From: Terry Reilly

Sent: Saturday, September 22, 2018 12:07:43 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 09/21/18

PDF attached

Corn.

・ Corn finished higher on continued short covering and technical buying, but not at frenzied as Thursday’s run-up. Volumes were higher than average due to the October option expiration and over 1% move higher.

・ CFTC reported that CBOT corn specs increased their net short position by 3,958 contracts to 86,528 in the week ending September 11. This could have been a factor in the late-week rally in grains and oilseeds as soybeans and wheat also showed an increase in the net spec positions.

・ Funds were net buyers of 12,000 corn futures contracts.

・ China reported two more cases of African swine fever on small farms, in Jilin and Inner Mongolia.

・ Harvest should resume in the NW Midwest this weekend following rains this week which limited field work.

・ Under the 24-hour announcement system, US exporters sold 121,700 tons of corn to unknown for the 2018-19 marketing year.

・ China sold 2,999,788 tons of corn at auction of state reserves at an average price of 1,559 yuan ($227.65) per ton, 75.45 percent of total corn available at the auction.

・ China will sell another 4 million tons of corn on Friday.

・ China sold about 83 million tons of corn out of reserves this season.

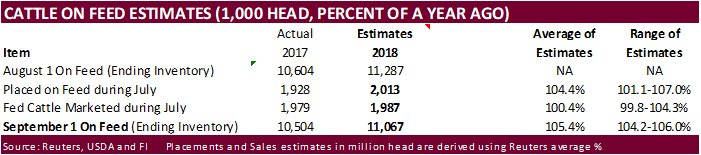

US monthly cattle on feed highlights – USDA

・ US September 1 cattle on feed was reported at 106%.

・ US August cattle placed on feed 107%.

・ US August cattle marketed 100%

・ Soybeans closed lower by a half-cent on the session, but ended the week higher 16.75 cents, the largest weekly gain in five weeks. The market found little direction today as headlines today revealed nothing new.

・ A senior White House official said there is not a scheduled date to announce for another round of trade talks.

・ There are two cargoes of beans headed to China in spite of the tariffs. The market is eyeing the cargoes to see if China scrutinizes these shipments as trade tensions build.

・ Meal vs beanoil spreading was noted as meal dipped 1.7% while soy oil rose 1.8% on the session.

・ CFTC reported that CBOT soybean specs increased their net short position by 11,828 contracts to 123,395 in the week ending September 11.

・ Funds were net sellers of 3,000 soybean and 4,000 soymeal futures contracts. Funds were said to have bought a net 5,000 soyoil contracts.

・ AgRural showed that soybean planting is moving ahead of the 5-yr pace for Brazil with the largest gain in pace seen in Paraná with 11.2% sown compared to 1.7% planted last year and 1.9% over the last 5-yrs.

・ AgRural also raised the projected soy area for 2018/19 by 110,000 hectares to 35.8 million hectares.

・ Under the 24-hour announcement system, US exporters sold 100,000 tons of soymeal to unknown for the 2018-19 marketing year.

・ Iran seeks 30,000 tons of sunflower oil on September 24.

・ China sold about 2.38 MMT of soybeans out of reserves this season.

・ CFTC reported that CBOT wheat specs increased their net short position by 18,775 contracts to 24,265 in the week ending September 11.

・ Funds sold an estimated net 3,000 Chicago wheat contracts.

・ IKAR lowered its estimate for Russia wheat production to 69.2 million tons from 69.6 million, and exports to 33.0 million tons from 33.9 million previously.

・ Russia’s SovEcon cut Russia’s 2018/19 wheat exports to 33.0 million tons from 33.9 million tons

・ EU wheat closed lower following Chicago wheat and position squaring following the rally this week.

Export Developments.

・ China sold 25,412 tons of imported 2013 wheat at auction from state reserves at an average price of 2,200 yuan ($321.66) per ton, 2.6 percent of total wheat available at the auction.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.