From: Terry Reilly

Sent: Tuesday, June 02, 2020 7:38:23 AM (UTC-06:00) Central Time (US & Canada)

Cc: Terry Reilly

Subject: FI Morning Grain Comments 06/02/20

PDF attached

Morning.

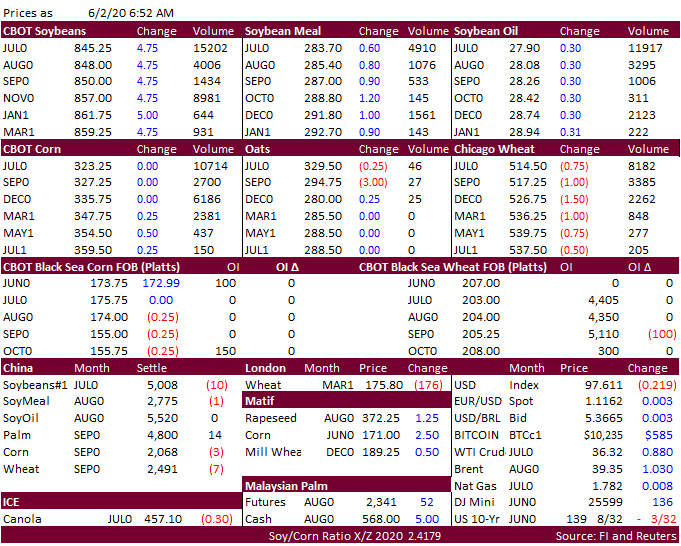

China bought at least three cargoes of US soybeans Monday for Q4 out of the Gulf and PNW. WTI was up about $0.90 earlier this morning after Russia and other members were said to favor a 1-month extension to OPEC+ cuts. USD was 25 lower. Taiwan is in for

corn and Jordan for wheat. US soybean oil stocks were reported well above trade expectations.