From: Terry Reilly

Sent: Monday, July 30, 2018 9:38:46 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/30/18

PDF attached

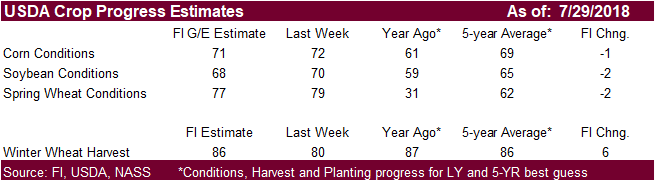

· We look for US corn and soybean conditions to be unchanged to down 1, and spring wheat ratings to slip 2 points in the combined G/E categories.

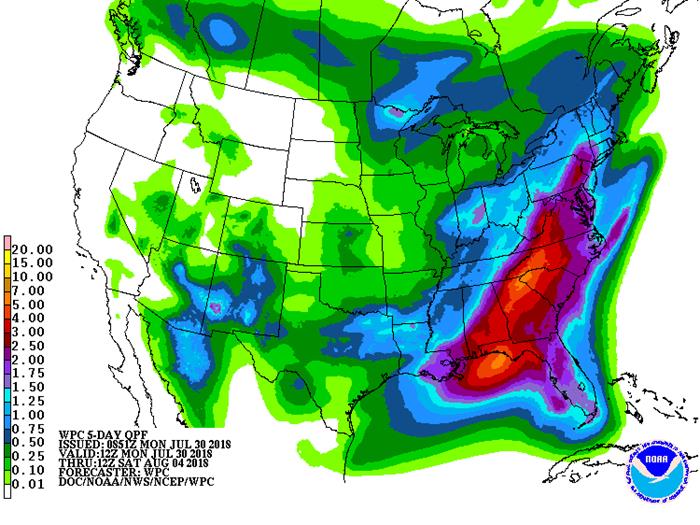

· One US main feature to keep an eye on is a ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

· Rainfall between now and August 5 for the Midwest will be very important.

· The US weather outlook is all not that bad. There will be some ongoing dry pockets across the western US and temperatures warn across the WBC this week. Rest of the Midwestern growing areas will see cool temperatures, which should slow evaporation rates.

· Europe’s weather will improve this week but much of the damage is done.

· Southern Russia and parts of Ukraine improved over the past week. Some areas will return to net drying.

· Australia’s canola crop will continue to see crop stress across New South Wales. There is an opportunity for rain across northern New South Wales this week but it will not be widespread enough to ease drought conditions.

· China’s weather improved late last week and conditions will overall be favorable.

· Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

· Net drying in the US PNW will add stress to the spring wheat crop.

WORLD WEATHER AREAS OF GREATEST INTEREST THIS WEEK

• Typhoon Jongdari reached central Honshu, Japan Saturday

• The storm reached the coast near Toba, Japan at 1400 GMT Saturday as a Category One hurricane equivalent storm, but was quickly downgraded to tropical storm status

• Since landfall the storm center moved through most of western Honshu and passed through northern Kyushu early today. Most of the storm’s convection was quickly stripped away from the storm center reducing rainfall

• No serious flooding has likely occurred away from the coast near Toba and wind speeds were at tropical storm force during much of its movement through western Honshu and Kyushu

• Damage from the storm was kept low, although reports from the event are still filtering in

• The storm will bring down temperatures after a week of sizzling heat

• Mid-July floods killed 200 people and this storm mostly likely did not add to that situation.

• Tropical Depression Jongdari was located over northwestern Kyushu, Japan earlier today and was expected to drift into open water in the East China Sea where it is expected to dissipate

• Southern Oscillation Index (SOI) rose additionally during the weekend lending more support for possible better August rainfall in eastern Australia

• Japan will resume its drier and warmer biased pattern of late this week, but temperatures will not be as hot in the west as they have been

• No active Tropical Cyclones were present in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico today and none were expected in the next five days

• Europe will experience an erratic rainfall pattern this week with net drying still a concern

• Temperatures will be well above average, but perhaps not quite as hot as far north this week as late last week

• Showers are expected to impact many areas during the next seven days with 0.20 to 0.75 inch and a few totals over 1.00 inch possible which will help to curb the heat and offer pockets of temporary dryness relief

• Europe received scattered showers and thunderstorms during the weekend with the United Kingdom, France, parts of Germany and Scandinavia receiving 0.15 inch to 0.39 inch with local totals to 1.50 inches

• Relief from dryness was noted in many areas, but no general soaking took place to end long term dryness

• Showers this week will continue offering pockets of relief, but a general soaking will elude the region.

• Europe highest temperatures Friday and Saturday were in the 80s and 90s Fahrenheit from Spain to Scandinavia with Friday hottest

• Highs in the U.K. were mostly in the 70s

• Waves of rain will continue to impact parts of Poland, western Ukraine and parts of Belarus this week keeping fieldwork slow and some pressure on the quality of unharvesting winter crops

• Rain is expected to return to western Russia next weekend and continue daily next week

• Drying until then will favor a short term bout of improvement for winter crop maturation and harvesting

• The environment will also be good for early 2019 small grain planting that begins in early August

• Cold air may settle into the eastern Russia New Lands – mostly west Siberia later this week that may induce some frost or a couple of brief light freezes

• The airmass has time to moderate

• Cool weather will occur from mid-week this week into early next week

• Thursday and Friday will be coldest

• Otherwise the CIS New Lands will receive brief periods of rain and sunshine over the next two weeks maintaining a mostly favorable crop development environment

• Some drying is going to be needed later in August to support spring wheat maturation and harvest progress

• Warm weather is expected west of the Ural Mountain region

• Drought from eastern Ukraine to Kazakhstan will remain even though there has been some relief this month

• Rainfall in the next two weeks will occur erratically and lightly leaving most of the moisture deficits in place

• However, crop stress will not be nearly what it was earlier this summer and crop conditions have likely improved slightly and may continue to improve in those areas that have received rain or in those areas that will get a few showers this week

• Temperatures will remain warmer than usual, but not excessively hot

• Northern and central Russia New Lands region weather trended cooler during the weekend and a few light showers were noted

• Rainfall was no more than 0.75 inch with most areas getting less than 0.30 inch

• High temperatures cooled to the 60s Fahrenheit in the northern New Lands while 80s and 90s occurred in the central and south

• A few thunderstorms occurred in western Russia, central and western Ukraine and Belarus with one report of locally heavy rain

• Eastern China rainfall distribution will be better over the next two weeks than that advertised late last week

• Timely rain will impact many crop areas, although net drying is expected in areas from Gansu and northern Shaanxi into western Inner Mongolia crop areas

• Some of the rain expected in east-central China may still have a tough time countering evaporation and some net drying may continue for a while in this first week of the outlook, but next week may be wetter

• Rainfall will be near to above average from Sichuan to Yunnan and Guangxi and near normal in the far southeast while near to below average in most other areas except Heilongjiang where rainfall will be close normal in northern and eastern production areas

• China rainfall during the weekend was greatest from Sichuan to Shandong where locally heavy amounts occurred resulting in rainfall of 2.25 to nearly 6.00 inches

• Most areas reported 0.65 to 1.50 inches

• Net drying occurred elsewhere in eastern China

• Temperatures were warm with highs in the 80s and 90s nationwide

• East-central Australia rainfall expectations late this week and into the weekend are unchanged from World Weather, Inc.’s perspective, but the GFS model rainfall expectations were reduced after being a little overly zealous on rainfall late last week

• Rainfall of 0.10 to 0.50 inch will impact parts of Queensland and northern New South Wales Friday into the weekend with a few greater amounts in southeastern Queensland near the coast

• Not much follow up rain is advertised

• Western and southern Australia will continue to experience favorable conditions for wheat, barley and canola

• Australia weekend rainfall developed in New South Wales, but amounts through dawn Sunday were rarely more than 0.25 inch in key crop areas

• Queensland was left mostly dry as were South Australia and much of Western Australia away from the coast

• Temperatures were mild to cool

• India rainfall will be well below average in most of western and southern India for the next week to ten days

• Totally dry weather is not likely, but the rain that falls will be erratic and light – unlikely to counter evaporation for the entire period leading to net drying

• Pockets of crop stress are likely this week as soil moisture steadily declines in the driest areas

• Rain will be very important later in August to ensure favorable production potentials

• Most of India’s summer crops are in favorable condition today

• Recent rain in the east has improved soil moisture and reduced rainfall deficits for the season

• This process will continue this week as eastern areas continue favorably wet

• India weekend rainfall was greatest near and northeast of the Ganges River Basin where local totals for 0.40 to 2.50 inches with local totals over 4.00 inches

• Some relief from dryness in Bihar occurred with one location getting more than 6.00 inches

• U.S. crop weather will continue favorably mixed over this coming week

• U.S. temperatures this week will be seasonable with a slight cooler than usual bias early this week and warmer bias at the end of the week and into the weekend

• Hot weather is advertised for the Plains and a part of the far western Corn Belt for a while next week

• Highs in the 90s are expected in the western Corn Belt while 90s and extremes above 100 occur in the central and southern Plains

• U.S. rain frequency and amounts will decrease next week as warmer weather evolves

• U.S. weekend precipitation….

• Was greatest in the central Plains where Nebraska, Kansas, Colorado and northern Oklahoma had widespread precipitation with varying amounts of rain

• Amounts ranged from 1.00 to more than 3.00 inches in southwestern Kansas and in several counties and parts of counties in northwestern Oklahoma and north-central Kansas through southwestern Nebraska

• Garden City, Kan. reported 4.32 inches

• Most other areas reported 0.10 to 0,.75 inch

• Rain moved through northern Missouri and extreme southern Iowa to central Illinois overnight and early today resulting in 0.40 to nearly 2.00 inches of rain according Doppler Radar estimates

• Most other U.S. Midwest crop areas were dry or mostly dry Friday into this morning

• Showers occurred in the middle and lower Delta, Florida and from southern Georgia to eastern Virginia

• Some locally heavy rain was reported with eastern North Carolina and northeastern South Carolina among the wettest areas with some totals of 1.00 to more than 3.00 inches

• As much as 4.03 inches occurred in eastern North Carolina

• Many Texas crop areas were unaffected by significant rain, although heavy rainfall occurred near the New Mexico border in southwestern parts of the Texas Panhandle

• U.S. Weekend temperatures….

• Were hot in the far western states and in the far south

• Extreme highs in the upper 90s to 105 degrees Fahrenheit were noted from southern Oklahoma to southern Texas

• Extremes of 100 to 119 degrees Fahrenheit were noted in the southwestern desert region while central California’s valleys reached into the lower 100’s

• Pacific Northwest extreme highs were in the upper 90s to 100 including Washington, Oregon and Idaho

• Seasonably mild to cool conditions occurred in the Midwest and northern Plains with many highs in the 70s and lower 80s Friday and upper 70s and lower 80s Saturday

• A few low temperatures in the upper 40s and 50s occurred in the northern Plains and in the 50s and 60s in the Midwest

• August 5-10 will trend warmer in the Plains and western Corn Belt with some potential for hot temperatures over a short period of time.

• Rain is still expected, but less frequently and less significantly in the southwestern Corn Belt and Delta.

• Canada Prairies began warming during the weekend

• Lows Saturday morning were in the middle and upper 30s in western Alberta and in the 40s and lower 50s elsewhere

• Highs warmed into the 70s and lower 80s Fahrenheit Friday and Saturday, but were expected to be warmer today (Sunday) and Monday

• Canada Prairies weekend precipitation was erratic and mostly light impacting areas in far western Saskatchewan and Manitoba most significantly

• Most of the rain was too light to counter evaporation, but a few areas received more than 0.25 inch

• Canada Prairies precipitation in the next ten days will be most limited in the south

• Erratic showers from southern Alberta to central and southern Saskatchewan will not generate enough rain to adequately counter evaporation, but there will be some showers

• Rain totals over for the next ten days will rarely be more than 0.50 inch

• These drier areas include most of the drought-stricken production areas

• Northern and western Alberta, northern Saskatchewan and the northeast half of Manitoba will get a little more significant rain during the next ten days with totals of 0.50 to 1.50 inches and local totals over 2.00 inches

• Canada Prairies Temperatures will be a little warmer than usual this week

• Argentina precipitation will be minimal this week

• Temperatures will be mild with a slight cooler than usual bias in the east

• Precipitation may continue restricted next week and temperatures will remain mild to cool

• Argentina rainfall during the weekend occurred from La Pampa and far southern Cordoba to Buenos Aires with amounts of 0.25 to 0.79 inch resulting

• The moisture was good for wheat establishment

• Brazil weather this week

• Wettest from southern Mato Grosso do Sul into Parana and southern and eastern Sao Paulo where 0.20 to 0.75 inch will result and a few local totals to more than 1.00 inch are expected through Wednesday

• Greater rain will fall in Parana and southern Sao Paulo Thursday into Saturday with another 0.60 to 2.00 inches will result

• Southern Minas Gerais, Rio de Janeiro and parts of southern Espirito Santo will also get a little rain during mid- and late-week, but most of it will be light

• One more wave of rain will impact the same areas noted above during the early to middle part of next week

• Wheat will benefit most from the rain while sugarcane will also benefit to some degree

• Coffee areas will also welcome some of the moisture, but pre-mature flowering might occur if too much rain falls and World Weather, Inc. expects only a few isolated pockets of flowering will result

• Dry and warm weather is expected for the next ten days in center west, northern parts of center south and northeastern Brazil favoring Safrinha corn and cotton harvesting

• Some corn harvest delay is expected in Parana, Sao Paulo and Mato Grosso do Sul because of periodic rain this week, but no negative impact is expected

• Temperatures will be cool in the south and seasonably warm north

• Brazil rain during the weekend occurred in Rio Grande do Sul and Santa Catarina while most other crop areas were dry

• Northeast Mexico rainfall will continue less than usual this week and possibly next week, as well.

• Parts of the region is in a drought impacting unirrigated citrus, corn and sorghum and eastern dry bean production areas

• Western, north-central and southern Mexico will remain favorably moist

• Central America rainfall will continue frequent and sufficient to support crops in the region.

• West-central Africa rainfall has shifted north and will continue periodically through the next two weeks

• The trend is normal and will leave some of the southern coffee, cocoa, sugarcane and rice production areas in Ghana and Ivory Coast in a temporary lull in rainfall that will last a few weeks

• Cotton areas in the north along with other crop areas will benefit greatly from ongoing rainfall

• East-central Africa rain will be greatest in Ethiopia during the next two weeks while erratic rain falls in Kenya and Uganda; Tanzania will be dry

• New Zealand rainfall will be light and erratic this week with seasonable temperatures.

Source: World Weather Inc. and FI

- Thailand on holiday

- EU weekly grain, oilseed import and export data, 10am (3pm London)

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

- EARNINGS: Heineken NV

TUESDAY, JULY 31:

- Cargo surveyors AmSpec, Intertek and SGS release their respective data on Malaysia’s July palm oil exports

- EARNINGS: AGCO Corp., Archer-Daniels-Midland Co.

WEDNESDAY, AUG. 1:

- Switzerland public holiday

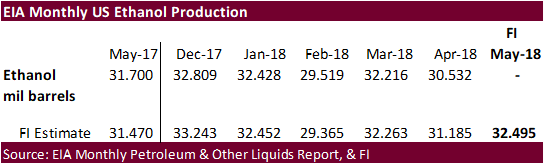

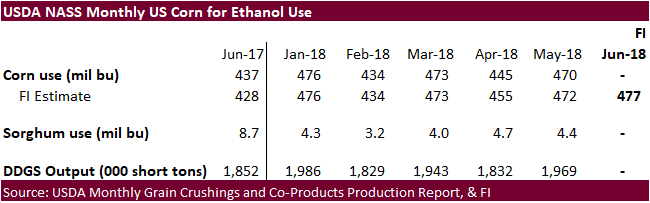

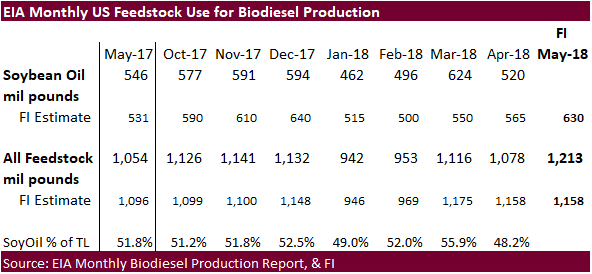

- EIA U.S. weekly ethanol inventories, output, 10:30am

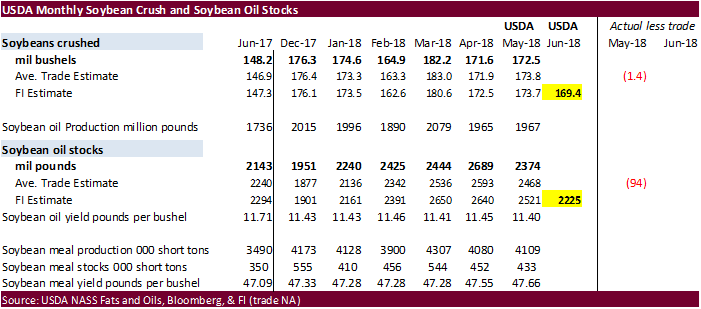

- USDA soybean crush for June, 3pm

- NOTE: Starting this day, the U.S. Agriculture Department ends its decades-long policy of giving crop data to news organizations under embargo in favor of posting reports directly on the web. This could benefit businesses with ability to quickly scan and trade on the figures

THURSDAY, AUG. 2:

- Costa Rica public holiday

- FAO food price index, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Colorado State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August

- EARNINGS: Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY, AUG. 3:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

Source: Bloomberg and FI

FI First Notice Day Delivery Estimates

• Soybeans – Zero

• Soybean Oil – 1000-2000 (about 84% carry), registrations 3,386

• Soybean Meal – 0-150 (more zero)

Registrations

• No changes

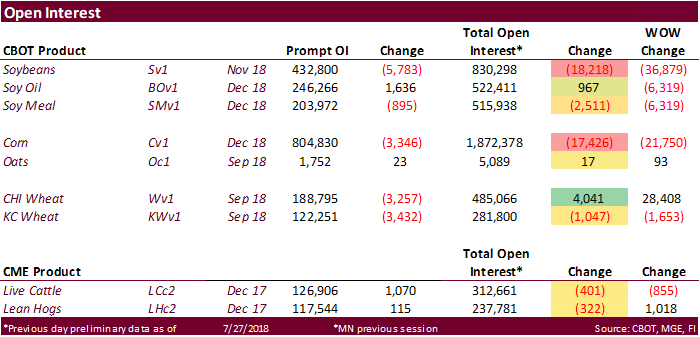

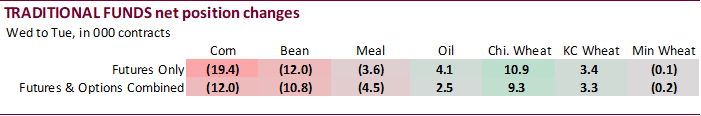

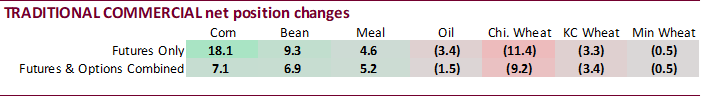

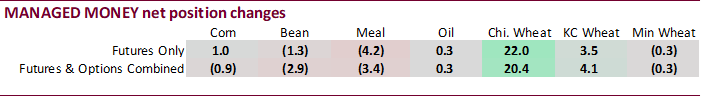

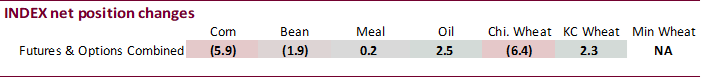

· Traditional funds sold corn, soybeans and meal while they bought wheat and soybean oil.

· Commercials were active on the other side. Producers bought corn and soybeans, and were good sellers of KC wheat. Index funds reduced positions in corn and soybeans.

· The daily estimate of funds position was way off for corn and soybeans.

· As of last Tuesday, funds futures only were net long 71,400 corn, and net short 10,800 soybeans. The trade estimate the funds net long 121,800 corn and net long 15,200 soybeans. The buying for the week ending July 24 was much, much less than expected for soybeans and corn.

· Note the funds futures only net position in corn were net long 71,400 contracts, while futures and options combined in corn are net short 53,400 contracts.

· Commercials in corn for the futures and options combined really turned around their positions since late May when they were net short 245k to current net long 59.7k.

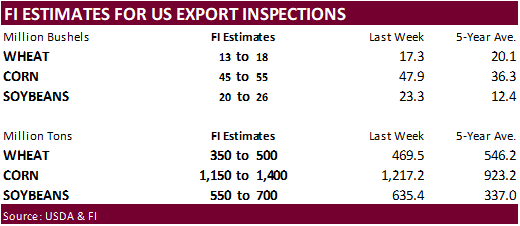

USDA inspections estimates via Reuters

Wheat 300,000-500,000

Corn 1,000,000-1,400,000

Soybeans 500,000-700,000

· US stocks are mixed, USD lower, WTI crude higher, and gold higher, at the time this was written.

· US Pending Home Sales (M/M) Jun: 0.9% (est 0.2%; prev -0.5%)

– Pending Home Sales (Y/Y) Jun: -4.0% (prev -2.8%)

Corn.

- Corn is higher following strength in wheat and US weather concerns starting to build as dry and warmer temperatures are forecast for the US Midwest during the Aug 5-14 period.

- Baltic Dry Index increased 27 points to 1,703 or 1.6%.

- Shipping delays along the Miss River are underpinning freight rates, which lowers the amount producers are paid for cash crops.

- Mexico is looking to buy corn from Argentina.

· South Korea’s KFA bought 67,000 tons of corn, optional origin, at $213.40/ton c&f for arrival around Jan 10.

· China sold about 57.7 million tons of corn out of reserves this season.

· China plans to offer another 8 million tons of corn from state reserves in early August.

Soybean complex.

· Soybeans are sharply higher on renewing US weather concerns, US producer economic relief, and higher soybean meal. Soybean meal/oil spreading is pressuring soybean oil.

· The US Midwest may turn drier during the August 5-14 period.

· USDA Ag Secretary Perdue said about $7-$8 billion of the $12 billion US aid package could start hitting mailboxes as early as late September (around peak of harvest) and $200 million could be allocated to trade missions.

· Strategie Grains lowered their EU rapeseed production outlook by 1.16 million tons from the previous month to 19.95 million, down 9.5 percent from 22.04 million tons in 2017-18. Note the EU rapeseed area is up 1.4 percent to 6.79 million hectares from 2017-18.

· Argentina crushed 3.268 million tons of soybeans in June, down from 3.918 million a year ago and down from 3.672 million in May 2018. January through June Argentina soybean crush was about 18.5 million tons, down from 21.4 million during the same period a year ago.

· Argentina imported 2.95 million tons of soybeans during first half 2018, up from 1.1 million year earlier.

· China September soybean futures +13 yuan per ton or 0.4%,

· China September meal +24 or 0.8%

· China September soybean oil +46 or 0.8%

· China September palm + 22 or 0.5%.

· September China cash crush margins were last running at 44 cents/bu, compared to 48 last week and 66 cents a year ago.

· Rotterdam vegetable oils and SA soybean meal were mixed, as of early morning CT time.

· October Malaysian palm was up 6 to MYR2192, and cash unchanged at $572.50/ton.

· Offshore values were leading soybean oil 5 points lower and meal $1.80/short ton higher.

- Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold 1.031 million tons of soybeans out of reserves so far, this season.

· US wheat futures are sharply higher from ongoing EU crop losses and unfavorable weather across the US PNW/spring wheat production regions, and Canadian southern growing areas.

· Germany’s farming association (DBV) seeks around 1 billion euros to aid producers that have lost 30 percent or more of their crop(s) due to drought/hot temperatures.

· December Paris wheat futures was last 4.50 euros higher at 203.75 euros.

· SovEcon reported Black Sea FOB wheat prices increased $9.00/ton as of late last week and IKAR reported 12.5% Russian wheat from the Black Sea up $12/ton to $223/ton.

· Ukraine’s wheat exports in 2017-18 were 17.2 million tons (July-June), according to UkrAgroConsult, down from 17.5 million tons in 2016-17. Ukraine exported 1.96 million tons of wheat to Egypt and 1.56 million tons to Bangladesh.

· Australia’s New South Wales announced a AUS$500 million drought relief package.

· Iraq’s lowest offer for wheat was $327.77/ton cif, US origin.

· South Korea’s NOFI group seeks 63,000 tons of feed wheat on July 31 for arrival around December 15.

· Algeria seeks at least 50,000 tons of milling wheat on August 1 for October shipment.

· China sold 2,000 tons of 2013 imported wheat at auction from state reserves at 2405 yuan/ton ($352.28/ton), 0.11 percent of wheat was offered.

· Jordan seeks 120,000 tons of hard milling wheat on August 2.

· Jordan seeks 120,000 tons of barley on July 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 1 for arrival by January 31.

· Iraq seeks 50,000 tons of US, Canadian, and/or Australian wheat on July 29, valid until August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

· China sold 38,435 tons of rice at auction from state reserves at 2592 yuan/ton ($379.14/ton), 4.4 percent of wheat was offered.

· Vietnam rice exports fell 16.4 percent from June to 450,000 tons, but year to date exports are up 14.2% to 3.93 million tons.

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.