From: Terry Reilly

Sent: Monday, July 16, 2018 8:48:45 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/16/18

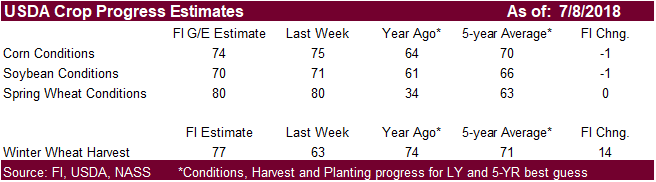

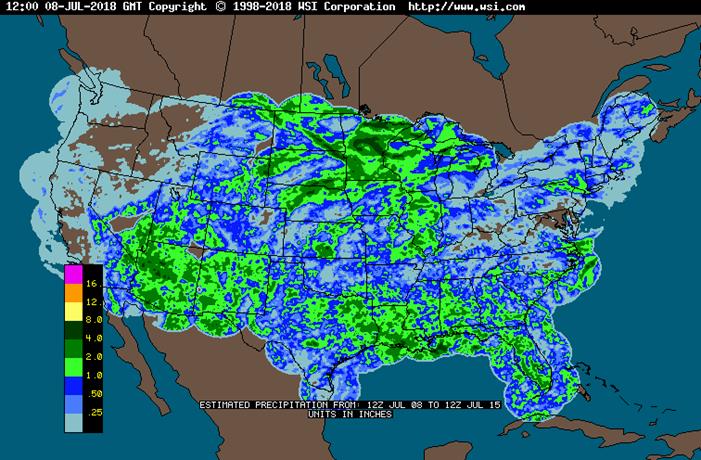

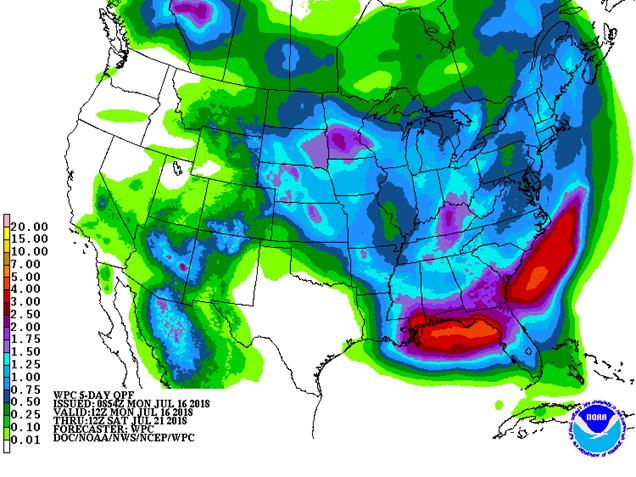

· Rain over the weekend was about as expected and cooling will start to set in after warm Monday temperatures. Nighttime low temperatures will be down into the 50s and 60s during mid-week, lasting through July 26. The southern U.S. Plains and lower Delta will remain hot during this period.

· Several waves of rain are forecast across the northern and central Plains, Midwest, Delta and southeastern states through July 31.

· The U.S. Pacific northwest and northwestern U.S. Plains will be dry or mostly dry during the next ten days

· Net drying will continue across the southwestern Corn Belt and the southern Plains.

· The Delta and southeastern states will see a mix of rain and sunshine.

· The northwestern Plains will see an increase of net drying.

· We are hearing lack of corn tasseling across WI. Feedback is welcome.

· The Canada Prairies will see net drying across the southern crop areas. Western and northern Alberta will be wettest.

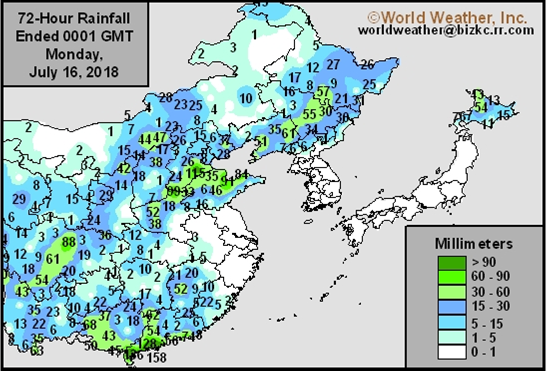

· East-central China will continue to see net drying this week but the Northeast Provinces will improve with rain.

· Frequent rain will fall from eastern Europe through the western CIS this week.

· Western Europe will trend wetter this week.

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

MONDAY, JULY 16:

- Japan on holiday; no rubber trading on Tokyo Commodity Exchange

- Cargo surveyors AmSpec and Intertek release their respective data on Malaysia’s July 1-15 palm oil exports, 11pm ET Sunday (11am Kuala Lumpur Monday); SGS data during same period, 3am ET Monday (3pm local time Monday)

- European Cocoa Association 2Q cocoa grind data, 2am ET (7am London)

- German Confectionery Industry 2Q cocoa grind data, 2am ET (7am London)

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- EU weekly grain, oilseed import and export data

- Ivory Coast weekly cocoa arrivals

TUESDAY, JULY 17:

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

WEDNESDAY, JULY 18:

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, JULY 19:

- Nicaragua on holiday

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for June, 3pm

- National Confectioners Association North America 2Q cocoa grind, ~4pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JULY 20:

- Colombia on holiday

- Cocoa Association of Asia is set to release 2Q cocoa grind data

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA milk production for June, 3pm

- USDA cattle on feed for June, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

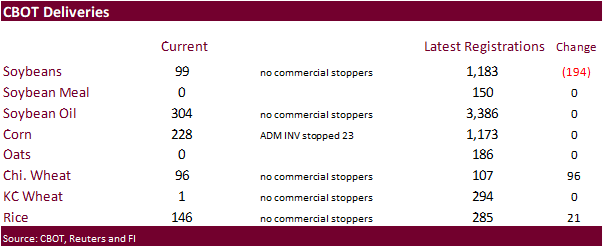

· Chicago wheat up 96 to 107

· Rice up 21 to 285

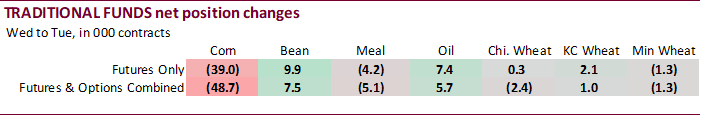

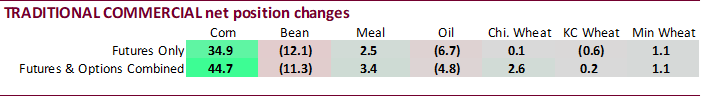

· Traditional funds for the futures and options position only, sold off more corn than the trade estimated, by 23,100 contracts to net long 109,300 contracts (sold net 39,000 from the previous week). In futures and options, funds in corn unloaded 48,700 contracts, going negative for the first time since early February.

· The traditional funds for futures and options combined are now short in corn, oats, soybeans, soybean meal and Minneapolis wheat.

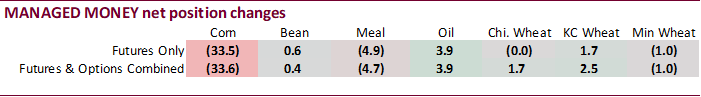

· Funds during the week ending July 10 bought more soybean contracts than expected.

· Money managers were also busy selling corn and a little meal.

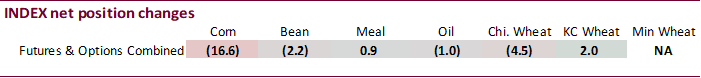

· Index funds sold off 16,600 contracts of corn.

· US stocks are mixed, USD lower, WTI crude sharply lower, and gold slightly, at the time this was written.

Corn.

- Corn prices are higher following soybeans. A non-threatening US weather forecast is limiting gains. WTI crude is under a good amount of pressure. USD is lower.

- News is light.

· We are hearing lack of corn tasseling across WI. Feedback is welcome.

· South Korea’s FLC bought 66,000 tons of optional origin corn at $203.99/ton c&f for arrival around December 25. Last week MFG, KFA and NOFI bought corn.

· China sold about 52-53 million tons of corn out of reserves this season.

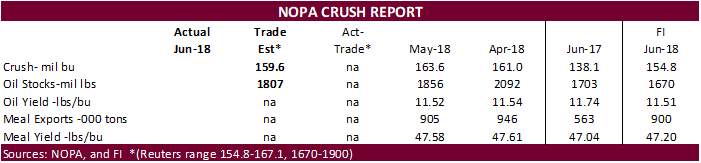

Soybean complex.

· Soybean futures opened higher and rallied by nearly 10 cents, along with soybean meal up $4.50-$5.50. Soybean oil is under pressure from lower WTI crude oil.

· The rally in soybeans was thought to be weather related, and selected field reports (northwestern IA) showing poor crops in low lying areas.

· August CBOT crush was sitting at 206.75.

· China September soybean futures decreased 14 yuan per ton or 0.4%, September meal was down 18 or 0.6%, China soybean oil down 36 (0.7%) and China September palm down 10 (0.2%).

· September China cash crush margins were last running at 36 cents, down from 39 cents last week and 78 a year ago.

· Rotterdam vegetable oils were lower and SA soybean meal when delivered into Rotterdam were unchanged to lower as of early morning CT time.

· Cargo surveyor SGS reported July 1-15 Malaysian palm exports at 454,524 tons, down 43,748 tons or 9% from the same period a month ago and down 161,147 tons from the same period a year ago (26% decrease). AmSec shows a 2.7% decrease at 486,609 tons.

· September Malaysian palm was 19 higher at MYR2166 and cash unchanged $558.75.

· India imported 1.8% less palm oil in June from May, at 487,147 tons, a 4-1/2-year low (lowest volume since February 2014). Crude palm oil import tax was lifted to 44 percent in March from 30 percent and refined tax to 54 percent from 40 percent.

· Offshore values were leading soybean oil 31 points higher and meal $3.40/short ton higher.

· Safras & Mercado estimated the 2018-19 soybean planted area to increase 2.3 percent from 2017-18. We were looking for the area to increase 3.2 percent.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

- China will offer 61,000 tons of rapeseed oil on July 17.

· China sold 832,302 tons of soybeans out of reserves so far, this season.

- Results awaited: Iran seeks 30,000 tons of sunflower oil on July 10.

- Results awaited: Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

· US wheat futures are lower on improving global weather.

· Problems for major producing countries still exist.

· Agritel pegged the German wheat crop at 21.5 million tons, down 12 percent from a 2017 and 16 percent below a 5-year average.

· Saudi Arabia bought 625,000 (595,000 tons sought) of wheat at an average $256.57/ton C&F.

· Results awaited: Saudi Arabia seeks 1,740,000 million tons of fodder barley during the period September-October 2018.

- China sold 1,709 tons of imported wheat from state reserves at auction at an average price of 1709 yuan/per ton or $360.45/ton, 0.09 percent of what was offered.

· Jordan seeks 120,000 tons of barley for Oct/Nov shipment on July 17.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 18 for arrival by December 28.

· Jordan seeks 120,000 tons of wheat on July 19 for Oct-Nov shipment.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

Rice/Other

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

- Thailand seeks to sell 120,000 tons of raw sugar on July 18.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.