From: Terry Reilly

Sent: Tuesday, July 31, 2018 8:28:22 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 07/31/18

PDF attached

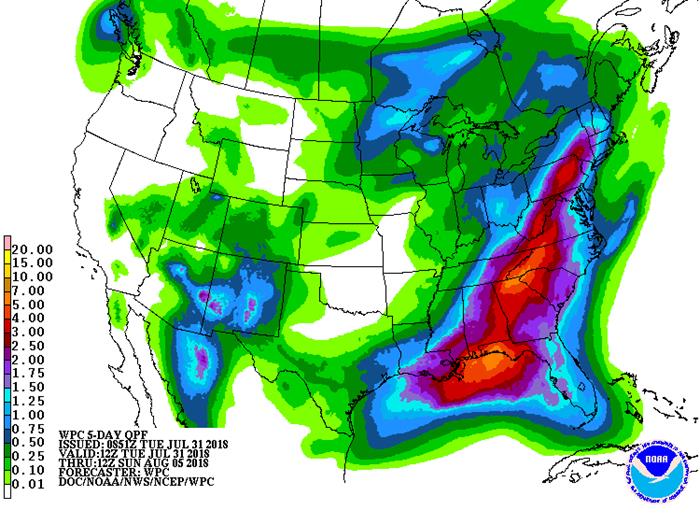

· 6-10 day is warmer for the northern Midwest and 11-15 day is drier for the southeastern Midwest and northern Delta.

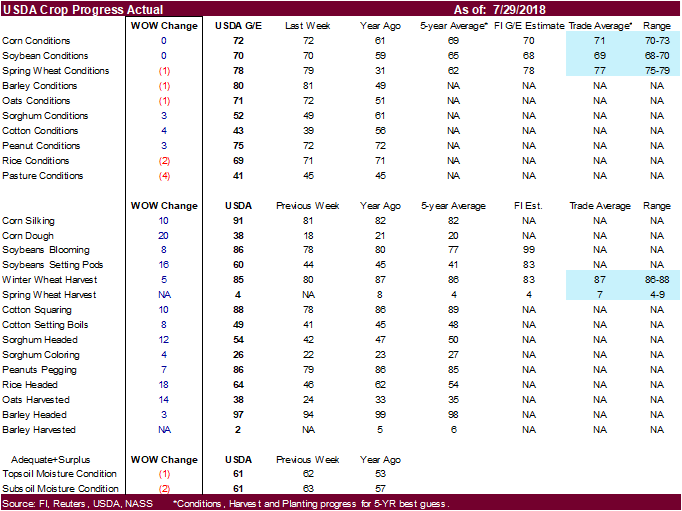

· Crop conditions were a point higher than trade expectations for corn, soybeans, and spring wheat. Winter wheat harvest progress was 85 percent, 2 points below expectations, and spring wheat harvest at 4 percent, 3 below expectations.

· One US main feature to keep an eye on is a ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

· Rainfall between now and August 5 for the Midwest will be very important.

· The US weather outlook is all not that bad. There will be some ongoing dry pockets across the western US and temperatures warn across the WBC this week. Rest of the Midwestern growing areas will see cool temperatures, which should slow evaporation rates.

· Europe’s weather will improve this week but much of the damage is done.

· Southern Russia and parts of Ukraine improved over the past week. Some areas will return to net drying.

· Australia’s canola crop will continue to see crop stress across New South Wales. There is an opportunity for rain across northern New South Wales this week, but it will not be widespread enough to ease drought conditions.

· China’s weather improved late last week, and conditions will overall be favorable.

· Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

· Net drying in the US PNW will add stress to the spring wheat crop.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

and local amts over 2.0”;

central In. wettest;

Mich. driest

Tue-Thu 15-30% daily cvg of

up to 0.50” and locally

more each day; Ia.

to Wisc. wettest

Wed-Sat 15-35% daily cvg of

up to 0.35” and locally

more each day

Fri-Sat 60% cvg of up to 0.75”

and local amts to 1.75”;

far south driest

Sun-Aug 6 50% cvg of up to 0.75”

and local amts to 1.50”;

wettest north

Sun-Aug 7 75% cvg of up to 0.75”

and local amts to 1.75”

Aug 7-9 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 8-10 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 10-12 45% cvg of up to 0.65”

and locally more;

driest SW

Aug 11-12 50% daily cvg of

up to 0.35” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Tue 80% cvg of up to 0.65”

and local amts over 1.50”;

far north driest

Tdy-Wed 90-100% cvg of 0.35-1.50”

and local amts to 2.0” with

lighter rain in a few

locations and some bands

of 2.0-3.50”; driest west

Wed-Thu Up to 15% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Thu-Fri 80% cvg of up to 0.75”

and local amts to 2.0”

Fri-Sat 15-35% daily cvg of

up to 0.40” and locally

more each day;

wettest south

Sat-Aug 7 15-35% daily cvg of

up to 0.40” and locally

more each day

Sun-Aug 7 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 8-10 65% cvg of up to 0.75” 70% cvg of up to 0.75”

and local amts to 1.50” and local amts to 1.75”

Aug 11-13 5-20% daily cvg of up 15-35% daily cvg of

to 0.25” and locally up to 0.50” and locally

more each day more each day

Source: World Weather Inc. and FI

- Cargo surveyors AmSpec, Intertek and SGS release their respective data on Malaysia’s July palm oil exports

- EARNINGS: AGCO Corp., Archer-Daniels-Midland Co.

WEDNESDAY, AUG. 1:

- Switzerland public holiday

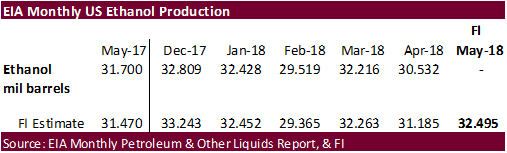

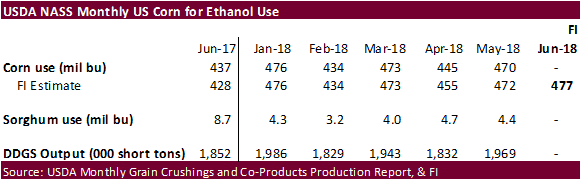

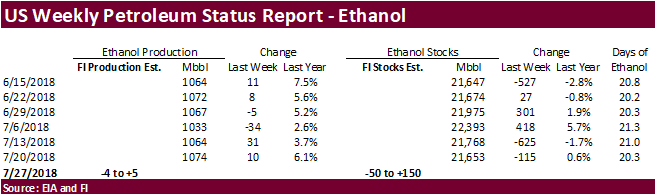

- EIA U.S. weekly ethanol inventories, output, 10:30am

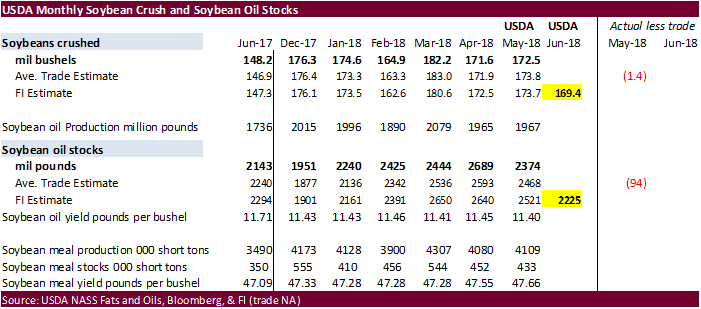

- USDA soybean crush for June, 3pm

- NOTE: Starting this day, the U.S. Agriculture Department ends its decades-long policy of giving crop data to news organizations under embargo in favor of posting reports directly on the web. This could benefit businesses with ability to quickly scan and trade on the figures

THURSDAY, AUG. 2:

- Costa Rica public holiday

- FAO food price index, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Colorado State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August

- EARNINGS: Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY, AUG. 3:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

Source: Bloomberg and FI

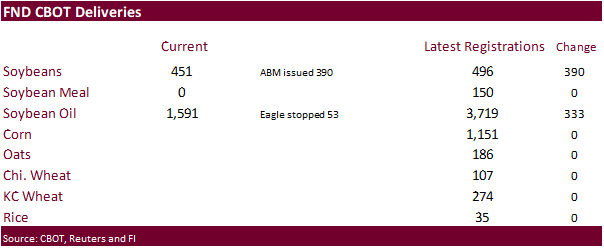

Registrations

• Soybeans up 390 to 496 (CIRM Chicago)

• Soybean oil up 333 to 3719 (MN Soybean Processors – Brewster, MN)

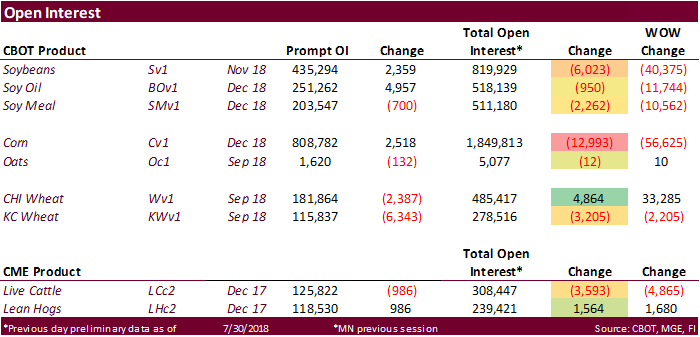

· US stocks are higher, USD higher, WTI crude lower, and gold lower, at the time this was written.

· US Personal Income (Jun): 0.4% (est 0.4%, prev 0.4%)

– US Personal Spending (Jun): 0.4% (est 0.4%, prevR 0.5%)

· CAD GDP (M/M) (May): 0.5% (est 0.3%, prev 0.1%)

– CAD GDP (Y/Y) (May): 2.6% (est 2.3%, prev 2.5%)

· PCE Core (M/M) (Jun): 0.1% (est 0.1%, prev 0.2%)

– PCE Core (Y/Y) (Jun): 1.9% (est 2.0%, prevR 1.9%)

Corn.

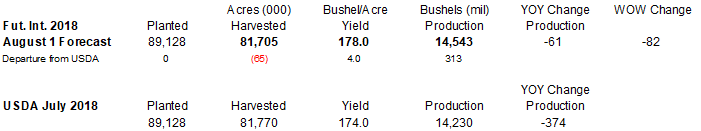

- Corn is higher following strength in wheat and US weather concerns. We lowered our August corn yield by a bushel to 178.0.

- ProAgro increased its Ukraine 2018 corn production estimate to a record 30.9 MMT from 26.9MMT previously, and compares to 24.1 million in 2017.

- AgRural lowered Brazil’s center-south winter corn crop estimate to 53.4MMT from previous 53.6MMT, down from 63.5 million last season. Total winter crop was seen at 56.8MMT versus 57.1MMT previous estimate, compared to 67.4MMT last season.

- Baltic Dry Index increased 44 points to 1,747 or 2.6%.

- Mexico is looking to buy 1 MMT of corn from Argentina.

- US corn conditions were unchanged from the previous week but on our weighted rating it was down 2/10 of a percent to 83.2. We lowered our yield by a bushel to 178.0 and production by 82 million to 14.543 billion, 61 million below last year.

· China sold about 57.7 million tons of corn out of reserves this season.

· China plans to offer another 8 million tons of corn from state reserves in early August.

Soybean complex.

· Soybeans are sharply higher on US weather concerns and higher values outside the US.

· China September soybean futures +14 yuan per ton or 0.4%

· China September meal +30 or 1.0%

· China September soybean oil +13 or 0.3%

· China September palm + 6 or 0.1%

· September China cash crush margins were last running at 53 cents/bu, compared to 44 previous session, 48 last week and 66 cents a year ago.

· Rotterdam vegetable oils were mixed, and SA soybean meal were mixed, as of early morning CT time.

· AmSpec reported palm exports at 1,030,909 tons, down 4 percent from the previous period last month.

· October Malaysian palm was up 2 to MYR2194, and cash down $5.00 at $567.50/ton.

· Palm oil futures are down about 5.7 percent this month.

· Offshore values were leading soybean oil 23 points higher and meal $0.90/short ton higher.

· MATIF Rapeseed looking to take out the contract high close at 374.50 currently sitting at 374.25, but is still well off the contract high trade dating to 5/29 when the opening apparently screamed to 384 though I do not remember that specifically. (MPI)

· Yesterday Strategie Grains lowered their EU rapeseed production outlook by 1.16 million tons from the previous month to 19.95 million, down 9.5 percent from 22.04 million tons in 2017-18. Note the EU rapeseed area is up 1.4 percent to 6.79 million hectares from 2017-18.

· Ukraine’s 2018-19 rapeseed crop was forecast at 2.65 million tons from previous 2.52 million tons, according to UAC, and exports to rise to 2.3 million from 2.28MMT.

· The EU increased soybean meal import commitments by 314,000 tons last week to 1.382 million tons for the July 1-July 29 period, down from 1.744 million tons at this time last year. Soybean import commitments are running at 983,000 tons, down from 1.073 million during July 2017.

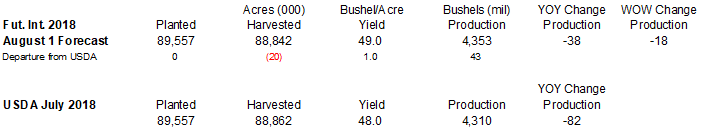

- US soybean conditions were unchanged from the previous week but on our weighted rating it was down 4/10 of a percent to 82.5. We lowered our yield by 0.2/bu to 49.0 and production by 18 million to 4.353 billion, 38 million below last year.

- Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold 1.031 million tons of soybeans out of reserves so far, this season.

· US wheat is sharply higher on follow through buying from global crop concerns.

· December Paris wheat futures was last 1.75 euros higher at 205.75 euros. Contract high is 207.00.

· Black sea wheat basis NOV is 1.50 higher this morning at $240/MT in the only overnight block trade. (MPI)

- ProAgro increased its Ukraine 2018 wheat production estimate to 24.4 MMT from 27.8MMT previously and compares to 26.1 million in 2017.

· Russia’s wheat grain harvest progress is running above this time last year.

· Australia’s New South Wales announced a AUS$500 million drought relief package.

· The EU increased soft wheat commitments by 226,000 tons to 775,000 tons, down from 1.452 million tons at this time last year.

· The Swedish wheat crop could fall 40 percent from 2017 due to drought to 1.7-1.9MMT from 3.2MMT in 2017, according to a farm cooperative.

· Manitoba’s crop report reported “Crops are advancing rapidly with the warm and dry conditions. Rain is needed in most areas to sustain crops and replenish soil moisture.“

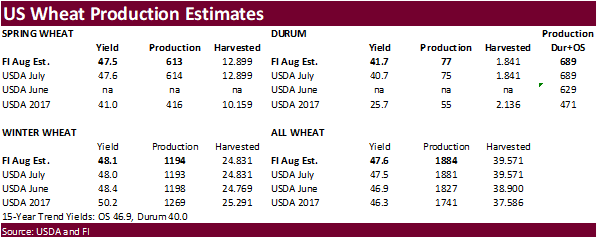

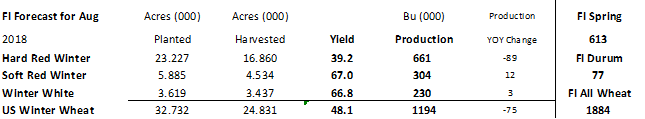

· US spring wheat conditions were down 1 in the G/E conditions to 78. We made a very small adjustment in our spring wheat yield and left durum unchanged from the previous week. Our estimates for the August report as follows:

· South Korea’s NOFI group passed on 63,000 tons of feed wheat for arrival around December 15.

· Jordan passed 120,000 tons of barley.

· China sold 1,202 tons of 2013 imported wheat at auction from state reserves at 2401 yuan/ton ($351.50/ton), 0.07 percent of wheat was offered.

· Japan seeks 140,968 tons of food wheat on Thursday.

· Algeria seeks at least 50,000 tons of milling wheat on August 1 for October shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 1 for arrival by January 31.

· Jordan seeks 120,000 tons of hard milling wheat on August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

· China sold 71,611 tons of rice at auction from state reserves at 2372 yuan/ton ($347.75/ton), 4 percent of wheat was offered.

· Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.