From: Terry Reilly

Sent: Monday, April 06, 2020 8:16:14 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/06/20

PDF attached

Revised

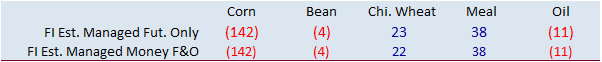

daily estimate of fund positions attached. USDA US crop progress is due out later today and US winter wheat ratings will be out. It was at 52 as of late November 2019.

We think it could end up around 49 percent for the combined good and excellent categories for the week ending April 5. The five-year average for early April winter wheat crop conditions is 48 percent (2018 was unusually low at 32 percent).

China’s

official manufacturing PMI rebounded to 52 in March after hitting an all-time low of 35.7 in February, boosting confidence of a recovery in China’s economic activity.

Dry

weather for Ukraine and Russia may expand this week. Also, dryness for SW Kansas, NW Ok, and SW Colorado with cooler, sometimes frigid temps, should be monitored. The US$ is slightly higher and WTI lower in the nearby position.