From: Terry Reilly

Sent: Tuesday, October 02, 2018 4:02:25 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 10/02/18

PDF attached

Weather and crop conditions

· Additional showers will fall across the northern areas of the US Midwest Wednesday and showers appear across the central areas Thursday, and northwestern areas Friday into Saturday. The Plains will see follow up rain in the northern areas Thur-Fri.

· US crop conditions were unchanged in soybeans and corn, down one in sorghum, and up 3 for cotton. Corn harvest progress was up 10 points to 26, at trade expectations. Soybean harvest were 23 percent, up 9 points, and 4 points below expectations. Winter wheat plantings were 15 percent, one point below trade expectations.

· The Midwest will be wet Thursday into mid-next week, bias WCB. The rain will delay harvesting efforts and raise concerns over quality for corn and soybeans. There will be an important period of drier weather October 10-15, which will be needed for producers.

· This week the Delta will be on the drier side. Showers will fall in the lower Midwest and Tennessee River Basin. Overall fieldwork activity across the Delta should improve.

· Rain will fall from the southwestern desert areas through the northern Plains early to mid-week this week.

· The Canada Prairies will be cold this week.

· Brazil will see rain in the central and southern growing areas (MG, MGDS, Goias, Parana) this week while Argentina will be dry through Saturday.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Wed 65% cvg of up to 0.50”

and local amts to 1.10”;

wettest NE

Wed-Thu 75% cvg of up to 0.55”

and local amts to 1.10”;

wettest west

Thu-Sat 80% cvg of 0.50-1.50”

and local amts to 3.0”

from Ks. to north Mo.

to far south Wi. with

up to 0.75” and locally

more elsewhere; S.D.

and Neb. driest

Fri-Sun 80% cvg of up to 0.75”

and local amts to 2.0”;

west and north wettest;

driest SE

Sun-Oct 9 85% cvg of up to 0.75”

and local amts over 2.0”

with a few bands of

2.0-3.50” and locally

more

Mon 15% cvg of up to 0.20”

and locally more

Oct 9-11 80% cvg of up to 0.75”

and local amts to 2.0”;

wettest west; driest SE

Oct 10 20% cvg of up to 0.50”

and locally more;

wettest south

Oct 11-13 65% cvg of up to 0.75”

and local amts to 1.50”

Oct 12-14 70% cvg of up to 0.75”

and local amts to 1.50”

Oct 14-16 Up to 20% daily cvg of

up to 0.25” and locally

more each day

Oct 15-16 Up to 20% daily cvg of

up to 0.25” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Wed-Fri Up to 15% daily cvg of Up to 20% daily cvg of

up to 0.20” and locally up to 0.20” and locally

more each day; some more each day; some

days may be dry days may be dry

Sat 70% cvg of up to 0.75”

and local amts to 1.50”;

wettest south

Sat-Sun 5-20% daily cvg of up

to 0.30” and locally

more each day

Sun-Oct 10 5-20% daily cvg of up

to 0.30” and locally

more each day

Mon-Oct 11 10-25% daily cvg of

Up to 0.40” and locally

more each day

Oct 11-13 60% cvg of up to 0.50”

and local amts to 1.10”

Oct 12-14 50% cvg of up to 0.50”

and local amts to 1.10”

Oct 14-16 Up to 20% daily cvg of

up to 0.20” and locally

more each day

Oct 15-16 Up to 20% daily cvg of

up to 0.20” and locally

more each day

Source: World Weather Inc. and FI

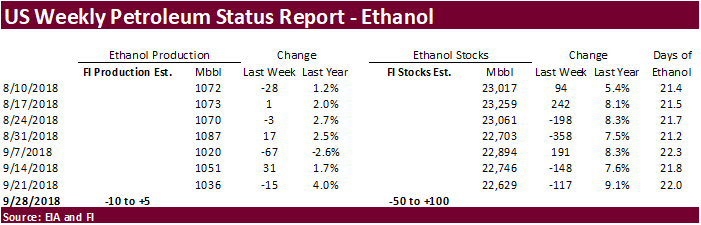

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, 0CT. 4:

- FAO food index for September, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, OCT. 5:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Corn.

- Corn futures ended 1.75-2.25 cents higher from higher soybeans and higher wheat. There was little news to trade on in the corn market. Some cited unfavorable US harvest weather from too much rain this week across the ECB but we think that is worked into the market.

- Funds bought an estimated 11,000 corn contracts.

- China will see heavy rain this week across the NE growing areas.

· Soybean and Corn Advisory left his 2018 U.S. corn estimate unchanged at 182.0 bu/ac. FC Stone is at 182.7 and USDA at 181.3. We are using 183.5.

· China will sell 8 million tons of corn for the week ending October 5.

· China sold about 85.5 million tons of corn out of reserves this season and some are predicting up to 100 million tons will be sold by the end of the marketing season.

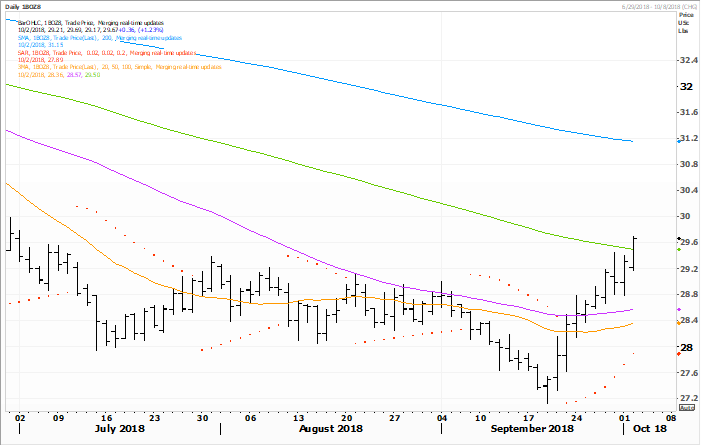

· The soybean complex rallied on short covering and buy stops. The short covering and harvest delays were noted for soybeans. Buy stops were present in soybean oil after the December contract traded above its 100-day MA. We see resistance in Dec soybean oil at 30 cents. Meal gains were trimmed on oil/meal spreading.

· We are hearing, but did not confirm, some central IL soybean growers are using bags to store soybeans, like to what you can find in Argentina.

· US producer selling was slow today and some processors raised basis levels.

· Funds bought an estimated 8,000 soybean contracts, bought 2,000 soybean meal and bought 4,000 soybean oil.

- APK-Inform estimated combined sunflower seed production in all the five Black Sea countries (Ukraine, Russia, Moldova, Bulgaria and Romania) at 31.7 million tons in 2018, a 10-percent increase. Ukraine was pegged at 14.8 MMT and Russia at 10.9 MMT.

· Deral reported soybean planting progress in Parana reached 29 percent, and corn at 70 percent.

· Soybean and Corn Advisory left his 2018 U.S. soybean estimate unchanged at 53.0 bu/ac. FC Stone is at 54.0. USDA @ 52.8 and we are using 53.3.

December soybean oil broke above a 100-day MA today

Source: Reuters and FI

· US wheat futures rallied after a report surfaced that Russia could curb wheat exports.

- Funds bought 8,000 SRW wheat contracts.

· Russia’s agriculture quality control government arm (Rosselkhoznadzor) reported the possible temporary suspension of 30 grain loading points in two of Russia’s top grain exporting regions of Krasnodar and Rostov over violation of phytosanitary rules. The suspension could last up to 90 days. After newswires dug into the issue, it was not clear how many points could or will be suspended.

· Any such suspension will not change our outlook for the Russian wheat export projection for the 2018-19 crop year of 36 million tons (1 MMT higher than USDA) as Russia will still have the opportunity to export wheat on the back end of the marketing year. See our attached Russia wheat S&D.

· This comes after Algeria may soon buy Russian wheat, which would be a monumental shift from traditional supplier Europe.

· Eastern Australia saw its driest September on record. Eastern Australia may see some rain across NSW and southern Queensland this week.

- Traders should monitor a potential significant rain event in far southern Brazil Saturday into Sunday which could negatively impact wheat conditions.

- Morocco will suspend import duties on wheat November 1.

- Taiwan bought 110,000 tons of US wheat for Nov-Dec shipment.

o The first consignment for shipment between Nov. 18 and Dec. 2 involved 26,980 tons of U.S. dark northern spring wheat of 14.5 percent protein content bought at $252.21 per ton FOB U.S. Pacific Northwest coast. Another 20,480 tons of hard red winter wheat of 12.5 percent protein content was bought at $248.14 a ton FOB and 7,540 tons of soft white wheat with 9 percent protein was bought at $231.49 a ton FOB.

o The second consignment for shipment between Dec. 3 and Dec. 17 involved 30,595 tons of dark northern spring wheat of 14.5 percent protein content bought at $255.53 a ton FOB. The second consignment also included 18,430 tons of hard red winter wheat of 12.5 percent protein content bought at $249.71 a ton FOB and 5,975 tons of western white wheat with 9 percent protein bought at $229.73 a ton FOB. (Reuters)

- Tunisia seeks optional origin 50,000 tons of durum wheat, 75,000 tons of soft wheat and 50,000 tons of feed barley, on Oct. 3.

- The UN bought 50,000 tons of wheat for Yemen.

- Libya seeks 1 million tons of Russian wheat.

- Bahrain seeks 25,000 tons of wheat on October 2 for Nov shipment.

- Jordan retendered for another 100,000 tons of feed barley on October 3.

- Bangladesh seeks 50,000 tons of 12.5 percent wheat on October 9, optional origin.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on October 10 for arrival by late February.

- Postponed: UAE seeks 60,000 tons of wheat for Oct/Nov shipment.

Rice/Other

· Thailand seeks to sell 120,000 tons of sugar on October 3.

· The Philippines seek 250,000 tons of rice on October 18 for arrival by late November.

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.