From: Terry Reilly

Sent: Wednesday, October 23, 2019 2:24:12 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 10/23/19

PDF attached does no include the daily estimate of funds

From World Weather:

US Midwest weather in the coming week

- The Midwest will continue to see a mostly restricted precipitation pattern and improving to favorable conditions for crop maturation and fieldwork through the next two weeks and good harvest progress should be made around the occasional rounds of precipitation expected.

- Dry conditions will be most common through Nov. 6 with the most significant precipitation events through the next ten days occurring Thursday into Saturday and Monday into Tuesday.

- Kentucky into central and southern Ohio will be wettest Thursday into Saturday and will see 1.0-2.50” of rain and locally more with most other areas from central and southeastern Missouri to northern Ohio and Michigan seeing 0.20-1.0” and locally more.

- Fieldwork will be delayed, but much of the region where rain will be heaviest has relatively dry soil conditions and harvest delays should be temporary while winter wheat benefits from the moisture.

- The Monday into Tuesday precipitation event will favor the southern and eastern Midwest with most of the precipitation light and not likely to cause serious interruptions to fieldwork.

- Kentucky into central and southern Ohio will be wettest Thursday into Saturday and will see 1.0-2.50” of rain and locally more with most other areas from central and southeastern Missouri to northern Ohio and Michigan seeing 0.20-1.0” and locally more.

- Recent precipitation the northwestern Corn Belt and cool temperatures that will limit drying rates will keep that region from seeing aggressive harvesting for a while longer, but steady drying will occur there, and fieldwork should accelerate.

- Dry conditions will be most common through Nov. 6 with the most significant precipitation events through the next ten days occurring Thursday into Saturday and Monday into Tuesday.

US Delta weather in the coming week

- Rain has been increased since Tuesday’s forecast for the Delta than what was advertised Monday and the region will see rain Thursday night into Friday before a restricted rainfall pattern resumes this weekend and continues into the first week of November allowing harvesting to accelerate.

- Rainfall totals Thursday night into Friday will be 0.60-2.0” and locally more and some cotton discoloration is likely.

- Dry conditions will be most common this weekend into Nov. 6 allowing good harvest progress to be made.

- After a significant rain event Thursday into Monday rain has been reduced for the southeastern states for later next week and a restricted rainfall pattern is now expected from Tuesday through Nov. 6.

- The greater rain Thursday into Monday has been shifted westward in today’s forecast and Mississippi into northern Alabama will see 1.0-3.0” of rain and locally more that will likely cause some cotton discoloration.

- Rain will be mostly light from southeastern Alabama to eastern Georgia, the Carolinas, and southern Virginia with significant rain between those regions.

- Similar to what is expected in the Delta, dry conditions will be most common Tuesday through Nov. 6 and harvesting should advance well around the occasional rounds of showers expected.

- The greater rain Thursday into Monday has been shifted westward in today’s forecast and Mississippi into northern Alabama will see 1.0-3.0” of rain and locally more that will likely cause some cotton discoloration.

Brazil weather in the coming week

- Many of the driest areas from Mato Grosso to Bahia and Minas Gerais to Sao Paulo will benefit regular rounds of showers and thunderstorms during the next week while much of central Paraguay into much of Mato Grosso do Sul and surrounding areas see little rain of significance.

- Significant rain will also fall during the next week from Rio Grande do Sul and southern Paraguay to central and eastern Parana and this region as well as the other region that will benefit from significant rain will see general totals of 1.0-2.50” and locally more through Tuesday.

- Further increases in soil moisture and improvements in conditions for planting and establishment of summer crops are expected.

- Significant rain will also fall during the next week from Rio Grande do Sul and southern Paraguay to central and eastern Parana and this region as well as the other region that will benefit from significant rain will see general totals of 1.0-2.50” and locally more through Tuesday.

- Northern Brazil will be wettest during the next few days before rain increases in the south Sunday.

- Central Paraguay into Mato Grosso do Sul, southwestern Mato Grosso, and northwestern Parana will miss much of the rain that other areas see and planting may be put on hold in areas that have not seen significant rain recently while crop stress may rise in areas that have already been planted.

- The Oct. 30-Nov. 6 period will feature an increase in showers in the drier areas of Brazil and Paraguay and a continuation of showers in other areas that will keep conditions for planting and establishment of crops favorable in most areas with some improvements from central Paraguay to Mato Grosso do Sul and nearby areas.

Argentina weather in the coming week

- Rain will increase Thursday into Tuesday and nearly all of Argentina will receive at least some rain with temporary improvements in conditions for winter wheat and planting of summer crops in the drier areas while the remainder of the country should receive enough rain to keep soil conditions favorable.

- Isolated and light showers will occur today with southeastern areas wettest.

- Showers will begin to increase Thursday in the southwest and rain Thursday through Tuesday will be greatest from Buenos Aires to Corrientes, Chaco, and southern Santiago del Estero where most areas will receive 0.50-1.75” and locally more with a few pockets of lighter rain.

- The driest areas from southern Cordoba into La Pampa and San Luis as well as central into northern Santiago del Estero will see totals of 0.10-0.70” most often and locally more.

- The rain in the drier areas should at least temporarily improve conditions for winter wheat, but much more rain will be needed to induce a lasting increase in soil moisture.

- The driest areas from southern Cordoba into La Pampa and San Luis as well as central into northern Santiago del Estero will see totals of 0.10-0.70” most often and locally more.

- Today’s forecast includes less rain for Nov. 2-3 than what was advertised Tuesday, but showers will occur most days from Oct. 30-Nov. 6.

- Isolated to scattered showers will occur most often Oct. 30-Nov. 6 allowing fieldwork to advance well with enough rain in most areas to maintain favorable soil conditions while rain in the drier areas should not be great enough to prevent stress to winter wheat from increasing.

Source: World Weather Inc. and FI

Bloomberg Ag Calendar

WEDNESDAY, Oct. 23:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- China imports of cotton, corn, wheat, sugar

- World Cocoa Foundation 2019 Partnership Meeting in Berlin Oct. 23-24

- Speakers include officials from Ivory Coast and Ghana’s cocoa regulators

- HOLIDAY: Thailand

THURSDAY, Oct. 24:

- USDA weekly crop export sales data for corn, soybeans, wheat, cotton, soymeal, beef and pork, 8:30am

- Port of Rouen data on French grain exports

- U.S. poultry slaughter, USDA red meat production, 3pm

- International Grains Council monthly report

FRIDAY, Oct. 25:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1pm (~6pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly crop conditions

- Brazil Unica cane crush, sugar output (tentative)

- U.S. cattle on feed report

· US DoE Crude Oil Inventories (W/W) 18-Oct: -1699K (est 3000K; prev 9281K)

– Distillate Inventories (W/W): -2715K (est -2723K; prev -3823K)

– Cushing OK Crude Inventories (W/W): 1506K (prev 1276K)

– Gasoline Inventories (W/W): -3107K (est -2238K; prev -2562K)

– Refinery Utilization (W/W): 2.10% (est 1.00%; prev -2.60%)

Corn.

· Corn futures ended slightly lower on lack of fresh news.

· EIA data was slightly supportive for corn futures.

· US biofuel and farmer groups filed a petition in the US court of appeals against the EPA over the latest granting of small refinery biofuel waivers.

· There was talk South Korea bought a couple cargos of corn for Feb/Mar arrival.

· China, the world’s top pork consumer, imported 72% more pork and 53% more beef in September than a year earlier. (Bloomberg)

· China Sept. Corn Imports 140,000 Tons, +237.2% Y/y (Bloomberg). Year to date corn imports are 3.87 million tons, up 33 percent.

· Armyworm Outbreak Risks 50% of Rwanda Corn Crop, Times Reports (Bloomberg)

· China’s Pork Crisis Risks Sending Inflation to 4% by Next Year (Bloomberg)

· U.S. Bacon Pile Is Biggest in 48 Years, But May Start to Ebb …More than 40 million pounds (18,000 metric tons) of pork bellies, the cut used for bacon making, were sitting in refrigerated warehouses as of Sept. 30, according to U.S. government data released Tuesday. That’s the most for the month since 1971 (Bloomberg).

· Reuters poll: South Africa’s 2019 corn area was expected to end up 2.6% higher than September’s estimate at 2.36 million hectares. September was 2.3 million hectares. 2019 poll consisted of 1.32 million hectares of white maize and 1.04 million hectares of yellow maize.

· The USDA Broiler Report showed US eggs set for the week ending October 19 up 3 percent and chicks placed up 6 percent. Cumulative placements from the week ending January 5, 2019 through October 19, 2019 for the United States were 7.82 billion. Cumulative placements were up 2 percent from the same period a year earlier.

· The US weekly EIA ethanol data was viewed neutral to slightly bullish for US corn futures and neutral for US ethanol futures.

· Weekly US ethanol production increased 25,000 barrels from the previous week to 996 thousand barrels per day (bbl). This was the largest weekly increase since the week ending June 7, 2019.

· Ethanol stocks decreased 697,000 barrels to 21.364 million.

· For comparison, A Bloomberg poll looked for weekly US ethanol production to increase 7,000 barrels from the previous week and stocks to decrease 423,000 barrels.

· US ethanol production of 996 thousand barrels per day is about 2.7% below from about the same time a year ago.

· Over the past 4 weeks, production changes averaged up 13,000 and stock changes down 284,000.

· Early September 2019 to date (7 weeks) US ethanol production is running 4.7% below the same period a year ago. At this time last year ethanol production was advancing 1.2% above the Sep 1, 2018-Oct 19, 2019 period.

· Padd2 production was 925,000 barrels, up 20,000 from a week earlier. Padd1 was up 4,000 and Padd3 up 2,000.

· There were 28,000 barrels of ethanol imports reported this week.

· Ethanol stocks of 21.364 million barrels are down 10.6% from a year ago and 8% below the last previous 4-week average. The record for ethanol stocks was 24.281 million barrels set on 3/9/18, but today’s inventories are still considered high.

· Days of inventory of 22.1 compares to 24.6 a month ago and 23.6 during comparable period a year ago.

· Weekly ending stocks of total gasoline were down 3.1 million barrels to 223.09 million barrels.

· The net blender input of fuel ethanol was down 14,000 from the previous week at 928,000 bpd, below its 4-week average of 929,000 bpd.

· Net production of finished reformulated and conventional motor gasoline with ethanol, decreased 163,000 to 9.177 million barrels, or 91.5 percent of the net production of all finished motor gasoline, up from 91.4 percent for the previous week.

· For 2019-20, we are using 5.425 billion bushels, compared to 5.400 billion by USDA.

· There was talk South Korea bought a couple cargos of corn for Feb/Mar arrival.

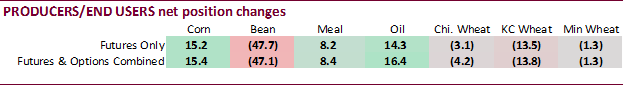

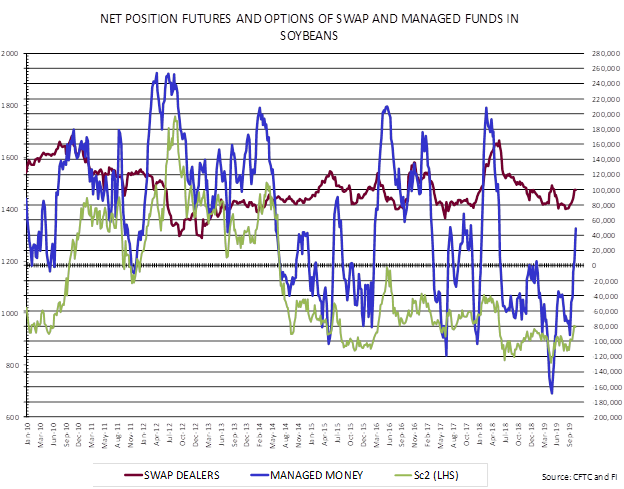

Soybean complex.

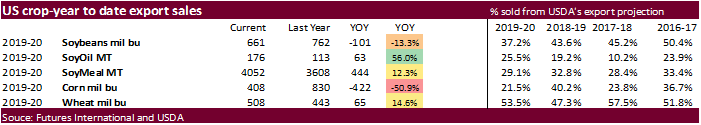

· Following a day after we heard China will allow up to 10 million tons of tariff free US soybean imports that will include private importers, there were rumors China bought 190,000 tons of US soybeans over the past day from the US. Later we heard 5-6 cargos out of the PNW and Gulf. Keep in mind late last week we heard China bought 400,000 tons from the US, but 24-hour sales failed to confirm that. This morning 128k were reported to unknown.

· Soybeans ended unchanged to moderately lower, meal $1.30-$1.70 higher, and SBO 21-28 points lower.

· There was heavy spreading in the Nov/Feb. About 89k traded.

· China cash crush was running at 148 cents vs. 125 last week and 154 cents year ago.

- Under the 24-hour announcement system, private exporters reported to the U.S. Department of Agriculture export sales of 128,000 tons of soybeans for delivery to unknown destinations during the 2019-20 marketing year.

- Egypt’s GASC bought 77,500 tons of vegetable oils, including 50,000 tons of local Egyptian soyoil and 5,000 tons of local sunflower oil. GASC also bought 22,500 tons of imported sunflower oil for arrival between December 5-20. For the local oils, delivery is for FH Dec. Reuters reported the following:

o 37,500 tons Egyptian soyoil at 11,075 Egyptian pounds equating to $684.06

o 5,000 tons Egyptian sunflower oil at 11,220 Egyptian pounds equating to $693.02

o 11,500 tons imported sunflower oil at $698 a ton c&f.

o 12,500 tons Egyptian soyoil 11,075 Egyptian pounds equating to $684.06

o 11,000 tons imported sunflower oil at $698.00 a ton c&f

- South Korea seeks 150,000 tons of non-GMO soybeans on November 11 for arrival between March 2021 and May 2023.

- Nov soybeans are seen in a $9.00-$9.55 range

- Dec soybean meal $295-$320 range

- Dec soybean oil 29.25-31.50 range

Wheat

· US wheat traded two-sided, ending higher despite improving weather for US and Canada. Global export developments increased over the past couple of days, but it appears the US will participate in 2, maybe 3 of them.

· Paris wheat futures earlier were unchanged at 181.00 euros.

· China Sept. wheat imports were 160,000 Tons, -44.5% Y/y (Bloomberg). Year to date wheat imports are 2.26 million tons, down 9.7 percent.

· India raised new crop wheat purchase by from local farmers by 85 rupees, or 4.6%, to 1,925 rupees per 100 kg for 2020 compares with 1,840 rupees a year ago.

- Iran will import 3 million tons of wheat during their local marketing year.

- Jordan’s seeks 120,000 tons of optional origin milling wheat on Oct. 29.

- Algeria bought around 600,000 tons of soft wheat for shipment in two periods, Dec. 1-15 and Dec. 16-31. If sourced from South America, shipment is between Nov. 1-15 and Nov. 16-30. Reuters put initial trader assessments at about $228 or $229 a ton c&f. One French trader put the price at between $227 and $229.

- Turkey received offers for 127,500 tons of EU durum wheat at around $339.19/ton, c&f. Bloomberg reported they bought it. Yesterday Turkey’s TMO bought about 190,000 tons of EU wheat at $228.10/ton c&f as the lowest price for FH Dec shipment.

- Tunisia seeks 50,000 tons of milling wheat on October 23 for November and December shipment. The lowest offer in was around $225.92 a ton, optional origin, followed by other offers including $229.75, $229.98 and $231.89 all per ton c&f and all also for 25,000 tons. The wheat was sought in two consignments of 25,000 tons for shipment between Nov. 20 and Dec. 15, depending on origin selected.

- Taiwan Flour Millers’ Association seeks 88,900 tons of US milling wheat on Thursday off the PNW. The first consignment of 40,000 tons is sought for shipment between Dec. 5 and Dec. 19, 2019. The second consignment of 48,900 tons is sought for shipment between Dec. 21, 2019, and Jan 4, 2020.

- Syria floated a second tender to exchange 100,000 tons of its durum wheat for the same quantity of soft wheat (100k) with an October 28 deadline. Wheat production is around 2.2 million tons, but below 4 million tons they consume.

- Ethiopia seeks an additional 200,000 tons of milling wheat on October 29.

- Bangladesh seeks 50k of milling wheat on October 30.

- Syria seeks 150,000 tons of wheat on November 4.

- Ethiopia postponed their import tender for 400,000 tons of milling wheat to November 5, for shipment with shipment within two months after contract signing.

Rice/Other

Updated 10/21/19

· Chicago Dec wheat is seen in a $5.00-$5.45 range

· KC Dec wheat is seen in a $4.05-$4.55 range

· MN Dec wheat is seen in a $5.10-$5.70 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.