From: Terry Reilly

Sent: Thursday, December 26, 2019 6:26:39 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 12/26/19

Happy Boxing Day! U.S. President Donald Trump said he and Chinese President Xi Jinping will have a signing ceremony for phase one soon. It could be done by the end of the month.

![]()

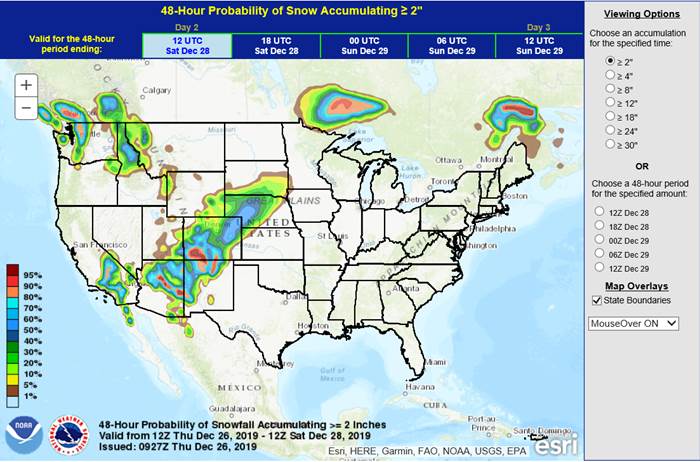

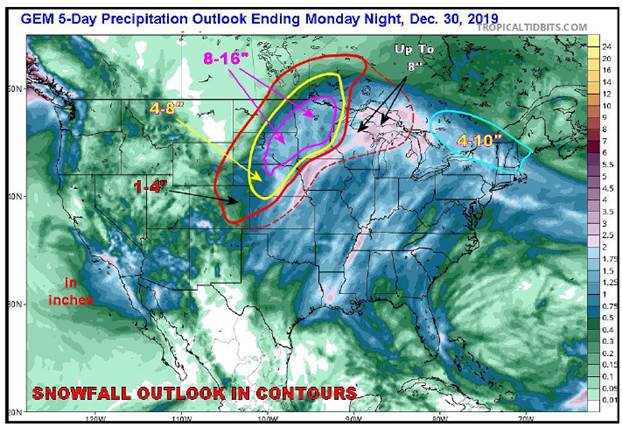

The US will see a large storm with big snow accumulations from parts of Nebraska to the eastern Dakotas and parts of Minnesota.

From World Weather Inc.

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Brazil and Argentina weather will be changing, and the change will be good for a while with rain in the northeast of Brazil and in southwestern Argentina. However, drying in southern Brazil and Paraguay may eventually bring on some crop stress and the same may occur in northern Argentina. Southwestern Argentina where it has been dry for so long could get flooding rainfall little later next week.

South Africa rainfall will be erratic over the next ten days leaving some areas a little too dry while some beneficial crop and field conditions evolve in other areas.

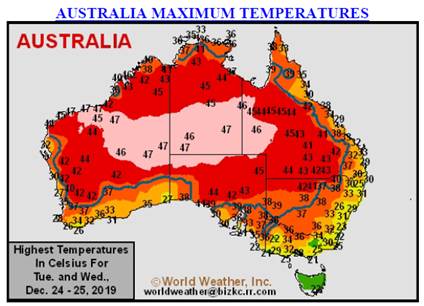

Eastern Australia’s summer coarse grain and oilseed crops have been stressed in recent heat and dryness, but irrigated areas remain in the best shape. Rain Tuesday into Wednesday was likely too close to the coast to benefit very many crops, but some eastern sorghum might benefit from a little rain this workweek. Temperatures will not be as oppressively hot over the next ten days in eastern crop areas.

Winter rapeseed conditions have not changed much in Europe central Asia of China, but some rain in each of these areas will either improve crop conditions later this week or in the spring when seasonal warming returns.

Late season harvest progress in the U.S. will not likely advance very much after the weekend because of the latest winter storm producing snow in the northwest and abundant rain elsewhere.

Overall, weather today will likely support a mixed influence on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

Winter wheat conditions in the west-central and southwestern U.S. Plains may improve later this week if the weekend storm occurs as advertised. The region needs moisture for improved crop establishment in the spring.

Additional rain in the Midwest this weekend and early next week will maintain wet field conditions in soft red wheat production areas. Crop conditions will not change much, although rising soil temperatures may reduce winter hardiness as this week moves along especially in the south.

Argentina wheat harvesting will advance relatively well for a little while longer as rainfall continues erratic and light. However, a boost in precipitation coming next week will set back late season harvesting and could raise some grain quality issues in a few areas. Much of this year’s crop has already been harvested.

Turkey will receive some additional needed rain over the next several days improving wheat establishment potential. Most other areas in the Middle East have seen a good mix of weather this season and will get additional moisture next week. Syria and Turkey need rain most.

Winter crops in Eastern Europe and the western CIS will not be vulnerable to any winterkill in the next ten days as temperatures remain near to above average. Snow cover remains minimal

North Africa wheat is rated favorably, but more rain is needed in southwestern Morocco, Tunisia and some interior eastern Algeria locations.

Recent rain in Spain and Portugal has improved winter crop prospects for early spring crop development in February. Additional rain would be welcome.

Overall, weather today will likely produce a slightly bearish bias to market mentality.

Source: World Weather Inc. and FI

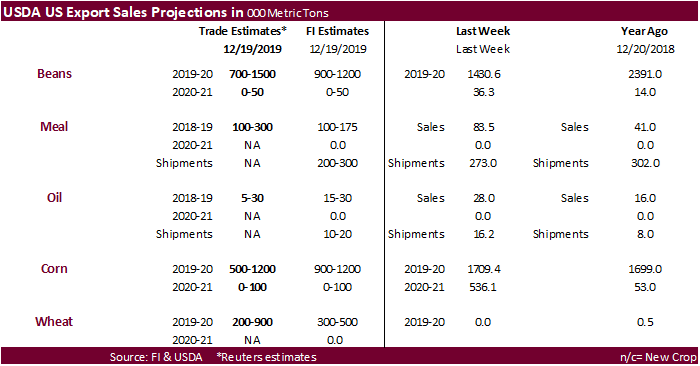

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- EIA U.S. weekly ethanol inventories, production, 11am

- U.S. agricultural prices paid, received, 3pm

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

SATURDAY, Dec. 28:

- Nothing major scheduled

SUNDAY, Dec. 29:

- Nothing major scheduled

MONDAY, Dec. 30:

- USDA weekly corn, soybean, wheat export inspections, 11am

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

TUESDAY DECEMBER 31

- AmSpec releases Malaysia’s Dec. 1-31 palm oil export data, 10pm Monday (11am Kuala Lumpur); SGS data due at 3pm KL

WEDNESDAY, Jan. 1:

- Nothing major scheduled

THURSDAY, Jan. 2:

- Australia commodity index

- USDA Soybean crush, DDGS production, corn for ethanol, 3pm

FRIDAY, Jan. 3:

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- EIA U.S. weekly ethanol inventories, production, 11am

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

Source: Bloomberg and FI

Corn

· There was not much news in the corn market today, ending higher. This and soybean/corn and wheat/corn spreading pathed the way for a two-sided trade.

· Funds bought an estimated net 1000 corn contracts on the session.

· Note the western US will see good precipitation over the next 5 days.

· A Chinese government report calls for China’s northeastern Corn Belt to get hit by another armyworm infestation in 2020. National Agriculture Technology Extension Service Center (NATESC) estimated 16.88 million mu or 1.13 million hectares were affected in 2019, across 26 provinces and regions, and was expected to spread out further in 2020.

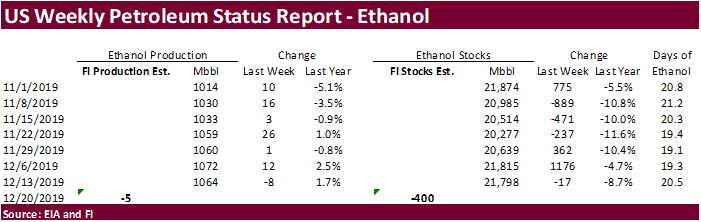

· A Bloomberg poll looks for weekly US ethanol production to be unchanged at 1.064 million barrels from the previous week and stocks to increase 70,000 barrels to 21.877 million.

Soybean complex.

· Soybean oil led soybeans higher. The March soybean oil contract hit a contract high of 34.86 today. Although we are bullish vegetable oils in general, we think its temporarily overbought. There are two factors for the more than 1.50 percent jump in nearby SBO, 1) the sharp increase in Malaysian palm oil prices and 2) Egypt’s GASC soybean oil import tender results.

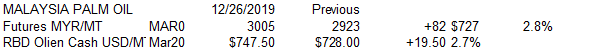

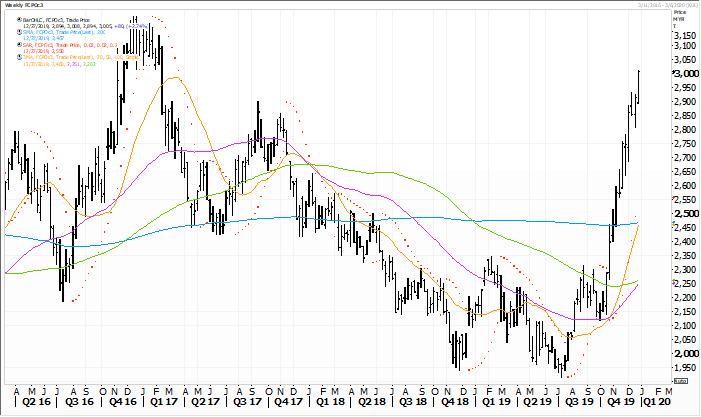

· Malaysian palm was up sharply, and futures are near a 3-year high and above 3000 MYR (last mid-Feb. 2017). According to Reuters, the Malaysian Palm Oil Association and Southern Peninsular Palm Oil Millers Association both look for a big fall in palm production in December, at 16% and 27% respectively, from November.

· Egypt was in for vegetable oils, local and international. They ended up buying 34,450 tons of local soybean oil. On December 11 GASC cancelled their import tender for vegetable oils as offers were poor. Last time GASC bought vegetable oil was October 23 when they picked up 77,500 tons of vegetable oils, including 50,000 tons of local soybean oil in Egyptian pounds equating to $684.06/ton. Today’s import tender for 34,450 tons of local soybean oil was $112.20/ton more than the late October tender. Last time Egypt paid this much for vegetable oil was when they went on a buying spree for sunflower oil back in mid-2018.

· Funds bought an estimated 3,000 soybeans, sold 3,000 soybean meal and bought 5,000 soybean oil.

· Soybeans were traded today to at a fresh or near 6-week high.

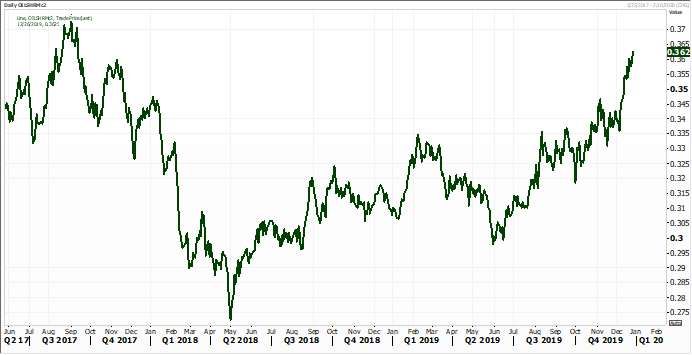

Second month rolling soybean oil share highest since September 2017, and second month rolling soybean oil prices were up more than 4 cents since late November 2019.

Source: Refiniv and FI

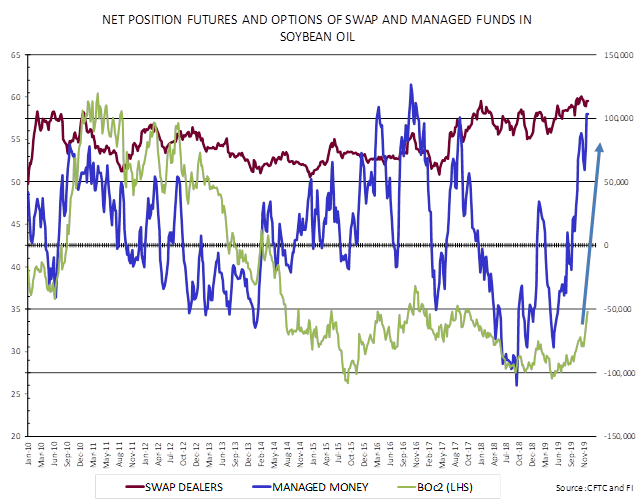

· The record CFTC managed money future and options position was 126,543 in November 2016. As of Wednesday evening, we estimated the managed money net long position in soybean oil at 103,000 contracts.

· Argentina saw light rain bias southern growing regions over the past couple days. Brazil weather is favorable, and some analysts are raising production estimates to high as 126MMT (124.4MMT is FI). US shipments of soybeans were more than 2.5MMT to China in November. However, other weather reports warned of net drying to dominate Argentina’s northern growing region and parts of Brazil. Traders should monitor South American weather forecasts over the next week.

· Phase one of the deal could be signed as early as the end of this month.

· Europe was on holiday. China meal futures were lower last two sessions.

· The Jan/Mar soybean spread was last 8.75, March premium. We think it will go to 7.00-7.25 cents.

· China imported 5.4 million tons of soybeans in November, up 54 percent from the previous year. Of that, 2.6 million tons originated from the US, up from zero year earlier. Shipments from Brazil were 3.86 million tons, down 24 percent y-o-y. Jan – Nov US shipments were 13.85MMT and Brazil 52.84MMT, down 16 and 14 percent, respectively.

· Cargo surveyor SGS reported month to date December 25 Malaysian palm exports at 1,066,943 tons, 99,733 tons below the same period a month ago or down 8.5%, and 11,331 tons below the same period a year ago or down 1.1%. Meanwhile cargo surveyor AmSpec reported Malaysian Dec 1-25 palm exports at 1,066,639 tons, down 9.6 percent from the same period a month ago. Cargo surveyor ITS reported December 1-25 Malaysian palm exports at 1,035,930 tons, down 12.8 percent from the same period a month ago.

· Near 3-year high. Thursday Malaysian palm markets:

- Egypt’s GASC bought 34,450 tons of local soybean oil for arrival on Feb. 5-20. The were in for soybean oil and sunflower oil for local and international origin.

- 3,450 tons of soyoil at 12,780 Egyptian pounds ($796.26)

- 23,000 tons of soyoil at 12,780 Egyptian pounds.

- 8,000 tons of soyoil at 12,780 Egyptian pounds.

Rolling third month palm oil futures – traded above 3000 MYR

Source: Refiniv and FI

- CBOT March soybeans are seen in a $9.00-$9.60 range

- March soybean meal $295-$315 range

- March soybean oil 33.00-36.00 range

- Upside on oil share is seen at 36.5 percent (lowered half percent)

Wheat

· US wheat futures rallied on a pickup in global import tender announcements and SovEcon slightly reducing their estimate for the Russian 2019-20 wheat exports by 0.2 million tons to 33.1 million tons. SovEcon also indicated they may lower their wheat export projection again in January.

· Funds bought an estimated net 5,000 wheat on the session.

· Russia harvested 74.3 million tons of wheat after drying and cleaning in 2019, above 72.14 million tons at this time last year.

· Europe was on holiday.

· Morocco will lower its import duty on soft wheat early January. They tendered for about 355,000 tons of durum wheat on January 9 for arrival by May 31.

- Morocco seeks to import about 355,000 tons of US durum wheat on January 9 for arrival by May 31.

- Jordan seeks 120,000 tons of wheat on January 7.

- As part of a 100,000-ton food aid package for Syria, Russia will ship 25,000 tons of grain to Syria by the end of this week.

- Russia sold 130,000 tons of wheat to Iran.

- China sold 83,747 tons of wheat out of auction, or 2.7 percent of what was offered, at an average price of 2,177 yuan per ton.

- Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) in an SBS import tender bought 23,048 tons of feed wheat and passed on barley for arrival in Japan by March 12.

- Mauritius seeks 95,000 tons of optional origin wheat flour on Jan. 10, 2020, for shipment between July 1, 2020, and June 20, 2021.

· Syria seeks 200,000 tons of soft wheat from Russia on January 20, 2020.

Rice/Other

Details of the tender are as follows:

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

3,000 Milled Long April 30, 2020/Busan

17,000 Milled Medium June 30, 2020/Busan

22,222 Brown Medium June 30, 2020/Busan

- Syria seeks 45,000 tons of white rice on Jan. 6, 2020. (Reuters) Short grain white rice of third or fourth class was sought. No specific country of origin was specified in the tender, traders said. Some 25,000 tons was sought for supply 90 days after confirmation of the order and 20,000 tons 180 days after supply of the first consignment. The rice was sought packed in bags and offers should be submitted in euros. A previous tender from the agency for 45,000 tons of rice with similar conditions had closed on Nov. 13.

Updated 12/17/19

· CBOT Chicago March wheat is seen in a $5.30-$5.80 range

· CBOT KC March wheat is seen in a $4.60-$4.85 range

· MN March wheat is seen in a $5.25-$5.55 range

· We like KC wheat over Chicago wheat.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.