From: Terry Reilly

Sent: Friday, May 22, 2020 8:39:04 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 05/22/20

PDF attached

Morning

and happy Friday. US, UK, Singapore,

India, Indonesia, Malaysia, Pakistan are all on holiday Monday.

US

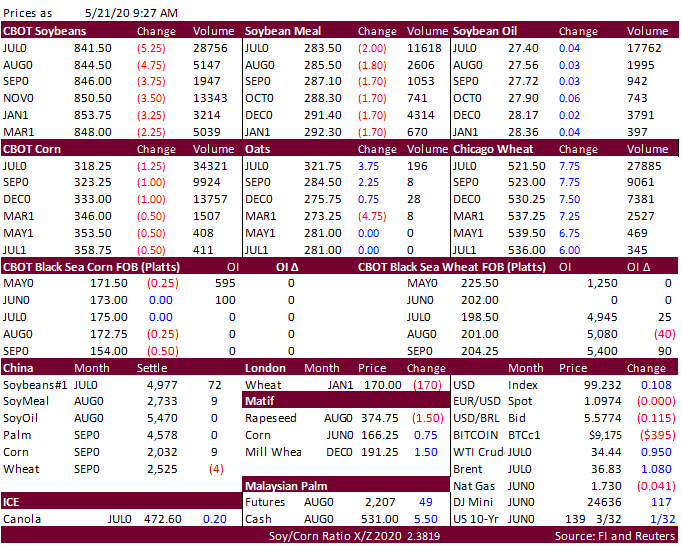

ag futures are lower early Friday on renewed US-Chine tensions. China confirmed on Friday that they intend to bypass Hong Kong’s legislature to launch national security laws. New protests and lower MSCI index (down 5.5%), among other reactions followed suit.

WTI crude was down about $1.00 this morning and US stocks lower. USD was up 47 points. China bought 2-4 US soybean cargoes on Thursday. China cash crush margins, on our calculation, continue to erode and are lowest since August 2019. US crop tour KS yield

was 44.5 bu/ac vs. USDA May 47.0. Jordan and the Philippines seeks wheat. French soft wheat ratings improved. Syria is in for soybean meal and corn. Cattle on Feed is due out after the close.

![]()