From: Terry Reilly

Sent: Wednesday, July 18, 2018 8:15:36 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/18/18

PDF attached

Under the 24-hour announcement system, US exporters reported the sales of 199,500 tons of soybeans for delivery to Pakistan during the 2018/2019 marketing year.

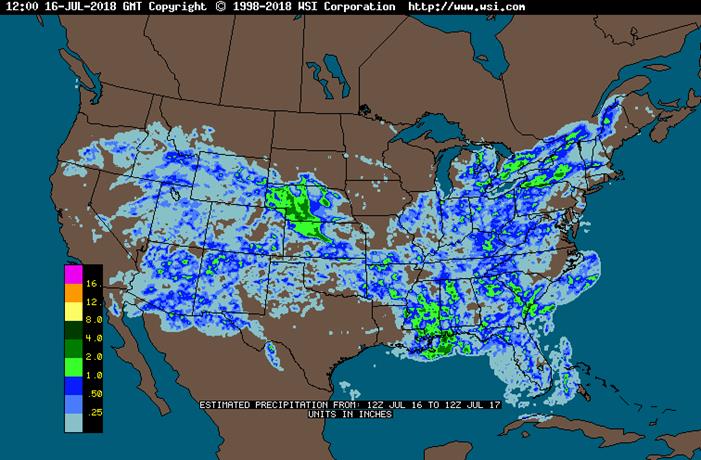

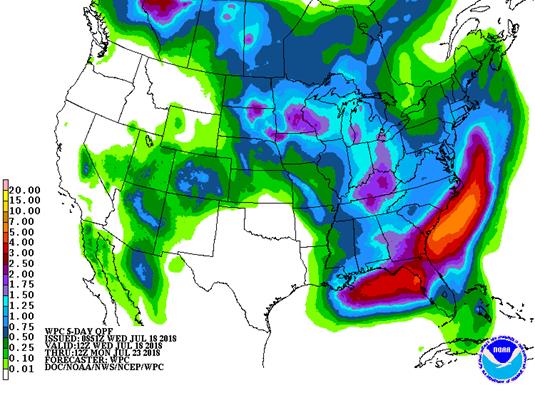

· Several waves of rain are forecast across the northern and central Plains, Midwest, Delta and southeastern states through July 31.

· The U.S. Pacific northwest and northwestern U.S. Plains will be dry or mostly dry during the next ten days

· Net drying will continue across the southwestern Corn Belt and the southern Plains.

· The Delta and southeastern states will see a mix of rain and sunshine.

· The northwestern Plains will see an increase of net drying.

· We are hearing lack of corn tasseling across WI. Feedback is welcome.

· The Canada Prairies will see net drying across the southern crop areas. Western and northern Alberta will be wettest.

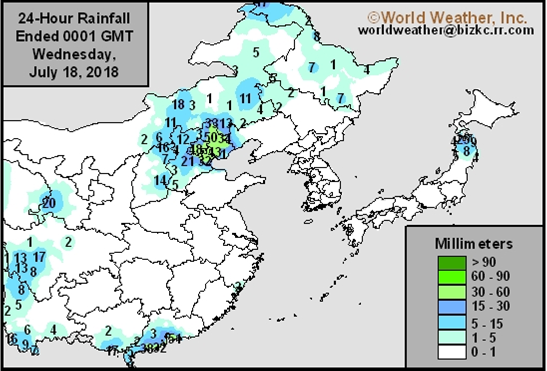

· East-central China will continue to see net drying this week but the Northeast Provinces will improve with rain.

· Frequent rain will fall from eastern Europe through the western CIS this week.

· Western Europe will trend wetter this week.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Wed Up to 15% daily cvg of

up to 0.20” and locally

more each day; wettest

east; some days may be

dry

Wed-Fri 85% cvg of up to 0.75”

and local amts to 1.50”

with a few bands of

1.50-3.30”; far SE and

far NW driest

Thu-Sat 90% cvg of up to 0.75”

and local amts over 2.0”;

driest SW

Sat 15% cvg of up to 0.15”

and locally more; east

Wisc. wettest

Sun-Mon 55% cvg of up to 0.50” 15-35% daily cvg of

and local amts to 1.10”; up to 0.35” and locally

wettest NW more each day;

wettest east

Jul 24-25 5-15% daily cvg of up 40% cvg of up to 0.30”

to 0.20” and locally and locally more;

more each day north and east wettest

Jul 26 15% cvg of up to 0.20”

and locally more

Jul 26-28 55% cvg of up to 0.50”

and locally more

Jul 27-29 60% cvg of up to 0.50”

and locally more

Jul 29-31 5-20% daily cvg of up

to 0.25” and locally

more each day

Jul 30-31 10-25% daily cvg of

up to 0.25” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Wed 65% cvg of up to 0.35” 55% cvg of up to 0.75”

and local amts to 0.75”; and local amts to 2.0”;

far north and far south wettest south

driest

Thu 30% cvg of up to 0.75”

and local amts to 2.0”;

wettest SE

Thu-Fri 5-20% daily cvg of up

to 0.25” and locally

more each day;

wettest north

Fri-Sat 75% cvg of up to 0.75”

and local amts to 1.75”

Sat-Mon Up to 15% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sun-Mon 10-25% daily cvg of

up to 0.35” and locally

more each day; Va.

and Carolinas wettest

Jul 24-25 40% cvg of up to 0.40”

and local amts to 1.0”

Jul 24-26 60% cvg of up to 0.75”

and local amts to 1.50”;

wettest NE

Jul 26 15% cvg of up to 0.25”

and locally more

Jul 27-31 10-25% daily cvg of 15-35% daily cvg of

up to 0.35” and locally up to 0.60” and locally

more each day more each day

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

WEDNESDAY, JULY 18:

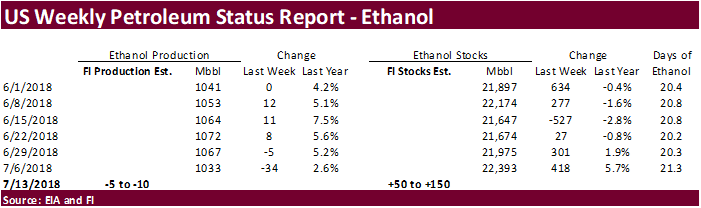

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, JULY 19:

- Nicaragua on holiday

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for June, 3pm

- National Confectioners Association North America 2Q cocoa grind, ~4pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JULY 20:

- Colombia on holiday

- Cocoa Association of Asia is set to release 2Q cocoa grind data

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA milk production for June, 3pm

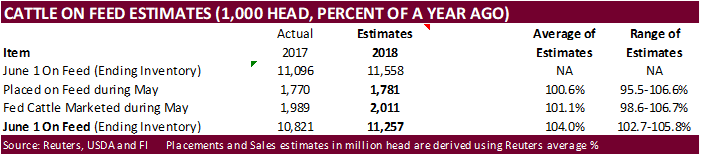

- USDA cattle on feed for June, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

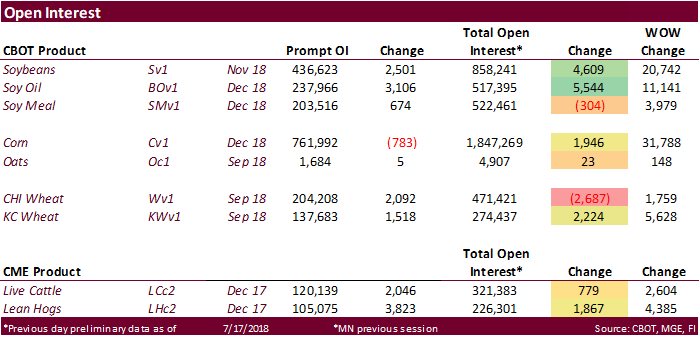

· Soybeans down 86 to 1001 (86 out of Utica)

· Corn down 22 to 1151 (Ottawa, IL – ADM)

· Rice down 129 to 85 (125 out of Jonesboro and 4 out of Otwell)

· KC Wheat down 20 to 274 (Wichita – Gav.)

· US stocks are mixed, USD higher, WTI crude lower, and gold higher, at the time this was written.

Corn.

- Corn prices are trading higher on follow through buying.

- Baltic Dry Index was 33 points lower to 1,688, or 1.9%.

- The French corn crop could start harvest season a couple week earlier this year (mid-Aug).

· A Bloomberg survey calls for weekly ethanol production to increase 16k/barrels per day and stocks to decline 74,000.

· The USDA Cattle on Feed report will be released on Friday.

· South Korea’s KOCOPIA Group bought 60,000 tons if US corn at $211.47/ton c&f for arrival around November 20.

· China sold about 52-53 million tons of corn out of reserves this season.

Soybean complex.

· Soybean prices continued to rebound after nearly hitting a decade low. Meal and oil are higher on technical buying.

· China September soybean futures decreased 2 yuan per ton or 0.1%, September meal was up 6 or 0.2%, China soybean oil up 14 (0.3%) and China September palm up 10 (0.2%).

· September China cash crush margins were last running at 41 cents, up from 40 previous session, and compares to 39 cents last week and 78 a year ago.

· Rotterdam vegetable oils were higher and SA soybean meal lower when supplied from SA, as of early morning CT time.

· It’s starting to get a little too dry across SE Asian palm growing regions.

· September Malaysian palm was 40 higher at MYR2211, a one-week high, and cash up $5.00 at $572.50/ton.

· Offshore values were leading soybean oil 4 points lower and meal $1.10/short ton lower.

- Under the 24-hour announcement system, US exporters reported the sales of 199,500 tons of soybeans for delivery to Pakistan during the 2018/2019 marketing year.

- China sold 140,068 of 2013 soybeans at an average price of 2993 yuan per ton, or $446.57/ton, 28 percent of the total.

· China sold 972,370 tons of soybeans out of reserves so far, this season.

· China failed to sell 56,611 tons of soybean oil out of state reserves.

- The CCC seeks 12,500 tons of soybean meal for Honduras, opened until July 18, for early October shipment.

- Results awaited: Iran seeks 30,000 tons of sunflower oil on July 10.

- Results awaited: Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

· All three US wheat markets were higher in early trading. Chicago wheat futures hit the $5.05/bu mark for the first time since July 10, before pairing gains.

· Egypt approved to import 120,000 tons of wheat from AOS and Union, two main supplies, bypassing the GASC. This might be in effort to make up for cargoes that were previous rejected/cancelled. Details were lacking.

· German farming association DBV lowered its estimate of the German winter barley crop by 700,000 tons to 7.3 million tons from early July, down from 9.0 million tons harvested in 2017. Yields were forecast at 6 tons/hectare versus 7.4 tons in 2017. The association could not determine winter rapeseed or winter wheat production as information lacked, but noted the harvest started 2-3 weeks early because of dry conditions, and crop sizes will be significantly lower.

· Egypt approved to import 120,000 tons of wheat from AOS and Union, two main supplies, bypassing the GASC. This might be in effort to make up for cargoes that were previous rejected/cancelled. Details were lacking.

- Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

- Japan in a SBS import tender passed on 120,000 tons of feed wheat and 200,000 tons of barley for arrival by December 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 25 for arrival by December 28.

- China sold 6858 tons of 2013 imported wheat from state reserves at auction at an average price of 2235 yuan/per ton or $332.90/ton, 0.4 percent of what was offered.

- Japan seeks 57,914 tons of US food wheat on Thursday for September loading.

· Jordan seeks 120,000 tons of wheat on July 19 for Oct-Nov shipment.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

Rice/Other

- Egypt plans to import 500,000-700,000 tons of rice paddy over the next year.

- Results awaited: Thailand seeks to sell 120,000 tons of raw sugar on July 18.

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.