From: Terry Reilly

Sent: Monday, January 28, 2019 7:28:47 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 01/28/19

US government is back open

· The US government will reopen for three weeks. Expect a flurry of USDA reports. We are crossing our fingers that USDA will release each weekly report at a day at a time, same as October 2014 when they reopened.

· What is the trade missing? Most major USDA and other agency reports (CFTC for example). See our stripped-down list at the end of the comment. Remember EIA data and export inspections have been released.

· The largest sticker shock, in our opinion, will be the release of a month’s worth of USDA FAS 24-hour announcements.

· Backing down, Trump agrees to end shutdown without border wall money – Reuters News

· It was the longest shutdown in U.S. history

· 6-10 is wetter for the southeastern Midwest and northern Delta. 6-10 temperature are warmer in the Great Plains, Midwest, and Delta. 11-15 day is wetter for the southwestern Great Plains and southeastern Midwest. Temps are cooler for the Great Plains and western Midwest.

· The US will see a record-breaking cold blast this week. In Chicago, the record daily “high” could be taken out on Wednesday. Cold temperature for the central upper Midwest will last through Friday. It had already fallen to minus 44 degrees Fahrenheit (minus 42 Celsius) in International Falls, Minnesota, on Sunday.

· Winterkill threat will be greatest across Nebraska and northern Kansas.

· Parts of the IL River might be closed this week.

· Madden Julian Oscillation (MJO) suggest warmer temperatures for the US next week.

· Brazil’s MGDS saw limited rainfall over the weekend but rain today for MGDS, and neighboring MG, could see up to 2.00”. Other areas received as expected rainfall. Rain will increase across southern Brazil during the weekend and by early next week. Dryness remains significant in many Mato Grosso do Sul, Paraguay, eastern Bolivia locations and from central Minas Gerais through Bahia. There was a weather group out of FL over the weekend mentioning central and northern Brazil received less than half of normal rain levels in last 60 days.

· Argentina rain over the weekend was widespread from southern Santiago del Estero and northern Cordoba to western and southern Entre Rios and northern Buenos Aires. Some areas saw 1.00 to 2.75 inches. Cordoba City, Cordoba received 3.75 inches.

· Argentina will see additional rain Wed-Fri of this week with local totals up to 7” from Uruguay through Entre Rios and central and southern Santa Fe to central and northern Cordoba and southern Santiago del Estero. Damage from flooding in Corrientes has been done.

· Excessive heat prevailed in southeastern Australia over the weekend.

· India saw welcome rain for the northern wheat production areas over the weekend.

· South Africa will experience more frequent rainfall over the next two weeks than last week.

· Europe weather will continue very active with frequent rain and some snow occurring over the next two weeks.

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Bloomberg Ag Calendar (will change now that US gov is back open……..)

- USDA weekly corn, soybean, wheat export inspections, 11am

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

- Ivory Coast cocoa arrivals

- China starts options trading on corn, cotton and rubber

- Latin America fertilizer conference starts in Mexico City

- Public holiday in Australia

TUESDAY, JAN. 29:

- Latin America fertilizer conference continues

- Orbital Insight forum on AI, satellite imagery and natural disasters

- Argentina’s agriculture and environment ministries hold press conference to announce crop mapping tools the govt will use to adapt to climate change

WEDNESDAY, JAN. 30:

- AmSpec, Intertek data on Malaysia’s Jan. 1-31 palm oil exports, ~10pm ET Wednesday (~11am Kuala Lumpur Thursday)

- SGS data for same period, ~2am Thursday (~3pm local time Thursday)

- EIA weekly U.S. ethanol inventories, output, 10:30am

- Chinese president’s top economic aide, Vice Premier Liu He, visits Washington for trade talks, meeting with U.S. Trade Representative and Treasury Secretary, through Thursday

THURSDAY, JAN. 31:

- USDA weekly crop net-export sales, 8:30am (dependent on end of govt shutdown)

- Buenos Aires Grain Exchange weekly crop report

- Port of Rouen data on French grain exports

- Latin America fertilizer conference ends

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: International Paper, Hershey Co., Diageo Plc

FRIDAY, FEB. 1:

- Australia January commodity index, 12:30am ET (4:30pm local time)

- Paris Grain Day conference, with speakers from Credit Agricole, Invivo Trading, Cyclope, MD Commodities, Euronext, USDA, Oil World, Sovecon

- India’s interim budget, with TLIV blog coverage

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1pm ET (~6pm London)

- USDA cattle-on-feed report for December, 3pm (dependent on end of govt shutdown)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm (dependent on end of govt shutdown)

No changes in CBOT ag registrations

· USD was slightly higher (7:26 CT).

· WTI was $1.12 lower

· Gold $2.80 higher

· Dow futures 195 points lower.

Corn.

· Corn futures are slightly lower on lower soybeans and higher wheat. News is light.

· Traders will be watching for news on US/China trade talks this week, as well as the flurry of USDA reports.

- Today the Baltic Dry Index was 53 points lower (5.9%) to 852 points, lowest since July 11, 2017.

· Ukrainian sea port grain exports for the week ending Jan. 25 fell to 687,000 tons from 969,000 tons a week earlier-APK-Inform consultancy. Corn exports fell to 189,000 tons from 498,000 tons a week earlier.

· South Korea reported an outbreak of foot-and-mouth disease at a dairy farm in Anseong city.

· China on Monday launched more options on commodity futures including natural rubber, cotton and corn.

· On Friday Reuters reported prompt month US Gulf corn basis hit its highest level since August. FOB corn offers for late January loadings were up 2 cents at about 62 cents over futures.

- A Reuters poll calls for South Africa’s corn area to decrease a large 18 percent to 1.998 million hectares, down from, down from 2.448 estimated in October and 2.318 hectares planted last season. The range of total maize estimates was 1.94 million to 2.07 million hectares. Bloomberg has a 1.970-million-hectare average estimate.

- Indonesia seeks 150,000 tons of corn for shipments by March 31.

Soybean complex.

· The US soybean complex is mixed with meal and soybeans lower and soybean oil higher. SBO is higher in large part to Malaysian palm advancing on Monday on strength in related vegetable oil markets, including China vegetable oils. Note WTI and Brent crude oil are trading lower.

· Ongoing weather problems in Brazil and Argentina continue to underpin prices. Don’t discount a tow-sided trade in soybeans and meal.

· On Friday March soybeans took out its 200-day MA by settling 9.25 cents higher. Oil share may run out of steam soon.

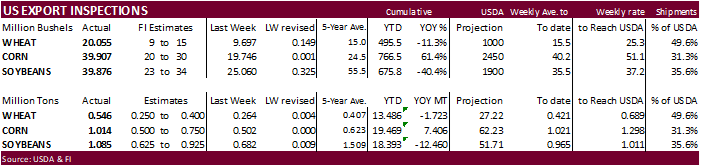

· We look for soybean export inspections to end up in a range of 1.0-1.3 million tons and include 300 to 500 thousand tons for China. Corn export inspections (0.9-1.2MMT) could be reported above a 5-year average and wheat (0.450-0.650MMT) above average for this time of year.

- India and China finished another round of talks regarding China imports of selected India agriculture goods, including soybean meal.

- Pakistan July through December palm oil imports were 1.506 million tons, above 1.378 million tons during the same period in 2017-18.

- Canada’s canola crush during the August through December period was 3.895 million tons, slightly above 3.878 million tons during the same period in 2017-18.

- Last we heard IL crude soybean oil was 25 under, East 50 over, West 100 over, and Gulf 200 over. Argentina degummed soybean oil basis was last 140 over, and Brazilian nominal 130 over, fob.

· Malaysian April palm futures ended 33 MYR higher at 2327MYR, and leading SBO 8 points lower. Malaysian April cash was $587.00/ton, up $9.00/ton.

· China markets:

· China cash crush margins were last positive 45 cents, compared to positive 36 cents late last week, and compares to positive 80 cents a year ago.

· Rotterdam oils were 5-7 euros higher from this time last session. Rotterdam meal when imported from SA were mostly higher.

· Offshore values are leading the soybean oil 5 points lower and meal $0.70 lower.

- Last week the CCC bought 1,000 tons of refined oil under the PL 480 program at $1,166 to $1,295/ton fob.

- Results awaited: Iran’s SLAL (state owned) seeks 200,000 to 300,000 tons of soymeal this week for shipment in February and March.

- South Korea seeks 100,000 tons of non-GMO soybeans on Jan 31 for arrival between Jan 2020 and Aug 2020.

Source: Refinitiv Eikon and FI

Wheat

- US wheat futures are higher. U.S. temperatures will be cold this week. There is a chance for wheat winterkill or crop damage on Wed and Thur for the southern Great Plains.

- The USD is higher.

- The Russian AgMin projected 2018-19 grain exports at 42 million tons (36MMT wheat, down 1 million tons from previous). As of late December, Russia harvested 72.1MMT of clean weight wheat, down from 86 MMT in 2017.

- Russia’s AgMin estimated 2019 grain production could reach 108-110 million tons.

- Russian weather forecaster Hydrometcentre reported favorable winter weather so far this year, especially for Russia’s southern regions of Krasnodar, Stavropol, Rostov and part of the Volga. Winter grains make up between 46 and 50 percent of Russia’s grain crop.

- Serbia looks to start exporting wheat to Egypt starting March 1.

- Paris wheat is unchanged to 0.50 higher.

- Agriculture and Agri-Food Canada updated their Canadian wheat production to 33 million tons, up from 31.8 million tons last year.

Source: Agriculture and Agri-Food Canada and FI

- China sold 4,112 tons of 2013 import wheat from reserves at an average price of 2,210 yuan per ton, 0.63 percent of what was offered.

- Taiwan seeks 55,000 tons of US wheat on January 29.

- Jordan seeks 120,000 tons of optional origin wheat on January 29 for April 1-15, April 16-30, May 1-15 and May 16-31 shipments.

- Jordan seeks 120,000 tons of optional origin feed barley on January 30. Possible shipment periods are June 1-15, June 16-30, July 1-15 and July 16-31.

- Turkey seeks 300,000 tons of wheat on Jan. 30, in 40 separate tenders each of 7,500 tons for shipment Feb. 6-25 and March 1-15.

- Japan in an SBS import tender seeks 220,000 tons of feed wheat and 200,000 tons of barley on January 30 for arrival by March 14.

- Ethiopia seeks 400,000 tons of milling wheat on Jan. 31 for shipment is two months after the contract award.

- Bangladesh seeks 50,000 tons of wheat on February 3 for shipment within 40 days of contract signing.

- Bangladesh seeks 50,000 tons of wheat on February 10 for shipment within 40 days of contract signing.

- Jordan’s state-owned Silos and Supply General Company seeks 25,000 tons of 11 percent protein milling wheat on Feb. 11 for shipment in March.

· Syria’s seeks 200,000 tons of Russian wheat on March 4.

Rice/Other

· Egypt got 4 offers in their GASC rice import tender

o 20,000 tons of Indian rice for arrival from April 1-30

o 25,000 tons of Vietnamese rice for arrival from April 1-30

o 20,000 tons of Chinese rice for arrival from March 20 – April 20 and 48,000 tons of Chinese rice for arrival from April 1-30

o 20,000 tons of Chinese rice for arrival from April 1-30

· Declining South Korea rice consumption per capita has pulled the annual price per capita to a record low in 2018.

· Results awaited: Mauritius seeks 6,000 tons of optional origin rice on Jan 24 for delivery between March 15 and June 30 in shipping containers.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.