From: Terry Reilly

Sent: Thursday, April 11, 2019 8:15:04 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/11/19

PDF attached

・ The CPC looks for a 65 percent chance for El Nino during the Northern Hemisphere summer and 50-55 percent chance during the fall.

・ The large winter storm encompassing the heart of the US started Tuesday evening. It will have a big impact on travel and livestock stress for the interior northern Plains, upper Midwest and northwest half of the Great Lakes region. According to World Weather Inc.:

- Snowfall of 4 to 12 inches will occur from northeastern Colorado to western Nebraska with up to 5 inches in northwestern Kansas

- Snowfall of 12 to 20 inches and local totals to 24 inches will occur from eastern South Dakota to central and southwestern Minnesota

- Snowfall of 4 to 12 inches will occur in parts of western and northern Wisconsin and western parts of the Great Lakes region

- Rain will fall heavily to the south of these areas from eastern Nebraska to the southern Great Lakes region including northern Iowa

・ Many US river locks on the upper section of the Mississippi are closed due to flooding and may not reopen until sometime second half April.

・ Cooling will continue today.

・ Highs Friday will be in the upper 30s through the 50s with 60s from south-central to eastern areas and some middle 30s in the northwest. Saturday’s lows will be in the middle 20s through the lower 40s most often, according to World Weather Inc.

- The Midwest over the next week will see more rain leaving fields to wet to plant.

- West Texas will see rain this weekend and again April 20-21.

- Australia weather this week will be restricted in most of the nation.

- Argentina and Brazil weather will remain favorable. Some showers will impact central and northwestern Argentina Sunday into Monday.

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- Port of Rouen data on French grain exports

- EARNINGS: Barry Callebaut AG

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Japan’s Agriculture Ministry releases result of milling-wheat import tender Tokyo 3am ET (4pm Tokyo)

- Brazil crop agency Conab releases the 7th report on 2018-19 grain crop, Sao Paulo

- Public holiday in Costa Rica

- Planalytics’ crop yield forecast for this year’s U.S. winter wheat, 12pm

- The Annual Africa Sugar Conference, April 9-11 in Nairobi, Kenya

- Speakers include officials from the International Sugar Organization, the FAO and Czarnikow

FRIDAY, APRIL 12:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1pm ET (~6pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China customs to publish March and 1Q soy import data

・ No changes

・ US (Dow) stocks are 30 higher (8:04 am CT)

・ USD 13 higher

・ Crude down $0.56

・ Gold down $12.10

・ US PPI Final Demand (M/M) Mar 0.6% (est 0.3%; prev 0.1%)

-US PPI Final Demand (Y/Y) Mar 2.2% (est 1.9%; prev 1.9%)

-US PPI Ex. Food & Energy (M/M) Mar 0.3% (est 0.2%; prev 0.1%)

-US PPI Ex. Food & Energy (Y/Y) Mar 2.4% (est 2.4%; prev 2.5%)

・ US Initial Jobless Claims (Apr 6) 196K (est 210K; prevR 204K; prev 202K)

-US Jobless Claims 4-Week Avg (Apr 6) 207.0K (prevR 214.0K; prev 213.5K)

-US Continuing Claims (Mar 30) 1.713M (est 1.735M; prev R 1.726M; prev 1.717M)

・ Canada New Housing Price Index (M/M) Feb 0.0% (est 0.0%; prev -0.1%)

-Canada New Housing Price Index (Y/Y) Feb 0.1% (est 0.1%; prev -0.1%)

Corn.

- May corn was lower this morning on lower soybeans and higher wheat.

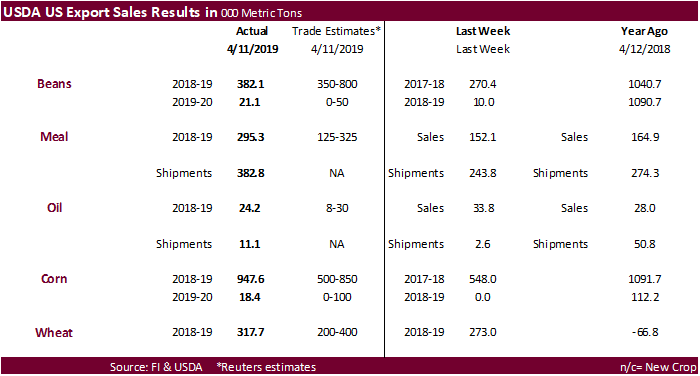

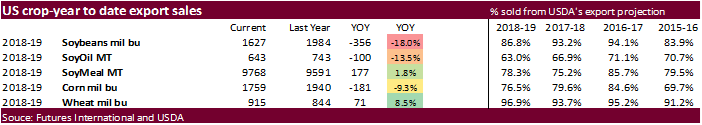

- USDA export sales were poor for corn but very strong for pork (see text below).

- A big storm continues to batter the heart of the US today, further delaying spring plantings.

- China said they are reviewing a request by the US to end anti-dumping duties on US DDGS.

- Yesterday the Rosario Grains Exchange increased their Argentina crop estimate by 0.7 million tons to 48 million tons. USDA is at 47 million tons.

- The USDA Broiler Report showed eggs set in the US up one percent and chicks placed up two percent. Cumulative placements from the week ending January 5, 2019 through April 6, 2019 for the United States were 2.58 billion. Cumulative placements were up 1 percent from the same period a year earlier.

- Weekly ethanol production increased 3,000 barrels per day to 1.002 million, highest in a month. Traders from a Bloomberg poll were looking for weekly US ethanol production to fall 4,000 barrels. Stocks fell a large 799,000 barrels to 23.193 million barrels. Traders were look for a 20,000-barrel decrease.

- South Korea’s KOCOPIA bought 60,000 tons of corn from the United States at $212.20/ton c&f for arrival in late June.

- 860,000 tons has been bought by SK since early March

USDA Export Sales Text

- Wheat: Net sales of 273,000 metric tons for delivery in the 2018/2019 were down 61 percent from the previous week and 37 percent from the prior 4-week average. Increases were reported for Mexico (89,100 MT, including decreases of 800 MT), South Africa (49,900 MT, including 50,000 MT switched from unknown destinations and decreases of 2,200 MT), Japan (49,400 MT, including decreases of 300 MT), the Philippines (40,400 MT), and Peru (40,200 MT). Reductions were primarily for unknown destinations (111,600 MT). For 2019/2020, net sales of 201,400 MT reported for Thailand (61,500 MT), Mexico (56,000 MT), South Korea (34,100 MT), and Italy (20,000 MT), were partially offset by reductions for Nigeria (11,000 MT). Exports of 586,700 MT were up 41 percent from the previous week and 21 percent from the prior 4-week average. The destinations were primarily to the Philippines (103,400 MT), Taiwan (67,300 MT), Nigeria (64,200 MT), Egypt (63,000 MT), and Thailand (59,000 MT).

- Corn: Net sales of 548,000 MT for 2018/2019 were up 2 percent from the previous week, but down 18 percent from the prior 4-week average. Increases were reported for Colombia (181,500 MT, including 82,600 MT switched from unknown destinations and decreases of 300 MT), unknown destinations (169,900 MT), South Korea (138,900 MT, including decreases of 3,400 MT), Mexico (76,600 MT, including decreases of 1,400 MT), and Saudi Arabia (71,600 MT). Reductions were primarily for Israel (162,000 MT) and El Salvador (11,900 MT). Exports of 983,000 MT were down 22 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Mexico (264,000 MT), South Korea (206,000 MT), Saudi Arabia (158,600 MT), Japan (123,900 MT), and Colombia (88,100 MT). Optional Origin: For 2018/2019, new optional sales totaling 65,000 MT were reported for South Korea. Options were exercised to export 135,000 MT to South Korea from the United States. The current outstanding balance of 569,500 MT is for South Korea (439,000 MT), Japan (50,000 MT), unknown destinations (48,000 MT), and Mexico (32,500 MT). For 2019/2020, the current outstanding balance is 120,000 MT, all unknown destinations.

- Barley: No net sales for 2018/2019 were reported for the week. Exports of 1,200 MT were primarily to Japan (700 MT) and Taiwan (400 MT).

- Sorghum: Net sales of 25,000 MT for 2018/2019 were reported for South Africa. Exports of 3,300 MT were to Japan (3,000 MT) and Mexico (300 MT). Optional Origin: For 2018/2019, the current outstanding balance of 10,000 MT is for unknown destinations.

- Hides and Skins: Net sales of 299,500 pieces reported for 2019 were down 36 percent from the previous week and 23 percent from the prior 4-week average. Whole cattle hide sales totaling 293,800 pieces were primarily for South Korea (72,900 pieces, including decreases of 5,000 pieces), China (70,700 pieces, including decreases of 7,000 pieces), Mexico (48,300 pieces, including decreases of 200 pieces), Indonesia (46,700 pieces), and Thailand (34,700 pieces, including decreases of 400 pieces). Exports of 384,600 pieces reported for 2019 were unchanged from the previous week, but down 2 percent from the prior 4-week average. Whole cattle hide exports of 372,700 pieces were primarily to China (187,500 pieces), South Korea (90,200 pieces), Mexico (55,000 pieces), Thailand (17,700 pieces), and Taiwan (10,500 pieces).

- Net sales of 193,300 wet blues for 2019 were up 38 percent from the previous week and 26 percent from the prior 4-week average. Increases were reported for China (66,700 unsplit and 27,800 grain splits), Hong Kong (28,800 grain splits), Italy (14,300 unsplit), Taiwan (12,000 unsplit), and Vietnam (10,800 unsplit). Exports of 158,300 wet blues for 2019 were up 10 percent from the previous week and 13 percent from the prior 4-week average. The primary destinations were Italy (39,300 unsplit), Vietnam (38,600 unsplit), China (29,400 unsplit and 1,900 grain splits), and Taiwan (20,000 unsplit). Net sales of splits totaling 82,100 pounds for 2019 were for Vietnam. Exports of 90,000 pounds for 2019 were down 78 percent from the previous and from the prior 4-week average. The destinations were China (50,000 pounds) and Vietnam (40,000 pounds).

- Beef: Net sales of 11,800 MT reported for 2019 were down 43 percent from the previous week and 28 percent from the prior 4-week average. Increases were reported for Hong Kong (3,300 MT, including decreases of 100 MT), South Korea (2,200 MT, including decreases of 500 MT), Japan (2,000 MT, including decreases of 400 MT), Taiwan (1,200 MT), and Canada (900 MT). Exports of 15,100 MT were up 1 percent from the previous and 2 percent from the prior 4-week average. The primary destinations were Japan (5,100 MT), South Korea (4,100 MT), Mexico (1,500 MT), Taiwan (1,300 MT), and Hong Kong (1,200 MT).

- Pork: Net sales of 90,700 MT reported for 2019 were up noticeably from the previous week and from the prior 4-week average. Increases were reported for China (77,700 MT), South Korea (3,600 MT), Chile (2,900 MT), Japan (2,200 MT), and Canada (1,100 MT). Exports of 27,500 MT were up 1 percent from the previous week and 3 percent from the prior 4-week average. The primary destinations were Mexico (7,200 MT), South Korea (4,900 MT), China (4,000 MT), Japan (3,300 MT), and Australia (1,800 MT).

- The soybean complex is lower on lack of direction and bullish news. US corn planting delays may force US producers to switch to soybeans.

- USDA export sales were poor for soybeans, at the lower end for meal and above expectations for soybean oil.

- US cash movement is slow.

- The CNGOIC expects China to import 27 million tons of soybeans in Q2, up 52 percent from Q1 of 17.8 million tons.

- Williams shipping data shows Brazil soybean exports during the month of April are on pace to reach a four-year low, consistent with predictions by Oil World earlier this month. April 10-29 shipping lineup shows Brazil will export about 5.8 million tons of soybeans, bringing April shipments to about 8.8 million tons. AgriBrasil is projecting 9.5 million tons in April.

- Yesterday AgRural increased their outlook for Brazil soybean production to 114.6 million tons from 112.9MMT. On Wed. USDA went up to 117.0 from 116.5 in March.

- Yesterday the Rosario Grains Exchange increased their Argentina crop estimate by 2 million tons to 56 million tons. USDA is it at 55 million tons while we are hearing over 59 from one source.

- USDA/FAS Attaché looks for Mexico to import 5.26 million tons in 2019-20 (September-October), up from 5.23 million tons this year.

- China markets:

・ Cargo surveyor SGS reported month to date April 10 Malaysian palm exports at 525,986 tons, 113,733 tons above the same period a month ago or up 27.6%, and 75,327 tons above the same period a year ago or up 16.7%.

・ Malaysian palm markets: one-week low

- Offshore values early this morning were leading the soybean oil 12 points lower and meal $0.20 lower.

・ Rotterdam vegetable oils earlier were mixed in the nearby positions from this time yesterday morning, and Rotterdam meal when imported from SA 1-2 euros higher.

- Egypt’s GASC is seeking at least 30,000 tons of soyoil and 10,000 tons of sunflower oil for arrival between June 1-15 and/or June 15-30. Lowest offer is $676.67/ton c&f for soybean oil and $699.00/ton for sunflower oil.

USDA Export Sales Text

- Soybeans: Net sales of 270,400 MT for 2018/2019 were down 86 percent from the previous week and 76 percent from the prior 4-week average. Increases were reported for Indonesia 73,700 MT, including 55,000 MT switched from unknown destinations and decreases of 700 MT), Mexico (71,000 MT, including decreases of 36,500 MT), the Netherlands (66,300 MT), Egypt (54,700 MT, including decreases of 4,000 MT), and Japan (48,700 MT, including 45,900 MT switched from unknown destinations and decreases of 100 MT). Reductions were primarily for unknown destinations (99,300 MT). For 2019/2020, net sales of 10,000 MT were for Malaysia (5,000 MT), Japan (3,900 MT), and South Korea (1,100 MT). Exports of 889,800 MT were up 16 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to China (384,900 MT), Egypt (154,700 MT), Mexico (107,700 MT), Indonesia (74,500 MT), and the Netherlands (66,300 MT). Optional Origin: For 2018/2019, the current outstanding balance of 113,000 MT is for unknown destinations. Exports for Own Account: For 2018/2019, the current exports for own account outstanding balance is 12,100 MT, all Canada.

- Soybean Cake and Meal: Net sales of 152,100 MT for 2018/2019 were down 20 percent from the previous week, but up 2 percent from the prior 4-week average. Increases were reported for the Philippines (93,700 MT), Colombia (22,300 MT, including 10,800 MT switched from unknown destinations and decreases of 3,400 MT), Canada (21,000 MT), Mexico (9,900 MT, including decreases of 300 MT), and El Salvador (7,800 MT, including 7,400 MT switched from Guatemala and decreases of 300 MT). Reductions were primarily for Peru (11,500 MT), Ecuador (7,000 MT), Nicaragua (6,800 MT), and Guatemala (6,300 MT). For 2019/2020, total net sales were reported for El Salvador (500 MT). Exports of 243,800 MT were down 17 percent from the previous week, but up 10 percent from the prior 4-week average. The destinations were primarily for Vietnam (53,100 MT), Mexico (40,400 MT), Slovenia (28,500 MT), Israel (21,200 MT), and Guatemala (20,500 MT).

- Soybean Oil: Net sales of 33,800 MT for 2018/2019 were down 8 percent from the previous week, but up 99 percent from the prior 4-week average. Increases reported for South Korea (24,000 MT, late reporting), Guatemala (6,700 MT), and Mexico (2,800 MT, including decreases of 100 MT), were partially offset by reductions for Canada (600 MT). Exports of 2,600 MT were down 89 percent from the previous week and 90 percent from the prior 4-week average. Exports were primarily to Mexico (2,000 MT), Canada (200 MT), and Honduras (200 MT).

・ US wheat futures are higher on light short covering but look for a two-sided trade in Chicago and KC.

・ USDA export sales were poor for wheat.

・ Cofco said they plan to double grain purchases in 2-3 years.

・ Strategie Grains lowered its EU soft wheat production estimate by 1.3 million tons to 144.8 million tons.

・ May Paris wheat was 0.25 euro higher at 188.75 euros.

- Results awaited: Algeria’s OAIC seeks at least 50,000 tons of optional origin milling wheat on Thursday, April 11, with offers valid until Friday, April 12, for shipment from June 1-15 and June 16-30.

・ China sold 5,330 tons of imported 2013 wheat or 1.1 percent offered at auction at an average selling price of 1,950 yuan per ton.

- Japan bought 113,124 tons of milling wheat on Thursday.

- Results awaited: The Philippines seek up to 165,000 tons of feed wheat on Wednesday, April 10, for shipment in June, July and August.

- Jordan seeks 25,000 tons of optional origin milling wheat on April 16.

- Japan under the SBS system seeks 120,000 tons of feed wheat and 200,000 tons of barley on April 17 for arrival by September 26.

- Jordan seeks 120,000 tons of barley on April 17.

- Ethiopia seeks 400,000 tons of wheat on April 19.

- Jordan seeks 25,000 tons of milling wheat on April 29 for LH July/FH August shipment.

・ Ethiopia seeks 600,000 tons of wheat on April 30.

Rice/Other

・ No developments

USDA Export Sales Text

- Rice: Net sales of 15,100 MT for 2018/2019 were down noticeably from the previous week and 73 percent from the prior 4-week average. Increases were reported for Saudi Arabia (5,100 MT), Guatemala (1,900 MT), Canada (1,800 MT), United Arab Emirates (1,200 MT), and Hong Kong (1,100 MT). Exports of 54,500 MT were down 18 percent from the previous week and 9 percent from the prior 4-week average. The destinations were to South Korea (25,100 MT), Libya (6,700 MT), Honduras (5,100 MT), Mexico (5,100 M), and Guatemala (4,200 MT). Export for Own Account: Exports for own account to Canada totaling 100 MT were applied to new or outstanding sales. The current exports for own account outstanding balance is 200 MT, all Canada.

- Cotton: Net sales of 289,000 RB for 2018/2019 were down 10 percent from the previous week, but up 39 percent from the prior 4-week average. Increases were reported for Vietnam (91,700 RB, including 2,200 RB switched from South Korea and decreases of 1,400 RB), India (70,000 RB), China (43,600 RB, including decreases of 2,600 RB), Turkey (32,200 RB, including decreases of 1,300 RB), and Bangladesh (15,500 RB, including decreases of 800 RB). Reductions were reported for Pakistan (1,300 RB), Japan (1,200 RB), and South Korea (100 RB). For 2019/2020, net sales of 205,900 RB were primarily for Vietnam (131,200 RB), China (36,500 RB), South Korea (16,000 RB), Mexico (14,100 RB), and El Salvador (3,200 RB). Exports of 383,300 RB were down 7 percent from the previous week, but up 7 percent from the prior 4-week average. Exports were primarily to Vietnam (73,600 RB), Pakistan (57,800 RB), Turkey (56,800 RB), China (53,000 RB), and Indonesia (23,700 RB). Net sales of Pima totaling 30,200 RB were up 87 percent from the previous week and 22 percent from the prior 4-week average. Increases were primarily for China (20,600 RB), India (5,200 RB), and Vietnam (3,500 RB, including 2,200 RB switched from Hong Kong and 900 RB switched from Macau). Reductions were reported for Hong Kong (2,200 RB) and Macau (900 RB). For 2019/2020, total net sales of 2,600 RB were for India. Exports of 21,000 RB were up 24 percent from the previous week and 53 percent from the prior 4-week average. The destinations were Vietnam (5,300 RB), India (3,900 RB), China (3,600 RB), Peru (2,800 RB), and Turkey (2,100 RB). Export of own account: For 2018/2019, the current exports for own account outstanding balance of 4,400 RB is for China (2,300 RB), Vietnam (1,800 RB), and Thailand (300 RB).

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.