From: Terry Reilly

Sent: Tuesday, April 14, 2020 8:07:28 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/14/20

PDF attached

File(s) attached

Morning.

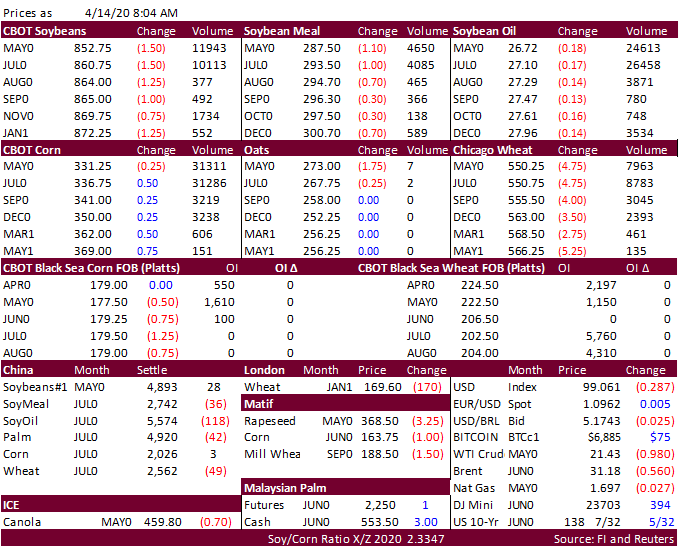

We could see a volatile day in US markets

led by poor earnings and outlooks by banks and choppy energy markets. USD was 33 lower, WTO off more than $1.00 basis nearby and natural gas down 2 percent, as of around 7:40 am CT.

Outside vegetable oil markets were mixed. China imported 4.28MMT of soybeans during March, but higher than year ago.

BRL is slightly weaker. Jordan passed on barley and traders await Egypt’s import tender for wheat. More than 100 US meat processing plants were thought to have idled. Two AFS cases popped up in China.