From: Terry Reilly

Sent: Friday, January 25, 2019 8:14:09 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 01/25/19

PDF attached

· Brazil saw additional rain in the central growing areas over the past day.

· Brazil’s northeast will continue to see limited rainfall. MGDS and RGDS will dry down again this workweek. MG should see good weather. Parana and southern Minas Gerais will see daily showers.

· Argentina will trend much wetter in the central and south this week while the northeast dries down.

· The lower half of the US Great Plains still lacks snow coverage. U.S. temperatures will be coldest Thursday and Friday mornings in the Midwest and northern Plains.

· Europe and western CIS will see rain and snow over the next two weeks.

· Australia was again hot.

· Belarus will see a frost event later this week that may impact winter grain crops in the south-east.

Source: World Weather Inc. and FI

SIGNIFICANT PRECIPITATION EVENTS FOR BRAZIL

-Fri 40% cvg of up to 0.75” and local amts to 2.0”;

east Sao Paulo wettest; Paraguay to Rio Grande

do Sul driest

Sat-Mon 60% cvg of up to 0.75” and local amts to 2.0”

with some 2.0-3.50” amts in Mato Grosso and

Goias; Paraguay to Rio Grande do Sul driest

Tue 20% cvg of up to 0.50” and local amts to 1.10”;

NE and NW wettest

Wed-Feb 1 40% cvg of up to 0.75” and local amts to 1.50”;

far south and NW wettest; driest SW

Feb 2-4 40% cvg of up to 0.75” and local amts over 2.0”;

wettest south; driest NE

Feb 5-7 60% cvg of up to 0.75” and locally more

SIGNIFICANT PRECIPITATION EVENTS FOR ARGENTINA

Tdy-Sat 60% cvg of 0.75-3.50” and local amts over 5.0”

from central Cordoba to east La Pampa and west

Buenos Aires with up to 0.75” and locally more

elsewhere; driest NE

Sun-Mon 40% cvg of up to 0.50” and local amts over 1.0”;

wettest SE

Tue-Jan 31 60% cvg of up to 0.75” and local amts over 2.0”;

driest north

Feb 1-3 40% cvg of up to 0.75” and local amts over 2.0”;

wettest north

Feb 4-7 10-25% daily cvg of up to 0.40” and locally

more each day

Source: Reuters and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Bloomberg Ag Calendar (Most USDA reports are delayed due to government shutdown)

- AmSpec, Intertek data on Malaysia’s Jan. 1-25 palm oil exports, ~10pm ET Thursday (~11am Kuala Lumpur Friday)

- SGS data during same period, ~2am Friday (~3pm local time Friday)

- Unica cane crush, ~7am (~10am Sao Paolo) though exact timing may vary

- USDA cattle-on-feed report for December, 3pm (dependent on end of govt shutdown)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1pm ET (~6pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Olam report on its 2019-2024 strategic plan

MONDAY, JAN. 28:

- USDA weekly corn, soybean, wheat export inspections, 11am

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

- Ivory Coast cocoa arrivals

- China starts options trading on corn, cotton and rubber

- Latin America fertilizer conference starts in Mexico City

- Public holiday in Australia

TUESDAY, JAN. 29:

- Latin America fertilizer conference continues

- Orbital Insight forum on AI, satellite imagery and natural disasters

- Argentina’s agriculture and environment ministries hold press conference to announce crop mapping tools the govt will use to adapt to climate change

WEDNESDAY, JAN. 30:

- AmSpec, Intertek data on Malaysia’s Jan. 1-31 palm oil exports, ~10pm ET Wednesday (~11am Kuala Lumpur Thursday)

- SGS data for same period, ~2am Thursday (~3pm local time Thursday)

- EIA weekly U.S. ethanol inventories, output, 10:30am

- Chinese president’s top economic aide, Vice Premier Liu He, visits Washington for trade talks, meeting with U.S. Trade Representative and Treasury Secretary, through Thursday

THURSDAY, JAN. 31:

- USDA weekly crop net-export sales, 8:30am (dependent on end of govt shutdown)

- Buenos Aires Grain Exchange weekly crop report

- Port of Rouen data on French grain exports

- Latin America fertilizer conference ends

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: International Paper, Hershey Co., Diageo Plc

FRIDAY, FEB. 1:

- Australia January commodity index, 12:30am ET (4:30pm local time)

- Paris Grain Day conference, with speakers from Credit Agricole, Invivo Trading, Cyclope, MD Commodities, Euronext, USDA, Oil World, Sovecon

- India’s interim budget, with TLIV blog coverage

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1pm ET (~6pm London)

- USDA cattle-on-feed report for December, 3pm (dependent on end of govt shutdown)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm (dependent on end of govt shutdown)

No changes in CBOT ag registrations

Weekly Bloomberg Bull/Bear survey

· Soybeans: Bullish: 4 Bearish: 6 Neutral: 6

· Corn: Bullish: 6 Bearish: 3 Neutral: 7

· Wheat: Bullish: 8 Bearish: 4 Neutral: 3

· Raw sugar: Bullish: 0 Bearish: 1 Neutral: 6

· White sugar: Bullish: 1 Bearish: 1 Neutral: 5

· White-sugar premium: Widen: 2 Narrow: 0 Neutral: 5

· USD was down 42 points (8:07 CT).

· WTI was $0.14 higher

· Gold $9.90 higher

· Dow 248 points higher.

· China trade delegation meets with US officials in DC on Monday.

Corn.

· Corn futures are moderately higher on past to declining SAf corn production prospects, lower USD, and new money inflow on Thursday. Total OI for corn was up 16.3k with prom month up 7.4k.

· Feb options expire today.

- A Reuters poll calls for SAf corn area to decrease a large 18 percent to 1.998 million hectares, down from, down from 2.448 estimated in October and 2.318 hectares planted last season. The range of total maize estimates was 1.94 million to 2.07 million hectares.

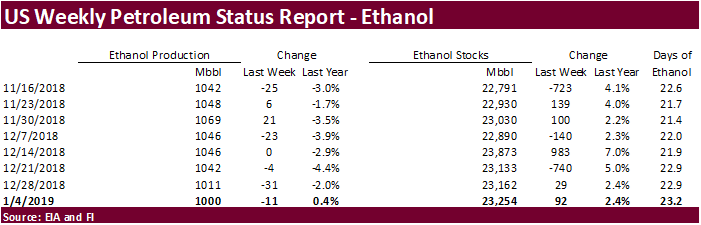

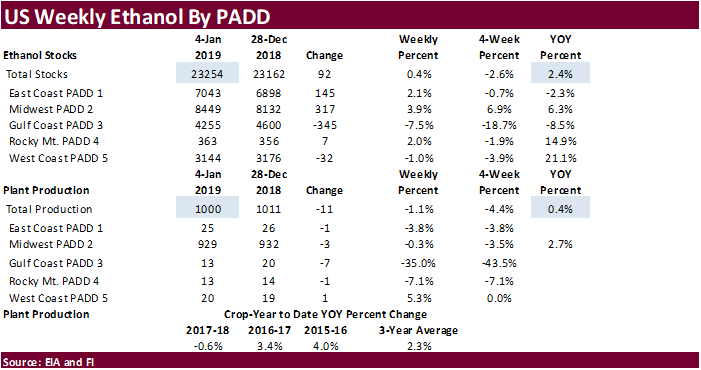

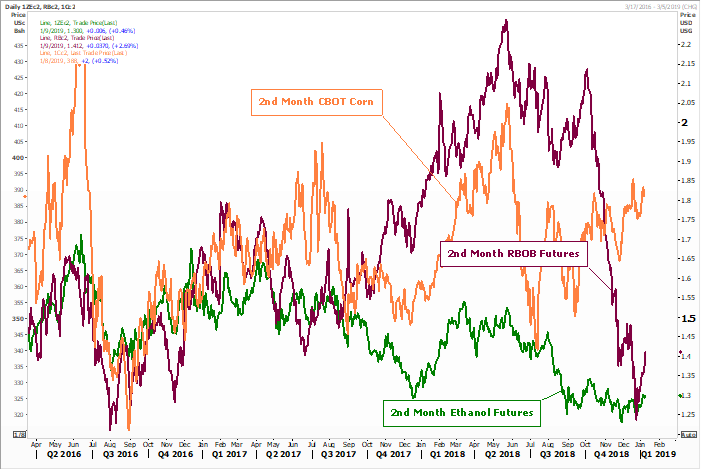

- The US weekly EIA ethanol data was viewed slightly negative for US corn futures and neutral US ethanol futures. Weekly US ethanol production was down 20,000 barrels from the previous week to 1.031 million barrels per day (bbl) and stocks increased 150,000 barrels to 23.501 million. Ethanol stocks of 23.501 million barrels are down 1.3% from a year ago and 1.5% above about 4 weeks ago. The record for ethanol stocks was 24.281 million barrels set on 3/9/18.

· Reuters noted when combining weekly Brazil shipment data and the lineup Williams puts out, Brazil corn shipments during January could end up near 3.5 million tons, above 2.5 million tons for soybeans. Apparently monthly corn shipments shave not been larger than soybean shipments for about a year.

- None reported

Soybean complex.

· The US soybean complex is mixed with SBO in focus again as it gained over meal. Look for bull oil share traders to take profits. Soybeans are slightly higher in part to a lower USD.

· China officials meet with US officials on Monday in DC.

· March oil share is back above 32 percent.

· Bloomberg reported six more US soybean vessels are headed to China, bringing total to 15.

· Indonesia will leave its CPO export tax unchanged in February at zero percent. They will leave cocoa beans unchanged at 5 percent.

· Malaysian April palm futures ended 3 MYR lower at 2294MYR, and leading SBO 5 points lower. Malaysian April cash was $578.00/ton, unchanged.

· AmSpec reported Malaysia palm exports during the Jan 1-25 period at 1.213 million tons, up 24.6 percent from 973,561 tons during the December 1-25 period. ITS shows an 18.5 percent increase to 1.204MMT.

· China markets:

· China cash crush margins were last positive 36 cents (33 on Thur), compared to positive 18 cents late last week, and compares to positive 80 cents a year ago.

· Rotterdam oils were unchanged to 7.50 euros higher from this time last session. Rotterdam meal when imported from SA were slightly lower.

· Offshore values are leading the soybean oil 2 points higher (13 lower week to date) and meal $0.20 lower ($0.10 higher week to date).

- Results awaited: Iran’s SLAL (state owned) seeks 200,000 to 300,000 tons of soymeal this week for shipment in February and March.

- South Korea seeks 100,000 tons of non-GMO soybeans on Jan 31 for arrival between Jan 2020 and Aug 2020.

Source: Refinitiv Eikon and FI

Wheat

- US wheat futures are mostly lower but don’t discount a two-sided trade. KC wheat lost a little ground to Chicago overnight. Black Sea markets were very quiet yesterday. Black Sea weather is ok with enough snow coverage. Lower US Central Plains and southern Greet plains lack snow coverage. Australia was again extremely hot yesterday.

- The USD is lower.

- Paris wheat is 0.25-1.00 euro lower.

- The Indonesian Flour Mills Association looks for Indonesian flour mill imports to increase 5-6 percent in 2019. 2018 actual wheat imports are on track to reach over 9.3 million tons.

- The Argentine AG ministry revised their wheat estimate -.45 MMT to 19.26 MMT. This is the first estimate since NOV from them. The ministry is still .56 MMT above Rosario’s estimate of 18.7 MMT and .26 MMT above the BA Grain exchange estimate. (Thanks MPI)

- Russia’s truck strike is not expected to have much of an impact on grain export flows.

- SovEcon estimated Russia’s 2018-19 grains and pulses exports at 44.6 million tons from 43.8MMT previous (42.5MMT for grains alone), including 35.6 million tons of wheat (up 500,000 tons).

· We revised out US winter wheat area from 32.0 million acres to 31.8 million. OK was taken down 94,000 acres and TX was taken down 20,000 acres from our previous estimate.

- Algeria bought 200,000 tons to 250,000 tons of optional origin durum wheat at around $290 to $292 a ton c&f. Shipment was sought for Feb. 16-28 or March 1-15.

- Taiwan seeks 55,000 tons of US wheat on January 29.

- Jordan seeks 120,000 tons of optional origin wheat on January 29 for April 1-15, April 16-30, May 1-15 and May 16-31 shipments.

- Jordan seeks 120,000 tons of optional origin feed barley on January 30. Possible shipment periods are June 1-15, June 16-30, July 1-15 and July 16-31.

- Turkey seeks 300,000 tons of wheat on Jan. 30, in 40 separate tenders each of 7,500 tons for shipment Feb. 6-25 and March 1-15.

- Japan in an SBS import tender seeks 220,000 tons of feed wheat and 200,000 tons of barley on January 30 for arrival by March 14.

- Ethiopia seeks 400,000 tons of milling wheat on Jan. 31 for shipment is two months after the contract award.

- Bangladesh seeks 50,000 tons of wheat on February 3 for shipment within 40 days of contract signing.

- Bangladesh seeks 50,000 tons of wheat on February 10 for shipment within 40 days of contract signing.

- Jordan’s state-owned Silos and Supply General Company seeks 25,000 tons of 11 percent protein milling wheat on Feb. 11 for shipment in March.

· Syria’s seeks 200,000 tons of Russian wheat on March 4.

Rice/Other

· Results awaited: Mauritius seeks 6,000 tons of optional origin rice on Jan 24 for delivery between March 15 and June 30 in shipping containers.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.