From: Terry Reilly

Sent: Wednesday, July 11, 2018 8:37:26 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/11/18

PDF attached

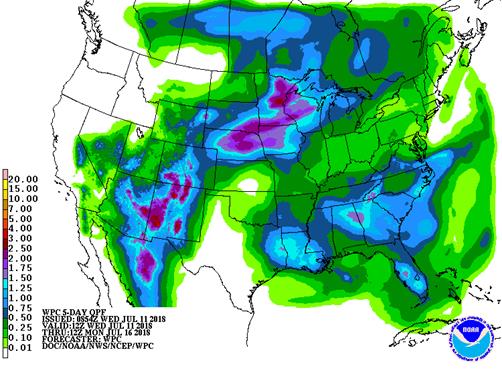

- There were no major changes to the US Midwestern weather forecast.

- The evening GFS model run in the United States increased rainfall in southern Iowa Saturday into Sunday. Amounts were also increased in western Kansas Sunday into Monday. Rainfall was decreased in week 1 in western Missouri Friday into Sunday.

- The US Midwest will see several rounds of timely rain are expected during the next two weeks, but not heavy in any locations. Some areas may receive multiple events, resulting in slowing of development.

- Temperatures will be warmer than normal across the US this week but trend cooler by the end of the week.

- For areas that receive little or no precipitation, we believe crop stress is most vulnerable across eastern Kansas into Missouri and portions of southeastern Iowa and west-central Illinois. These areas show short top soil moisture, and should be monitored over the next couple of weeks.

- Rain prospects improve for the Delta.

- Periodic rainfall and warm temperatures should be good for summer crop development for US hard red wheat.

- The Canadian Prairies will see rain early this week.

- There are no issues with Brazil second corn crop harvesting.

- Europe will continue to see net drying in parts of the northern and western growing regions, but in general weather is expected to improve this weekend into next week for many dry areas.

- Net drying is expected to persist across eastern Ukraine and in Russia’s southern, central and Volga regions.

- Australia will see an increase in net drying.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Wed-Thu Mostly dry with a few

insignificant showers

Wed-Fri 75% cvg of up to 0.75”

and local amts to 2.0”;

far south and far NW

driest

Fri-Sat 50% cvg of up to 0.65”

and local amts to 1.30”;

south and east driest

Sat-Mon 80% cvg of up to 0.75”

and local amts to 1.75”;

far NW driest

Sun-Jul 17 85% cvg of up to 0.75”

and local amts to 2.0”

Jul 17 20% cvg of up to 0.65”

and local amts to 1.35”;

central areas wettest

Jul 18 20% cvg of up to 0.65”

and local amts to 1.40”;

wettest SW

Jul 18-20 60% cvg of up to 0.75”

and local amts to 1.50”;

wettest NW

Jul 19-20 40% cvg of up to 0.35”

and local amts to 0.80”;

wettest NW

Jul 21-23 60% cvg of up to 0.50” 60% cvg of up to 0.40”

and locally more and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Wed 20-40% daily cvg of

up to 0.60” and locally

more each day;

driest north

Wed-Sun 15-35% daily cvg of

up to 0.75” and locally

more each day

Thu-Fri 5-20% daily cvg of up

to 0.30” and locally

more each day

Sat-Sun 15-35% daily cvg of

up to 0.40” and locally

more each day

Mon-Jul 17 40% cvg of up to 0.60”

and local amts to 1.30”;

wettest north

Mon-Jul 18 75% cvg of up to 0.75”

and local amts to 2.0”

Jul 18-22 5-20% daily cvg of up

to 0.30” and locally

more each day

Jul 19-22 10-25% daily cvg of

up to 0.30” and locally

more each day

Jul 23-24 10-25% daily cvg of 15-35% daily cvg of

up to 0.40” and locally up to 0.50” and locally

more each day more each day

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am

- FranceAgriMer updates cereals balance sheets

- Global Ethanol Focus conference in Singapore, final day

THURSDAY, JULY 12:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- U.S. National Weather Service’s Climate Prediction Center will release its latest forecast for El Nino, 9am

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for July, noon

- Brazil coffee exporters group Cecafe releases data on shipments in June and the prospect for exports in 2018-19 crop

- Strategie Grains publishes monthly EU grains report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: Suedzucker

FRIDAY, JULY 13:

- China’s General Administration of Customs releases preliminary commodity trade data for June, including soy and palm oil, 10pm ET Thursday (10am Beijing Friday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report for period ending July 10 on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

- Renewed China/US trade fears surfaced late Tuesday after the US president warned another $200 billion of import tariffs could soon go into place. U.S. Commerce Department released a list of Chinese goods that would be subject to new round of tariffs. https://www.bloomberg.com/news/articles/2018-07-11/you-have-a-month-to-comment-on-bull-semen-vegetable-hair-tariff

- China will retaliate.

· US stocks are lower, USD turned lower, WTI crude lower, and gold lower, at the time this was written.

· US PPI Ex Food and Energy June 0.3% M/M: (est 0.2% prev 0.3%)

· US PPI Ex Food, Energy and Trade June 0.3% M/M: (est 0.2% prev 0.1%)

· US PPI Final Demand June 3.4% Y/Y: (est 3.1% prev 3.1%)

· US PPI Ex Food and Energy 2.8% June Y/Y: (est 2.6% prev 2.4%)

· USPPI Ex Food. Energy and Trade June 2.7% Y/Y: ([rev 2.6%)

Corn.

- Corn prices are sitting at contract lows this morning. September is near a 5-month low.

- Renewed China/US trade fears surfaced late Tuesday after the US president warned another $200 billion of import tariffs could soon go into place.

- CME increased corn maintenance margins by 11 percent to $800 per contract.

- Baltic Dry Index was up 31 points to 1,586, or 2%.

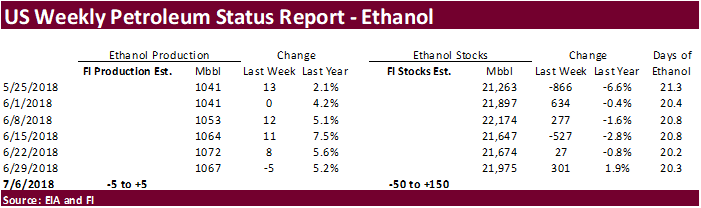

- A Bloomberg survey calls for weekly US ethanol production to average 1.065 (1.067 previous week) and stocks at 21.978 (21.975 last week).

- USDA plans to end the lockups, giving media an equal footing for access to data before they are released. Media is forbidden to share the data with the public until release time.

· USDA may increase its yield on Thursday from its current 174.0 bushels. We think they will go to 178.0 bushels.

· None reported.

· China sold about 50-51 million tons of corn this season. China will offer more corn on July 12 & 13.

Soybean complex.

· Soybeans are sharply lower on China/US trade fears and meal was mostly higher early this morning, lifting crush above $2.00. Soybean meal opened the day session near unchanged and trade lower. Soybean oil fell hard following sharp declines in Malaysian palm.

- CME increased soybean maintenance margins by 11 percent to $2050 per contract.

· Mato Grosso’s IMEA reported producers slowed sales of soybeans and corn after transportation costs increased. 2018-19 soybean sales were 21% complete at the end of June, compared with 20.8% from the previous month and 9.4% a year ago. Sales of the 2017-18 crop were 86.3%, up from 85.6% at the end of May and little changed from a year ago.

· Chinese officials are trying to keep local markets and traders calm by exercising monetary policy and issuing statements that they can handle feed use without the assistance of US soybeans. They are also careful on limiting media coverage, according to newswires.

· Cofco mentioned “China can meet any deficit in its domestic soy market should imports from the U.S. decline.”

· China September soybean futures decreased 11 yuan per ton or 0.3%, September meal was up 32 or 1.0%, China soybean oil down 40 (0.7%) and China September palm down 52 (1.1%).

· September China cash crush margins were last running at 63 cents, down a penny from the previous session, and compares to 56 cents last week and 84 a year ago.

· Rotterdam vegetable oils were lower and SA soybean meal when delivered into Rotterdam were 0.50-4.00 euros higher as of early morning CT time.

· Indonesia palm and palm kernel exports fell in May to 2.14 million tons from 2.22 million in April, and compare to 2.62 million tons in May 2017, according to GAPKI.

· Malaysia will lower its August CPO export tax to 4.5 percent from 5 percent in July.

· September Malaysian palm was 55 lower at MYR2204 and cash down $12.50 at $572.50.

· Offshore values were leading soybean oil 55 points lower and meal $0.70/short ton lower.

· NOPA is due out with the US soybean crush on Monday, July 16.

· China sold 6286 tons of soybean oil out of 49,000 tons offered at an average price of 5000 yuan per ton, or $754.19/ton, 12.5 percent of what was offered.

· China sold 171,778 tons of soybeans out of 493,000 tons offered at an average price of 2995 yuan per ton, or $449.14/ton, 35 percent of what was offered. China sold 832,302 tons of soybeans out of reserves so far, this season.

- China will offer 61,000 tons of rapeseed oil on July 17.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

· US wheat futures are on the defensive from widespread commodity selling amid China/US trade tensions.

- December Paris wheat fell 0.50 euros to 182.75 euros in early US trading hours.

- IKAR lowered 2018-19 Russia’s export forecast to 41.0 million tons from 43.2 million previously.

- Russia plans to sell 1.5 million tons of wheat reserves this marketing year.

- Black sea wheat dropped yesterday but held relative to WU. BSW SEP fell 1.50 Euro now back at 214.75 down only $1.75/MT from the recent range high while WU has fallen $12/MT. (MPI)

- Net drying is expected to persist across eastern Ukraine and in Russia’s southern, central and Volga regions.

- Japan in a SBS import tender bought 130 tons of barley for arrival by December 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 18 for arrival by December 28.

· Jordan passed 120,000 tons of barley for Oct/Nov shipment.

- China sold 6,000 tons of 2013 imported wheat from state reserves at auction at an average price of 2322 yuan/per ton or $348.07/ton, 0.3 percent of what was offered.

· Japan seeks 62,865 tons of milling wheat this week. (Reuters)

Details are as follows (in tons):

COUNTRY TYPE QUANTITY

U.S. Western White 17,177 *

U.S. Dark Northern Spring (protein minimum 14.0%) 11,353 *

Australia Standard White (West Australia) 34,335 *

Shipments: * Loading between Sept. 1 and Sept. 30, 2018

· Mauritius seeks 6,000 tons of white rice on July 13 for Sep 1-Nov 30 shipment.

· Jordan seeks 120,000 tons of wheat on July 19 for Oct-Nov shipment.

Rice/Other

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.