From: Terry Reilly

Sent: Friday, June 22, 2018 8:25:12 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 06/22/18

PDF attached

- US corn and soybean conditions may end up near unchanged when updated Monday. Spring wheat unchanged to down 2 and winter wheat unchanged.

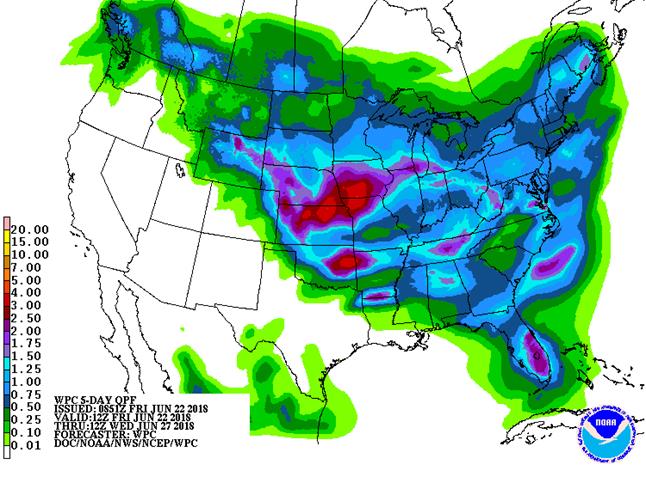

- 6-10 day is drier for the west central Midwest and wetter for the northern Great Plains. 11-15 day was mostly unchanged.

- US ridge for later next week may be short in time and pose no threat to the US crops. Ample soil moisture may generate precipitation when is shifts west.

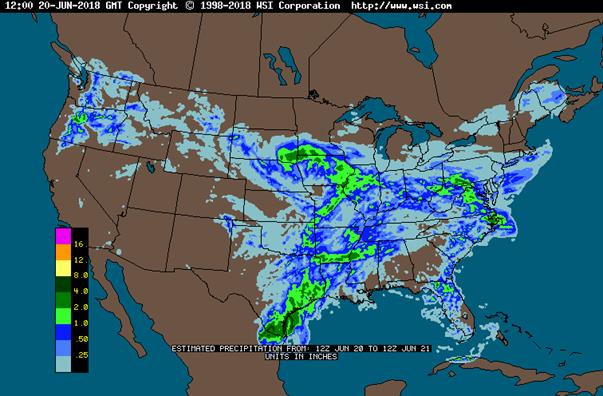

- Too much rain across US hard red winter wheat country is starting to raise concern for unharvested winter wheat. This is also starting to raise concerns for the summer crops across the Midwest.

- A high-pressure ridge will develop across Western Europe this weekend into next week, resulting in net drying for the UK and Germany.

- The western CIS will see an improvement in rainfall.

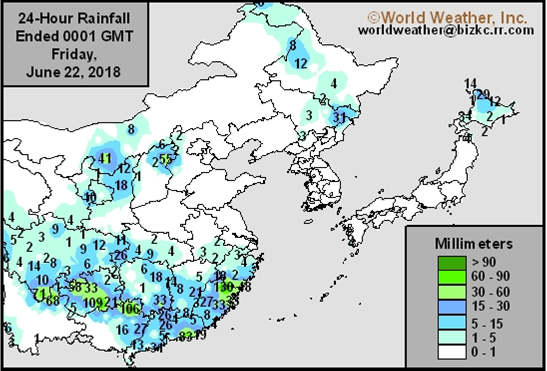

- Parts of China will see hot temperatures.

- Australia’s weather will improve slightly in the west bias south. Queensland and northern New South Wales will remain mostly dry through the end of the month but coastal areas should get rain sometime through June 29.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Fri 90-100% cvg of 0.15-1.0”

and local amts to 2.0”

with a few 2.0-3.0”

bands and lighter rain in

a few areas; central areas

wettest; driest SW

Fri-Sun am 10-25% daily cvg of

up to 0.40” and locally

more each day; central

areas driest

Sat-Sun 20-40% daily cvg of up

to 0.60” and local amts

over 1.0” each day;

wettest south

Mon 15% cvg of up to 0.25”

and locally more;

wettest west

Sun pm-Tue 80% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-3.50”

amts in central and

southern areas; Neb.

and west Ia. wettest;

far NW driest

Tue-Wed 75% cvg of up to 0.75”

and local amts to 2.0”;

wettest west

Wed-Jun 30 15-30% daily cvg of

up to 0.60” and locally

more each day;

wettest north

Jun 28-30 5-20% daily cvg of up

to 0.25” and locally

more each day

Jul 1-5 5-20% daily cvg of up 15-30% daily 1cvg of

to 0.25” and locally up to 0.35” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri 70% cvg of up to 0.75”

and local amts to 2.0”;

west and north wettest;

SE Ga. to N.C. driest

Fri-Sun 55% cvg of up to 0.70”

and local amts to 1.50”;

wettest north

Sat-Sun 15-35% daily cvg of

up to 0.60” and locally

more each day

Mon-Jun 28 5-20% daily cvg of up

to 0.25” and locally

more each day

Mon-Tue 70% cvg of up to 0.75”

and local amts to 2.0”

Wed-Jun 29 5-20% daily cvg of up

to 0.30” and locally

more each day

Jun 29-30 5-20% daily cvg of up

to 0.30” and locally

more each day

Jun 30-Jul 5 10-25% daily cvg of

up to 0.40” and locally

more each day

Jul 1-5 10-25% daily cvg of

up to 0.30” and locally

more each day

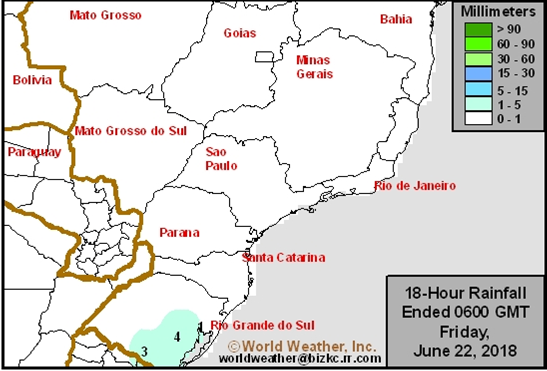

SIGNIFICANT PRECIPITATION EVENTS FOR BRAZIL

Tdy-Sat 15% cvg of up to 0.60” and local amts to 1.10”;

far south wettest

Sun-Mon 15% cvg of up to 0.75” and local amts to 2.0”;

south Parana and north Santa Catarina wettest

Tue-Jun 28 15% cvg of up to 0.75” and local amts to 1.50”;

far south wettest

Jun 29-Jul 1 5-20% daily cvg of up to 0.30” and locally more

each day; wettest NE and far south

Jul 2-4 15% cvg of up to 0.75” and locally more;

wettest south

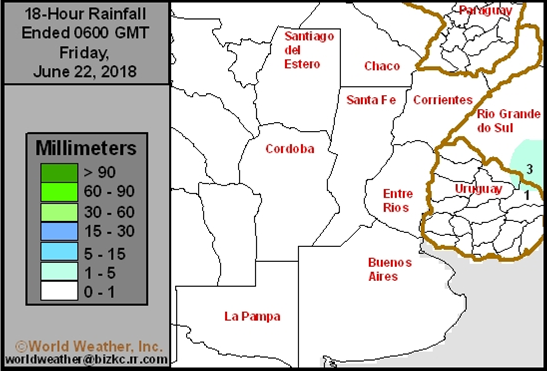

SIGNIFICANT PRECIPITATION EVENTS FOR ARGENTINA

Tdy-Fri 5-15% daily cvg of up to 0.25” and locally

more each day; Entre Rios wettest

Sat 25% cvg of up to 0.40” and locally more;

Corrientes wettest

Sun-Mon Mostly dry with a few insignificant showers

Tue-Jun 28 20% cvg of up to 0.50” and locally more;

wettest NE

Jun 29-30 Up to 20% daily cvg of up to 0.25” and locally

more each day; some days may be dry

Jul 1-3 20% cvg of up to 0.30” and locally more;

wettest east

Jul 4-5 5-20% daily cvg of up to 0.25” and locally

more each day

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

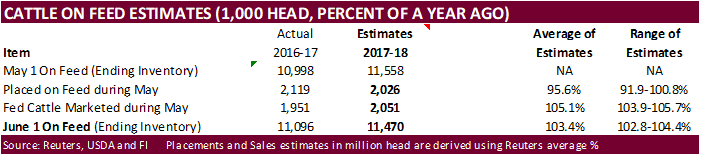

- USDA cold-storage report, cattle-on-feed figures for May, both at 3pm

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SATURDAY, JUNE 23:

- China scheduled to release May commodities trade data (final), including imports of palm oil, cotton, 2:30am ET (2:30pm Beijing)

MONDAY, JUNE 25:

- AmSpec and Intertek release their respective data on Malaysia’s June 1-25 palm oil exports, 11pm ET Sunday (11am Kuala Lumpur Monday); SGS data for same period, 3am ET Monday (3pm local time Monday)

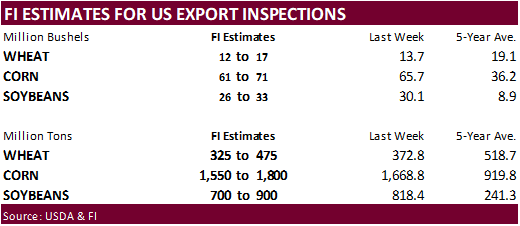

- USDA weekly corn, soybean, wheat export inspections, 11am

- China-EU high-level economic dialogue chaired by European Commission Vice President Jyrki Katainen and Chinese Vice Premier Liu He

- After meeting, joint presser planned at 12:30am ET (12:30pm Beijing)

- Andre Pessoa, head of Agroconsult, speaks at presser on Brazil’s 2017-18 corn crop and results of crop tour, 1pm ET (2pm Sao Paulo)

- USDA poultry slaughter data for May, 3pm

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

TUESDAY, JUNE 26:

- OECD-CEPS’s annual Agricultural Policies: Monitoring and Evaluation report

WEDNESDAY, JUNE 27:

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, JUNE 28:

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA hogs & pigs inventory data for 2Q, 3pm

- U.S. agriculture prices received for May, 3pm

- Buenos Aires Grain Exchange weekly crop report

- EU weekly grain, oilseed import and export data

- Port of Rouen data on French grain exports

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JUNE 29:

- Statistics Canada to release June seeded area for wheat, soy, barley, canola, durum 8:30am

- USDA annual plantings data for corn, soy, wheat, cotton, noon

- USDA grain stockpiles data for 2Q, noon

- Traders’ estimates for July raw sugar delivery on ICE Futures

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Honduran Coffee Institute releases monthly exports, 4pm

- FranceAgriMer weekly updates on French crop conditions

SATURDAY, JUNE 30:

- AmSpec data on Malaysia’s June 1-30 palm oil exports, 11pm ET Friday (11am Kuala Lumpur Saturday)

Bloomberg weekly bull/bear survey

· Wheat: Bullish: 7 Bearish: 8 Neutral: 3

· Corn: Bullish: 12 Bearish: 6 Neutral: 2

· Soybeans: Bullish: 7 Bearish: 9 Neutral: 4

· Sugar survey results: Bullish: 6 Bearish: 1 Neutral: 2

· White sugar: Bullish: 4 Bearish: 3 Neutral: 2

· White- sugar premium: Widen: 0 Narrow: 4 Neutral: 5

EPA 2019 proposed targets set: 19.88 billion gallons. 4.88 billion advanced, 15-billion conventional and 381 cellulosic. Formal announcement may be out later today.

· USD is lower, WTI crude is higher, and gold moderately higher, at the time this was written.

· OPEC Ministers Agree In Principle On 1 Mln BPD Nominal Output Increase For OPEC, Non-OPEC – RTRS Source

· OPEC Agreement In Principle Is Said For 600k BPD Real Increase

· Canada CPI May NSA M/M: 0.1% (est 0.4% prev 0.3%)

· Canada CPI May Y/Y: 2.2% (est 2.6% prev 2.2%)

· Canada Retail Sales April M/M: -1.2% (est 0.0% prev R 0.8%)

· Canada Retail Sales Ex Auto April M/M: -0.1% (est 0.5% prev -0.2%)

· Canada CPI Index: 133.4 (est 133.9 prev 133.3)

– -CPI Core – Common Y/Y%: 1.9% (est 1.9% prev 1.9%)

– -CPI Core – Median Y.Y%: 1.9% (est 2.1% prev R 1.9%)

– -CPI Core – Trim Y/Y: % 1.9 (est 2.1% prev 2.1%)

Corn.

- CBOT corn is higher but gains limited on lack of fresh news and positioning ahead of the weekend.

- Look for a 2-sided trade.

- USDA reported a combined 248.3 thousand of corn to Mexico and Panama.

- EPA 2019 proposed targets set: 19.88 billion gallons. 4.88 billion advanced, 15-billion conventional and 381 cellulosic. Formal announcement may be out later today.

- Reuters noted an EPA announcement could come early as today. Yesterday newswires reported the EPA will delay their biofuel announcement that was due out on today. 2019 mandates were expected to be addressed but yesterday we learned EPA may propose reallocating waived biofuels volumes to other refiners. The announcement was thought to be delayed on the latter. Details to either subject is lacking, but below is an earlier prediction of what the 2019 proposed biofuel requirements may look like.

- The EPA showed US May D6 RIN generation at 1.298 billion, up from 1.244 billion in April.

- Baltic Dry Index was down 6 points to 1341, or 0.5%.

- The soybean/corn ratio is sitting near a 10-month low.

- China has cancelled 1.3 million tons of US soybeans so far according to the USDA export sales report.

- A Bloomberg poll showed 60 percent of the respondents are bullish corn as of Wednesday, up from 52.6 percent as of June 14.

- The U.S. House of Representatives approved a $867 billion farm bill that includes changes to the Supplemental Nutrition Assistance Program (SNAP) program. Some Democrats opposed. Meanwhile the Senate has a different version. Separately, the White House unveiled an overhaul to many government agencies, that includes moving the government food stamp program from USDA to the Department of Health and Human Services, among several other changes in other agencies. If they can get it done, it would be the largest reform since the Great Depression. Many past administrations attempted to do this but failed.

- The Argentina AgMin estimated corn production at 42.4 million tons, up from 42.0 million tons previously.

- USDA 24-hour announcements:

- Export sales of 131,300 metric tons of corn for delivery to Mexico. Of the total 30,000 metric tons is for delivery during the 2017/2018 marketing year and 101,300 metric tons is for delivery during the 2018/2019 marketing year; and

- Export sales of 117,000 metric tons of corn for delivery to Panama during the 2018/2019 marketing year.

- China sold 739.9 thousand tons of corn from state reserves or 18.6 percent of what was offered at an average price of 1403 yuan per ton ($215.78/ton). China sold an estimated 46.9 million tons of corn out of reserves since April 12.

- Brazil looks to sell corn out of reserves soon.

Soybean complex.

· CBOT soybean complex is higher on positioning ahead of the week end and rebound from several days of lower trade. Look for a choppy session.

· China September soybean futures decreased 37 yuan per ton or 1.0%, September meal 52 or 1.7%, China soybean oil down 8 or 0.1% and China September palm up 12 or 0.3%.

· September China cash crush margins were last running at 52 cents, down 20 cents from the previous session, and compares to 36 cents last week and 1 cents higher a year ago.

· Rotterdam vegetable oils were 3-5 euros higher and SA soybean meal when delivered into Rotterdam were mixed as of early morning CT time.

· Palm oil snapped a four-day loss after hitting a 2-year low. September Malaysian palm was 33 higher and cash up $3.75.

· Offshore values were leading the soybean oil about 56 points higher (64 higher for the week to date) and soybean meal $0.50/short ton higher ($9.30 higher for the week to date).

- The EPA showed US May D4 RIN generation at 342.8 million, up from 314.5 billion in April. Soybean oil use for biodiesel production could end up around 600 million pounds in May.

- The Argentina AgMin estimated soybean production that is nearing harvest completion at 37.2 million tons, up from 36.6 million previously, first uptick in production we have seen in more than six months for the crop.

· Yesterday the European Union reported soybean import licenses since July 1 at 13.073 million tons, below 13.652 million tons a year ago. European Union soybean meal import licenses are running at 18.095 million tons for 2017-18, above 17.490 million tons a year ago. EU palm oil import licenses are running at 5.934 million tons for 2017-18, up from 5.948 million tons a year ago.

Export Developments

· China sold 40% of soybean oil offered out of auction. 19,816 tons were sold out of 60,000 tons offered. Average price was 5001 yuan per ton. Base price was 5,000 yuan per ton.

· China plans to offer to sell 500,000 tons of soybeans and 50,000 tons of soybean oil from state reserves on June 27. China sold 270,106 tons of soybeans out of reserves so far this season.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- US wheat futures are lower on light profit taking from the recent rally and French soft wheat conditions deteriorating week-over-week

- Ukraine’s AgMin forecast the 2018 harvest between 23 and 26 million tons for wheat with an exportable surplus at about 17.2 million tons in the 2018/19 season. Ukraine consumption was estimated at 4.7 million tons of milling wheat in the 2018/19 season. Ukraine harvested 26.2 million tons of wheat in 2017 and exported 17.3 million tons in the 2017/18 July-June season. (Reuters)

- Ukraine harvested 1.1 million tons of grain so far with an average yield of 3.16 tons/hectare.

- The Argentina AgMin slightly lowered its Argentina wheat planted area to 6.135 million hectares from 6.15 million previously.

- Yesterday the European Union granted export licenses for 93,000 tons of soft wheat imports, bringing cumulative 2017-18 soft wheat export commitments to 19.349 million tons, well down from 23.625 million tons committed at this time last year.

Export Developments.

- The Philippines bought 220,000 tons of feed wheat for Aug-Oct shipment. They paid $222.70-$227.50/ton.

- China sold 1,374 tons of imported wheat out of reserves or less than 0.07% of what was offered at an average price of 2320 yuan per ton ($357.09/ton).

- Taiwan seeks 95,350 tons of US wheat on June 26 for Aug/early Sep shipment, depending on origin.

- Jordan seeks 120,000 tons of barley on June 26.

- Jordan seeks 120,000 tons of wheat on June 27.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on June 27.

- Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

- Bangladesh seeks 50,000 tons of wheat on July 3.

Rice/Other

- South Korea seeks 102,800 tons of rice for September-February arrival on June 27.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Short Sept. 15, 2018/Incheon

20,000 Brown Short Sept. 15, 2018/Ulsan

20,000 Brown Short Sept. 15, 2018/Masan

10,000 Brown long Sept. 30, 2018/Mokpo

10,000 Brown long Sept. 30, 2018/Donghae

2,800 Milled Medium Dec. 1-31, 2018/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

- Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.