From: Terry Reilly

Sent: Friday, February 28, 2020 8:22:04 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 02/28/20

PDF attached

Morning.

What a week. COVID-19: 83,000+ infected and 2,800+ deaths.

Iran Reports 143 New Coronavirus Cases, Total At 388 – RTRS. More countries report initial cases.

https://www.bbc.com/news/world-51235105

Three trillion USD has been wiped out of the S&P since the panic started. 2870 is the 50 percent retracement level for the S&P.

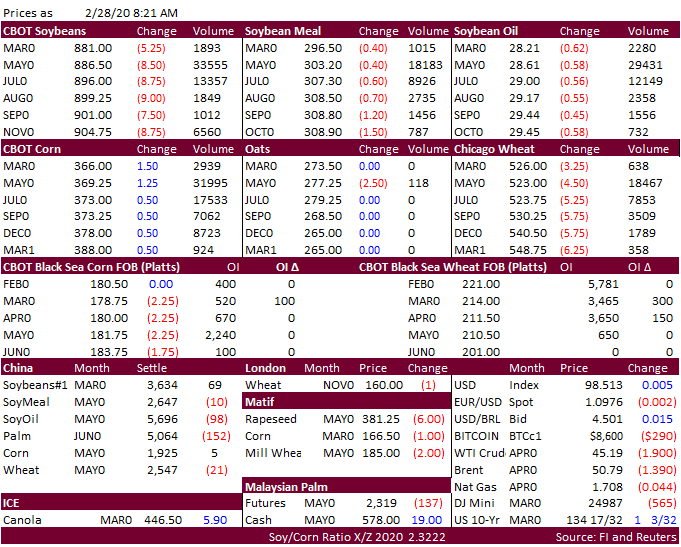

![]()