From: Terry Reilly

Sent: Friday, December 27, 2019 1:54:17 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 12/27/19

PDF attached does not include the daily estimate of funds

USD

was down 59 as of 1:15 CT. CFTC COT is delayed until Monday.

·

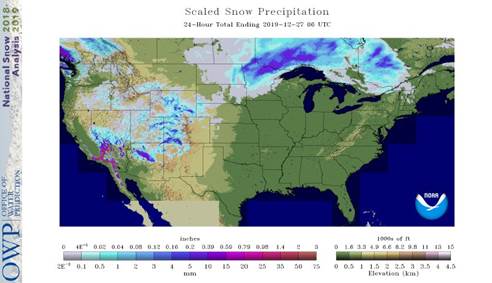

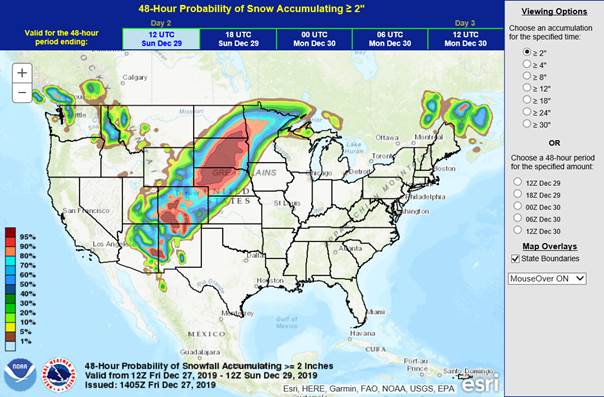

Rain, freezing rain, sleet and snow will develop in the western Corn Belt today and tonight

·

Snow is expected to become heavy from Nebraska to the eastern Dakotas and Minnesota Saturday and will shift to the northwestern Great Lakes region Sunday with most of the snow diminishing Monday

·

Rain and thunderstorms will occur elsewhere in the Midwest

Source:

World Weather Inc. and FI

From

World Weather Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

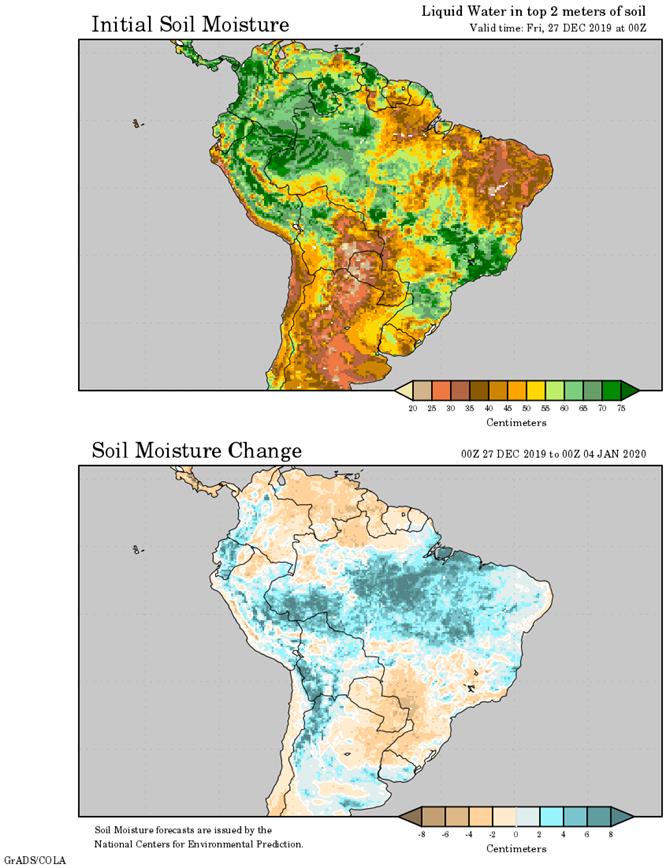

Brazil

and Argentina weather will be changing and the change will be good for a while with rain in the northeast of Brazil and in southwestern Argentina. However, drying in southern Brazil and Paraguay may eventually bring on some crop stress and the same may occur

in northern Argentina. Southwestern Argentina where it has been dry for so long could get flooding rainfall little later next week.

South

Africa rainfall will be erratic over the next ten days leaving some areas a little too dry while some beneficial crop and field conditions evolve in other areas.

Eastern

Australia’s summer coarse grain and oilseed crops have been stressed in recent heat and dryness, but irrigated areas remain in the best shape. Rain Tuesday into Wednesday was likely too close to the coast to benefit very many crops, but some eastern sorghum

might benefit from a little rain this workweek. Temperatures will not be as oppressively hot over the next ten days in eastern crop areas.

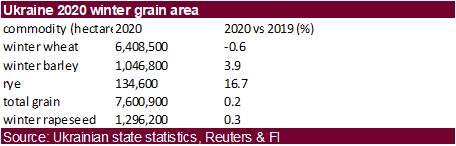

Winter

rapeseed conditions have not changed much in Europe, western or southern Asia or China, but some rain in each of these areas will either improve crop conditions later this week or in the spring when seasonal warming returns.

Frost

in northern India overnight had little to no impact on most winter grain and oilseed crops.

Late

season harvest progress in the U.S. will not likely advance very much after the weekend because of the latest winter storm producing snow in the northwest and abundant rain elsewhere.

Overall,

weather today will likely support a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Winter

wheat conditions in the west-central and southwestern U.S. Plains will improve in the spring because of moisture that occurs tonight and Saturday, but more moisture will be needed to induce the best environment for crop improvements when seasonal warming resumes.

Additional rain in the Midwest this weekend and early next week will maintain wet field conditions in soft red wheat production areas. Crop conditions will not change much, although rising soil temperatures may reduce winter hardiness as this week moves along

especially in the south.

Argentina wheat harvesting will be slowed in the coming week because of increasing rainfall. The wetter weather may raise some grain quality issues in a few areas, but much of this year’s crop has already been harvested.

Turkey

will receive some additional needed rain over the next few days improving wheat establishment potential. Most other areas in the Middle East have seen a good mix of weather this season and will get additional moisture next week. Syria and Turkey need rain

most.

Winter

crops in Eastern Europe and the western CIS will not be vulnerable to any winterkill in the next ten days as temperatures remain near to above average. Snow cover remains minimal

North

Africa wheat is rated favorably, but more rain is needed in southwestern Morocco, Tunisia and some interior eastern Algeria locations. Recent production estimates from abroad have suggested morocco may suffer a significant decline in production if greater

rain does not fall soon.

Recent

rain in Spain and Portugal has improved winter crop prospects for early spring crop development in February. Additional rain would be welcome.

Overall, weather today will likely produce a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Source:

World Weather Inc. and FI

- USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - EIA

U.S. weekly ethanol inventories, production, 11am - U.S.

agricultural prices paid, received, 3pm - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

SATURDAY,

Dec. 28:

- Nothing

major scheduled

SUNDAY,

Dec. 29:

- Nothing

major scheduled

MONDAY,

Dec. 30:

- USDA

weekly corn, soybean, wheat export inspections, 11am - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

TUESDAY

DECEMBER 31

- AmSpec

releases Malaysia’s Dec. 1-31 palm oil export data, 10pm Monday (11am Kuala Lumpur); SGS data due at 3pm KL

WEDNESDAY,

Jan. 1:

- Nothing

major scheduled

THURSDAY,

Jan. 2:

- Australia

commodity index - USDA

Soybean crush, DDGS production, corn for ethanol, 3pm

FRIDAY,

Jan. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - EIA

U.S. weekly ethanol inventories, production, 11am - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

Source:

Bloomberg and FI

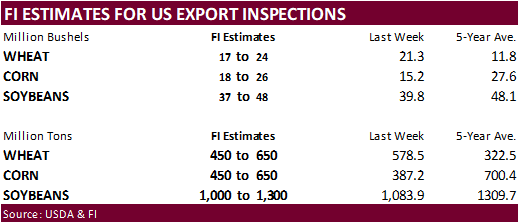

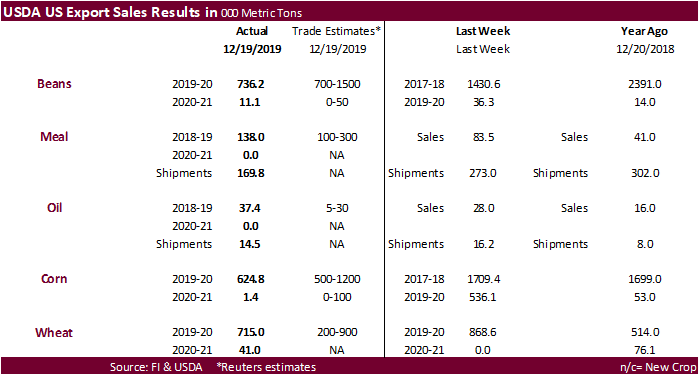

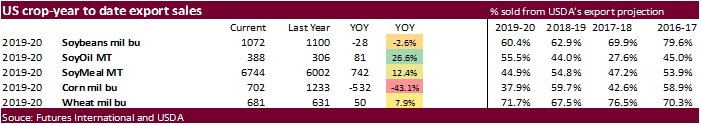

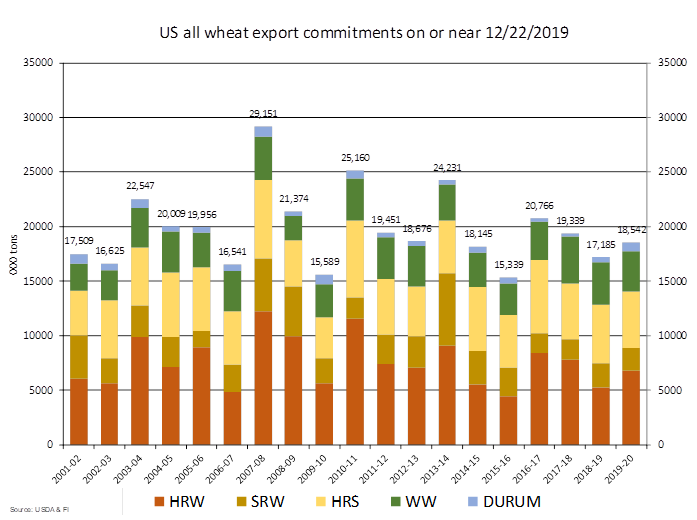

USDA

export sales. Low

soybeans and corn export sales. Meal was low while soybean oil was very good. All-wheat was good as well. Pork sales were 16,400 tons. China net sales for sorghum of 75,800 tons included 66k switched from unknown.

Market

impact: Friendly soybean oil. Slightly negative soybeans. Negative corn.

Positive wheat.

Weekly

Bloomberg Bull/Bear survey report:

·

Soybeans: Bullish: 11 Bearish: 3 Neutral: 5

·

Corn: Bullish: 10 Bearish: 3 Neutral: 6

·

Wheat: Bullish: 8 Bearish: 5 Neutral: 6

·

Raw sugar: Bullish: 4 Bearish: 0 Neutral: 3

·

White sugar: Bullish: 4 Bearish: 0 Neutral: 3

·

White-sugar premium: Bullish: 2 Bearish: 1 Neutral: 4

Corn

·

CBOT corn ended 1.50 cents higher. Gains were limited from lower soybeans. There was light profit taking in soybean/corn spreads. Ongoing speculation China will buy millions of tons of US grain and wheat

in 2020 added to the support today.

·

USDA export sales for corn were at the low end of expectations.

·

The western US will see good precipitation over the next 5 days.

·

Buenos Aires Grain Exchange reported Argentina (all) corn plantings at 75 percent, up 12 points from the previous week and compares to 73 percent last year and 70 percent average. The second corn crop was

74.4 percent complete, above 74 percent year ago. 44.6 percent of the Argentina corn crop was rated good and excellent, above 31.5 percent at this time last year.

·

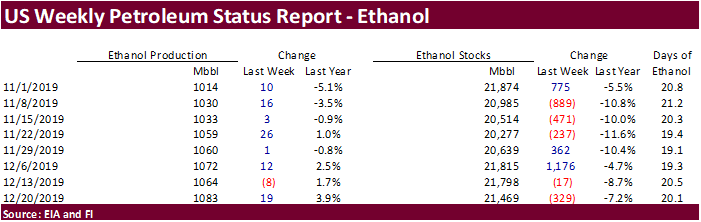

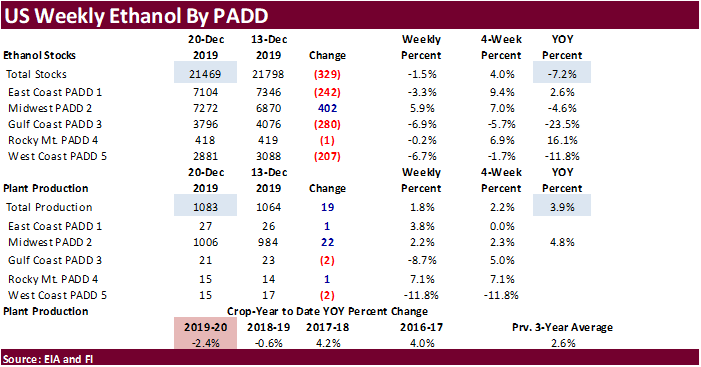

EIA reported US ethanol production for the week ending 12/20 at 1.083 million barrels, up 19,000 barrels from the previous week, well above a Bloomberg average of 1.064 million, and largest since June 7, 2019.

September to date ethanol production is running 2.4 percent below the same period year ago. Stocks of 21.469 million were 329,000 barrels below the previous week and lowest in four weeks. The poll called for a 70,000-barrel increase. There were no imports

last week. The ethanol blend rate into finished motor gasoline was running at 90.4 percent, above 89.7 percent last week.

·

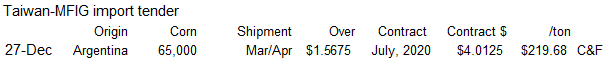

Taiwan’s MFIG bought 65,000 tons of corn from Argentina at a premium of 156.75 U.S. cents c&f over the July for shipment between March 26 and April 14.

·

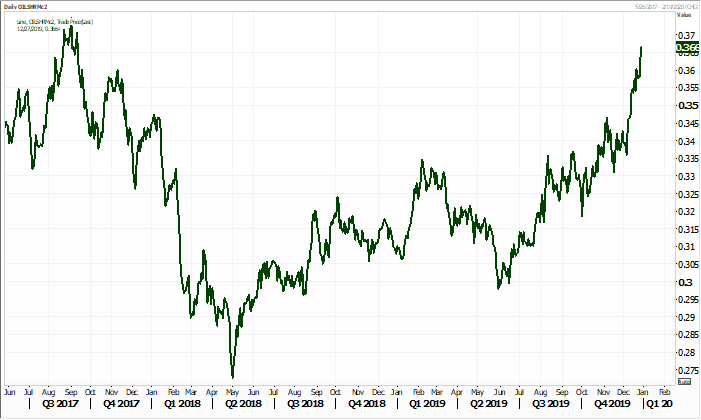

Soybean oil was higher on follow through buying and soybeans made a large reversal on profit taking. Monday is position day ahead of first notice day deliveries so some traders were getting ahead. With that

said, the Jan/Mar soybean spread collapsed to 12.25 cents, March premium. A lot of people didn’t see that coming. It narrowed to 6.75 cents early this week!

·

Soybean meal ended $2.50-$4.10 lower and soybean oil 32-37 points higher. Soybean oil made an impressive rebound in afternoon trading.

·

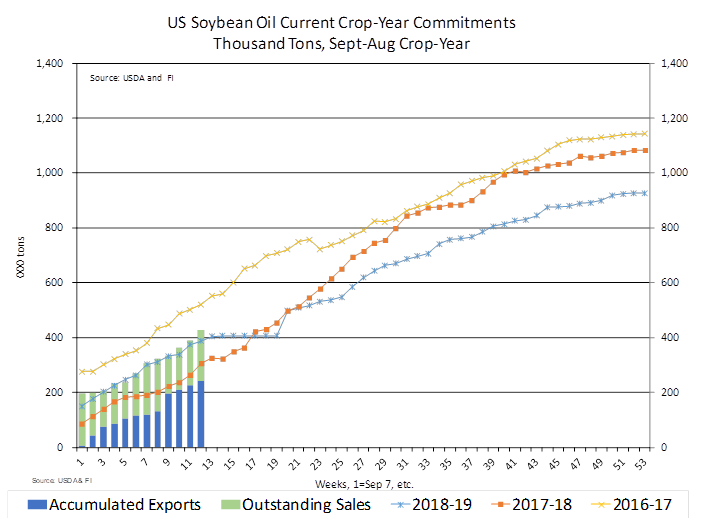

USDA export sales for soybean oil were very good and crop-year commitments are now running above last year.

·

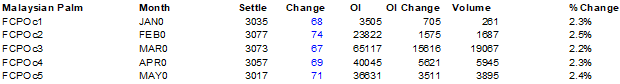

Malaysian palm oil prices were on fire again. The March soybean oil contract hit another contract high of 35.18 today. Sell stops were hit at the beginning of the day session. Although we are bullish vegetable

oils in general, we think soybean oil is temporarily overbought.

·

USDA export sales were poor for soybeans, a reminder demand is not living up to trade expectations. Soybean meal sales were low while soybean oil was very good.

·

Monday is position day. First Notice day deliveries are Tuesday and we estimate soybeans 700-1000, meal 200-500 and soybean oil 800-1200.

·

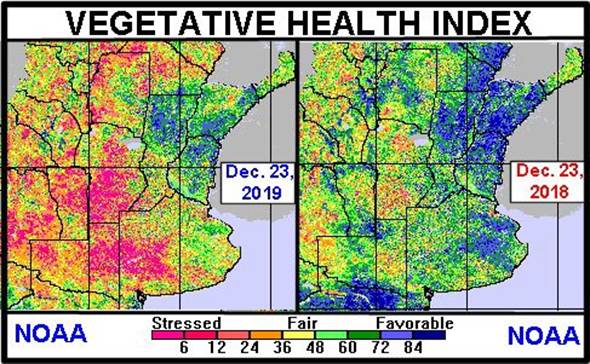

Buenos Aires Grain Exchange reported Argentina (all) soybean plantings at 79 percent, up 9 points from the previous week and compares to 83 percent last year and 83 percent average. The second soybean crop

was 24 percent complete, well below 61 percent year ago. 31 percent of the Argentina soybean crop was rated good and excellent, well below 61 percent at this time last year.

·

Phase one of the deal could be signed as early as the end of this month but other reports indicate sometime in January it will be signed.

·

China cash crush was last 131 cents per bushel (124 on Thur), compared to 160 on Friday and negative 21 cents year ago.

·

3-year high. Malaysian palm markets:

-

This

week India bought 80-100k tons of vegetable oils. They also priced soybean oil out of Argentina.

-

US

soybean sales were slow this week.

Second

month rolling oil share

Source:

Refiniv and FI

-

CBOT

March soybeans are seen in a $9.00-$9.60 range -

March

soybean meal $285 (lowered $10) to $310 range -

March

soybean oil 33.00-36.00 range -

Upside

in oil share is seen limited at 37.5 percent, for the short term. Eventually it could rally to 38.5-39.0 percent.

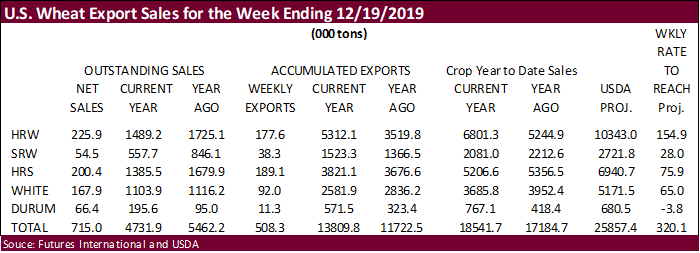

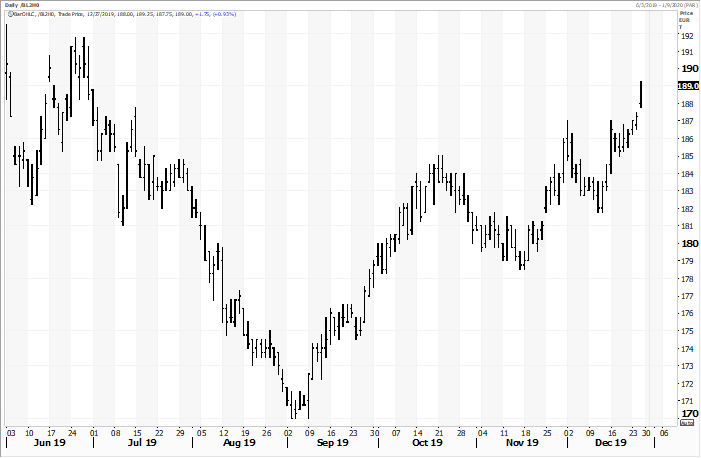

Wheat

·

Wheat was up strong today on good USDA export sales of 715,000 tons and an increase in global export developments. There is also speculation China will buy a large amount of US wheat in 2020, according to

a Bloomberg article. A market letter circulating talked about China buying 5-6 million tons of US wheat. Note the China import quota for wheat is 9.6 million tons and corn at 7.2 million tons.

·

March Paris wheat futures ended up strong by 1.75 euros at 189.00 euros.

·

The USD was sharply lower which supported wheat futures.

·

Morocco will lower its import duty on soft wheat early January. They tendered for about 355,000 tons of durum wheat on January 9 for arrival by May 31.

·

Russian wheat exports crop-year to date (local) are running about 13 percent below year ago.

Paris

wheat

Source:

Refiniv and FI

Export

Developments.

- Jordan

seeks 120,000 tons of wheat on January 7. - Morocco

seeks to import about 355,000 tons of US durum wheat on January 9 for arrival by May 31.

- Mauritius

seeks 95,000 tons of optional origin wheat flour on Jan. 10, 2020, for shipment between July 1, 2020, and June 20, 2021.

·

Syria seeks 200,000 tons of soft wheat from Russia on January 20, 2020.

Rice/Other

Details

of the tender are as follows:

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

3,000 Milled Long April 30, 2020/Busan

17,000 Milled Medium June 30, 2020/Busan

22,222 Brown Medium June 30, 2020/Busan

- Syria

seeks 45,000 tons of white rice on Jan. 6, 2020. (Reuters) Short grain white rice of third or fourth class was sought. No specific country of origin was specified in the tender, traders said. Some 25,000 tons was sought for supply 90 days after confirmation

of the order and 20,000 tons 180 days after supply of the first consignment. The rice was sought packed in bags and offers should be submitted in euros. A previous tender from the agency for 45,000 tons of rice with similar conditions had closed on

Nov.

13.

Updated

12/27/19

(high end increased)

·

CBOT Chicago March wheat is seen in a $5.40-$5.80 range

·

CBOT KC March wheat is seen in a $4.70-$5.00 range

·

MN March wheat is seen in a $5.50-$5.75 range

·

We like KC wheat over Chicago wheat.

U.S. EXPORT SALES FOR WEEK ENDING 12/19/2019

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

225.9 |

1,489.2 |

1,725.1 |

177.6 |

5,312.1 |

3,519.8 |

0.0 |

0.0 |

|

SRW |

54.5 |

557.7 |

846.1 |

38.3 |

1,523.3 |

1,366.5 |

0.0 |

4.2 |

|

HRS |

200.4 |

1,385.5 |

1,679.9 |

189.1 |

3,821.1 |

3,676.6 |

0.0 |

4.8 |

|

WHITE |

167.9 |

1,103.9 |

1,116.2 |

92.0 |

2,581.9 |

2,836.2 |

0.0 |

0.0 |

|

DURUM |

66.4 |

195.6 |

95.0 |

11.3 |

571.5 |

323.4 |

41.0 |

41.0 |

|

TOTAL |

715.0 |

4,731.9 |

5,462.2 |

508.3 |

13,809.8 |

11,722.5 |

41.0 |

49.9 |

|

BARLEY |

0.0 |

31.5 |

31.3 |

0.7 |

27.4 |

26.3 |

0.0 |

0.0 |

|

CORN |

624.8 |

9,895.6 |

13,728.8 |

331.7 |

7,927.6 |

17,595.7 |

1.4 |

807.0 |

|

SORGHUM |

43.6 |

593.5 |

139.0 |

146.7 |

493.4 |

316.7 |

0.0 |

0.0 |

|

SOYBEANS |

736.2 |

9,316.9 |

13,904.4 |

1,007.3 |

19,844.3 |

16,025.3 |

11.1 |

178.4 |

|

SOY MEAL |

138.0 |

3,022.0 |

4,197.4 |

169.8 |

2,421.9 |

2,546.9 |

0.0 |

85.8 |

|

SOY OIL |

37.4 |

186.7 |

212.7 |

14.5 |

240.9 |

175.0 |

0.0 |

0.5 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

43.1 |

328.5 |

231.7 |

30.7 |

618.4 |

555.6 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

15.4 |

17.4 |

0.1 |

15.4 |

10.2 |

0.0 |

0.0 |

|

L G BRN |

0.4 |

22.4 |

5.5 |

0.6 |

17.8 |

24.2 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

52.2 |

9.0 |

4.5 |

6.8 |

43.1 |

0.0 |

0.0 |

|

L G MLD |

2.4 |

193.4 |

146.3 |

40.9 |

444.2 |

348.0 |

0.0 |

0.0 |

|

M S MLD |

16.4 |

150.6 |

182.4 |

29.0 |

239.0 |

185.1 |

0.0 |

0.0 |

|

TOTAL |

62.3 |

762.5 |

592.3 |

105.7 |

1,341.6 |

1,166.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

135.1 |

7,527.3 |

7,148.8 |

202.1 |

3,700.9 |

3,202.0 |

-9.3 |

978.0 |

|

PIMA |

19.3 |

172.5 |

309.0 |

8.4 |

160.8 |

143.9 |

0.0 |

34.4 |

Export Sales Highlights

This summary is based on reports from exporters for the period December 13-19, 2019.

Wheat: Net sales of 715,000 metric tons for 2019/2020 were down 18 percent from the previous week, but up 29 percent

from the prior 4-week average. Increases primarily for the Philippines (147,400 MT, including decreases of 4,300 MT), Taiwan (105,000 MT), unknown destinations (104,000 MT), Mexico (76,100 MT, including decreases of 23,200 MT), and Sri Lanka (65,000 MT),

were partially offset by reductions primarily for Italy (8,700 MT). For 2020/2021, net sales of 41,000 MT were reported for unknown destinations (21,000 MT) and Italy (20,000 MT). Exports of 508,300 MT were down 4 percent from the previous week, but up 27

percent from the prior 4-week average. The destinations were primarily to Mexico (126,400 MT), the Philippines (101,400 MT), Bangladesh (64,200 MT), South Korea (31,900 MT), and Colombia (30,700 MT). Optional Origin Sales: For 2019/2020, new optional origin

sales of 300 MT were reported for South Korea. Options were exercised to export 3,800 MT to South Korea from the United States. The current outstanding balance of 56,000 MT is for the Philippines.

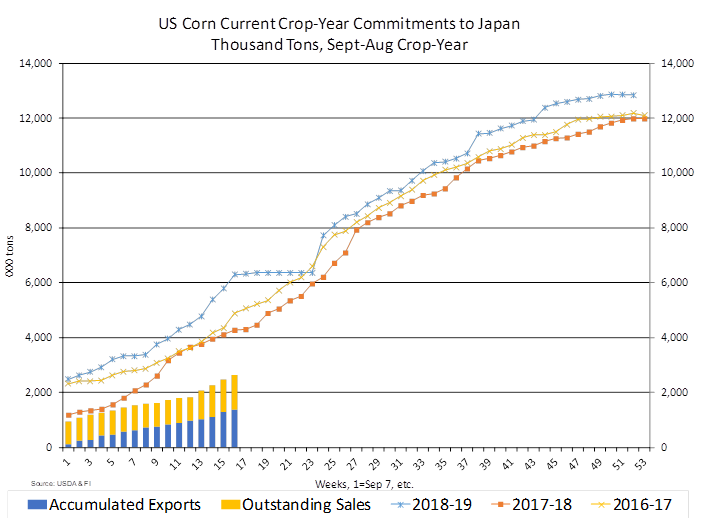

Corn: Net sales of 624,800 metric tons for 2019/2020 were down 63 percent from the previous week and 37 percent

from the prior 4-week average. Increases primarily for Mexico (216,300 MT, including decreases of 19,600 MT), Japan (168,600 MT, including 32,300 MT switched from unknown destinations and decreases of 500 MT), Colombia (120,300 MT), unknown destinations (34,200

MT), and Canada (29,100 MT, including decreases of 1,000 MT), were offset by reductions for South Korea (15,000 MT) and Nicaragua (3,000 MT). For 2020/2021, total net sales of 1,400 MT were for Japan. Exports of 331,700 MT were down 54 percent from the previous

week and 44 percent from the prior 4-week average. The destinations were primarily to Mexico (154,600 MT), Japan (82,500 MT), Canada (21,800 MT), Panama (19,700 MT), and Colombia (16,300 MT). Optional Origin Sales: For 2019/2020, options were exercised

to export 96,100 MT to South Korea (70,400 MT) and Israel (25,700 MT) from other than the United States. The current outstanding balance of 506,900 MT is for South Korea (388,000 MT), Israel (60,000 MT), and Egypt (58,900 MT).

Barley: No net sales for 2019/2020 were reported for the week. Exports of 700 MT were up 17 percent from the previous

week, but down 4 percent from the prior 4-week average. The destinations were to Japan (500 MT) and South Korea (200 MT).

Sorghum: Net sales of 43,600 MT for 2019/2020 resulted in increases for China (75,800 MT, including 66,000 MT switched

from unknown destinations), Mexico (34,300 MT), and South Africa (7,500 MT, switched from unknown destinations), were offset by reductions for unknown destinations (74,000 MT). Exports of 146,700 MT were up 66 percent from the previous week and up noticeably

from the prior 4-week average. The destinations were primarily to China (138,800 MT) and South Africa (7,500 MT).

Rice:

Net sales of 62,300 MT for 2019/2020 were up 69 percent from the previous week, but down 10 percent from the prior 4-week average. Increases primarily for Mexico (22,600 MT), El Salvador (16,000

MT), Japan (13,900 MT), Guatemala (5,300 MT), and Canada (2,000 MT), were offset by reductions primarily for Honduras (100 MT).

Exports of 105,700 MT were up 40 percent from the previous week and 62 percent from the prior 4-week average. The destinations were primarily to Iraq (30,500 MT), Mexico (26,200 MT), Japan (23,000

MT), Haiti (7,100 MT), and Nicaragua (5,800 MT).

Exports for Own Account: For 2019/2020, the current exports for own account outstanding balance is 200 MT, all Canada.

Soybeans: Net sales of 736,200 MT for 2019/2020 were down 49 percent from the previous week and 39 percent from

the prior 4-week average. Increases were primarily for China (400,400 MT, including 66,000 MT switched from unknown destinations and decreases of 400 MT), the Netherlands (161,100 MT, including 154,500 MT switched from unknown destinations and decreases of

700 MT), Thailand (85,400 MT, including 70,000 MT switched from unknown destinations and decreases of 200 MT), Saudi Arabia (72,100 MT, including 66,000 MT switched from unknown destinations), and the United Kingdom (63,300 MT, including 57,000 MT switched

from unknown destinations), were offset by reductions primarily for unknown destinations (313,300 MT) and South Korea (15,000 MT). For 2020/2021, total net sales of 11,100 MT were for Japan. Exports of 1,007,300 MT were down 28 percent from the previous

week and 39 percent from the prior 4-week average. The destinations were primarily to China (348,500 MT), the Netherlands (161,100 M), Thailand (94,100 MT), Saudi Arabia (72,100 MT), and the United Kingdom (66,600 MT).

Exports for Own Account: For 2019/2020, the current exports for own account outstanding balance is 2,100 MT, all

Canada.

Soybean Cake and Meal: Net sales of 138,000 MT for 2019/2020 were up 65 percent from the previous week, but down 8 percent

from the prior 4-week average. Increases primarily for Colombia (31,600 MT), the Philippines (25,900 MT, including decreases of 500 MT), Ecuador (20,500 MT), Mexico (19,100 MT), and Canada (7,600 MT, including decreases of 2,100 MT), were offset by reductions

primarily for the Dominican Republic (2,700 MT), Guatemala (800 MT), and Panama (300 MT). Exports of 169,800 MT were primarily to the Philippines (47,500 MT), the Dominican Republic (23,700 MT), Canada (19,100 MT), Morocco (16,500 MT), and El Salvador (12,800

MT).

Soybean Oil:

Net sales of 37,400 MT for 2019/2020 were primarily for South Korea (23,000 MT), the Dominica Republic (10,500 MT), Colombia (1,700 MT, including decreases of 300 MT), Mexico (1,100 MT), and Canada

(600 MT). Exports of 14,500 MT were to Colombia (9,500 MT), Nicaragua (2,200 MT), El Salvador (1,700 MT), Mexico (900 MT), and Canada (200 MT).

Cotton: Net sales of 135,100 RB for 2019/2020 were down 46 percent from the previous week and 44 percent from the

prior 4-week average. Increases primarily for Vietnam (46,400 RB, including 400 RB switched from Japan and decreases of 1,300 RB), Turkey (29,700 RB), Indonesia (17,900 RB, including 900 RB switched from Malaysia, 500 RB switched from Japan, and decreases

of 3,600 RB), Colombia (11,000 RB), and Bangladesh (8,900 RB), were offset by reductions for China (12,900 RB). For 2020/2021, net sales reductions of 9,300 RB resulting in increases for Costa Rica (4,200 RB) and Thailand (1,300 RB), were more than offset

by reductions for Indonesia (14,900 RB). Exports of 202,100 RB were down 5 percent from the previous week, but up 8 percent from the prior 4-week average. Exports were primarily to Pakistan (34,100 RB), Bangladesh (29,000 RB), Vietnam (24,800 RB), China

(22,100 RB), and India (21,300 RB). Net sales of Pima totaling 19,300 RB were up 36 percent from the previous week and up noticeably from the prior 4-week average. Increases were primarily for India (8,500 RB), Bangladesh (3,700 RB), Austria (2,600 RB),

Pakistan (1,300 RB), and Thailand (1,200 RB). Exports of 8,400 RB were down 28 percent from the previous week and 11 percent from the prior 4-week average. The primary destinations were India (2,800 RB), Vietnam (1,800 RB), El Salvador (900 RB), Peru (900

RB), and Turkey (600 RB).

Exports for Own account: For 2019/2020, new exports for own account totaling 3,800 RB were to China (1,300 RB),

Egypt (1,300 RB), Indonesia (1,100 RB), and Vietnam (100 RB). Exports for own account totaling 2,100 RB to Indonesia (1,100 RB), Bangladesh (800 RB), Vietnam (100 RB), and China (100 RB) were applied to new or outstanding sales. Decreases were reported for

India (1,200 RB). The current exports for own account outstanding balance of 18,300 RB is for India (8,900 RB), Bangladesh (4,300 RB), China (3,800 RB), and Egypt (1,300 RB).

Hides and Skins: Net sales of 285,900 pieces reported for 2019 were down 27 percent from the previous week and 32

percent from the prior 4-week average. Whole cattle hide sales totaling 288,600 pieces were primarily for China (158,700 pieces, including decreases of 13,700 pieces), South Korea (60,700 pieces, including decreases of 4,200 pieces), Mexico (20,700 pieces,

including decreases of 200 pieces), Brazil (19,100 pieces, including decreases of 400 pieces), and Taiwan (12,500 pieces, including decreases of 1,300 pieces). For 2020, net sales of 119,000 pieces were primarily for China (83,900 pieces), Brazil (11,000

pieces), South Korea (8,900 pieces), and Mexico (7,100 pieces). Exports of 310,400 pieces reported for 2019 were down 31 percent from the previous week and 33 percent from the prior 4-week average. Whole cattle hide exports of 302,000 pieces were primarily

to China (176,100 pieces), South Korea (70,900 pieces), Thailand (18,100 pieces), Taiwan (12,800 pieces), and Mexico (10,000 pieces).

Net sales of 2,600 wet blues for 2019 were down 53 percent from the previous week and 96 percent from the prior 4-week

average resulting in increases for Thailand (19,100 unsplit), China (10,000 unsplit), Taiwan (4,700 unsplit), and Vietnam (4,000 unsplit), were offset by reductions primarily for Italy (10,500 grain splits and 8,500 unsplit), Thailand (6,400 grain splits),

Vietnam (3,600 grain splits), and India (1,900 grain splits and 700 unsplit). For 2020, net sales of 138,600 wet blues primarily for Vietnam (31,900 unsplit and 8,400 grain splits), Italy (27,700 unsplit and 10,500 grain splits), Thailand (20,800 grain splits

and 14,800 unsplit), and China (18,000 unsplit and 2,400 grain splits), were offset by reductions for Taiwan (2,000 unsplit). Exports of 110,500 wet blues for 2019 were down up 12 percent from the previous week, but down 6 percent from the prior 4-week average.

The primary destinations were Vietnam (30,600 unsplit and 3,300 grain splits), China (28,000 unsplit and 3,400 grain splits), Italy (27,100 unsplit and 1,800 grain splits), and Thailand (4,500 unsplit). Total net sales of splits, 979,000 pounds for 2019,

were for Vietnam. For 2020, total net sales of 306,700 pounds were for Vietnam. Exports of 496,500 pounds were to Vietnam.

Beef:

Net sales of 6,300 MT reported for 2019 were down 37 percent from the previous week and 34 percent from the prior 4-week average. Increases primarily for South Korea (3,100 MT, including decreases

of 1,300 MT), Japan (2,700 MT, including decreases of 500 MT), Mexico (1,600 MT, including decreases of 100 MT), Canada (500 MT), and Indonesia (500 MT), were offset by reductions primarily for Hong Kong (2,000 MT) and Taiwan (900 MT). For 2020, net sales

of 13,100 MT primarily for Hong Kong (3,400 MT), South Korea (3,300 MT), Japan (2,700 MT), Taiwan (1,300 MT), and Mexico (1,100 MT), were offset by reductions primarily for Vietnam (200 MT). Exports of 16,000 MT were down 11 percent from the previous week

and 7 percent from the prior 4-week average. The destinations were primarily to Japan (4,600 MT), South Korea (3,800 MT), Mexico (2,300 MT), Hong Kong (1,200 MT), and Taiwan (1,200 MT).

Pork:

Net sales of 16,400 MT reported for 2019 were down 39 percent from the previous week and 42 percent from the prior 4-week average. Increases primarily for Mexico (12,200 MT), Japan (2,400 MT),

South Korea (1,700 MT), Canada (1,400 MT), and Vietnam (200 MT), were offset by reductions primarily for China (800 MT), Australia (600 MT), Colombia (400 MT), and Chile (200 MT). For 2020, net sales of 17,800 MT were primarily for China (5,700 MT), Mexico

(2,700 MT), Australia (2,300 MT), Japan (2,200 MT), and Colombia (1,400 MT). Exports of 40,100 MT were up 2 percent from the previous week and 5 percent from the prior 4-week average. The primary destinations were to China (16,100 MT), Mexico (10,500 MT),

South Korea (3,200 MT), Japan (3,000 MT), and Canada (2,200 MT).

December 27, 2019 1 FOREIGN AGRICULTURAL SERVICE/USDA

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.