From: Terry Reilly

Sent: Thursday, January 02, 2020 8:03:35 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 01/02/20

PDF attached

·

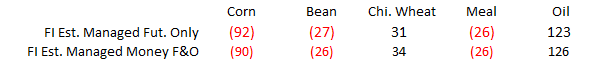

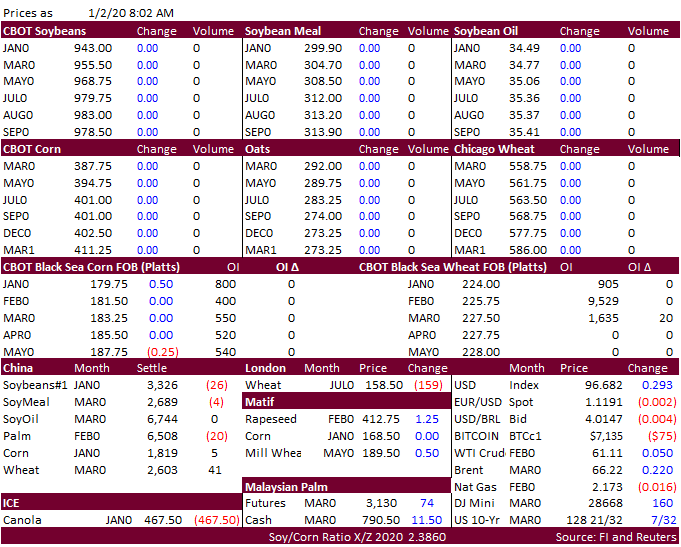

Soybeans 5-7 higher

·

Soybean meal: $0.50-$1.50 higher

·

Soybean oil: 30-40 points higher

·

Corn: 2-3 higher

·

Chicago wheat: 3-5 higher