From: Terry Reilly

Sent: Tuesday, March 17, 2020 8:03:38 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 03/17/20

Morning.

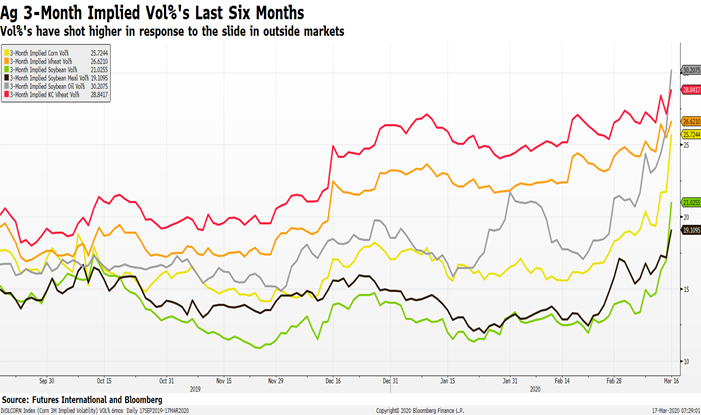

USD surges this morning on Kashkari FED comments. “Negative rates” were tossed in a one liner.

Argentina

is seeing export delays. Another leading analysts slashes SA soybean and corn production. Egypt is in for vegetable oils and SK bought a couple cargos of corn overnight. Wheat import tenders continue to develop.

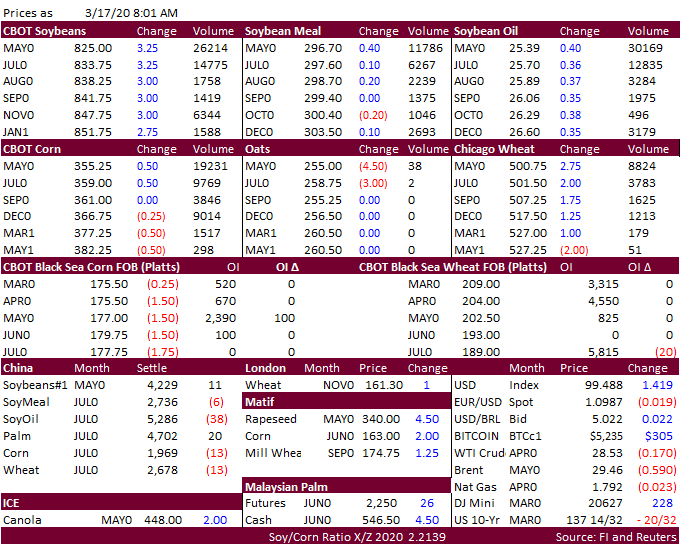

Source: Bloomberg and FI