From: Terry Reilly

Sent: Wednesday, August 01, 2018 8:19:06 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/01/18

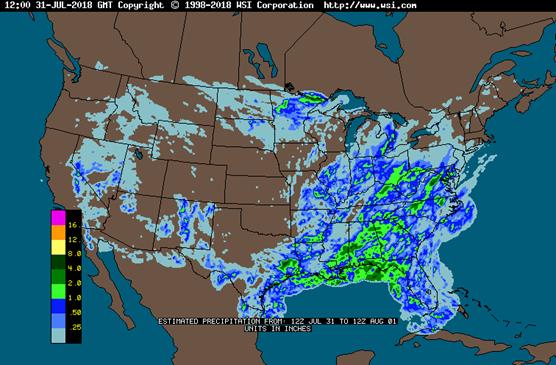

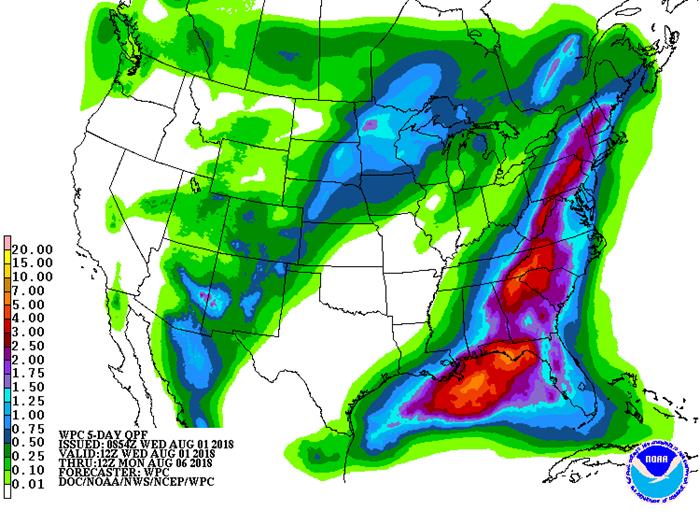

· 6-10 day is wetter in the central and southwestern Midwest and Delta, and drier for the northwestern Midwest and northeastern Great Plains. The 11-15 day is wetter in the southeastern Midwest and southeastern Great Plains and temperatures are slightly cooler in the Great Plains.

· An independent weather forecaster (Skymet) lowered the India monsoon rainfall outlook for 2018. August rainfall was seen at 88 percent of average, and 93 percent in September.

· Australia’s July was the driest since 2002.

· One US main feature to keep an eye on is a ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

· Rainfall between now and August 5 for the Midwest will be very important.

· Before temperatures warm during the second week of August, the US weather outlook is all not that bad. There will be some ongoing dry pockets across the western US and temperatures warn across the WBC this week. Rest of the Midwestern growing areas will see cool temperatures, which should slow evaporation rates.

· Europe’s weather will improve this week but much of the damage is done.

· Southern Russia and parts of Ukraine improved over the past week. Some areas will return to net drying.

· Australia’s canola crop will continue to see crop stress across New South Wales. There is an opportunity for rain across northern New South Wales this week but it will not be widespread enough to ease drought conditions.

· China’s weather improved late last week and conditions will overall be favorable.

· Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

· Net drying in the US PNW will add stress to the spring wheat crop.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

up to 0.50” and locally

more each day; wettest

SE today; Ia. to Wisc.

wettest Wednesday

Wed-Sat 15-35% daily cvg of

up to 0.35” and locally

more each day

Thu 10% cvg of up to 0.20”

and locally more;

wettest NW

Fri-Sun 60% cvg of up to 0.75”

and local amts to 1.75”;

far south driest

Sun-Aug 7 75% cvg of up to 0.65”

and local amts to 1.50”

Mon-Aug 8 5-20% daily cvg of up

to 0.35” and locally

more each day;

wettest north

Aug 8-9 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 9-11 45% cvg of up to 0.65”

and locally more;

driest SW

Aug 10-12 50% cvg of up to 0.65”

and locally more

Aug 12-14 5-20% daily cvg of up

to 0.30” and locally

more each day;

wettest north

Aug 13-14 5-20% daily cvg of up

to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Wed 90-100% cvg of 0.35-1.50”

and local amts to 2.0” with

lighter rain in a few

locations and some bands

of 2.0-3.50”; driest west

Wed-Thu Up to 15% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Thu-Fri 80% cvg of up to 0.75”

and local amts to 2.0”

Fri-Sat 15-35% daily cvg of

up to 0.40” and locally

more each day;

wettest south

Sat-Aug 7 15-35% daily cvg of

up to 0.40” and locally

more each day

Sun-Aug 7 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 8-10 65% cvg of up to 0.75” 70% cvg of up to 0.75”

and local amts to 1.50” and local amts to 1.75”

Aug 11-13 5-20% daily cvg of up 15-35% daily cvg of

to 0.25” and locally up to 0.50” and locally

more each day more each day

Source: World Weather Inc. and FI

- Switzerland public holiday

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA soybean crush for June, 3pm

- NOTE: Starting this day, the U.S. Agriculture Department ends its decades-long policy of giving crop data to news organizations under embargo in favor of posting reports directly on the web. This could benefit businesses with ability to quickly scan and trade on the figures

THURSDAY, AUG. 2:

- Costa Rica public holiday

- FAO food price index, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Colorado State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August

- EARNINGS: Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY, AUG. 3:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

Source: Bloomberg and FI

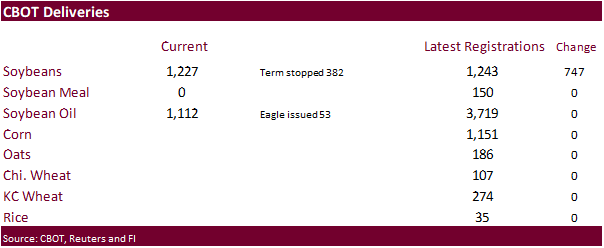

• Soybeans up 747 to 1243 (CIRM Chicago)

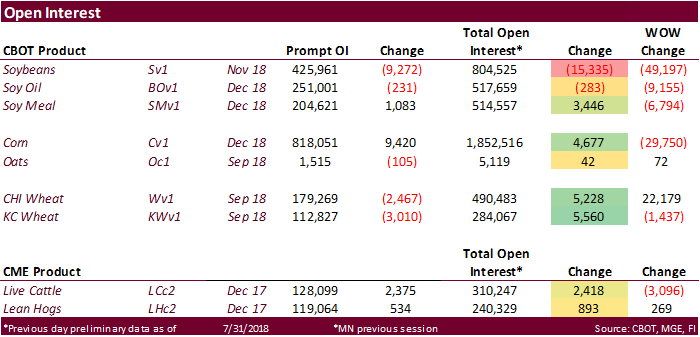

· US stocks are mixed, USD higher, WTI crude lower, and gold lower, at the time this was written.

· ADP Employment Change (Jul): 219K (est 186K, prev 177K)

· ADP Employment Change (Jul): 219K (est 186K, prevR 181K)

Corn.

- Corn is lower on weakness in soybeans.

- Ukraine seeks to secure 500,000 tons of corn from local producers.

- Baltic Dry Index increased 13 points to 1,760 or 0.7%.

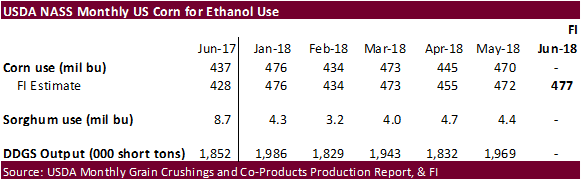

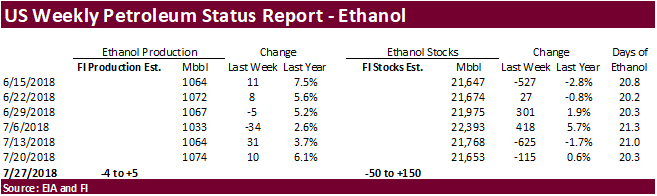

- A Bloomberg survey calls for weekly US ethanol production to decrease 8,000 barrels per day and stocks to increase 132,000 barrels.

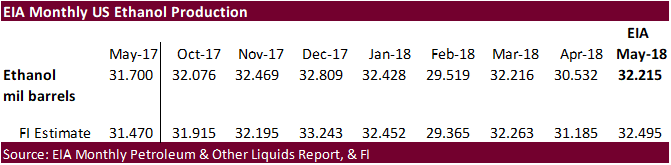

- US ethanol production in May was 32.215 million barrels, slightly below the 32.495 million we were looking for, and compares to 30.532 million in April and 31.700 million in May 2017.

· South Korea’s MFG bought 69,000 tons of corn, optional origin, at $212.90/ton, c&f, for arrival around January 3, 2019.

· China sold about 57.7 million tons of corn out of reserves this season.

· China plans to offer another 8 million tons of corn from state reserves in early August.

Soybean complex.

· Soybeans are lower in a risk off day after China threatened to retaliate if the US adds on additional import tariffs.

· The European Commission said soybean imports from the US tripled after the EU & US reached a trade deal. The EU imported 360,000 tons of US soybeans during the five weeks through July 30, and accounted for about 37% of US market share. EU soymeal imports in July from the US were 185,000 tons, up from about 5,000 tons last year.

· China said they will retaliate, again, if the US increased tariffs on additional products from China. The White House may double its planned tariffs on $200 billion in Chinese imports.

· China September soybean futures -19 yuan per ton or 0.5%

· China September meal -19 or 0.6%

· China September soybean oil -2 or 0.1%

· China September palm – 2 or 0.1%

· September China cash crush margins were last running at 46 cents/bu, compared to 53 previous session, 48 last week and 66 cents a year ago.

· Rotterdam vegetable oils were higher, and SA soybean meal were higher, as of early morning CT time.

· October Malaysian palm was up 18 to MYR2212, and cash up $6.25 at $573.75/ton.

· Offshore values were leading soybean oil 31 points lower and meal $5.00/short ton lower.

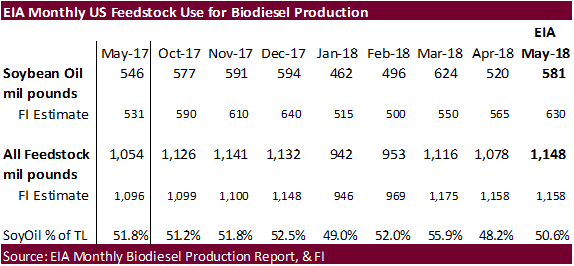

· EIA Monthly US feedstock use for biodiesel production during May was 581 million pounds, well below our estimate of 630 million pounds. All feedstock use totaled 1.148 billion pounds, 10 million below our estimate. Soybean oil for biodiesel was up from 520 million in April and 546 million in May 2017. Soybean oil for biodiesel in May made up of 50.6 percent of the total feedstock, up from 48.2% in April and down from 51.8% in May 2017. U.S. production of biodiesel was 149 million gallons in May 2018, 9 million gallons higher than production in April 2018. We lowered our 2017-18 US soybean oil for biodiesel use by 25 million to 7.000 billion pounds, still 100 million above USDA.

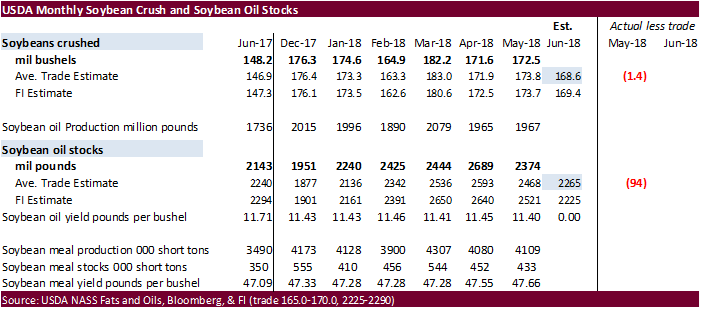

· USDA will update its US crush for June on Wednesday and the trade looks for 168.6 million bushels, up from 172.5 million in May and 148.2 million in June 2017, according to Bloomberg. Reuters is using a 168.8 average. The Bloomberg average for US soybean oil stocks is 2.265 billion, down from 2.468 billion last month.

· China sold 1.054 million tons of soybeans out of reserves so far, this season.

· China failed to sell any soybean oil out of auction. 56,611 tons were offered.

· China sold 4,250 tons of rapeseed oil out of auction from state reserves at an average price of 6,000 yuan per ton, 5.5% of the 76,932 tons offered.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· US wheat is higher on ongoing global crop concerns.

· December Paris wheat futures was last 3.00 euros higher at 207.25 euros. The contract made another high during the session. On a rolling basis, it’s the highest since July 2015.

· German farm cooperative DBV estimated the winter-wheat crop down 25% 18MMT tons from the previous season.

· Australia’s July was the driest since 2002.

Export Developments.

· Results awaited: Algeria seeks at least 50,000 tons of milling wheat on August 1 for October shipment.

- Japan in a SBS import tender bought 18,465 tons of feed wheat and 46,060 tons of barley for arrival by January 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

· China sold 3,739 tons of 2013 imported wheat at auction from state reserves at 2370 yuan/ton ($348.60/ton), 0.22 percent of wheat was offered.

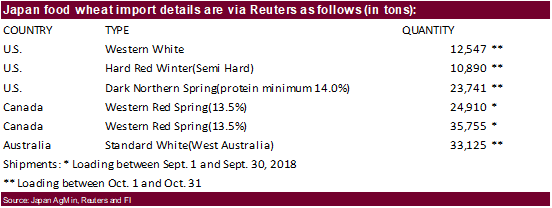

· Japan seeks 140,968 tons of food wheat on Thursday.

· Jordan seeks 120,000 tons of hard milling wheat on August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

· Vietnam sees July rice exports at 382,000 tons.

· Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.