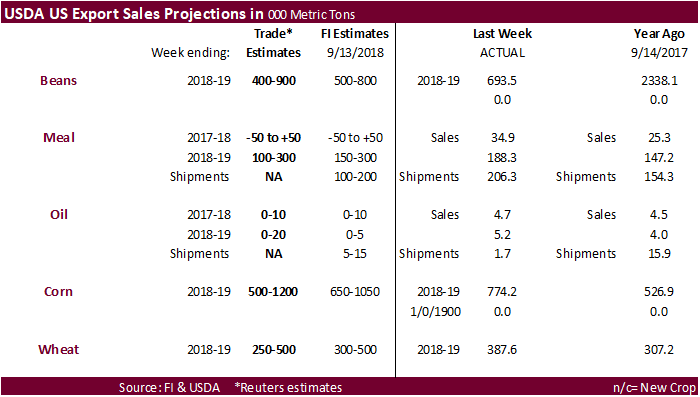

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for August, 3pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Intl Palm Oil Sustainability Conference in Kota Kinabalu, final day

FRIDAY, SEPT. 21:

- Ghana public holiday

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA cattle-on-feed report for August, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Statistics Canada Canadian crop production estimates based on satellite and agroclimatic data, not the farm survey.

· Canada 2018 all-wheat output seen +3.5 pct. to 31.02 mln tons vs 29.98 mln tons in 2017

· Canada 2018 durum wheat output seen +15.0 pct to 5.71 mln tons vs 4.96 mln tons in 2017

· Canada 2018 oats output seen -9.4 pct to 3.38 mln tons vs 3.73 mln tons in 2017

· Canada 2018 barley output seen +4.3 pct to 8.23 mln tons vs 7.89 mln tons in 2017

· Canada 2018 canola output seen -1.5 pct to 21.00 mln tons vs 21.33 mln tons in 2017

Macros.

· US Housing Starts Aug: 1.282M (est 1.235M, prevR 1.174M)

– US House Starts Change MM Aug: 9.2% (prevR -0.3%)

· US Building Permits Aug: 1.229M (est 1.310M, prev 1.303M)

US Building Permits Change MM Aug: -5.7% (prev 0.9%)

Corn.

· Corn futures ended higher following wheat and soybeans. Large US crop prospects and harvesting pressure limited gains. Recall prices hit contract lows on Tuesday, and could test those lows again by the end of the week. Global trade has increased this week. South Korea is covering through the end of February.

· CIF corn bids fell about 4-6 cents. Interior corn was steady to lower.

· Around Ontario, old crop corn is 40-50 over and new-crop 25-35 over. Toledo corn is about 30 under.

· China’s sow herd fell in August by 4.8 percent from August 2017, according to the Ministry of Agriculture and Rural Affairs. Poor pig prices and outbreaks of African swine fever were noted. Sow herd declined by 1.1 percent from the prior month. China’s hog herd fell in August by 2.4 percent from a year earlier and by 0.3 percent from July.

· The USDA Broiler Report showed eggs set in the US down 2 percent and chicks placed down slightly. Cumulative placements from the week ending January 6, 2018 through September 15, 2018 for the United States were 6.81 billion. Cumulative placements were up 1.4 from the same period a year earlier.

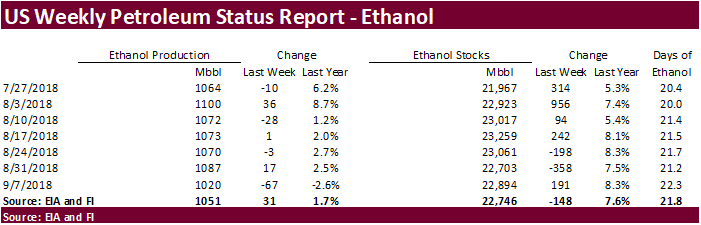

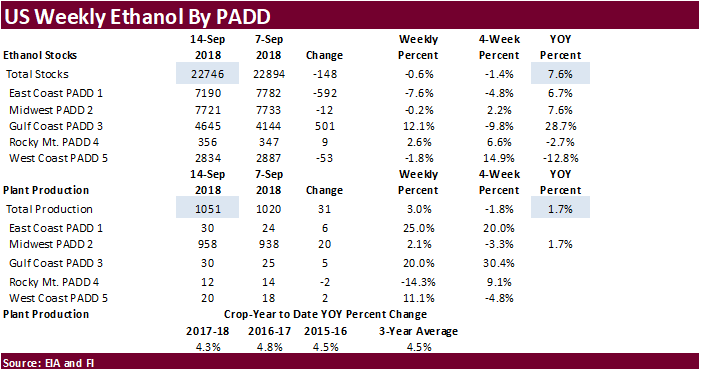

· Weekly US ethanol production increased 31,000 barrels per day to 1.051 million, higher than trade expectations, 1.7 percent above the comparable period a year ago but 2.1% below 4 weeks earlier. US ethanol stocks decreased 148,000 barrels to 22.746, about in line with expectations. At 22.746 million barrels, ethanol stocks are up 7.8% from the comparable period a year ago. Days of inventory stand at 21.8, up from 21.5 last month and compares to 20.5 a year earlier. The weekly ethanol figures were viewed as neutral for corn futures. Note year to date corn futures are down about 2 percent while ethanol futures are off 6 percent. WTI year to date is up 17 percent.

· South Korea’s KOCOPIA bought about 60,000 tons of optional origin corn, likely to be sourced from the United States, at $202.12 a ton c&f for arrival around Jan. 10, 2019.

· South Korea’s KFA bought about 63,000 tons of optional origin corn at $200.95 a ton c&f for arrival around Feb. 28, 2019.

· China will sell another 8 million tons of corn later this week.

· China sold about 80 million tons of corn out of reserves this season.

· Soybeans saw a strong technical rebound after trading near a 10-year low on Thursday. Prices settled near session highs.

· There was chatter Argentina bought additional US soybeans.

· Topic of storage is starting to pick up steam. We are hearing some producers are being turned away from elevators across the western areas of the WCB and upper Great Plains. Soybeans and soybean oil fully carry is already high. Bull spreading is an option for producers if plan to store it. Look for short rolling from Nov to Jan, then eventually Jan to Mar, etc, until the cash market appreciates and/or spreads tighten.

· Price gains in soybeans were limited on US harvesting pressure, good SA weather and US/China trade conflict to limit gains.

· Soybean oil was lower after Malaysian palm fell out of bed but turned higher from a rally in WTI crude oil.

· US Gulf soybeans weakened on Wednesday. CIF soybeans were unchanged to 5 cents lower. Brazil soybeans increased roughly 5 to 10 cents. Two Indiana processing plants lowered bids by 5 cents.

· Soybean meal is back above $300/short ton. We picked up European meal buying after it dipped below $300 on Tuesday.

· Funds bought 6,000 soybeans, bought 3,000 meal and bought 3,000 soybean oil.

· A week from this Friday is the USDA September 1 stocks report. We are not looking for a large deviation in US soybean stocks from USDA’s September WASDE projection.

· Coceral lowered its estimate of EU rapeseed production to 19.4 million tons from 21.0 million in June.

· Malaysia November palm oil fell to a 2-month low.

· A University of Illinois report projects corn may return a higher return over soybeans in 2019:

2019 Crop Budgets Suggest Dismal Corn and Soybean Returns

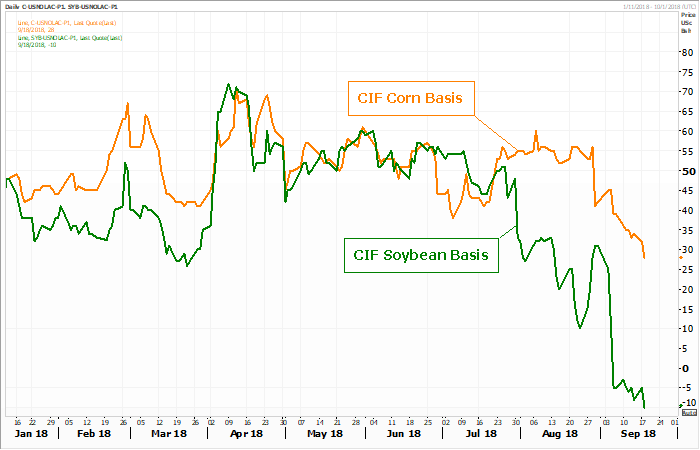

CIF soybean and corn basis

Source: Reuters and FI

· China sold 92,988 tons of 2013 soybean at auction of state reserves at average price of 3,060 yuan ($446.12) per ton, 100 percent of total 2013 soybean available for the auction.

· China sold about 2.38 MMT of soybeans out of reserves this season.

· Iran seeks 30,000 tons of sunflower oil on September 24.

· US wheat was higher on follow through buying from an increase in global demand and Australian production woes.

· December Paris wheat increased 3.25 euros to 202.50 euros.

· Coceral lowered its outlook for EU soft wheat production to 129.9 million tons from 138.8 million in June. Corn production was pegged at 58.9 million tons from 60.3 million previously and barley production at 57.4 million tons from 60.8 million.

· Traders noted Russia is in for cold and wet weather, threatening Russian spring wheat

· Ukraine exported 7.7 million tons of grain since July, down from 8.5 million tons at the same point last year. Ukraine has exported 4.3 million tons of wheat, 1.8 million tons of barley and 1.4 million tons of corn. Grain production in Ukraine is estimated at 63.1 million tons, only 200,000 tons below 2017.

· Kazakhstan collected 11.2 million tons of grain as of September 18, 2018 compared with 12.6 million tons harvested a year earlier, 59% of the total area under crop. Harvesting delays was noted. The AgMin has a 20-million-ton crop and exports at 9 million tons. In 2017 Kazakhstan harvested 21.9 million tons of grain in net weight.

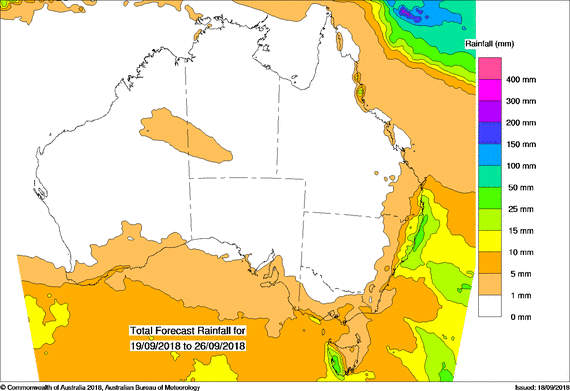

Australian 8-day precipitation forecast.

Export Developments.

· Syria bought about 200,000 tons of Russian wheat at $224.50 per ton c&f for shipment between Oct. 15 and Dec. 15. Syria is planning to import around 1.5 million tons of mostly Russian wheat this year.

· Jordan passed on 120,000 tons of feed wheat, optional origin. 2 offers were presented.

· China sold 3,000 tons of imported 2013 wheat at auction from state reserves at an average price of 2,160 yuan ($315.31) per ton, 0.3 percent of total wheat available at the auction.

· Japan in a SBS import tender passed 120,000 tons of feed wheat and 200,000 tons of barley for arrival by late February.

· Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 26 for arrival by late February.

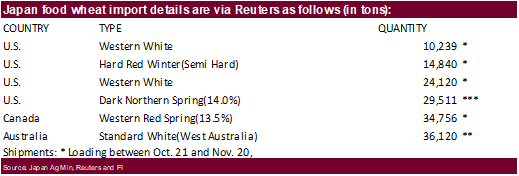

· Japan seeks 149,586 tons of wheat on Thursday.

· Jordan seeks 120,000 tons of feed barley, optional origin, on September 26.

· Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

· Results awaited: Algeria seeks 75,000 tons of feed barley on Wednesday for November shipment.

· Turkey seeks a total of 252,000 tons of red milling wheat for October 2-22 loading. It closes on September 22. The depreciation of the lira sent importers seeking Turkish wheat flour, causing them to restrict exports. But countries like Iraq that heavily depend on flour from Turkey may have to import from other countries.

· Iraq seeks 50,000 tons of wheat on September 23, with offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

· Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

· China sold 92,988 tons of 2013 rice at auction from state reserves at average price of 3,060 yuan ($446.12) per ton, 100 percent of total rice available for the auction.

· Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.