From: Terry Reilly

Sent: Friday, May 29, 2020 8:28:21 AM (UTC-06:00) Central Time (US & Canada)

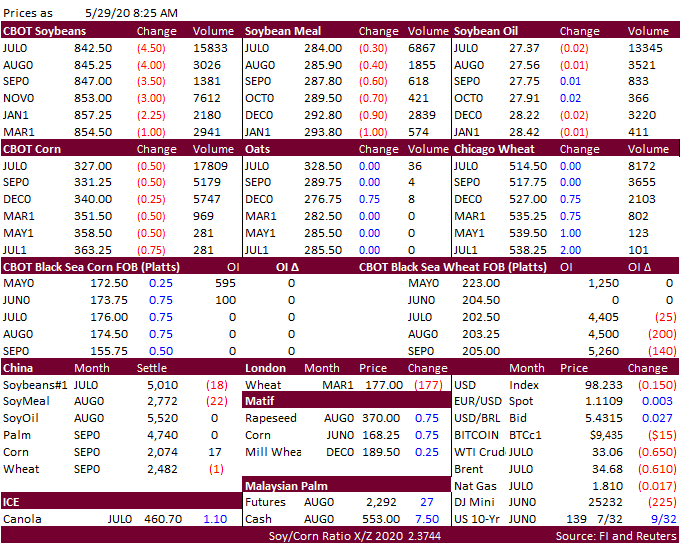

Subject: FI Morning Grain Comments 05/29/20

PDF attached

Morning.

The US will see a drier pattern over the next week. Short covering still a feature today in grains while the trade waits for China to buy soybeans.

(Reuters)

– China may reduce its imports of agricultural products from the United States if Washington issues a severe response to Beijing’s push to impose national security laws on Hong Kong, three sources said.