From: Terry Reilly

Sent: Monday, December 30, 2019 2:54:26 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 12/30/19

Tuesday

will be a regular session for CBOT agriculture. Poor grain inspections sent prices lower while soybean export inspections fell within a range of trade expectations. China took 281k soybeans.

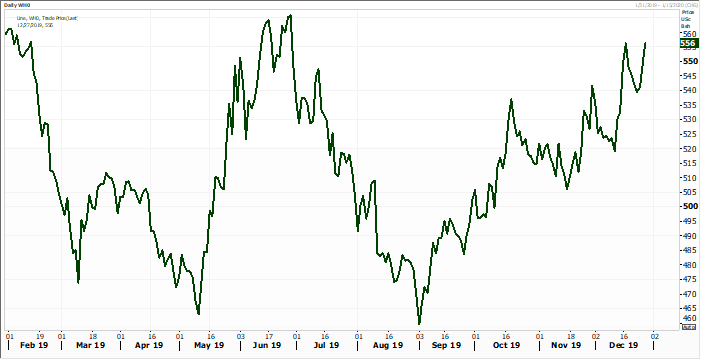

Record

net long SBO?….

Source:

Refiniv and FI

Weather

·

Argentina’s dry areas saw much need rain over the weekend, from Buenos Aires to southern Cordoba and northeastern La Pampa and from northern Cordoba to western Santiago del Estero.

·

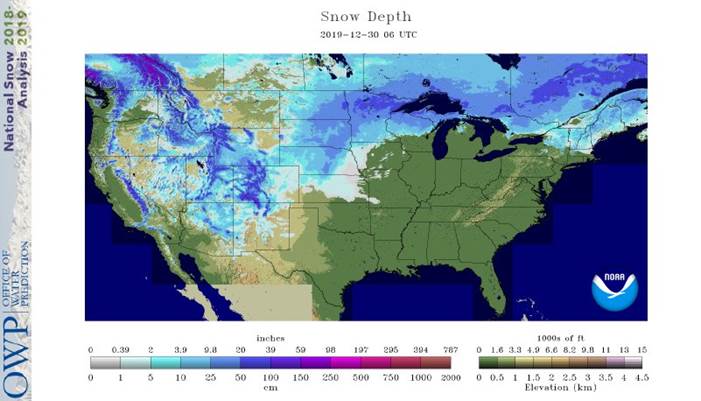

Eastern, central and parts of western Kansas as well as western Oklahoma saw good precipitation over the weekend, which was needed. Far western KS and eastern Colorado picked up on light precipitation and

more is needed to boost soil moisture levels. The weekend storm was not as heavy as expected in terms of snowfall coverage, so there is still some concern lack of snowfall coverage may leave poorly established HRW wheat across the central US Great Plains

vulnerable to cold snaps. The central Great Plains will see additional snow events in January. No extreme cold threat is expected through January 6.

·

Rain and thunderstorms occurred elsewhere in the Midwest

Source:

World Weather Inc. and FI

From

World Weather Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

South

America weather will be mostly good over the next two weeks. Recent rain in the previously dry areas of Argentina is improving recently planted crop emergence and establishment while crops planted earlier in the year likely experienced some stress relief and

this trend may continue for a while as additional showers and thunderstorms occur in many areas. The northeast will be driest

Brazil

weather will continue favorably mixed, although a close watch on the south is warranted due to net drying over the next ten days. Dryness will have to breakdown later in January to protect production potentials.

In

the meantime, recent rain in southern Sumatra and western and central Java and has been improving soil moisture for better oil palm production potentials in 2020. The rain must be sustainable over multiple weeks and it looks like that may be the case.

South

Africa crop weather will remain varied offering some timely rainfall to many areas, but frequent follow up rain will be needed to seriously change crop moisture and development potential. Some areas may not get enough rain to counter evaporation in the next

two weeks while others will.

India

will get some additional rain in the central and east this week benefiting some summer crops. Timely precipitation has occurred in many other areas and more is expected later in January to support good yields.

Winter

crops in China and Europe are semi-dormant and mostly in good shape. Rain in China this winter will help to improve soil moisture for better winter rapeseed establishment prior to reproduction in the spring.

Late season farming activity in the United States will not advance very well for a while, but that is no change from last week’s weather outlook.

Overall,

weather today will provide a neutral to slightly bearish bias to market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Precipitation

in the U.S. hard red winter wheat production region during the weekend bolstered topsoil moisture for improved wheat establishment in the spring. Additional moisture will be needed periodically through the winter to ensure the best crop development potential.

More

rain in the U.S. Midwest and snow in the southeastern Canada will leave those wheat areas plenty wet for spring fieldwork.

Winter

crop conditions in China may improve if precipitation falls as expected this week and next week. The moisture will fall in areas that were a little dry in the autumn. Improvements in wheat establishment prior to reproduction cannot occur until warmer weather

comes along in the spring, but the moisture should still be available to crops unless a warm and dry finish to winter and start to spring takes place.

India wheat production areas will receive some welcome precipitation this week further ensuring high yields this winter.

Crops

in Europe and the western CIS are dormant and mostly in fair to good shape. Dryness in the autumn left many crops in southeastern Europe, including Ukraine, and Kazakhstan with poor emergence and establishment. Timely rain and seasonable temperatures will

be needed in the spring. Until then, snow is needed to protect poorly established crops from any harsh or extreme weather that suddenly evolves. There is no threat of damaging cold for the next two weeks

North Africa wheat is in fair to good shape. Crops in southwestern Morocco are not well established and need timely rain in the next few weeks to induce better establishment prior to reproduction.

Argentina

harvesting was disrupted during the weekend by some rain and additional precipitation periodically into next week will likely perpetuate this concern, although more than 80% of the wheat crop has been harvested. Barley has not been harvested as well.

Overall,

weather today will likely provide a bearish bias to market weather mentality.

Source:

World Weather Inc. and FI

- USDA

weekly corn, soybean, wheat export inspections, 11am - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

TUESDAY

DECEMBER 31

- AmSpec

releases Malaysia’s Dec. 1-31 palm oil export data, 10pm Monday (11am Kuala Lumpur); SGS data due at 3pm KL

WEDNESDAY,

Jan. 1:

- Nothing

major scheduled

THURSDAY,

Jan. 2:

- Australia

commodity index - USDA

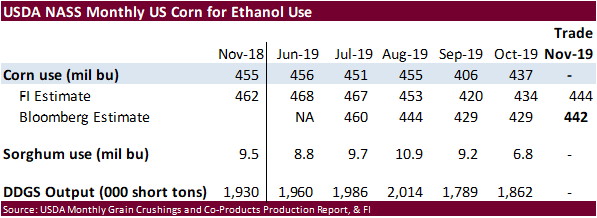

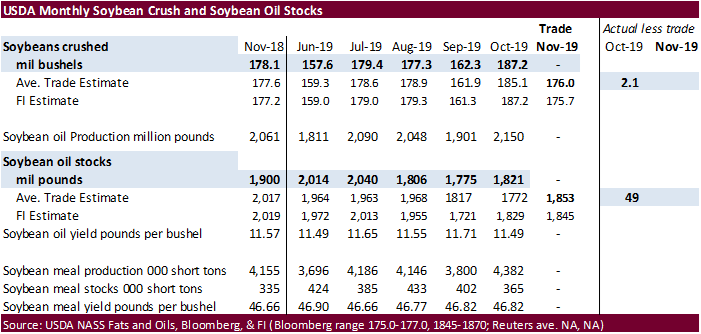

Soybean crush, DDGS production, corn for ethanol, 3pm

FRIDAY,

Jan. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - EIA

U.S. weekly ethanol inventories, production, 11am - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

Source:

Bloomberg and FI

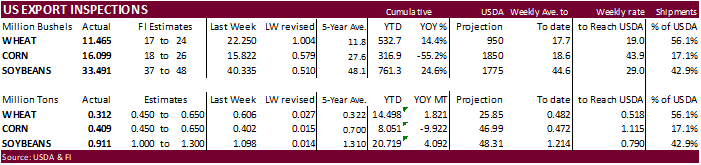

USDA

inspections versus Reuters trade range

Wheat

312,017 versus 300000-650000 range

Corn

408,946 versus 450000-650000 range

Soybeans

911,482 versus 750000-1300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 26, 2019

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/26/2019 12/19/2019 12/27/2018 TO DATE TO DATE

BARLEY

0 0 0 16,760 6,191

CORN

408,946 401,894 952,881 8,050,874 17,972,678

FLAXSEED

100 100 0 396 218

MIXED

0 0 0 0 0

OATS

0 0 0 1,918 1,693

RYE

0 0 0 0 0

SORGHUM

4,049 157,401 29,769 869,974 458,712

SOYBEANS

911,482 1,097,748 756,153 20,719,478 16,627,065

SUNFLOWER

0 0 0 0 0

WHEAT

312,017 605,545 380,421 14,497,684 12,677,074

Total

1,636,594 2,262,688 2,119,224 44,157,084 47,743,631

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

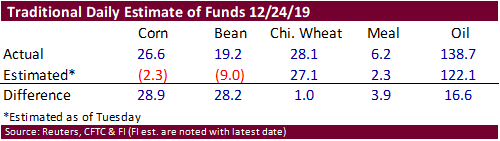

As of 12/24/19

·

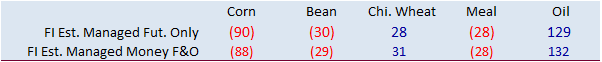

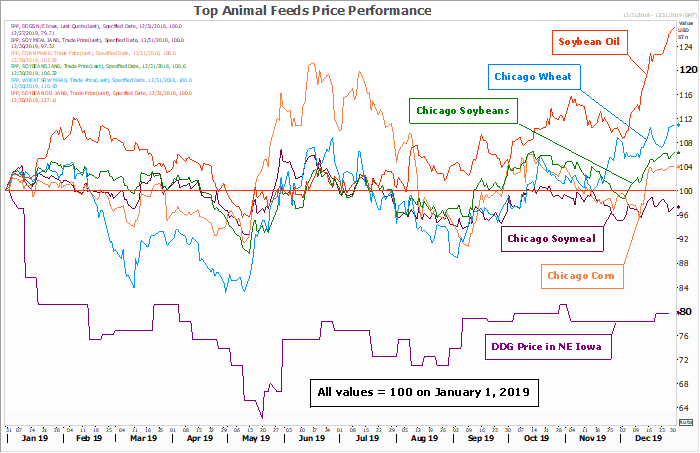

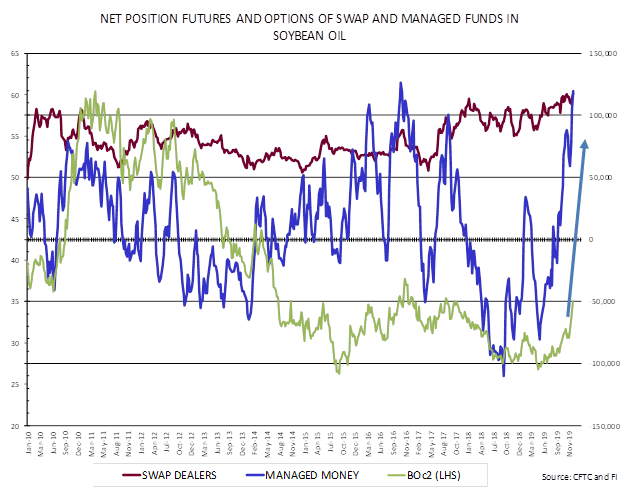

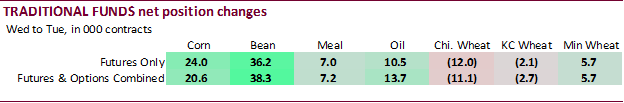

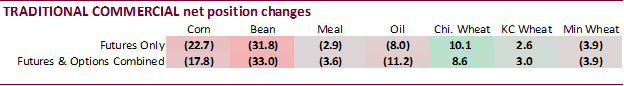

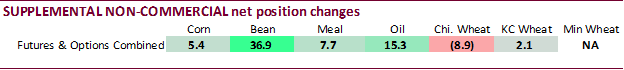

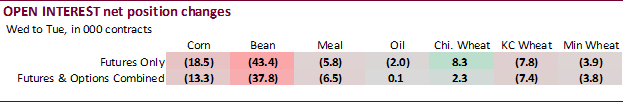

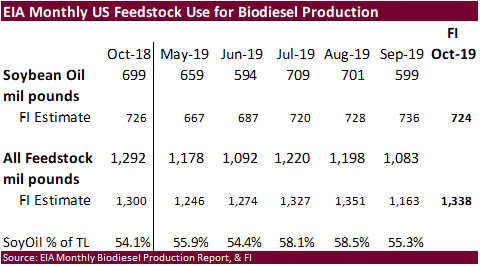

The traditional fund net long position in soybean oil continued to take off to the upside while meal continues to struggle.

·

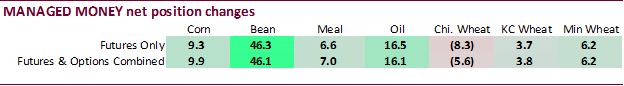

Managed money in soybean oil futures and options increased their net long position by 16,080 contracts to 140,752 lots, largest position since November 2016. The record is 126,543 contracts in early November

2016. Prices back then were around 37-38 cents/pound.

·

For managed money, they added an impressive 46,119 net long contracts, cutting the short position to net 33,888 lots.

·

Traditional futures only funds bought 20,600 corn, 38,300 soybeans, 7,200 meal, 13,700 soybean oil and sold 11,100 Chicago wheat for the week.

·

Open interest in soybeans decreased 37,800 contracts futures and options combined.

·

Funds were much more long than expected for corn (by 28,900), soybeans (by 28,200) and soybean oil (16,600).

Corn

·

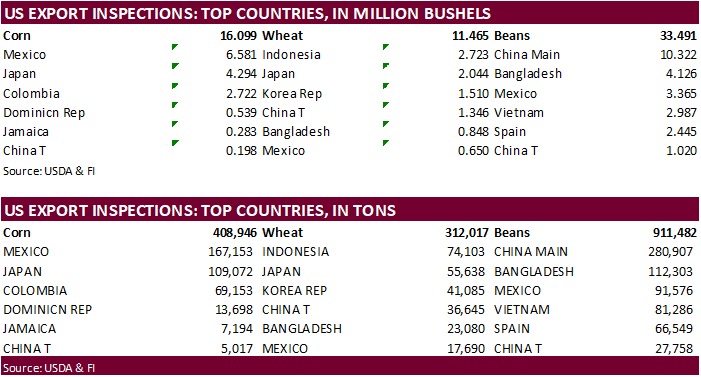

Poor USDA export inspections of only 409,000 tons triggered selling in corn during the morning session, creating a two-sided trade. Bear spreading was a feature.

·

USDA US corn export inspections as of December 26, 2019 were 408,946 tons, below a range of trade expectations, above 401,894 tons previous week and compares to 952,881 tons year ago. Major countries included

Mexico for 167,153 tons, Japan for 109,072 tons, and Colombia for 69,153 tons.

·

Profit taking could have been a feature. CBOT corn

hit

a 7-week overnight on trade optimism.

·

The northern and parts of the central Great Plains and far northwestern Corn Belt saw a large storm system over the weekend that impacted travel and increased livestock stress, but at the same time provided

beneficial moisture to the growing regions.

·

There are conflicting weather forecasts for southern Brazil. Southern Brazil will see drought like conditions through the 10th of January, according to one weather person, stressing corn and soybeans.

Temperatures will remain hot. But much of the area will not be completely dry. World Weather indicated “Southern Brazil should get some timely rainfall to prevent dryness from becoming an issue in the next two weeks…All of Brazil will see timely rain, although

Paraguay and southwestern Mato Grosso do Sul will be left in a drying mode this week before relief comes next week.”

·

As for yields, we raised our Argentina yield (was low to begin with) to 2.90 tons per hectare. Others are around 3.03 to 3.05 tons. USDA is using 3.03 versus 3.33 last year. For Brazil, USDA is at 3.33 versus

3.26 last year. Our Brazil production was raised to 123.1 million tons from 121.3 million previously. We think the weather situation improved for Argentina and will not be as bad as some project for southern Brazil.

·

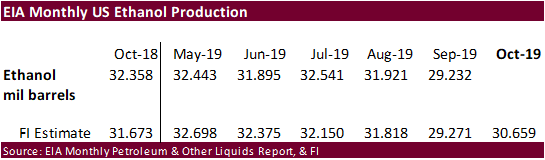

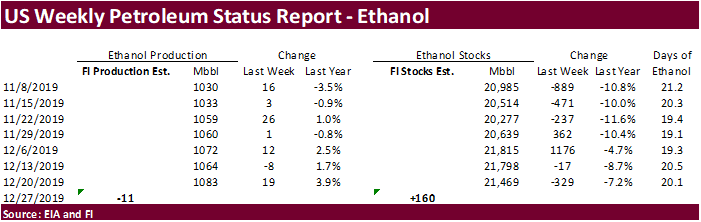

USDA radio talked about a recent US ethanol delegation’s trip to Mexico, a market that could be very lucrative for the US. Related: www.usda.gov/media/radio/daily-newsline/2019-12-27/mexicos-potential-ethanol-export-market.

And reading up on US corn S&D: https://www.ers.usda.gov/webdocs/publications/93633/fds-19f-01.pdf?v=4463.2

·

Speaking of ethanol demand, Brazil ethanol stocks are projected to be very tight despite a record 35 billion liters (9.25 billion gallons) produced during the peak April through mid-December season. An ethanol

analyst with INTL FCStone doesn’t see a comfortable stock situation to cover seasonal downtime during the mid-December and early April period. Cheaper ethanol in 2019 increased demand for the fuel to record levels. Are imports from the US likely? US ethanol

is cheap relative to Brazil. Spot prices of ethanol in Brazil is pretty firm.

·

China will soon release frozen pork, frozen beef and mutton from reserves, and increase imports of pork, all ahead of the China New Year starting January 25. January through November China’s pork imports

were up 57.9% from a year earlier to 1.7 million tons.

·

Vietnam’s pig prices declined recently despite ongoing ASF problems. The government had launched several initiatives to drive prices down, including the encouragement to increase slaughter rates to boost the

countries frozen pork supplies. Vietnam’s General Statistics Office reported the hog population in December declined 26 percent from year ago, largest monthly decline during the span of nine consecutive months of it falling. ASF was first discovered on Feb.

1 and since then, it led to culling of six million pigs through mid-December.

·

CBOT soybean

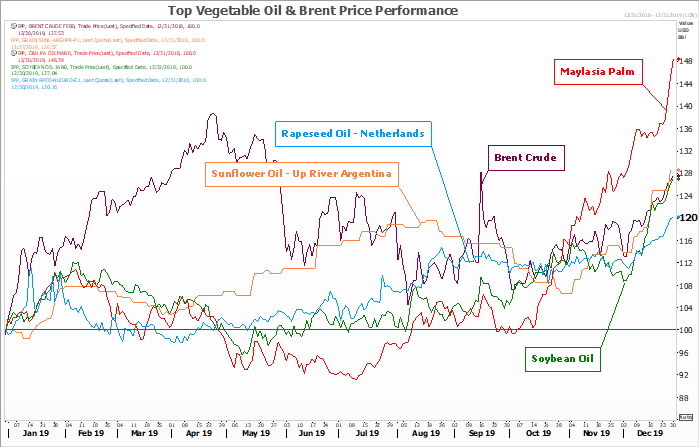

futures were higher on Monday following good USDA export inspections, strength in soybean oil and ideas China will buy more US soybeans after renewing 10 GMO variety strains and approving 2 new import varieties. However, China is making a move to approve

GMO seeds for commercial production, which long-term is slightly bearish, assuming the slope of the trend yield increases. Soybean meal was led higher by weather forecasts calling for colder temperatures through early January and soybean oil was up on sharply

higher Malaysian palm and China vegetable oil futures. Egypt bought sunflower oil and they paid more than $150/ton more than their last tender back in October. Going home tonight, we think money managers are a record net long 132k soybean oil (F&O).

·

USDA US soybean export inspections as of December 26, 2019 were 911,482 tons, within a range of trade expectations, below 1,097,748 tons previous week and compares to 756,153 tons year ago. Major countries

included China Main for 280,907 tons, Bangladesh for 112,303 tons, and Mexico for 91,576 tons.

-

China’s

AgMin will make a monumental move that could change the landscape for the nearby trend in soybean and corn yields. They plan to issue biosafety certificates for one GMO soybean seed variety and two corn varieties, for commercial production, a signal the country

turned the page and open the door to boosting crop production. Rather than become dependent on international research and GMO seed varieties, they spent billions of USD in research over years. SHZD32-01 soybeans, developed by Shanghai Jiaotong University,

drew no public objection during a 15-day period. Dabeinong’s 002385.SZ DBN9936 corn and double-stacked 12-5 corn by Hangzhou Ruifeng Biotech Co Ltd and Zhejiang University may also be approved. -

China

also approved two new genetically modified (GM) crops for import and renewed permits for 10 others. The two news ones were Corteva AgriScience’s CTVA.N DAS-81419-2 soybean and 55-1 papaya by USDA and Hawaii University. -

Argentina

producers in in Rosario and Cordoba are staging a protest over export taxes. This is not expected to impact grain transportation or export flow.

·

APK-inform reported Ukraine sunflower exports as of late December increased 44% to 1.585 million tons so far this season from 1.099 million during the same period a year ago.

-

USDA

CCC seeks 14,650 tons of packaged vegetable oils for export to Yemen on January 7 with shipment February 1-29 (Feb. 16-Mar. 15 for plants at ports).

-

Egypt’s

GASC bought 10,500 tons of sunflower oil at $857/ton. They were in for an undetermined amount of vegetable oil for arrival Feb. 5-20 arrival and earlier the lowest offer was $857.00 per ton for 10,500 tons of sunflower oil. GASC received only one offer for

soyoil at $908.33 a ton. Offers per Reuters for cost and freight (C&F) basis:-

6,000

tons of sunflower oil at $862.00 -

10,500

tons of sunflower oil at $857.00 -

15,000

tons of soyoil at $908.33 -

11,000

tons of sunflower oil at $864.33 -

11,000

tons of sunflower oil at $880.00

-

6,000

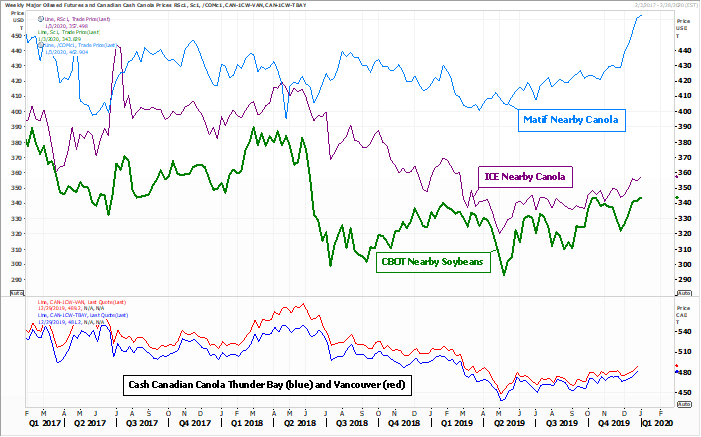

Rapeseed/Canola

prices have been rallying along with soybeans, but large Canadian supplies have widened the spread against EU rapeseed

Source:

Refiniv and FI

Source:

Refiniv and FI

-

CBOT

March soybeans are seen in a $9.00-$9.60 range -

March

soybean meal $285 (lowered $10) to $310 range -

March

soybean oil 33.00-36.00 range -

Upside

in oil share is seen limited at 37.5 percent, for the short term. Eventually it could rally to 38.5-39.0 percent.

·

Lackluster USDA export inspections created a two-sided trade in US wheat futures.

·

Wheat futures

started higher on follow through bullish optimism China will buy US wheat in 2020 and rising Black Sea wheat prices, traded mixed after the release of USDA export inspections, and rallied into the close to settle mostly higher.

·

USDA US all-wheat export inspections as of December 26, 2019 were 312,017 tons, low end a range of trade expectations, below 605,545 tons previous week and compares to 380,421 tons year ago. Major countries

included Indonesia for 74,103 tons, Japan for 55,638 tons, and Korea Rep for 41,085 tons.

·

Eastern, central and parts of western Kansas as well as western Oklahoma saw good precipitation over the weekend, which was needed. Far western KS and eastern Colorado picked up on light precipitation and

more is needed to boost soil moisture levels. The weekend storm was not as heavy as expected in terms of snowfall coverage, so there is still some concern lack of snowfall coverage may leave poorly established HRW wheat across the central US Great Plains

vulnerable to cold snaps. The central Great Plains will see additional snow events in January. No extreme cold threat is expected through January 6.

·

EU weekly agriculture trade data will not be released this week. They will resume Monday, January 6.

·

Russian 12.5% protein wheat from Black Sea January delivery increased $2 per ton to $218according to SovEcon. IKAR reported unchanged at $218 per ton.

·

March Paris wheat futures settled unchanged at 189.00 euros.

·

Will Egypt tender for wheat tonight or Tuesday? Egypt said they have enough strategic reserves of wheat for five months. I put the odds for a tender at 85 percent.

·

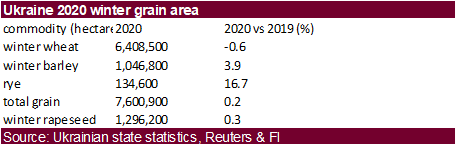

Ukraine’s Ministry for Development of Economy, Trade and Agriculture reported grain exports as of late December increased 32.5% to 30 million tons since July 1, fueled by higher corn and wheat exports. Wheat

export are 4.2 million tons higher to 14.6 million tons. Ukraine also exported 3.7 million tons of barley and 11.4 million tons of corn.

March

Chicago wheat

Source:

Refiniv and FI

- Jordan

seeks 120,000 tons of wheat on January 7. - Morocco

seeks to import about 355,000 tons of US durum wheat on January 9 for arrival by May 31.

- Mauritius

seeks 95,000 tons of optional origin wheat flour on Jan. 10, 2020, for shipment between July 1, 2020, and June 20, 2021.

·

Syria seeks 200,000 tons of soft wheat from Russia on January 20, 2020.

Rice/Other

- Results

awaited: South Korea is in for 42,222 tons of rice for April-June arrival on Dec 27. Reuters:

Details

of the tender are as follows:

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

3,000 Milled Long April 30, 2020/Busan

17,000 Milled Medium June 30, 2020/Busan

22,222 Brown Medium June 30, 2020/Busan

- Syria

seeks 45,000 tons of white rice on Jan. 6, 2020. (Reuters) Short grain white rice of third or fourth class was sought. No specific country of origin was specified in the tender, traders said. Some 25,000 tons was sought for supply 90 days after confirmation

of the order and 20,000 tons 180 days after supply of the first consignment. The rice was sought packed in bags and offers should be submitted in euros. A previous tender from the agency for 45,000 tons of rice with similar conditions had closed on

Nov.

13.

Updated

12/27/19

(high end increased)

·

CBOT Chicago March wheat is seen in a $5.40-$5.80 range

·

CBOT KC March wheat is seen in a $4.70-$5.00 range

·

MN March wheat is seen in a $5.50-$5.75 range

·

We like KC wheat over Chicago wheat.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.