From: Terry Reilly

Sent: Friday, April 03, 2020 8:08:05 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/03/20

PDF attached

China

bought 567,000 tons of US corn.

US

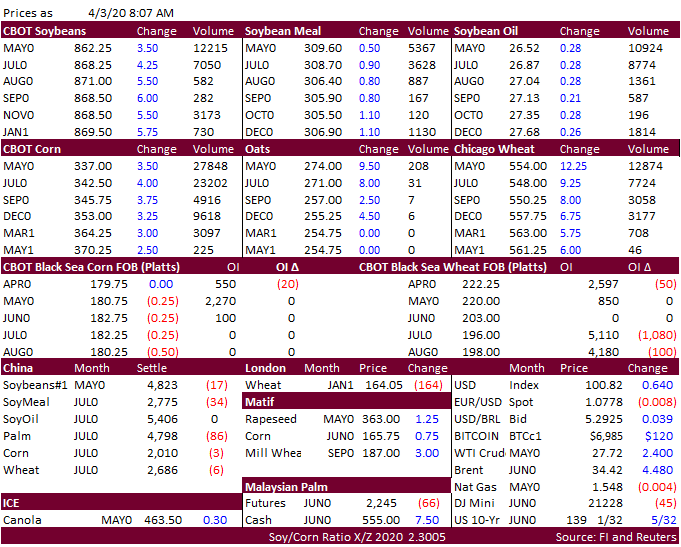

March jobs number out today was thought to be already obsolete. 4.4% unemployment rate, down 701,000. WTI and Brent are extending gains. Higher trade in US agriculture futures. Palm oil traded lower. China crush margins are still near multiyear highs.

![]()