From: Terry Reilly

Sent: Monday, April 13, 2020 6:54:13 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/13/20

PDF attached

Morning.

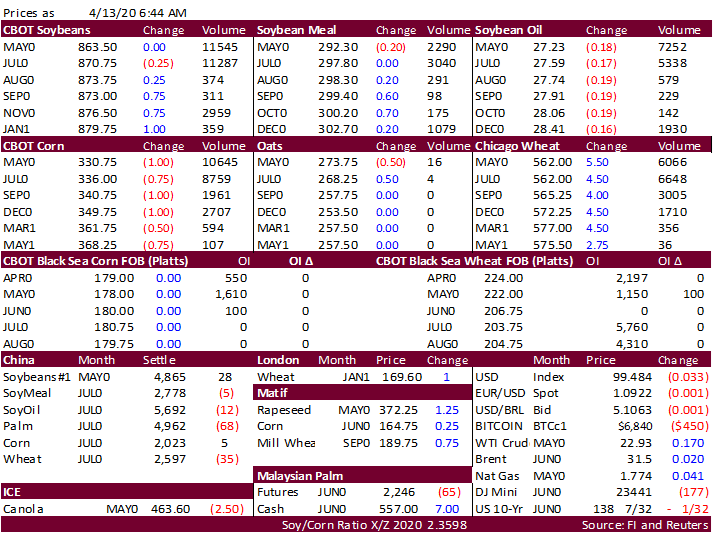

US

wheat is higher on solid global import demand, corn lower on US feed and industrial demand woes and soybean complex mixed with soybean oil lower on a 3 percent decline in palm prices. Little planting, if any, was completed across the US Delta and Southeast

over the weekend due to widespread precipitation.