From: Terry Reilly

Sent: Monday, January 27, 2020 8:06:33 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 01/27/20

PDF attached

Morning.

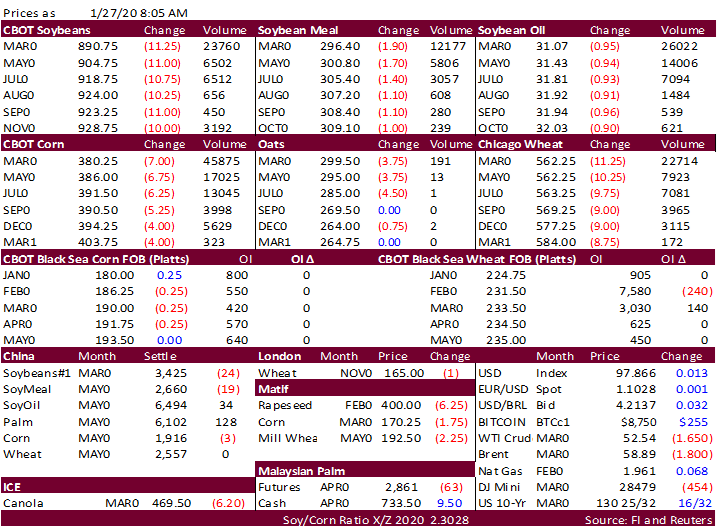

Coronavirus

fears are driving commodities lower. CNN has a live update page, along with other major news outlets.

https://www.cnn.com/asia/live-news/coronavirus-outbreak-01-27-20-intl-hnk/index.html