From: Terry Reilly

Sent: Monday, March 09, 2020 8:59:36 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 03/09/20

PDF attached

Morning.

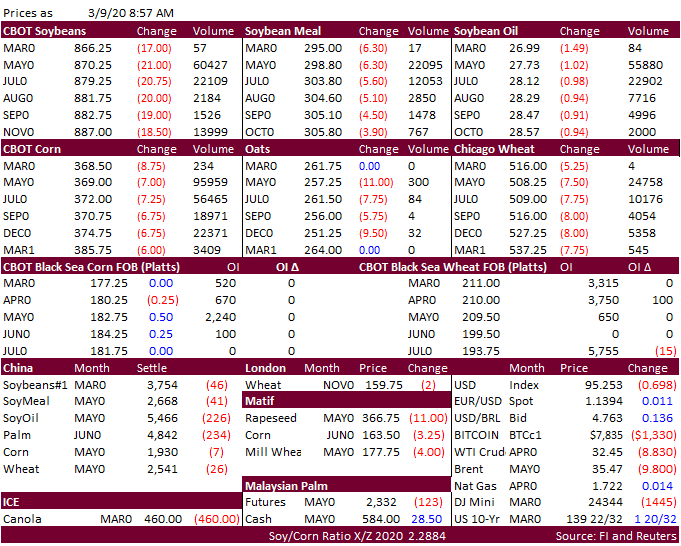

WTI in focus today as Saudi Arabia and Russia continue to argue. WTI traded $10 lower overnight and recoil in the equity markets are in focus. A level one circuit breaker for equities was triggered and trading resumed 15 min thereafter. We are seeing selling

spill over into the ag markets.