From: Terry Reilly [mailto:treilly@futures-int.com]

Sent: Tuesday, June 19, 2018 9:20 AM

Subject: FI Morning Grain Comments 06/19/18

PDF attached

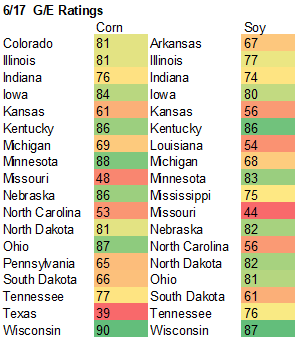

· Biggest surprise in USDA crop conditions this week was in spring wheat ratings were the combined good/excellent categories jumped 8 points to 78 percent. Trade was looking for unchanged. Last year SW was 41 and 5-year is 65. Keep in mind spring wheat emerged increased 3 points to 97 percent, so it appears recent good crop weather really had a positive impact on the crop.

· Winter wheat harvest increased 13 points from last week to 27 percent, one point above an average trade guess.

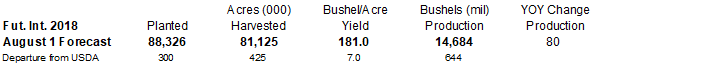

· Corn conditions improved one to 78. Trade was looking for down one. We are leaving our US corn yield unchanged at 181.0 bu/ac.

· Soybean conditions were down one. Trade was looking for unchanged. Despite the decline this week, we decided to reevaluate our yield and determined we are still low relative to current conditions. We took the FI soybean yield up 0.5 bu/ac to 49.6. USDA is at 48.5. That added 100 million bushels to our forecast from the previous week. Note we are now looking for USDA to report the June soybean planted area 225 million acres above USDA March.

· The US Midwest weather outlook appears to be wetter than that of last week. Good coverage is expected to fall across the Midwest through June 28. The Delta and southeastern states will also receive good rain through late June. What will bring the rain is two upper level low pressure systems moving across the US. 1.00-3.00” will fall, locally more from Nebraska and South Dakota to Ohio. NE and IA should be wettest.

· In late June through early July, a higher-pressure ridge will return across the middle of the United States, resulting in drier and warmer conditions.

· The Canada’s Prairies will dry down this week with above normal temperatures.

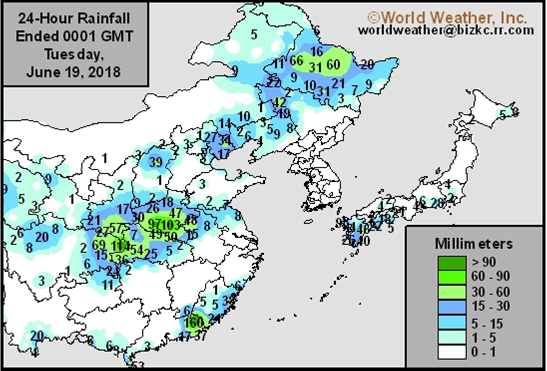

· Northern China will see spotty rainfall this week.

· France and Germany will dry down this week.

· Western Australia will see another chance for rain, but won’t occur until early next week.

· Drought will continue in Queensland and northern New South Wales through June 27.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Tue 60% cvg of up to 0.75”

and local amts to 2.0”

with a few 2.0-3.50”

bands; wettest in and

around east Neb. to

south Wi.; driest NW

-Wed 85% cvg of up to 0.75”

and local amts to 1.75”

with a few 1.75-3.25”

bands; south Il. to Ky.

driest

Wed-Fri 65% cvg of up to 0.75”

and local amts to 2.0”

with a few 2.0-4.0”

bands in central and

southern areas; driest

NW

Thu-Sat 85% cvg of up of 0.75”

and local amts to 1.50”

with a few 1.50-3.50”

bands; wettest west

Sat-Sun 15-35% daily cvg of

up to 0.75” and local

amts to 1.50” each day;

central and south

wettest

Sun-Jun 25 15-35% daily cvg of

up to 0.75” and locally

more each day;

driest north

Jun 25-27 70% cvg of up to 0.75”

and local amts to 2.0”;

far NW driest

Jun 26-28 75% cvg of up to 0.75”

and local amts to 2.0”

Jun 28-29 10-25% daily cvg of

up to 0.50” and locally

more each day

Jun 29-30 15-35% daily cvg of

up to 0.35” and locally

more each day

Jun 30-Jul 2 60% cvg of up to 0.60”

and locally more

Jul 1-3 60% cvg of up to 0.60”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Wed 10-25% daily cvg of

up to 0.40” and locally

more each day

Tue-Wed 55% cvg of up to 0.75”

and local amts to 1.50”;

far north driest

Wed-Fri 75% cvg of up to 0.75”

and local amts to 2.0”

Thu-Fri 60% cvg of up to 0.75”

and local amts to 1.50”

Sat-Jun 25 Up to 20% daily cvg of 15-35% daily cvg of

up to 0.35” and locally up to 0.50” and locally

more each day; some more each day

days may be dry

Jun 26-29 10-25% daily cvg of 15-35% daily cvg of

up to 0.50” and locally up to 0.60” and locally

more each day more each day

Jun 30-Jul 2 5-20% daily cvg of up 10-25% daily cvg of

to 0.25” and locally up to 0.50” and locally

more each day more each day

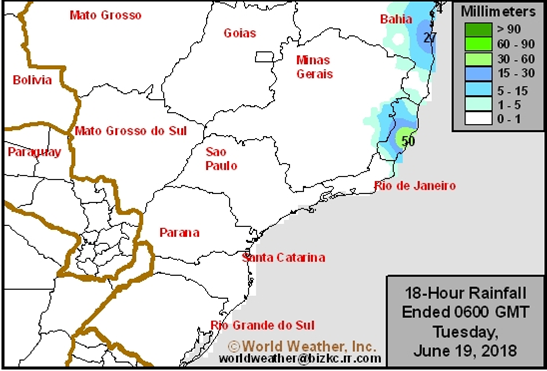

SIGNIFICANT PRECIPITATION EVENTS FOR BRAZIL

Tdy-Wed 5-20% daily cvg of up to 0.35” and locally more

each day; Sao Paulo to east Bahia wettest

Thu-Sat 15% cvg of up to 0.75” and local amts to 1.50”;

far south wettest

Sun-Jun 26 15% cvg of up to 0.75” and local amts to 1.50”;

with some 1.50-3.0” amts from south Paraguay

to south Parana and north Santa Catarina

Jun 27-28 5-20% daily cvg of up to 0.30” and locally more

each day; wettest south

Jun 29-30 15% cvg of up to 0.75” and locally more;

wettest south

Jul 1-2 5-20% daily cvg of up to 0.30” and locally more

each day

SIGNIFICANT PRECIPITATION EVENTS FOR ARGENTINA

-Tue Mostly dry with a few insignificant showers

Wed-Fri 15% cvg of up to 0.25” and local amts to 0.50”;

Entre Rios and south Corrientes wettest

Sat-Jun 25 15% cvg of up to 0.40” and locally more;

Corrientes wettest

Jun 26-Jul 2 Up to 20% daily cvg of up to 0.25” and locally

more each day; some days may be dry

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- China, Indonesia on holiday, along with various Muslim countries celebrating the end of Ramadan

- AmSpec, Intertek release their respective data on Malaysia June 1-15 palm oil exports, 11pm ET Sunday (11am Kuala Lumpur Monday); SGS data for same period is issued 3am ET Monday (3pm KL time Monday)

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- EU Monitoring Agricultural Resources (MARS) bulletin on crop progress and weather conditions in Europe

- Brazilian industry group Unica holds sugar and ethanol conference in Sao Paulo

- Ivory Coast weekly cocoa arrivals

TUESDAY, JUNE 19:

- Indonesia and several Mideast nations on holiday

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET Tuesday (~noon London Tuesday, ~1am Wellington Wednesday)

- USDA milk production for May, 3pm

- International Grains Council conference in London, June 19-20. Speakers are from USDA, WTO, Olam Intl, Australia’s ABARES, Argentina’s Agroindustry Ministry, China National Grain and Oils Information Center, among others

- ABARES releases quarterly agricultural commodities report

- Sanderson Farms presents at Jefferies consumer conference

WEDNESDAY, JUNE 20:

- Argentina on holiday

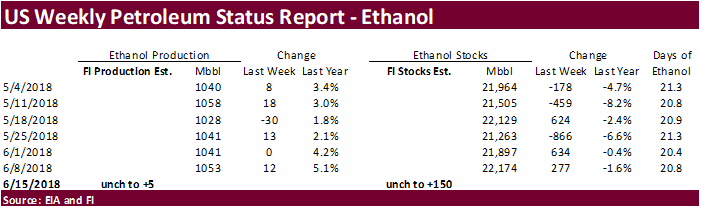

- EIA U.S. weekly ethanol inventories, output, 10:30am

- AmSpec, Intertek release their respective data on Malaysia June 1-20 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday); SGS data during same period, 3am ET Wednesday (3pm local time Wednesday)

- Intl Grains Council conference, final day

THURSDAY, JUNE 21:

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production data for May, 3pm

- Buenos Aires Grain Exchange weekly crop report

- EU weekly grain, oilseed import and export data

- Port of Rouen data on French grain exports

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JUNE 22:

- USDA cold-storage report, cattle-on-feed figures for May, both at 3pm

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SATURDAY, JUNE 23:

- China scheduled to release May commodities trade data (final), including imports of palm oil, cotton, 2:30am ET (2:30pm Beijing)

· USD is higher, WTI crude is lower, and gold lower.

· President Trump threatened to add another 200 billion USD import tariffs on China imports.

· China stocks were down about 4 percent

· US Housing Starts May: 1350K (exp 1311K; R prev 1286K)

– Housing Starts (M/M) May: 5.0% (exp 1.9%; R prev -3.1%)

– Building Permits May: 1301K (exp 1350K; R prev 1364K)

– Building Permits (M/M) May: -4.6% (exp -1.0%; R prev -0.9%)

CBOT Current Daily Price Limit

http://www.cmegroup.com/trading/Price-Limit-Update.html

Corn.

· Intensifying China/US trade tensions slammed CBOT corn futures prices.

· CBOT contracts reach all-time highs on Tuesday.

· US weather looks good and corn conditions are above average. We left our US corn yield unchanged at 181.0 bu/ac. Planalytics is at 172.8 bu/ac.

· Baltic Dry Index was down 23 points to 1419, or 1.6%.

· USDA US corn export inspections as of June 14, 2018 were 1,668,835 tons, above a range of trade expectations, above 1,410,564 tons previous week and compares to 1,220,450 tons year ago. Major countries included Mexico for 301,875 tons, Japan for 213,990 tons, and Vietnam for 205,990 tons.

· South Korea’s MFG group seeks 140,000 tons of corn for November arrival.

· Brazil looks to sell corn out of reserves soon.

· China sold an estimated 44.7 million tons of corn out of reserves since April 12.

Soybean complex.

· Soybeans are on the defensive again amid escalating China/US trade war fears after president Trump threatened to add 10% tariff on $200 billion on top of the 50 billion already announced. Details on the products included in the tariffs for both counties are still pending, but the second batch is expected to include finished goods/retail products. China said they would “forcefully” retaliate. US corn $14 billion of soybeans to China last year.

· Soybeans were more than 45 cents lower within the first 30 minutes of day trading (more than double than losses at the end of the overnight session), soybean meal off more than $7.00 and soybean oil down a whopping 133 points.

· US soybean crop ratings remain high and US weather forecast looks good. Yesterday we took the FI soybean yield up 0.5 bu/ac to 49.6. USDA is at 48.5. Planalytics is at 48.4 bu/ac.

· China received additional rain across it northeastern growing areas.

· China’s futures and cash markets made big moves overnight.

· China September soybean futures increased 85 yuan per ton or 2.3%, September meal up 108 or 3.7%, China soybean oil down 74 or 1.3% and China September palm down 158 or 3.2%.

· China soybean meal cash prices (average) are running at a 4-week high. China cash crush margins were last running at 84 cents, up 48 cents from the previous session, and compares to 36 cents last week and 1 cents higher a year ago.

· Crude and mineral oils are lower.

· Rotterdam vegetable oils were 2-10 euros lower and SA soybean meal when delivered into Rotterdam were 5-9 euros lower, as of early morning CT time.

· September Malaysian palm was 44 lower and cash was down $12.50/ton.

· Offshore values were leading the soybean oil about 68 points lower and soybean meal $4.60/short ton higher.

· Brazil premiums were higher again on Monday due to renewed demand. Last we heard was about 150/170 over August.

· Brazil is expected to ship more than expected soybeans to China, with US losing additional market share, at least during the August through early November period, and then again late January 2019 through June 2019 period, if China and US drag on trade disputes.

· Brazil soybean commitments are running at 53 million tons, up 6 million from a year ago. Brazil shipped 2.3 million tons of soybeans last week, up from 1.95 million tons previous week. Rising Brazil trucker freight rates are apparently not heavily affecting delivery of soybeans to ports, or at least yet.

· Question we are getting these days is how long can Brazil keep up with heavy soybean shipments before tapping out for the 2018-19 local crop year. We think it could stretch into Q4 2018, but amounts will taper off after August. Supplies are thin for export for Argentina, Paraguay and Uruguay, so Brazil is one of the only countries, outside the US, for China to source soybeans.

· We look for Brazil’s 2019-20 (planted later this year) to increase 2.4 percent from this season.

· At this point we don’t think China will import a large amount of soybeans meal. A small boat or two could make its way to China, but that’s about it.

· We have not heard anything on the US EPA proposing biofuel blending targets for 2019.

Export Developments

· South Korea bought 180,000 tons of soybean meal form SA between $437.50/ton to $447.99/ton for arrival around November 10 through December 25.

· South Korea bought 8,000 tons of non-GMO soybeans (out of 10k sought) for arrival in July and October.

TONNES(M/T) PRICE($/T) SUPPLIER/ORIGIN ARRIVAL

3,000 $573.15 Sinsong Food Corp/U.S. Nov 1-Nov 30

5,000 $573.15 BSK Corp/U.S. Nov 20-Dec 15

· China plans to auction off 60,000 tons of soybean oil on June 22 using a base price of 5,000 yuan per ton.

· China plans to offer to sell 500,000 tons of soybeans and 50,000 tons of soybean oil from state reserves on June 27.

· Iran seeks 30,000 tons of sunflower oil on July 10.

· Iran seeks 30,000 tons of palm olein oils on July 10.

· Iran seeks 30,000 tons of soybean oil on August 1.

· A rise in US spring wheat ratings by 8 points, favorable US weather, and China/US trade disputes along with a higher USD and lower lead by the outside commodity markets are keeping US wheat futures prices at multi-week lows for Chicago, multi-month lows for KC, and more than a one-year low for Minneapolis.

· Egypt bought 240,000 tons of Romanian wheat.

· Egypt bought 3.4 million tons of local wheat so far during the local marketing year campaign. Reserves are at 4.4 months, not including the recent Romanian import tender.

· Taiwan seeks 95,350 tons of US wheat on June 26 for Aug/early Sep shipment, depending on origin.

· Manitoba’s weekly crop report states parts of southwest and central Manitoba, Canada, crop regions saw heavy rainfall, strong winds, and hail.

· Argentina seeks to increase grain and oilseed production to 150 million tons by 2020. Previous record was 136 million tons in 2016-17. This year production fell to 108 million tons.

· Dry weather will dominate eastern Australia over the next week.

· The heavy rain in France affected crop conditions. Fusarium was noted.

Export Developments.

· Egypt bought 240,000 tons of Romanian wheat.

· Bangladesh seeks 50,000 tons of wheat on July 3.

· China sold 1500 tons of wheat out of state reserves and another 4833 tons of imported wheat out of reserves. Prices were 2380 yuan ($367.62/ton) and 2309 yuan (356.66/ton), respectively.

· Japan seeks 91,188 tons of milling wheat on June 21. Origins were open to Australia and US. No Canada.

· Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on June 20 for arrival by November 30.

· Jordan seeks 120,000 tons of barley on June 26.

· Jordan seeks 120,000 tons of wheat on June 27.

· Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

Rice/Other

· China sold 134,022 tons of rice out of state reserves at 2388 yuan per ton ($369.79/ton), 5.6 percent of what was offered.

· China sold 45,457 tons of rice out of state reserves at 2725 yuan per ton ($422.69/ton), 4.4 percent of what was offered.

· Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.