From: Terry Reilly

Sent: Friday, October 05, 2018 5:46:04 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 10/05/18

See PDF attached for US S&D balances

Corn.

- Corn traded sharply lower at one point. December settled 0.75 cent higher. Nearby December hit a one-month high.

- Corn spreads were very active.

- Funds bought an estimated 8,000 corn contracts.

- Oats prices fell a cent today, snapping a seven day winning streak.

- US corn exports in August were 230 million bushels, well above our expectations, down from 266.4 million in July and well up from 137.6 million in August 2017.

- France collected 42 percent of their corn crop as of October 1, double from the previous week and above 12 percent from a year ago.

- Bird flu was detected in Bulgaria.

- On October 11 USDA will updated their latest US crop supply survey and demand expectations. Using Bloomberg trade guesses, we were surprised to see such a wide range on US corn ending stocks for 2018-19 of 648 million bushels. The average trade guess is 1.913 billion bushels, up 139 million from September’s 1.774 billion bushels. US corn production averaged 14.859 billion, 32 million above last month with a 305-million-bushel range between the low/high estimates. Analysts look for the US corn harvested area to increase 34,000 acres from September.

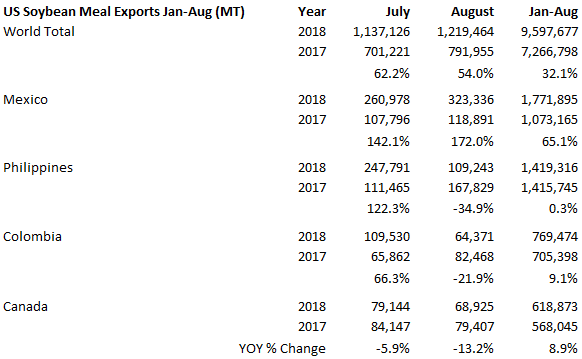

· Soybeans rallied from sharply higher soybean meal (bull spreads). The strength in soybean meal was related to ideas Brazil will no longer offer soybean meal for export during the November and December period, resulting in buying turning to the US. In addition, Census reported higher than expected US soybean meal exports for the month of August. September US soybean meal exports are thought to the be equally strong, if not larger than August. November soybeans traded as high as $8.7025. The contract settled 9.75 cents higher near its intraday high. The most active soybean meal contract, December, traded to nearly a one-month high, ending $7.40/short ton higher. December soybean oil fell 20 points to 29.41. On Wednesday the contract hit its highest level since June 22.

· Funds bought an estimated 7,000 soybean contracts, bought 6,000 soybean meal and sold 2,000 soybean oil.

· The Brazil presidential election is Sunday. https://www.bloomberg.com/graphics/2018-brazil-election/ If no presidential candidate surpasses 50 percent of the vote on Sunday, the top two will compete in a runoff on October 28. Caution to those trading the Brazil currency.

· AgRural estimated Brazil planted 10 percent of their soybean crop, double than that of last year.

· Safras & Mercado reported new-crop brazil soybean sales as of October 1 at 27.3 percent, up from 14.1 percent at this time last year, and compares to an average 30.2 percent. Safras is using 121 million tons for 2019 production. Conab is due out soon with their estimate.

· The Philippines bought 134,000 tons of soybean meal. US soybean meal export business should remain steady to firm over the next few months as Argentina and Brazil become non-competitive.

· Census reported August soybean meal/flour and hulls exports at 1.344 million short tons (80k above our working estimate), up from 1.226 million in July and well above 875,484 short tons in August 2017. Impressive figure for this time of year. Weekly exports as reported by USDA Export Sales during September are roughly 12 percent higher than August. If we were to add a 6 percent increase to the daily adjusted August figure, US soybean meal exports in September could end up near 1.380 million short tons. This would put marketing year exports 600-650 thousand short tons above USDA’s 14.4 million estimate for 2017-18. Our 2018-19 US soybean meal carryout is 222,000 short tons, below USDA’s current 400,000 estimate. We look for USDA to lower their carryout on October 11.

· The US exported 123.7 million bushels of soybeans in August, down from 125.9 million in July and up from 113 million in August 2017.

· Census soybean oil exports were 198 million pounds, up from 174.7 million in July and 163.2 million in August 2017.

· Water levels for the upper Mississippi River are high and stalling some cargo shipments.

- On October 11 USDA will updated their latest US crop supply survey and demand expectations. A Bloomberg survey calls for the average US soybean production to end up at 4.722 billion bushels, up 29 million from the prior 4.693 billion. The yield average was 53.3 versus 52.8 in September. US 2018-19 soybean ending stocks were estimated at 905 million bushels, up 60 million from September. Analysts look for the US soybean harvested area to decrease 230,000 acres from September.

· Wheat finished higher on short covering and Australian production concerns. A return of drier bias weather across Europe and Black Sea region also supported prices.

- Funds bought 3,000 SRW wheat contracts.

· FCStone estimated the Australia wheat crop at 16.4 million tons, lowest in 11 years, down from 18.8 million tons last month. ABARES is at 19.1 million tons.

· France planted 5 percent of their soft wheat crop as of October 1, one point below a year ago. If France’s weather does not improve, we look for a smaller winter wheat and rapeseed planted area from 2017-18.

· December EU wheat settled 0.50 euros higher at 203.25.

- On October 11 USDA will updated their latest US crop supply survey and demand expectations. A Bloomberg survey calls for the average US all-wheat ending stocks to end up at 959 million bushels, 24 million above September.

- Traders should monitor a potential significant rain event in far southern Brazil Saturday into Sunday which could negatively impact wheat conditions.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.