From: Terry Reilly

Sent: Thursday, July 05, 2018 8:08:00 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/05/18

PDF attached

CBOT ag Calls for hard open at 8:30 CT.

· Soybeans 2-5 cents lower, look for a two-sided trade.

· Soybeans meal $0.50-$2.00 lower

· Soybean oil 5-15 points lower

· Corn 2-4 cents lower, look for a 2-sided trade.

· Chicago wheat steady to 4 cents higher

· KC wheat 1-5 cents higher

· MN wheat steady to 4 cents higher

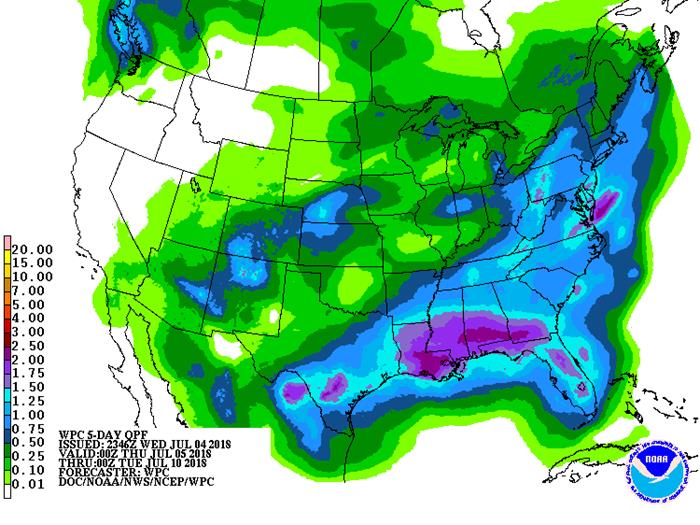

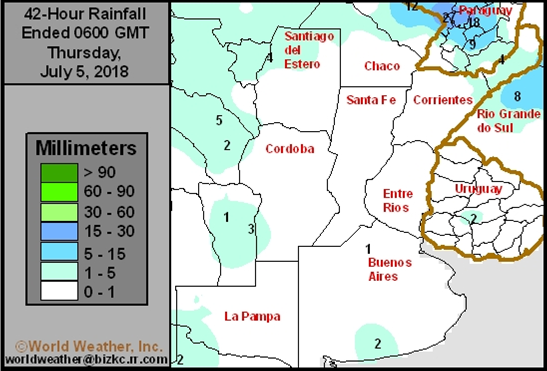

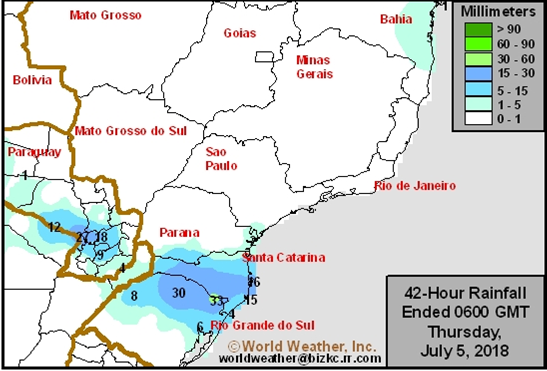

- Rest of July could yield near normal precipitation and above normal temperatures for the US, but a extended period of warm temperatures next week, last 7 days, could result in some crop stress. For this week, rain will be restricted across many areas.

- The morning model runs are suggesting greater rain in the Midwest during the latter part of next week and into the following weekend. This includes the July 13-20th period. An increase of rain will become very important after the hot spell.

- The high pressure across the Midwest will shifting to the west today and Friday, then shift back east resulting in the warm temperatures Sunday through mid-week.

- Australia’s Victoria and South Australia has an opportunity for rain today and Friday.

- Northern Europe will continue to see net drying through at least July 11.

- Eastern Ukraine to Kazakhstan will experience slightly less threatening weather over the coming week to ten days.

Source: World Weather Inc. and FI

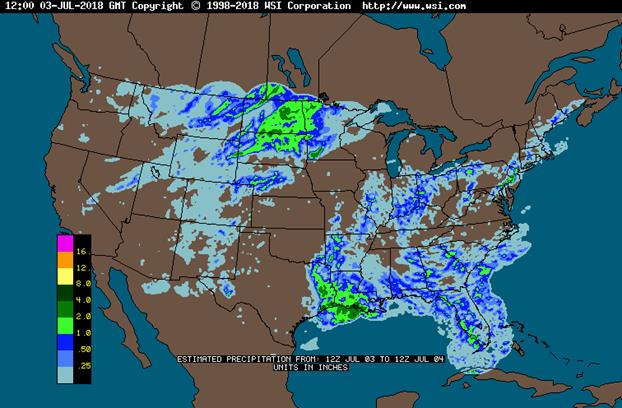

24-hour July 3

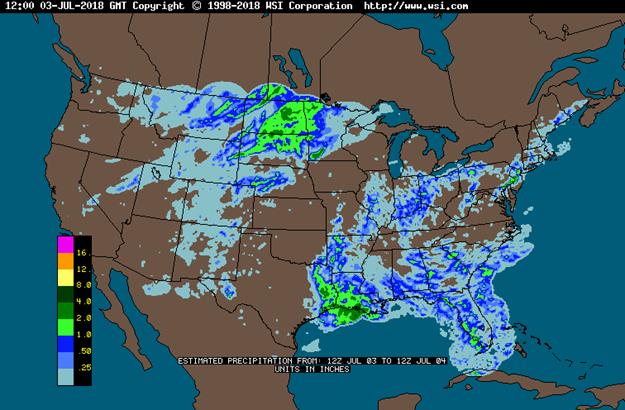

24-hour July 4

Source: World Weather Inc. and FI

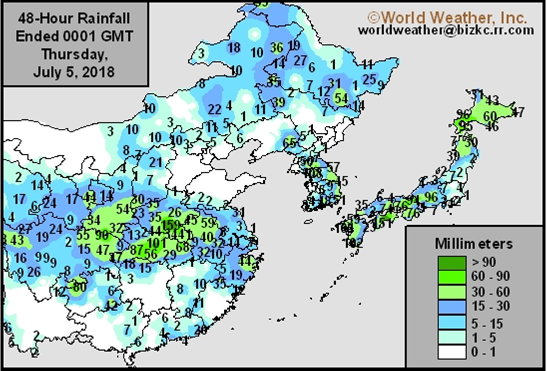

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- Guatemala coffee exports for June

- AB Foods trading updates, 2am ET (7am London)

- FAO Food Price Index, 4am ET (9am London)

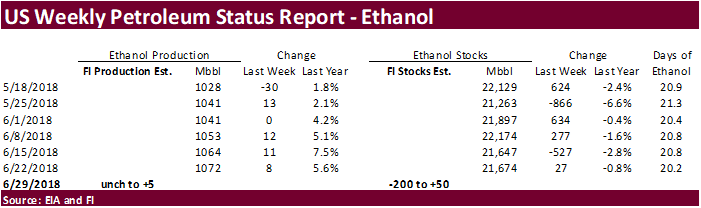

- EIA U.S. weekly ethanol inventories, output, 11am (delayed from Wednesday due to U.S. holiday)

- Andre Pessoa, head of Agroconsult, and executives from Brazil’s grain exporter group Anec speak on nation’s 2018-19 soybean and corn crops

- EU weekly grain, oilseed import and export data

- Port of Rouen data on French grain exports

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JULY 6:

- China is set to start levying tariffs on agriculture products, in retaliation for U.S. tariffs on imports from China

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday due to U.S. holiday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders report will be delayed until Monday July 9

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

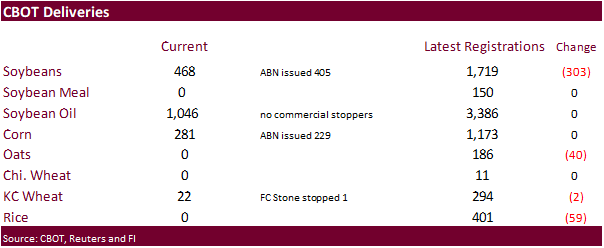

· Oats down 40 to 186 contracts

· Soybeans down 303 to 1,719 (303 taken out of Chicago-CIRM)

· Rice down 59 to 401

· KC wheat down 2 to 294

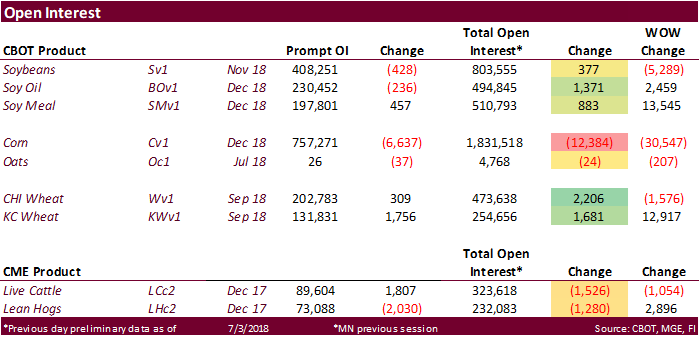

· USD is lower, WTI crude higher, and gold higher, at the time this was written.

· US stocks are higher.

· US jobs report is due out Friday.

· China said they will not impose tariffs against the US until the US decides to pull the trigger.

Corn.

- Corn could open lower on a wetter outlook for the US during the July 13-20 period.

- Baltic Dry Index was up 91 points on Wednesday to 1,567, or 6.2%, to a six-month high. On Thursday it was up another 45 points or 2.9% to 1612 points.

- Reuters noted “high water levels restricted navigation and limited barge tow sizes on the Mississippi River. High waters also prevented some elevators on northern stretches of the river from loading barges.”

- A Bloomberg poll calls for weekly US ethanol production and stocks at 1.068 million/day and 21.733 million, compared to 1.072 and 21.670 million last week.

- The US corn crop to date looks fantastic all over the major growing areas, with exception to some dry areas across the western part of the Delta and a few areas of the WCB, along with ponding in other areas where heavy rain occurred over last half June. Early crop soybeans don’t like too much water. Based on the current crop ratings, we are getting a lot of questions if the USDA will take their US corn and soybean yield estimates higher in the July report. Our bias is that they will leave soybeans unchanged at 48.5 bu/ac and raise the corn yield by 4 bushels per acre to 178 bu/ac. Going back to 2000, in most of the poor crop condition years, USDA lowered its July soybean yield from June in 2005 & 2012, and for corn they lowered it in 2004, 2008, and 2012. In good years, USDA never raised its soybean yield, but the corn yield increased in 2003 by 3 bu/ac. We recently lowered our August 1 corn yield by 0.5 to 180.5 bu/ac. Earlier this week we lowered our US yield by 0.2 to 49.4 bu/ac.

· Under the 24-hour reporting system, exporters sold 137,000 tons of OPTIONAL ORIGIN corn to South Korea for 2018-19 delivery.

· China sold 1.088 million tons of corn out of state reserves, at an average price of 1529 yuan per ton ($230.47/ton), 27 percent of the corn offered. China plans to auction off 4 million tons of corn on July 6.

Soybean complex.

· US soybean complex may open lower. US weather is a little less threatening for second half July and China is expected to retaliate against the US by slapping on import tariffs that will include soybeans, after the US does so with 34 billion USD on good this Friday.

· Traders are waiting to see if the US will slap on 34 billion USD of import tariffs on Chinese goods, resulting in a counter strike by China which could be the last nail in the coffin for 2017-18 US soybean exports to China. China has already been maximizing purchases from Brazil.

· The CNGOIC reported China bought 1.1 million tons of soybeans last week from Brazil.

· For the week ending June 29, Brazil exported 2.22 million tons of soybeans, down from 2.34 million previous week. Commitments were thought to be running at 56.6MMT, a record.

· Due to the federal holiday on July 4th, the next U.S. Export Sales report is scheduled for release at 8:30 A.M. on Friday, July 6, 2018. (USDA) Traders are looking for additional cancellations of US cargos by China when USDA updates their weekly export sales report on Friday. Little more than 1 million tons of soybean sales are on the books for China.

· Over a two-day period, China September soybean futures decreased 35 yuan per ton or 0.9%, September meal was down 42 or 1.3%, China soybean oil down 20 (0.4%) and China September palm down 44 at 4820 yuan/ton (0.3%).

· September China cash crush margins were last running at 54 cents, down 22 cents from Tuesday, and compares to 78 cents last week and 67 a year ago.

· After two days, Rotterdam vegetable oils were mostly higher and SA soybean meal when delivered into Rotterdam were lower as of early morning CT time.

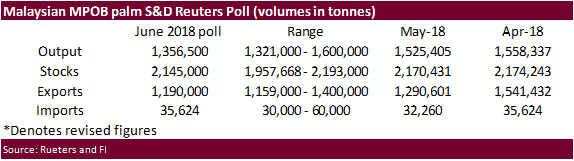

· After two days, September Malaysian palm was 29 lower at MYR2284 and cash $7.50 lower at $588.75.

· Offshore values as of July 5 were leading soybean oil 23 points higher and meal $1.20/short ton lower.

· China plans to launch a GMO labeling investigation on cooking oils.

· Brazil producers are suing a large seed company over a patent’s validity to collect 800 million reais ($204 million) in royalties.

· India raised their government set purchase prices for several crops, by most since at least 2014. They are rising about 25 percent compares to previous increases of 3-4 percent in the last three years. Some warned this could hurt India’s economy.

· China sold 29,817 tons of 2011 soybean oil out of reserves at an average price of 5002 yuan per ton ($753.68/ton), 50.9 percent of the 50,000 tons offered.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- We are looking for a higher trade in US wheat on additional downward revisions in EU crop prospects and a lower USD.

- The Food and Agriculture Organization’s (FAO) food price index averaged 173.7 points last month, down 1.3 percent from May.

- Paris wheat hit a three-week high on July 4, ending 1.00 euro higher. On Thursday they were up 2.00 euros during early US trading hours.

- The EU awarded 10,150 tons of wheat import quotas and 3,500 tons of barley import quotas.

- A Reuters poll calls for EU soft wheat production to fall to 136 million tons from 141.8 million tons last year.

- Hottest U.K. Summer in Decades May Mean Bigger Wheat Imports (Bloomberg).

- France’s Rouen Grain Exports Fell 26% in Week to July 4 (Bloomberg).

- German Grains Harvest to Fall 9.9% in 2018 on Dry Weather: DBV (Bloomberg). They are using 20.5 million tons for 2018 winter wheat, down 15.1 percent from 2017.

- Manitoba weekly crop report headlined “Warm Conditions and Rainfall over the past week welcomed and has advanced crop development.”

- India plans to sell 7 to 8 million tons of wheat to the domestic market for the local marketing year ending March 31, up from a 2017-18 target of 5.3 million tons.

- Russia’s AgMin increased their forecast for 2018-19 to 40-45 from previous 35-40 million tons. They left their crop estimate of 100 million tons unchanged.

- A Reuters poll calls for the Black Sea wheat exports to fall 11 percent to 58.8 million tons, and leave Russia as the world largest exporter at 35 million tons. Ukraine was polled at 16 million and Kazakhstan at 7.8 million tons. The combined crop of Russia, Ukraine and Kazakhstan is expected to decline by 12.6 percent to 110.8 million tons of wheat in 2018, the Reuters article added.

- Ukraine exported 17.1 million tons of wheat in 2017-18.

- The Czech grain harvest is seen at 6.3 million tons, down 8.2 percent from last season.

Export Developments.

- Algeria bought about 600,000 optional origin milling wheat at $234-$237/ton for September shipment.

- Brazil bought 25,000 tons of Russian wheat recently.

- Japan in a SBS import tender bought 27,210 tons of feed wheat and 38,180 tons of barley for arrival by December 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 11 for arrival by December 28.

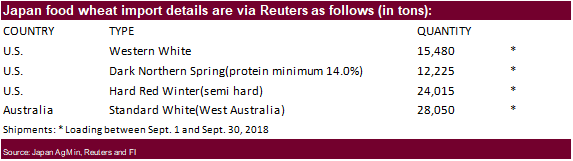

- Japan seeks 79,770 tons of food wheat on Thursday. Original details of the tender as follows:

· Jordan canceled their import tender for 120,000 tons of barley for Oct-Nov shipment.

· Jordan seeks 120,000 tons of barley on July 11 for Oct/Nov shipment.

- China sold 3,000 tons of 2013 imported wheat from state reserves at auction at an average price of 2370 yuan/per ton or $358.08/ton, 0.2 percent of what was offered.

- China sold 2,447 tons of 2013 imported wheat from state reserves at auction at an average price of 2250 yuan/per ton or $339.27/ton, 0.1 percent of what was offered.

- Saudi Arabia seeks 1.5 million tons of barley for Sep/Oct shipment.

- Results awaited: Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

· Jordan seeks 120,000 tons of wheat on July 8 for Oct-Nov shipment.

Rice/Other

- Results awaited: South Korea seeks 102,800 tons of rice for September-February arrival on June 27.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Short Sept. 15, 2018/Incheon

20,000 Brown Short Sept. 15, 2018/Ulsan

20,000 Brown Short Sept. 15, 2018/Masan

10,000 Brown long Sept. 30, 2018/Mokpo

10,000 Brown long Sept. 30, 2018/Donghae

2,800 Milled Medium Dec. 1-31, 2018/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

- Results awaited: Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.