From: Terry Reilly

Sent: Wednesday, March 18, 2020 8:09:41 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 03/18/20

Morning.

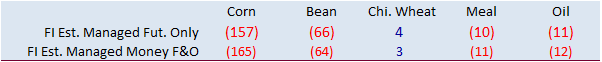

Funds

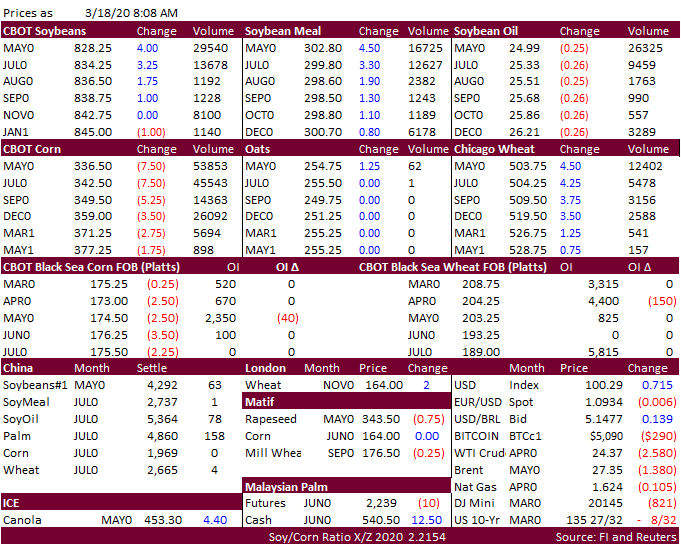

sold an estimated net 105,000 corn contracts over the past 5 business days. Real surged to 5.1604 earlier, yet CBOT soybeans are higher. Corn continues to decline on demand destruction while wheat is higher on an increase in global import business.