From: Terry Reilly

Sent: Tuesday, June 26, 2018 8:15:47 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 06/26/18

PDF attached

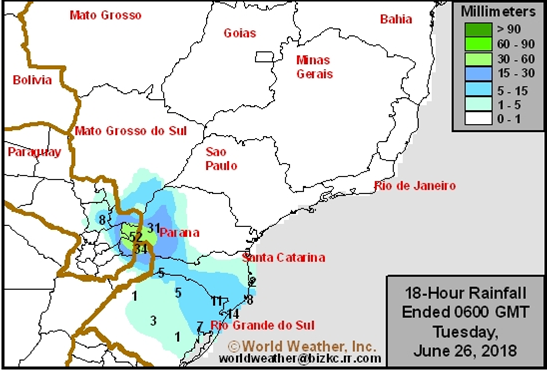

- 6-10 day is drier for the north central Great Plains and northern Midwest, and wetter for the southern Delta. Temps are slightly cooler in the western Midwest. 11-15 day is unchanged.

- Ridging across the US is still expected later this week starting with the US and shifting into the Plains and WCB next week.

- The US trend warmer and drier this week. 80-90’s is expected most of this week, with some 95’s across the southwestern Corn Belt.

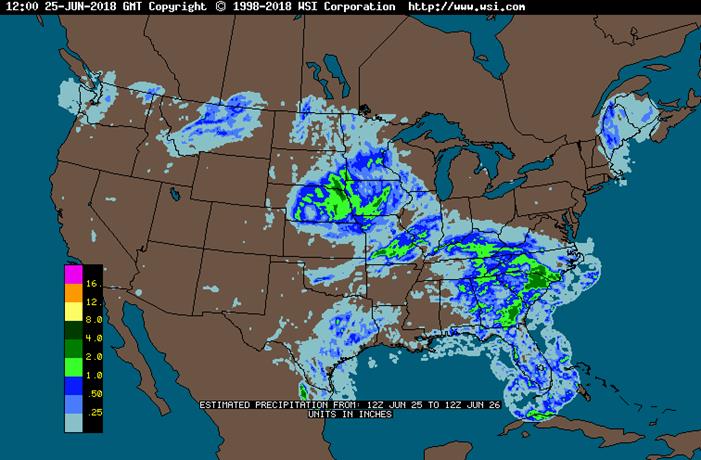

- The Midwest will stay wet during the first half of the week. Through Thursday, rainfall will range from 0.20 to 0.75 inch with local totals to 1.30 inches in the eastern Midwest, and 0.75 to 2.50 inches with local totals to 3.50 inches in the western Corn Belt. Then Friday over Friday, the Midwest will see limited precip.

- Flooding across the central US is underpinning grain/oilseed basis by affecting transportation. Heavier rain is on the way for the central Great Plains.

- U.S. northern Plains will receive daily rainfall through the next ten days to two weeks.

- The Texas Blacklands, West Texas and parts of the Delta where dryness will continue to see crop stress due to net drying through early July.

- Western Europe will continue to see a high-pressure ridge in place through at least July 4.

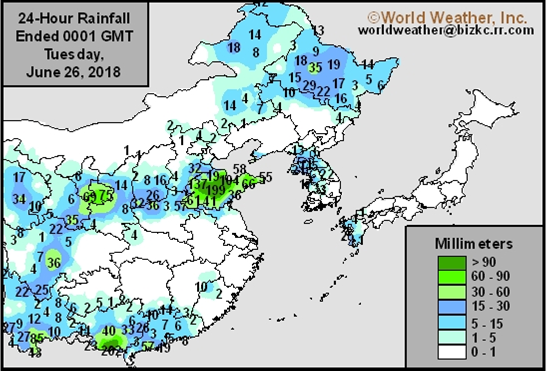

- Northeast China rainfall will be frequent through July 4.

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- OECD-CEPS’s annual Agricultural Policies: Monitoring and Evaluation report

WEDNESDAY, JUNE 27:

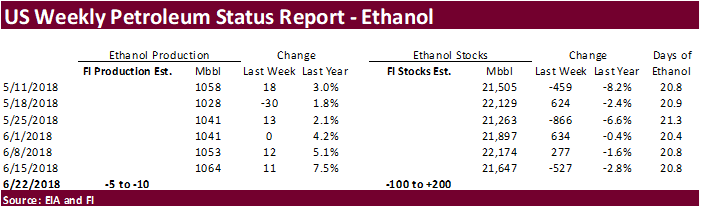

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, JUNE 28:

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA hogs & pigs inventory data for 2Q, 3pm

- U.S. agriculture prices received for May, 3pm

- Buenos Aires Grain Exchange weekly crop report

- EU weekly grain, oilseed import and export data

- Port of Rouen data on French grain exports

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JUNE 29:

- Statistics Canada to release June seeded area for wheat, soy, barley, canola, durum 8:30am

- USDA annual plantings data for corn, soy, wheat, cotton, noon

- USDA grain stockpiles data for 2Q, noon

- Traders’ estimates for July raw sugar delivery on ICE Futures

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Honduran Coffee Institute releases monthly exports, 4pm

- FranceAgriMer weekly updates on French crop conditions

SATURDAY, JUNE 30:

- AmSpec data on Malaysia’s June 1-30 palm oil exports, 11pm ET Friday (11am Kuala Lumpur Saturday)

Source: Bloomberg and FI

· USD is higher, WTI crude higher, and gold lower, at the time this was written.

· ICE: Philadelphia Fed June 2018 Nonmanufacturing Business Outlook Survey

-Philadelphia Fed Non-Manufacturing Regional Business Activity Index 39.1 In June Vs 45.3 In May- Philadelphia Fed Non-Manufacturing Firm-Level Business Activity Index 40.7 In June Vs 39.5 In May- Philadelphia Fed Non-Manufacturing New Orders Index 35.5 In June Vs 36.2 In May- Philadelphia Fed Non-Manufacturing Full-Time Employment Index 19.9 In June Vs 7.7 In May- Philadelphia Fed Wage And Benefit Cost Index 51.1 In June Vs 46.4 In May

· US S&P CoreLogic CS 20-City April M/M SA: 0.20% (est 0.40% prev R 0.40%)

US S&P CoreLogic CS 20-City April Y/Y NSA: 6.56% (est 6.80% prev R 6.73%)

US S&P CoreLogic CS 20-City April Index NSA: 210.17 (prev R 208.50)

US S&P CoreLogic CS US HPI Index April NSA: 200.86 (prev R 198.86)

US S&P CoreLogic CS US HPI April NSA: 6.41% (prev R 6.49%)

Corn.

- Lower prices seem to correct any desired market and South Korea again bought corn overnight, increasing June purchases to a level 2.1 times their average monthly consumption.

- There was US commercial buying in corn overnight.

- Corn was more than 3 cents higher in a turnaround Tuesday trade.

- Baltic Dry Index was down 10 points to 1,323, or 0.75%.

- Brazil’s MG is 13 percent complete on second corn harvesting, according to IMEA, down from 20 percent a year earlier.

- Brazil’s grain/oilseed movement remains slow from grain handlers reluctant to pay for high freight prices. The Brazil Supreme Court is said to rule on the government’s recent “price fix” for freight rates.

- Agroconsult estimated the 2017-18 Brazil second corn crop at 55 million tons, down 2 million tons from their May estimate. The second corn crop fell 3 percent this season to 11.6 million hectares. Total corn production is seen at 82 million tons versus 99 million tons last season.

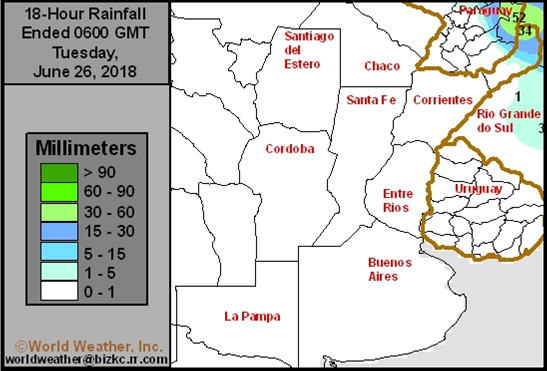

- A general strike in Argentina launched on Monday is already affecting shipping.

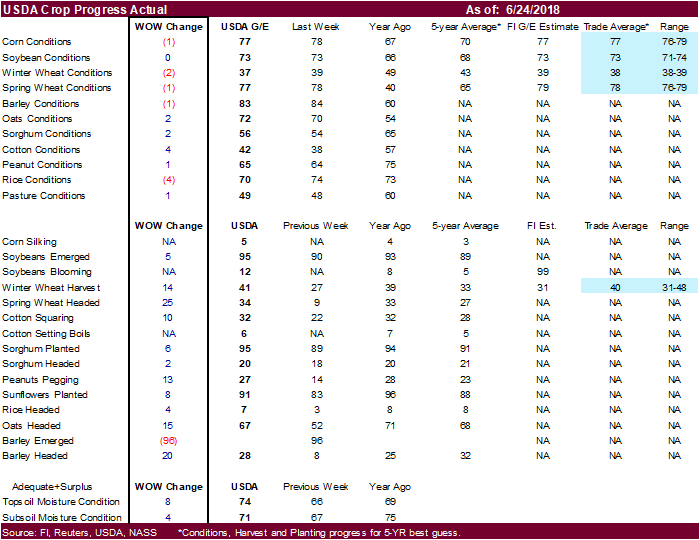

- US corn silking was pegged by USDA at 5 percent complete, and compares to 4 percent last year and 3 percent average.

- US corn conditions fell one point (good cat.) to 77 percent, at trade expectations, and compares to 67 year ago and 70 percent average.

- We left our US corn yield estimate unchanged at 181.0 bu/ac. USDA working estimate is at 174.0. Soybean and Corn Advisory increased his US corn yield estimate by 2 bu/ac to 178.0.

- South Korea’s MFG bought 69,000 tons of optional origin corn at $207.89/ton c&f for arrival in South Korea around Dec. 5 and Dec. 14

- South Korea’s NOFI group bought 138,000 tons corn at $207.89 a ton c&f for arrival in South Korea around November 25 and December 5.

- South Korea in June alone bought about 1.7 million tons of corn, or 2.1 times their average monthly consumption.

- China sold an estimated 46.9 million tons of corn out of reserves since April 12.

Soybean complex.

· CBOT soybean complex is higher on technical buying.

- China announced they will remove import tariffs effective from July 1 on five Asian countries for soybeans (currently set at 3 percent), soymeal (5 percent) and rapeseed (2 percent). Countries included are Bangladesh, India, Laos, South Korea and Sri Lanka. If Chinese crushers allow it, India could benefit by importing oilseeds and send meal to China. But China will need to scramble to change phytosanitary agreements with these countries. Traders are viewing this move by China as a “statement” and sees little impact on global oilseed and oilmeal trade.

- Agroconsult estimated Brazil’s soybean export forecast could top 73.5 million tons in 2018 if China duties on US exports follow through on July 6.

· China’s Ministry of Agriculture and Rural Affairs estimated the summer grain acreage at 408 million mu (27.2 million hectares), down slightly from last year. They didn’t get into many details, but noted the some of the corn area was in bad shape bias northeast due to drought.

· China September soybean futures increased 13 yuan per ton or 0.4%, September meal was up 45 or 1.5%, China soybean oil down 30 or 0.5% and China September palm unchanged at 4740 yuan/ton.

· September China cash crush margins were last running at 51 cents, and compares to 52 cents last week and 27 a year ago.

· Rotterdam vegetable oils were unchanged to lower and SA soybean meal when delivered into Rotterdam were mixed as of early morning CT time.

· September Malaysian palm was 13 lower at MYR2277 and cash down $3.75 at $591.25. The trade data for June 1-25 palm export weighed on prices.

· Offshore values were leading the soybean oil about 13 points higher and soybean meal $7.50/short ton higher.

· US soybeans emerged were pegged by USDA at 95 percent, and compares to 93 last year and 89 percent average.

· US soybean conditions were unchanged at 73, at trade expectations, and compares to 66 year ago and 68 average.

- We left our US soybean yield estimate unchanged at 49.6 bu/ac. USDA working estimate is at 48.5. Soybean and Corn Advisory increased his US soybean yield estimate by 1 bu/ac to 51.0.

- There is talk about ramping up the government CCC program to help US producers by buying and storing soybeans.

· Ukraine’s 2018 rapeseed crop was projected by UkrAgroConsult at 2.518 million tons from 2.302 million tons in 2017. 2018-19 rapeseed exports were estimated at 2.28 million tons compared with 2.12 million tons last season.

· Today the CCC seeks 12,500 tons of soybean meal for Honduras for Sep 1-10 shipment.

· Egypt seeks 30,000 tons of soybean oil and 10,000 tons of sunflower on June 28 for arrival around Aug 15-31. GASC will also accept offers for at least 10,000 tons of soyoil and 5,000 tons of sunflower oil in Egyptian pounds. (Reuters)

· China plans to offer to sell 500,000 tons of soybeans and 50,000 tons of soybean oil from state reserves on June 27. China sold 270,106 tons of soybeans out of reserves so far, this season.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- US wheat futures are higher in part from technical buying and Black Sea weather concerns.

- Egypt seeks wheat for August 11-20 shipment. Lowest offer is $201.95/ton for Russian wheat. Egypt still is battling problems on accepting previous purchased cargo(s) of wheat.

- South Korea lifted their GMO suspension on Canada wheat after tests concluded there was no GMO found in samples.

- Manitoba (Canada) weekly crop progress showed crops advanced quickly and dry conditions continues throughout the province.

- The CME will add options to Black Sea wheat futures on July 16.

- USDA report US winter wheat harvesting progress at 41 percent, up 14 points and 1 point above a trade average. We were looking for a much lower figure given all the rain that occurred last week and a ground report that states harvesting activity virtually came to a stop last Tuesday.

- US winter wheat conditions slid two points to 37 percent and were one point below a trade estimate.

- Spring wheat conditions were down one point to 77, also one point below a trade estimate.

· China’s Ministry of Agriculture and Rural Affairs estimated the summer grain acreage at 408 million mu (27.2 million hectares), down slightly from last year. The China wheat yield was estimated lower from rain and low temperature in early April. China’s quality wheat acreage in its overall wheat acreage rose 2.5 percent to 30 percent this year.

Export Developments.

- Egypt seeks wheat for August 11-20 shipment. Lowest offer is $201.95/ton for Russian wheat.

- Taiwan bought 95,350 tons of milling wheat from the United States in two consignments for shipment from the U.S. Pacific North West coast. The first consignment for shipment between Aug. 8-22 involved 25,450 tons of U.S. dark northern spring wheat of 14.5 percent protein content was purchased at $257.84 a ton fob. Second was for 15,350 tons of hard red winter wheat of 12.5 percent protein content was bought at $244.75 a ton fob and 7,775 tons of soft white wheat with 9 percent protein was bought at $224.54 a ton fob.

- Tunisia seeks 142,000 tons of optional origin soft milling wheat and 100,000 tons of feed barley on June 27.

- China sold 2,500 tons of imported wheat out of reserves or 0.14% of what was offered at an average price of 2,298 yuan per ton ($350.53/ton).

- Jordan passed on 120,000 tons of barley.

- Jordan seeks 120,000 tons of wheat on June 27.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on June 27.

- Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

- Iraq seeks 50,000 tons of wheat from the US, Australia and/or Canada on July 2, valid until July 8.

- Bangladesh seeks 50,000 tons of wheat on July 3 for shipment within 40 days of contract signing.

Rice/Other

- China sold 109,505 tons of rice out of reserves or 4.55% of what was offered at an average price of 2381 yuan per ton ($363.52/ton).

- South Korea seeks 102,800 tons of rice for September-February arrival on June 27.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Short Sept. 15, 2018/Incheon

20,000 Brown Short Sept. 15, 2018/Ulsan

20,000 Brown Short Sept. 15, 2018/Masan

10,000 Brown long Sept. 30, 2018/Mokpo

10,000 Brown long Sept. 30, 2018/Donghae

2,800 Milled Medium Dec. 1-31, 2018/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

- Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.