From: Terry Reilly

Sent: Tuesday, March 03, 2020 8:20:18 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 03/03/20

PDF attached

Morning.

Markets

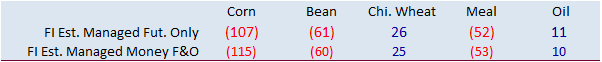

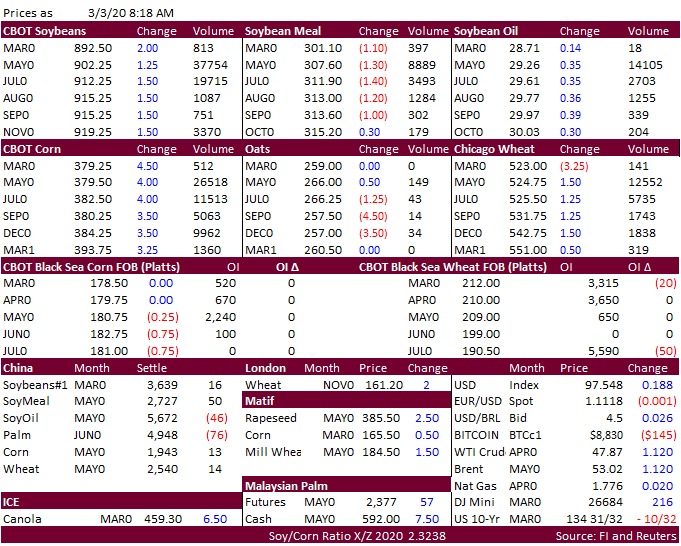

selling off as G-7 makes statement that they stand ready combat any significant downturn in economy but takes no specific action at this time. NASS crush was supportive for SBM. The US$ is higher today and the BRL remains weak.

COVID-19:

90,000+ infected and 3,300+ deaths.