From: Terry Reilly

Sent: Monday, July 23, 2018 8:08:56 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/23/18

PDF attached

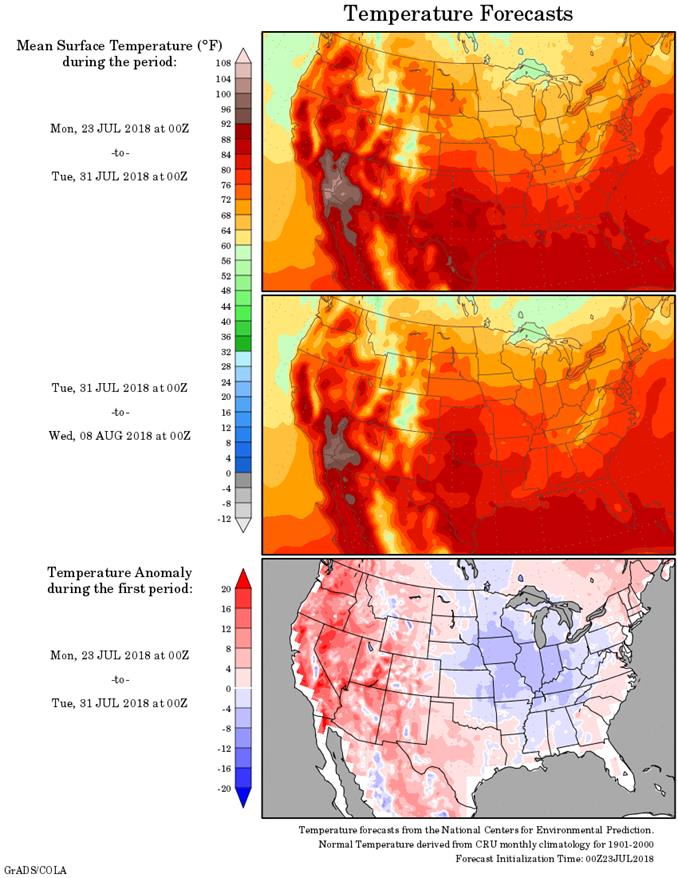

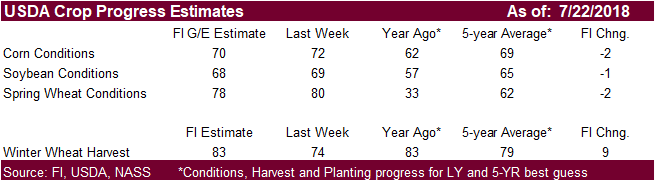

· We are thinking of 2-point decrease in spring wheat conditions after hot and dry weather set in across the PNW. Note the drought monitor shows drought conditions expanding across the Pacific Northwest.

· G/E US corn conditions could decline 2 and soybeans down one.

· The ridge of high pressure is expected to stay centered over the southwestern United States throughout this week, creating a northwesterly flow aloft in the central U.S., Northern Plains and Corn Belt.

· It was hot across the US southwest over the weekend.

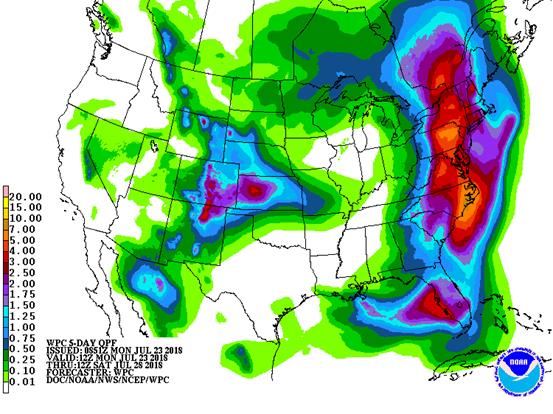

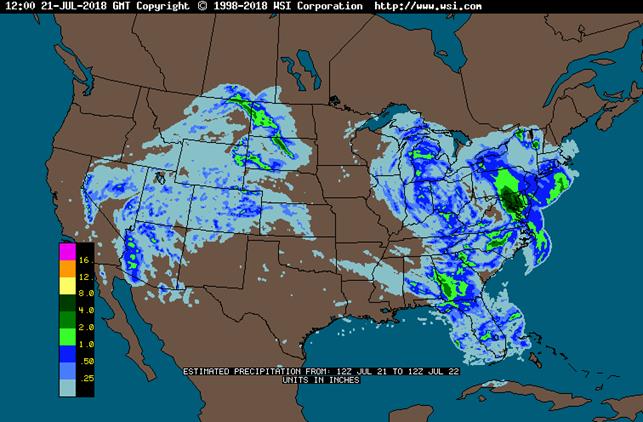

· Rainfall across the Midwest over the weekend was restricted to the ECB and western Dakotas. Dry or mostly dry weather occurred in much of Illinois, western Indiana, western Kentucky, western Tennessee and from much of Missouri through Iowa to western and southern Minnesota and the eastern Dakotas.

· The western Corn Belt will see net dry this week. The eastern Midwest will see rain.

· U.S. weather late this week through the weekend will be wettest from the central Plains into the lower Ohio River Valley and far northern Delta.

WORLD WEATHER AREAS OF GREATEST INTEREST THIS WEEK

· Northern Europe dryness is not likely change much

· Eastern Europe and the western CIS will see frequent rain maintaining concern over unharvested small grain quality

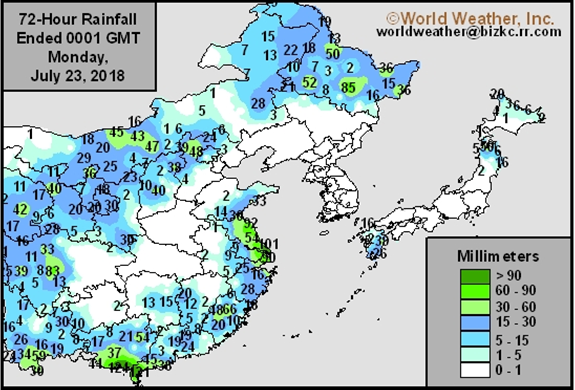

· Interior eastern and some central China areas will be drying out this week while Tropical Storm Ampil produces heavy rain from Jiangsu through western Shandong and Hebei to parts of the Northeast Provinces

· East-central Australia drought will remain unchanged, despite a few showers

· U.S. Midwest weather will be mild to cool, but net drying is still expected in the central and western Corn Belt through mid-week and in central and northwestern areas late this week into early next week

· Southern U.S. Plains livestock and crops will get relief from heat this week, but not much rain expected

· Key Texas crop areas will stay dry this week, but some rain in West Texas

· SW Canada Prairies, northwestern U.S. Plains and U.S. Pacific Northwest will stay drier and warmer biased through the next week

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- China scheduled to release June commodities trade data, including imports of palm oil, cotton, corn, wheat, sugar, 2:30am ET (2:30pm Beijing)

- NOTE: China will skip some data, including country breakdown details

- EU weekly grain, oilseed import and export data, 10am (3pm London)

- EU’s monthly (MARS) report on European crop progress and weather conditions, with scorching heat already ruining the grain harvest

- USDA weekly corn, soybean, wheat export inspections, 11am

- U.S. cold storage report for June, 3pm

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

- Datagro hosts Global Agribusiness Forum, Sao Paulo, 1st day of 2. Speakers include Brazilian Agriculture Minister Blairo Maggi, executives from Minerva, John Deere, Copersucar and Cofco

TUESDAY, JULY 24:

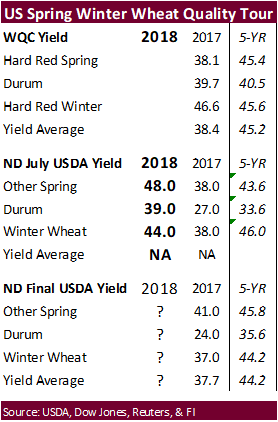

- Wheat Quality Council’s U.S. spring wheat crop tour begins in North Dakota, with final data expected Thursday

- Grain World crop tour in Canada hosted by FarmLink begins in Manitoba, Saskatchewan and Alberta, with final data for spring wheat, canola, durum and pulses expected Thursday

- Allendale holds webinar on weather outlook, 3pm ET (2pm CST)

- Datagro’s Global Agribusiness Forum in Sao Paulo, final day

WEDNESDAY, JULY 25:

- Costa Rica public holiday; Pakistan holds general election

- Cargo surveyors AmSpec, Intertek to release data on Malaysia’s July 1-25 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday); SGS data for same period, 3am ET Wednesday (3pm local time Wednesday)

- EIA U.S. weekly ethanol inventories, output, 10:30am

- Allendale holds webinar on grains and oilseeds, 3pm ET (2pm CST)

- U.S. poultry slaughter June, 3pm

- Wheat Quality Council’s U.S. spring wheat crop tour, 2nd day

- Grain World crop tour in Canada, 2nd day

- EARNINGS: Coca-Cola

THURSDAY, JULY 26:

- Intl Grains Council monthly grains report, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Allendale holds webinar on livestock outlook, 3pm ET (2pm CST)

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Wheat Quality Council’s U.S. spring wheat crop tour, 3rd day

- Grain World crop tour in Canada, final day

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- World Trade Organization holds a General Council meeting that will last through July 27 to cover issues related to the U.S.-China trade conflict

- EARNINGS: Nestle SA, Anheuser-Busch Inbev, Diageo Plc

FRIDAY, JULY 27:

- Thailand, Peru public holidays

- G20 Agriculture ministers meet in Buenos Aires

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

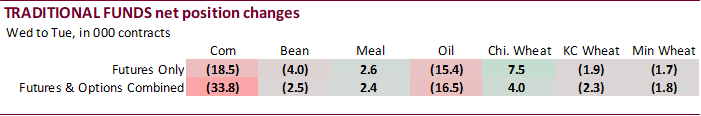

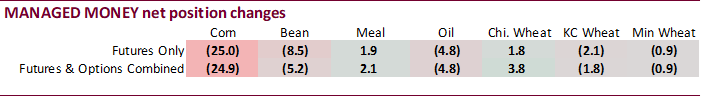

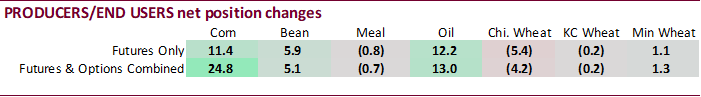

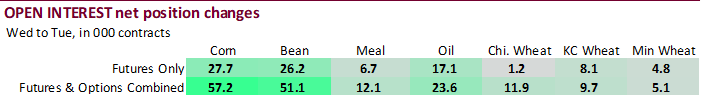

· The net short position in soybean oil futures and options combined was a record 61,621 contracts as of July 17.

· Traditional funds were about 21,500 contracts less long than expected in corn and 5,100 contracts more long in soybeans.

· Traditional funds were net sellers of 33,800 contracts in corn futures and options, while they sold 18,500 futures only contracts. Funds were also good sellers in soybean oil.

· Money managers were active sellers of corn and soybeans.

· US stocks are lower, USD lower, WTI crude higher, and gold lower, at the time this was written.

Corn.

- Corn is higher following wheat.

· EU’s crop monitoring service (MARS) increased its 2018 corn yield to 7.64 tons/hectare from 7.35 last month.

· China plans to inspect all of its grain reserve facilities through October 2019 to update volume and quality figures.

· China imported 450,000 tons of sorghum in June, up from 324,301 tons last year and down from 470,000 tons in May. Jan-June sorghum imports of 3.25 million tons were up 8.7 percent from a year ago.

· China imported 520,000 tons of corn in June, down from 760,000 tons in May but up 35 percent from June 2017. Jan-June corn imports were 2.21 million tons, about three times greater than the same period a year ago.

· China imported 98,566 tons of pork in June.

- Baltic Dry Index was 29 points higher to 1,718, or 1.7%.

· China sold about 55.6 million tons of corn out of reserves this season.

Soybean complex.

· The soybean complex is expected to open near unchanged but don’t discount a higher trade on a forecast calling for net drying across the WCB and northern Delta this week.

· Under the 24-hour reporting system, US exporters reported the cancelation of 165,000 tons of soybeans for new-crop delivery. We are not totally sure, but this could be the first new-crop soybean cancellation by China.

· EU’s crop monitoring service (MARS) decreased its 2018 rapeseed yield to 2.89 tons/hectare from 3.05 last month.

· President Trump plans to visit Dubuque, IA on Thursday.

· Chinese soybean crusher Shandong Sunrise Group has filed for bankruptcy. They were unable to repay debts.

· Reuters noted China soybean crushers in Shandong were losing nearly 50 yuan ($7.40) per ton, via Shanghai JC Intelligence.

· China September soybean futures decreased 11 yuan per ton or 0.3%, September meal was up 3 or 0.1%, China soybean oil up 14 (0.2%) and China September palm up 10 (0.2%).

· September China cash crush margins were last running at 45 cents/bu, and compares to 46 cents last week and 71 cents a year ago.

· Rotterdam vegetable oils were mixed and SA soybean meal mostly lower, as of early morning CT time.

· September Malaysian palm was 25 lower at MYR2169, and cash down $5.00 at $565.00/ton.

· There is talk palm oil production will increase over the next few weeks.

· Offshore values were leading soybean oil 30 points lower and meal $0.60/short ton higher.

· We last heard IL soybean oil at 75 under, East option, West 100 under, Southwest 25 over and Gulf nominal 230 over. Brazil degummed nominal 205 over and Argentina degummed 200 over, fob.

· Safras estimated 2019-20 (Feb-Jan) Brazil soybean exports at 75 million tons, up from estimated 74.5 million in 2018-19. They have a record 120-million-ton production for next season.

· Under the 24-hour reporting system, US exporters reported the cancelation of 165,000 tons of soybeans for new-crop delivery. We are not totally sure, but this could be the first new-crop soybean cancellation by China.

- Pakistan bought 360,000 tons of US and/or Brazil soybeans over the past couple weeks, bringing purchases to 600,000 tons over the past month. They have been buying for October through March shipment.

- Last week the CCC bought 12,500 tons of soybean meal for Honduras for Oct 1-10 shipment at $402.89/ton fob.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

- Iran seeks 30,000 tons of soybean oil on August 1.

· China sold 972,370 tons of soybeans out of reserves so far, this season.

· US wheat is higher on fund buying amid higher global wheat cash prices and higher Paris futures (+1.25 euros as of early this morning-CT).

· EU’s crop monitoring service (MARS) decreased its 2018 soft wheat yield to 5.82 tons/hectare from 6.04 last month. They lowered barley to 4.74 from 4.98 and increased corn to 7.64 from 7.35 last month.

· Russia is about 19 percent harvested, above last year’s pace. Yields are coming in below a year ago.

· Russia wheat export prices were up last week.

· IKAR noted Black Sea prices for Russian wheat with 12.5 percent protein content for delivery in August were $211 per ton fob, up $11.50 from a week earlier. SovEcon reported Black Sea FOB prices for wheat were at $207.5 a ton, up $9.50. Russian barley prices increased $13.00 to $203.5 per ton. Russia’s central regions has seen poor growing conditions this year.

· China imported 310,000 tons of wheat in June, down 33.6 percent from a year ago. Jan-Jun wheat imports were 1.95 million tons, down 26.4 percent from the same period a year ago.

· China imported 590,000 tons of barley in June, down 5.6 percent from a year ago. Jan-June barley imports were 4.4 million tons, down 2.7 percent.

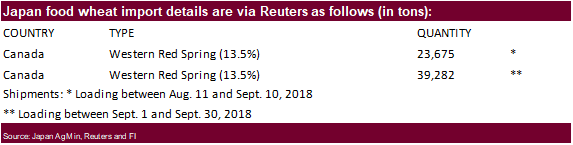

· Japan dropped its ban on Canadian wheat.

· US harvesting activity is advancing north with active CO, NE, and SD posting higher protein levels than a year ago. MT harvesting is just getting started. Plains Grains, Inc. said out of 293 HRW samples, average protein came in at 12.8 percent, above 11.4 for 2017, and test weights at 60.3 pounds/bu, below 60.8 last year.

- On Tuesday the Wheat Quality Council’s U.S. spring wheat crop tour begins in North Dakota. Results are due out Thursday.

Export Developments.

· Iraq seeks 50,000 tons of US, Canadian, and/or Australian wheat on July 29, valid until August 2.

· Japan is back in the market for 62,957 tons of food wheat, all from Canada, on Thursday.

· Jordan seeks 120,000 tons of wheat on July 26 for Sep-Nov shipment.

· Jordan seeks 120,000 tons of barley on July 24.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 25 for arrival by December 28.

- Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

Rice/Other

- China sold 60,174 tons of rice out of auction at an average price of 2621 yuan per tons ($387.50/ton), 6 percent of what was offered.

- Results awaited: Thailand seeks to sell 120,000 tons of raw sugar on July 18.

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.