From: Terry Reilly

Sent: Wednesday, April 15, 2020 8:22:35 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 04/15/20

PDF attached

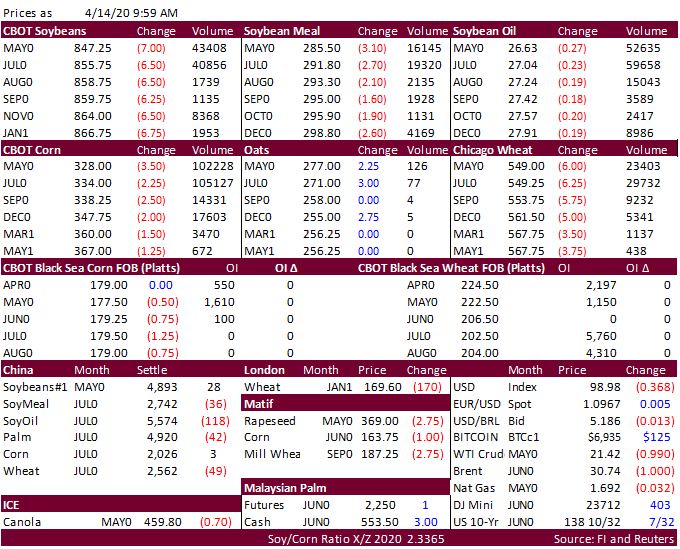

USD

+95 points. WTI crude oil back to $19-$20 area (supplies exceeding demand). NOPA and EIA ethanol data are due out later today. After 11 sessions of decline, SBM is higher today.