From: Terry Reilly

Sent: Friday, July 06, 2018 8:21:37 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/06/18

PDF attached

Trade woes already worked into the ag markets. Is it time to buy? Feedback welcome

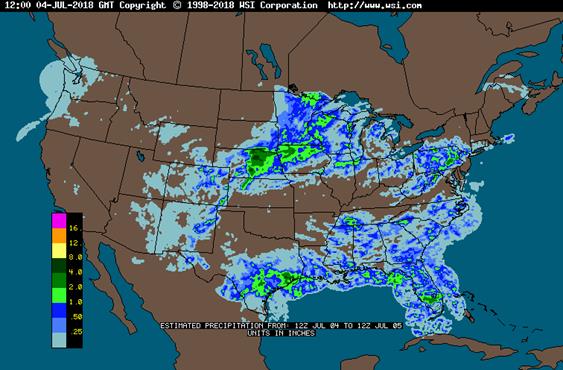

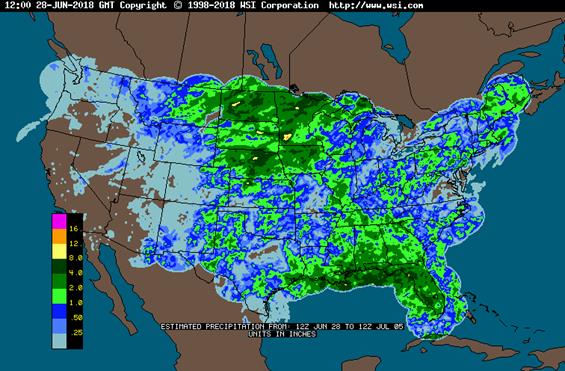

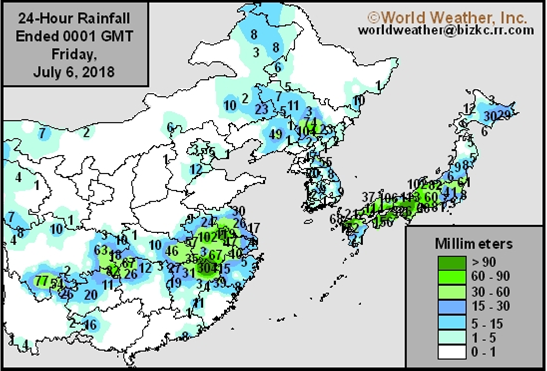

- Not much rain fell across the US Midwest. The central Great Plains and upper northwestern Corn Belt saw rain.

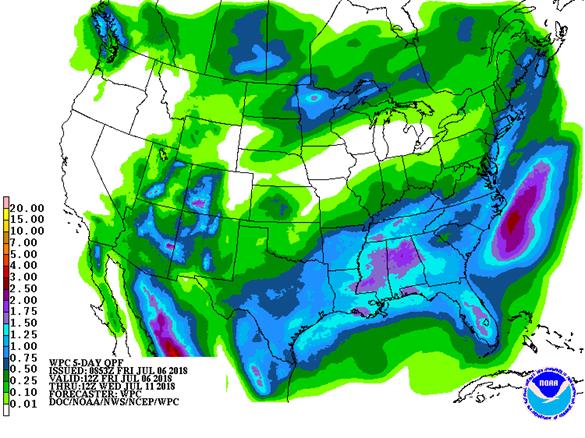

- Rain is expected from the Dakotas into northern Minnesota Sunday with rainfall of 0.20 to 1.00 inch and local totals to 1.60 inches.

- Rain will occur Wednesday into Friday in the northwestern half of the Corn Belt with 0.30 to 0.80 inch and local totals to 1.50 inches.

- The high pressure across the Midwest will shifting to the west today, then shift back east resulting in the warm temperatures Sunday through mid-week.

- Australia’s Victoria and South Australia has an opportunity for rain today and Friday.

- Northern Europe will continue to see net drying through at least July 11.

- Eastern Ukraine to Kazakhstan will experience slightly less threatening weather over the coming week to ten days.

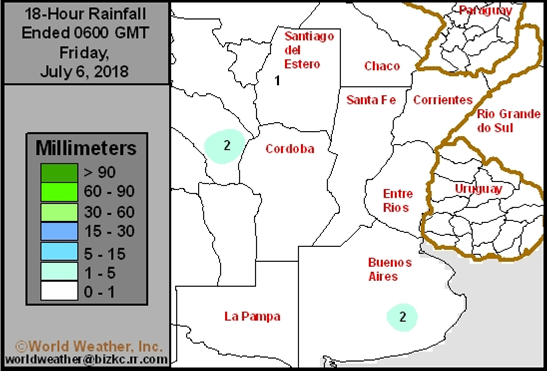

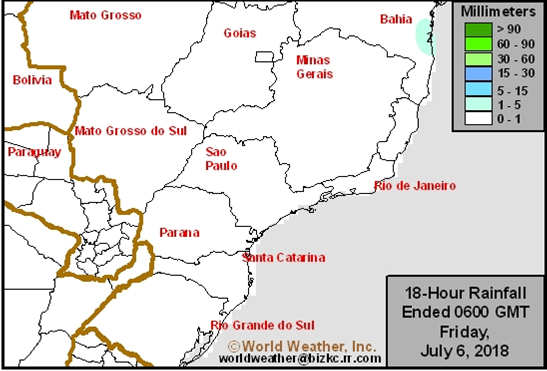

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Fri 75% cvg of up to 0.50”

and local amts to 1.0”;

south and east wettest

Fri 5% cvg of up to 0.25”

and locally more;

mostly SE Mo.

Sat Mostly dry with a few

insignificant showers

Sat-Sun 5-20% daily cvg of

up to 0.60” and locally

more each day;

wettest NW

Sun-Mon 5-20% daily cvg of up

to 0.30” and locally

more each day;

wettest south

Mon-Tue 5-20% daily cvg of up

to 0.25” and locally

more each day

Tue-Wed 10-20% daily cvg of

up to 0.40” and locally

more each day; south

and west wettest

Wed-Jul 12 60% cvg of up to 0.55”

and local amts to 1.25”;

far NW driest

Jul 12-13 70% cvg of up to 0.55”

and local amts to 1.25”

Jul 13-15 55% cvg of up to 0.60”

and locally more

Jul 14-16 65% cvg of up to 0.60”

and locally more

Jul 16-19 10-25% daily cvg of

up to 0.35” and locally

more each day

Jul 17-19 10-25% daily cvg of

up to 0.35” and locally

more each day

DELTA SOUTHEAST

Fri-Sat 75% cvg of up to 0.75” 80% cvg of up to 0.75”

and local amts to 1.50”; and local amts to 2.0”

central and south

wettest

Sun-Mon 35-60% daily cvg of 20-40% daily cvg of

up to 0.65” and locally up to 0.75” and locally

more each day; more each day; south

driest north and west wettest

Tue-Jul 12 10-25% daily cvg of 5-20% daily cvg of up

up to 0.35” and locally to 0.30” and locally

more each day more each day

Jul 13-14 70% cvg of up to 0.50” 60% cvg of up to 0.50”

and local amts to 1.0”; and local amts to 1.0”;

wettest north driest south

Jul 15-16 50% cvg of up to 0.50”

and locally more;

wettest north

Jul 15-17 50% cvg of up to 0.60”

and locally more

Jul 17-19 10-25% daily cvg of

up to 0.30” and locally

more each day

Jul 18-19 10-25% daily cvg of

up to 0.40” and locally

more each day

Source: World Weather Inc. and FI

- China is set to start levying tariffs on agriculture products, in retaliation for U.S. tariffs on imports from China

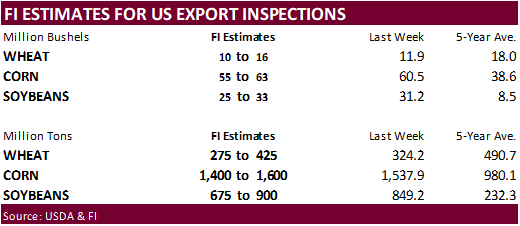

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday due to U.S. holiday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders report will be delayed until Monday July 9

- FranceAgriMer weekly updates on French crop conditions

MONDAY, JULY 9:

- Argentina on Independence Day holiday

- USDA weekly corn, soybean, wheat export inspections, 11am

- CFTC commitments of traders weekly report for period ending July 3 on positions for various U.S. futures and options, 3:30pm (report delayed from Friday because of July 4 holiday)

- USDA weekly crop progress report, 4pm

- FAO Fisheries and Aquaculture report

- EU publishes grains and oilseeds trade data

- Ivory Coast weekly cocoa arrivals

TUESDAY, JULY 10:

- Cargo surveyors Intertek and AmSpec release their respective data on Malaysia’s July 1-10 palm oil exports, 11pm ET Monday (11am Kuala Lumpur Tuesday); SGS data during same period, 3am ET Tuesday (3pm local time Tuesday)

- Brazil’s crop agency Conab releases soy, corn output for July, 8am ET (9am Sao Paulo), along with 2017-18 grain and oilseed crop report

- Unica bi-weekly data on Brazil Center-South sugar production, 9am ET (10am Sao Paulo)

- Malaysian Palm Oil Board (MPOB) data on stockpiles, exports, production for June, 12:30am ET (12:30pm Kuala Lumpur)

- French Agriculture Ministry publishes crop areas, production forecasts

- FAO bi-annual food outlook report, which includes food import bill

- Global Ethanol Focus conference in Singapore, 1st day of 2

- EARNINGS: PepsiCo

WEDNESDAY, JULY 11:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- FranceAgriMer updates cereals balance sheets

- Global Ethanol Focus conference in Singapore, final day

THURSDAY, JULY 12:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- U.S. National Weather Service’s Climate Prediction Center will release its latest forecast for El Nino, 9am

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for July, noon

- Brazil coffee exporters group Cecafe releases data on shipments in June and the prospect for exports in 2018-19 crop

- Strategie Grains publishes monthly EU grains report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: Suedzucker

FRIDAY, JULY 13:

- China’s General Administration of Customs releases preliminary commodity trade data for June, including soy and palm oil, 10pm ET Thursday (10am Beijing Friday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report for period ending July 10 on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

· Soybeans down 30 to 1,689 (CIRM Chicago)

· Rice down 35 to 366

Bloomberg weekly bull/bear survey (taken Thursday)

• Wheat: Bullish: 10 Bearish: 0 Neutral: 4

• Corn: Bullish: 10 Bearish: 2 Neutral: 3

• Soybeans: Bullish: 5 Bearish: 2 Neutral: 8

• Raw sugar: Bullish: 2 Bearish: 5 Neutral: 2

• White sugar: Bullish: 2 Bearish: 5 Neutral: 2

• White-sugar premium: Widen: 3 Narrow: 2 Neutral: 4

· 34 billion USD of trade tariffs against China were confirmed. President Trump warned more will be added, possibly up to $550 billion. China responded by adding $34 billion.

· US stocks are higher, USD is lower, WTI crude lower, and gold lower, at the time this was written.

· China’s Commerce Min: Lodges a Case Against US At WTO

· US Non Farm Pay Rolls June: 213k (est 195k prev 223k)

· US Unemployment Rate June: 4.0% (est 3.8% prev 3.8%)

· US Average Hourly Earnings June M/M: 0.2% (est 0.3% prev 0.3%)

· US Average Hourly Earnings June Y/Y: 2.7% (est 2.8% prev 2.7%)

· US Change In Manufacturing Payrolls June: 36k (est 15k prev R 19k)

· US Change In Private Payrolls June: 202k (est 190k prev R 239k)

· US Labor Force Participation Rate June: 62.9% (est 62.7% prev 62.7%)

· US Trade Balance May: -43.1B (est -$43.7B prev R $46.1B)

Corn.

- Corn is higher on light technical buying. Lower energy could cap gains.

- USDA corn export sales were on the lower end of expectations.

- Baltic Dry Index was up 10 points to 1,622, or 0.6%.

· Scott Pruitt resigned from the EPA.

· US ethanol production decreased 5,000 barrels per day to 1.067 million, and stocks increased 301,000 barrels to 21.975 million. A Bloomberg poll called for weekly US ethanol production and stocks at 1.068 million/day and 21.733 million, respectively. The report was seen as neutral for corn.

- The USDA Broiler report showed eggs set in the US 3 percent and chicks placed up 2 percent. Cumulative placements from the week ending January 6, 2018 through June 30, 2018 for the United States were 4.77 billion. Cumulative placements were up 1 percent from the same period a year earlier.

· China sold 814,003 tons of corn out of state reserves, at an average price of 1423 yuan per ton ($213.97/ton), 21 percent of the corn offered. Yesterday China sold 1.088 million tons of corn out of state reserves, at an average price of 1529 yuan per ton ($230.47/ton), 27 percent of the corn offered.

Soybean complex.

· Day one of the US import tariffs. $34 billion for both sides.

· CBOT soybeans briefly hit fresh contract lows overnight but rebounded on light strength in soybean meal.

· China’s Ministry of Agriculture and Rural Affairs published a document on exploring ways to reduce the use of soybean meal in animal feed.

· Reuters shows Brazil soybeans at a $1.60/bu premium over US but prices need to widen to $2.00/bu in order to attract China to buy US soybeans. Feedback welcome.

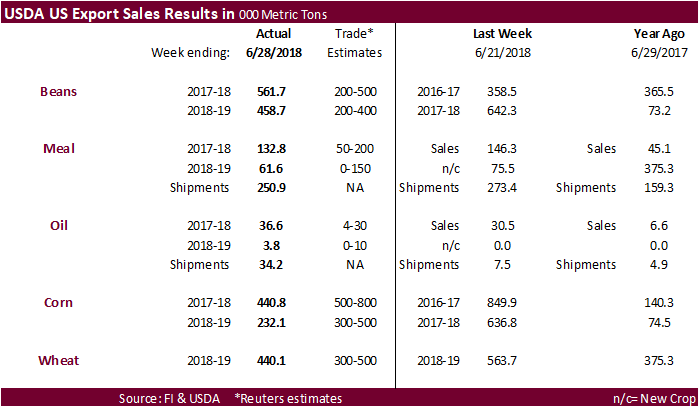

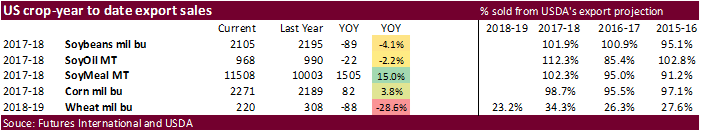

· The USDA Export Sales report showed US soybean commitments above expectations for both old and new-crop. Soybean meal export sales were within expectations, but shipments are positive at 250,900 tons. Soybean oil export commitments were good and shipments were supportive at 34,200 tons.

· Traders were looking for large soybean cancellations by China. At least 366,000 for China were reduced this week.

· China September soybean futures decreased 10 yuan per ton or 0.3%, September meal was up 6 or 0.2%, China soybean oil up 34 (0.6%) and China September palm down 4 at 4816 yuan/ton (0.1%).

· September China cash crush margins were last running at 56 cents, up 2 cents, and compares to 78 cents last week and 67 a year ago.

· Rotterdam vegetable oils were lower and SA soybean meal when delivered into Rotterdam were lower as of early morning CT time.

· September Malaysian palm was 18 lower at MYR2266 and cash $1.25 lower at $587.50.

· Offshore values were leading soybean oil 3 points higher (57 higher for the week to date) and meal $0.30/short ton higher ($3.20 higher for the week).

· India June oilseed meal exports fell 34 percent to 166,833 tons.

· The European Union reported soybean import licenses since July 1 at 13.383 million tons, below 14.110 million tons a year ago. European Union soybean meal import licenses are running at 18.678 million tons for 2017-18, above 18.071 million tons a year ago. EU palm oil import licenses are running at 6.060 million tons for 2017-18, up from 6.151 million tons a year ago.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

· China sold 660,524 tons of soybeans out of reserves so far, this season.

· Chicago wheat is near unchanged and KC & MN slightly higher. Wheat has a chance to rally again today unless profit taking sets in. We are bullish over the short term.

· French wheat and barley conditions declined from the previous week.

- Paris wheat was 1.25 euros lower during early US trading hours.

- The European Union granted export licenses for 65,000 tons of soft wheat imports, bringing cumulative 2017-18 soft wheat export commitments to a final 20.297 million tons, well down from 24.026 million tons committed at this time last year.

Export Developments.

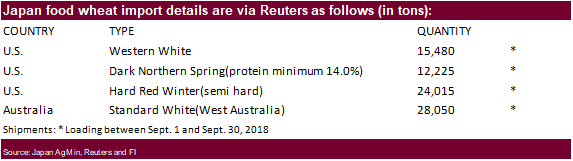

- Japan bought 79,770 tons of food wheat. Original details of the tender as follows:

- Saudi Arabia seeks 1.5 million tons of barley for Sep/Oct shipment.

- China sold 1,709 tons of 2013 imported wheat from state reserves at auction at an average price of 2380 yuan/per ton or $357.98/ton, 0.1 percent of what was offered.

- Results awaited: Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

· Jordan seeks 120,000 tons of wheat on July 8 for Oct-Nov shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 11 for arrival by December 28.

· Jordan seeks 120,000 tons of barley on July 11 for Oct/Nov shipment.

Rice/Other

- Results awaited: South Korea seeks 102,800 tons of rice for September-February arrival on June 27.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Short Sept. 15, 2018/Incheon

20,000 Brown Short Sept. 15, 2018/Ulsan

20,000 Brown Short Sept. 15, 2018/Masan

10,000 Brown long Sept. 30, 2018/Mokpo

10,000 Brown long Sept. 30, 2018/Donghae

2,800 Milled Medium Dec. 1-31, 2018/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

- Results awaited: Iran seeks 50,000 tons of rice from Thailand on July 3.

U.S. EXPORT SALES FOR WEEK ENDING 6/28/2018

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

136.6 |

1,117.2 |

1,811.4 |

86.6 |

351.4 |

1,080.8 |

0.0 |

0.0 |

|

SRW |

85.8 |

545.6 |

721.6 |

40.0 |

200.5 |

170.9 |

0.0 |

0.0 |

|

HRS |

83.6 |

1,489.0 |

1,519.3 |

144.1 |

442.1 |

783.0 |

0.0 |

0.0 |

|

WHITE |

133.1 |

1,233.7 |

1,463.5 |

115.4 |

484.3 |

639.8 |

0.0 |

0.0 |

|

DURUM |

1.0 |

125.8 |

148.5 |

1.0 |

2.6 |

53.5 |

0.0 |

0.0 |

|

TOTAL |

440.1 |

4,511.2 |

5,664.4 |

387.1 |

1,480.8 |

2,728.1 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

45.3 |

26.5 |

1.4 |

3.6 |

3.4 |

0.0 |

0.0 |

|

CORN |

440.7 |

12,527.1 |

8,191.1 |

1,514.8 |

45,166.2 |

47,411.4 |

232.1 |

4,519.9 |

|

SORGHUM |

37.2 |

348.1 |

437.8 |

9.2 |

4,849.2 |

4,065.3 |

0.0 |

38.0 |

|

SOYBEANS |

561.6 |

7,739.6 |

6,842.8 |

937.8 |

49,552.3 |

52,883.8 |

458.7 |

7,982.2 |

|

SOY MEAL |

132.8 |

2,387.2 |

2,016.7 |

250.9 |

9,120.8 |

7,986.4 |

61.6 |

452.4 |

|

SOY OIL |

36.6 |

182.5 |

105.5 |

34.2 |

785.4 |

884.1 |

3.8 |

19.3 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

22.6 |

111.5 |

228.2 |

29.8 |

1,151.7 |

1,204.9 |

13.5 |

43.5 |

|

M S RGH |

0.0 |

0.0 |

9.4 |

0.0 |

52.7 |

186.4 |

0.0 |

0.0 |

|

L G BRN |

-0.3 |

3.4 |

10.0 |

0.2 |

14.8 |

16.0 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

0.2 |

4.1 |

0.1 |

66.5 |

188.4 |

0.0 |

0.0 |

|

L G MLD |

2.4 |

63.0 |

218.6 |

3.1 |

854.8 |

790.6 |

0.0 |

0.0 |

|

M S MLD |

2.3 |

106.2 |

47.7 |

4.1 |

510.4 |

780.2 |

0.0 |

1.3 |

|

TOTAL |

27.1 |

284.3 |

518.0 |

37.3 |

2,651.0 |

3,166.4 |

13.5 |

44.8 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

18.0 |

2,663.5 |

1,917.0 |

411.6 |

13,522.9 |

12,642.9 |

268.2 |

5,581.4 |

|

PIMA |

1.0 |

83.5 |

65.5 |

12.1 |

553.7 |

562.8 |

-33.4 |

167.7 |

Export Sales Highlights

This summary is based on reports from exporters for the period June 22-28, 2018.

Wheat: Net sales of 440,100 metric tons were reported for delivery in marketing year 2018/2019. Increases were primarily for Taiwan (97,600 MT), Mexico (88,300 MT, including decreases of 200 MT), Japan (53,200 MT), unknown destinations (49,200 MT), and Chile (40,000 MT). Reductions were reported for the United Kingdom (7,900 MT), Jamaica (1,700 MT), and Belize (700 MT). Exports of 387,100 MT were reported to South Korea (63,000 MT), Thailand (49,500 MT), the Philippines (49,500 MT), Taiwan (49,300 MT), and Mexico (45,900 MT).

Corn: Net sales of 440,700 MT for 2017/2018 were down 48 percent from the previous week and 37 percent from the prior 4-week average. Increases were reported for Mexico (144,800 MT, including decreases of 3,600 MT), Egypt (109,200 MT, including 111,000 MT switched from Spain and decreases of 1,800 MT), Vietnam (75,100 MT, including 68,000 MT switched from unknown destinations), Colombia (74,200 MT, including 29,000 MT switched from unknown destinations and decreases of 2,200 MT), and Saudi Arabia (71,900 MT). Reductions were primarily for unknown destinations (228,800 MT), Spain (52,100 MT), and France (20,500 MT). For 2018/2019, net sales of 232,100 MT were reported for Guatemala (91,100 MT), Mexico (45,700 MT), Japan (31,000 MT), and unknown destinations (25,400 MT). Exports of 1,514,800 MT were up 2 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to Mexico (394,300 MT), Japan (200,200 MT), Taiwan (155,400 MT), South Korea (138,400 MT), and Egypt (127,200 MT).

Optional Origin Sales: For 2017/2018, options were exercised to export 70,000 MT to Saudi Arabia from the United States. Decreases of 10,000 MT were reported for Egypt. The current optional origin outstanding balance of 337,000 MT is for South Korea (206,000 MT), unknown destinations (91,000 MT), and Egypt (40,000 MT). For 2018/2019, new optional origin sales of 50,000 MT were reported for unknown destinations. The current outstanding balance of 188,000 MT is for Saudi Arabia (70,000 MT), South Korea (68,000 MT), and unknown destinations (50,000 MT).

Barley: No net sales were reported for the week. Exports of 1,400 MT were to Japan (1,200 MT) and Taiwan (200 MT).

Sorghum: Net sales of 37,200 MT, for 2017/2018 resulted as increases for Mexico (38,000 MT) and South Africa (9,200 MT, switched from unknown destinations), were partially offset by reductions for unknown destinations (10,000 MT). Exports of 9,200 MT were to South Africa.

Rice: Net sales of 27,100 MT for 2017/2018 were down 14 percent from the previous week and 50 percent from the prior 4-week average. Increases were reported for Colombia (17,500 MT), Honduras (4,400 MT), Canada (2,100 MT, including decreases of 400 MT), Jordan (600 MT), and Guatemala (600 MT). For 2018/2019, net sales of 13,500 MT were reported for Venezuela. Exports of 37,300 MT were down 34 percent from the previous week and 53 percent from the prior 4-week average. The destinations were primarily to Mexico (28,500 MT), Canada (2,600 MT), El Salvador (1,800 MT), Japan (1,300 MT), and Saudi Arabia (700 MT).

Soybeans: Net sales of 561,600 MT for 2017/2018 were up 57 percent from the previous week and 78 percent from the prior 4-week average. Increases were reported for the Netherlands (162,100 MT, including 132,000 MT switched from unknown destinations), Pakistan (134,700, including 65,000 MT switched from unknown destinations, 60,000 MT switched from China, and decreases of 300 MT), Bangladesh (109,300 MT, including 60,000 MT switched from China, 55,000 MT switched from unknown destinations, and decreases of 6,700 MT), Japan (80,400 MT, including 65,100 MT switched from unknown destinations and decreases of 200 MT), and Germany (79,600 MT). Reductions were for China (366,000 MT). For 2018/2019, net sales of 458,700 MT reported for Mexico (193,600 MT), unknown destinations (187,500 MT), Vietnam (60,500 MT), and Thailand (35,100 MT), were partially offset by reductions for China (66,000 MT). Exports of 937,800 MT were up 87 percent from the previous week and 49 percent from the prior 4-week average. The destinations included the Netherlands (162,100 MT), Mexico (154,500 MT), Pakistan (137,700 MT), Bangladesh (108,300 MT), and Japan (104,700 MT).

Optional Origin Sales: For 2018/2019, the current optional origin outstanding balance of 228,000 MT is for China (165,000 MT) and unknown destinations (63,000 MT).

Export for Own Account: New exports for own account totaling 29,800 MT were reported to Canada. The current outstanding balance of 101,200 MT is for Canada.

Export Adjustment: Accumulated exports of soybeans to the Netherlands were adjusted down 79,601 MT for week ending June 4th. The correct destination is Germany and is included in this week’s report.

Soybean Cake and Meal: Net sales of 132,800 MT for 2017/2018 were down 9 percent from the previous week, but up 14 percent from the prior 4-week average. Increases were reported for the Philippines (31,600 MT), Ecuador (30,800 MT), Portugal (27,500 MT, including 28,000 MT switched from unknown destinations and decreases of 500 MT), Mexico (17,100 MT, including decreases of 100 MT), and Colombia (10,300 MT, including decreases of 900 MT). Reductions were reported for unknown destinations (25,000 MT). For 2018/2019, net sales of 61,600 MT were primarily for Guatemala (44,200 MT) and Mexico (8,100 MT). Exports of 250,900 MT were down 8 percent from the previous week, but up 1 percent from the prior 4-week average. The primary destinations were the Philippines (49,500 MT), Venezuela (30,000 MT), Portugal (27,500 MT), Mexico (20,900 MT), and Canada (19,100 MT).

Soybean Oil: Net sales of 36,600 MT for 2017/2018 were up 20 percent from the previous week and up noticeably from the prior 4-week average. Increases were primarily for South Korea (13,000 MT), unknown destinations (12,300 MT), Venezuela (5,000 MT), Guatemala (3,000 MT), and Mexico (1,400 MT). For 2018/2019, net sales of 3,800 MT were reported for Mexico. Exports of 34,200 MT were up noticeably from the previous week and up 48 percent from the prior 4-week average. The primary destinations were South Korea (15,300 MT), Guatemala (6,600 MT), the Dominican Republic (4,200 MT), Jamaica (3,500 MT), and Colombia (2,500 MT).

Export Adjustment: Accumulated exports of soybean oil to Colombia were adjusted down 3,000 MT for week ending May 24th. This export was reported in error.

Cotton: Net sales of 18,000 running bales for 2017/2018 were down noticeably from the previous week and from the prior 4-week average. Increases were reported for Turkey (17,700 RB, including decreases of 600 RB), Vietnam (8,000 RB, including 11,000 RB switched from China, 2,000 RB switched from South Korea, 300 RB switched from Japan, and decreases of 13,800 RB), Egypt (6,500 RB, including decreases of 100 RB), Taiwan (4,400 RB, including decreases of 200 RB), and India (2,000 RB, including decreases of 200 RB). Reductions were reported for China (8,100 RB), Thailand (7,200 RB), and Mexico (4,200 RB). For 2018/2019, net sales of 268,200 RB reported for Indonesia (67,300 RB), South Korea (59,100 RB), Mexico (43,900 RB), and Vietnam (40,700 RB), were partially offset by reductions for Japan (900 RB). Exports of 411,600 RB were up 12 percent from the previous week, but down 4 percent from the prior 4-week average. The primary destinations were Turkey (69,900 RB), Vietnam (66,600 RB), Indonesia (66,500 RB), Bangladesh (45,200 RB), and China (31,400 RB). Net sales of Pima totaling 1,000 RB for 2017/2018 were down 55 percent from the previous week and 82 percent from the prior 4-week average. Increases were reported for Vietnam (2,600 RB), Turkey (2,500 RB), and Thailand (1,700 RB). Reductions were for China (6,100 RB). For 2018/2019, net sales reductions of 33,400 RB resulted as increases for China (11,100 RB), Pakistan (3,000 RB), and India (2,600 RB), were more than offset by reductions for South Korea (50,200 RB). Exports of 12,100 RB were down 5 percent from the previous week, but up 28 percent from the prior 4-week average. The primary destinations were China (3,500 RB), India (2,400 RB), and Vietnam (2,200 RB).

Optional Origin Sales: For 2017/2018, options were exercised to export 600 RB to Indonesia from the United States. The current optional origin outstanding balance is 7,800 RB, all Indonesia.

Exports for Own Account: The current outstanding balance of 13,000 RB is for Vietnam (6,300 RB), China (6,200 RB), and Bangladesh (500 RB).

Hides and Skins: Net sales of 398,800 pieces reported for 2018 were up 15 percent from the previous week, but down 11 percent from the prior 4-week average. Whole cattle hide sales totaling 394,800 pieces were primarily for Thailand (140,600 pieces, including decreases of 9,200 pieces), China (105,100 pieces, including decreases of 24,300 pieces), South Korea (76,500 pieces, including decreases of 3,100 pieces), Indonesia (34,600 pieces, including decreases of 300 pieces), and Mexico (19,300 pieces, including decreases of 1,400 pieces). Exports of 383,000 pieces for 2018 were down 2 percent from the previous week and 3 percent from the prior 4-week average. Whole cattle hide exports of 375,300 pieces were primarily to China (182,400 pieces), South Korea (64,600 pieces), Thailand (61,800 pieces), Mexico (30,400 pieces), and Taiwan (12,500 pieces).

Net sales of 90,300 wet blues for 2018 were down 34 percent from the previous week and 42 percent from the prior 4-week average. Increases were reported for China (44,500 unsplit and 200 grain splits), Mexico (12,000 grain splits and 7,000 unsplit), Vietnam (15,100 unsplit), Italy (6,900 unsplit), and India (4,800 grain splits). Reductions were reported for the Dominican Republic (100 unsplit) and Thailand (100 grain splits). Exports of 147,100 wet blues for 2018 were up 17 percent from the previous week, but down 9 percent from the prior 4-week average. The primary destinations were China (46,000 unsplit and 2,000 grain split), Vietnam (39,300 unsplit), Italy (16,300 unsplit and 4,800 grain splits), and Thailand (11,100 grain splits and 8,300 unsplit). Net sales splits totaling 256,600 pounds for 2018 were down 60 percent from the previous week and 80 percent from the prior 4-week average. The destination of Vietnam (256,900 pounds), was partially offset by a reduction for Mexico (300 pounds). Exports of 395,300 pounds were down 23 percent from the previous week and 38 percent from the prior 4-week average. The destinations were Vietnam (292,300 pounds), China (100,000 pounds), and Mexico (3,000 pounds).

Beef: Net sales of 12,900 MT for 2018 were down 30 percent from the previous week and 29 percent from the prior 4-week average. Increases were primarily for Japan (3,700 MT, including decreases of 1,800 MT), Hong Kong (2,700 MT, including decreases of 100 MT), Taiwan (1,800 MT, including decreases of 100 MT), Mexico (1,600 MT, including decreases of 100 MT), and South Korea (1,400 MT, including decreases of 500 MT). Reductions were reported for Chile (100 MT). Exports of 18,500 MT were up 1 percent from the previous week and 6 percent from the prior 4-week average. The primary destinations were Japan (6,800 MT), South Korea (5,100 MT), Mexico (1,800 MT), Taiwan (1,500 MT), and Canada (1,300 MT).

Pork: Net sales of 16,500 MT for 2018 were down 32 percent from the previous week, but up 15 percent from the prior 4-week average. Increases were reported for Mexico (3,900 MT), Hong Kong (2,700 MT), South Korea (2,600 MT), Canada (2,500 MT), and Japan (1,700 MT). Exports of 20,300 MT were up 38 percent from the previous week and 7 percent from the prior 4-week average. The primary destinations were Mexico (7,800 MT), Japan (3,900 MT), South Korea (1,900 MT), Canada (1,900 MT), and Australia (1,200 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.