From: Terry Reilly

Sent: Wednesday, September 05, 2018 8:15:17 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/06/18

PDF attached

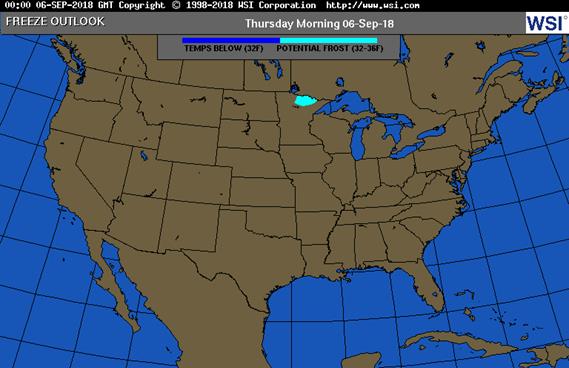

First indication of frost/freeze, that we see, may occur tonight.

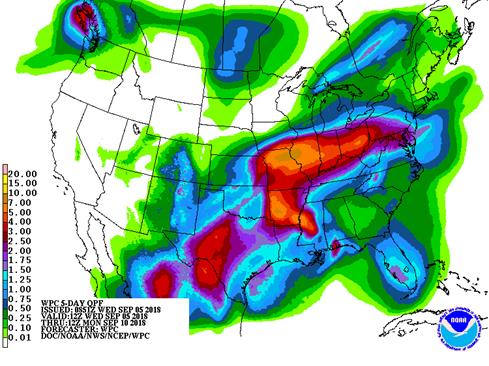

6-10 day is drier for the central and southwestern Midwest and temperatures are warmer in the northern Greta Plains. 11-15 day is wetter for the eastern Midwest and central Delta, and temperatures are slightly cooler in the Midwest.

Selected World Weather bullet points:

- Drought continues in western CIS, but relief is likely for central and southeastern Ukraine Thursday into the weekend with daily showers expected.

- Drought in Canada’s Prairies will prevail through the next ten days

- Eastern Australia will get some additional rainfall in the coming week

- Western Australia will dry out over the next ten days

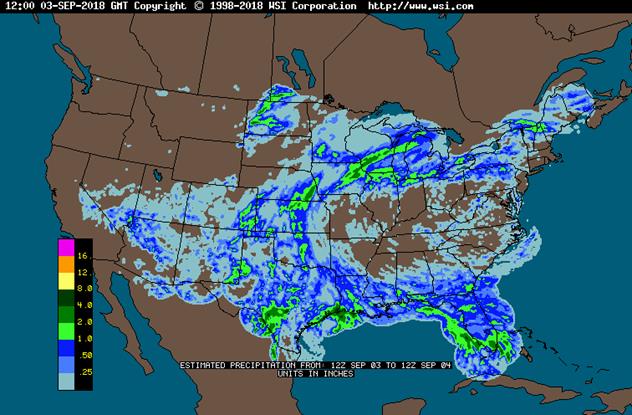

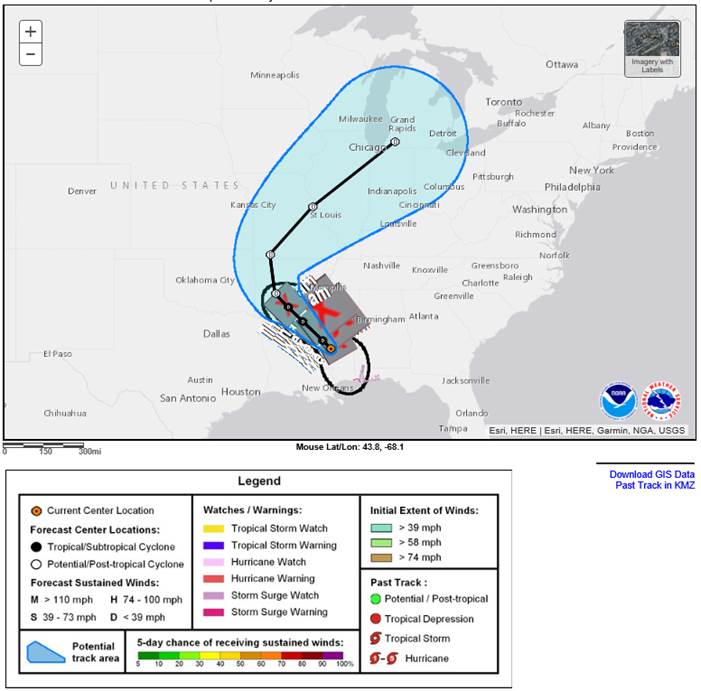

- U.S. wet weather bias will continue this week, but less rain is expected next week. Flooding will raise concern over crop conditions from Kansas and southeastern Nebraska to southern Michigan and northern Ohio.

- Brazil weather will be drier this week until the weekend and early next week when rain returns to the south

- Argentina weather will stay dry into Saturday this week and then may get some light showers Sunday into Tuesday of next week

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Wed 80% cvg of 0.40-2.0”

and local amts over 4.0”

in most areas from east

Neb. and east Ks. to Wi.

with up to 0.40” and

locally more elsewhere

Tdy-Thu 85% cvg of up to 0.75”

and local amts to 1.50”;

wettest west

Thu 20% cvg of up to 0.65”

and local amts to 1.50”;

SE Mo. wettest

Fri-Sat 40% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-4.0”

amts and locally more

in north Mo. and SE

Ia.

Fri-Sun 90-100% cvg of 0.15-1.0”

and local amts to 2.0”

with some 2.0-4.0” amts

and locally more from

central and north Il. to

Mi.

Sun-Sep 11 15-35% daily cvg of

up to 0.50” and locally

more each day;

wettest north

Mon-Sep 13 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Sep 12-14 10-25% daily cvg of

up to 0.30” and locally

more each day;

wettest north

Sep 14-15 10-25% daily cvg of

up to 0.30” and locally

more each day

Sep 15-17 75% cvg of up to 0.75”

and locally more

Sep 16-18 70% cvg of up to 0.75”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Thu 50% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-6.0”

amts from centrl to SE

Ms. and SW Ala.

Wed-Fri 100% cvg of 0.50-2.0”

and local amts over 4.0”

with lighter rain in a

few far north locations;

central areas wettest

Fri-Sat 10-25% daily cvg of

up to 0.30” and locally

more each day

Sat-Mon 90-100% cvg of up to 0.75”

and local amts over 2.0”

Sun-Sep 11 80% cvg of up to 0.75”

and local amts to 1.50”

Sep 11-14 10-25% daily cvg of

up to 0.35” and locally

more each day

Sep 12-14 10-25% daily cvg of

up to 0.35” and locally

more each day

Sep 15-18 Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.30” and locally to 0.30” and locally

more each day more each day

Source: World Weather and FI

WEDNESDAY, SEPT. 5:

- 9th Annual Kingsman Asia Sugar Conference in New Delhi, Sept. 5-6

- Indian Sugar Mills Association President Gaurav Goel, Intl Sugar Organization Executive Director Jose Orive due to speak

- Rabobank 2019 market outlook seminar in Kuala Lumpur

- Projections include palm oil, soy; Global Head of Financial Markets Research Jan Lambregts, analyst Oscar Tjakra due to speak

- UN Climate Change Conference in Bangkok, Day 2

- Intl Rubber Glove Conference in Kuala Lumpur, Day 2

THURSDAY, SEPT. 6:

- Trump administration awaits Sept. 6 end of public comment period before it potentially proceeds with next round of tariffs on $200b Chinese goods; China expected to retaliate

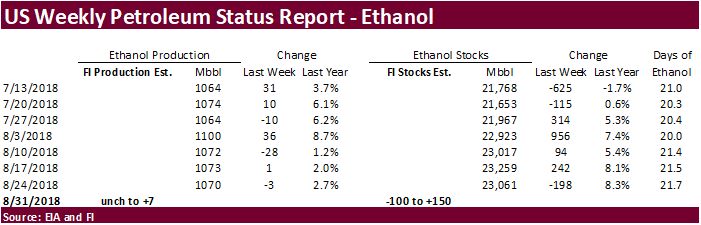

- EIA U.S. weekly ethanol inventories, output, 11am (delayed from Wednesday because of Labor Day holiday)

- Statistics Canada’s domestic crop stockpile report for July, 8:30am ET

- FAO Food Price Index for August, 4am

- The Russian Grain Union hosts conference in Moscow

- Agriculture Ministry’s director for food markets Anatoly Kutsenko, director of crop department Pyotr Chekmarev expected to attend

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- UN Climate Change Conference in Bangkok, Day 3

- Kingsman Asia Sugar Conference in New Delhi, final day

- Intl Rubber Glove Conference in Kuala Lumpur, final day

FRIDAY, SEPT. 7:

- Brazil on public holiday

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday because of Labor Day holiday)

- Guatemala’s National Coffee Association’s export data for August

- FranceAgriMer weekly updates on French crop conditions

- UN Climate Change Conference in Bangkok, Day 4

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SATURDAY, SEPT. 8:

- China’s General Administration of Customs releases agricultural commodity trade data for August (preliminary), including soybean imports

- UN Climate Change Conference in Bangkok, Day 5

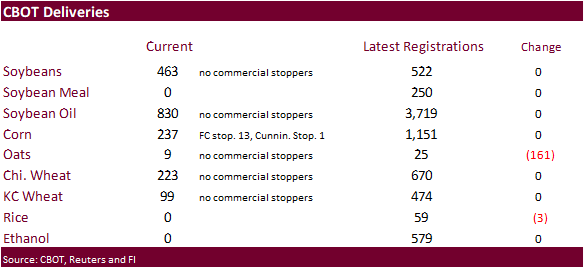

- Oats down 161 to 25

- Rice down 3 to 59

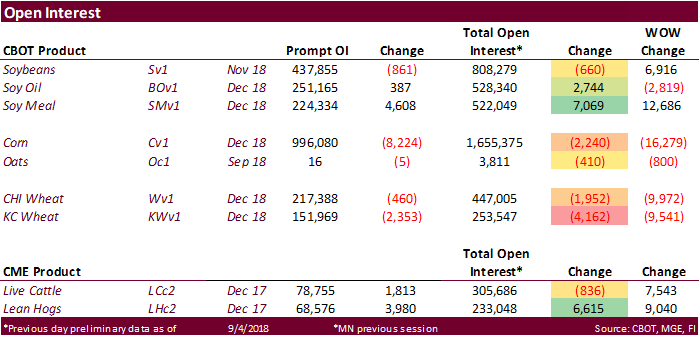

・ US stocks are lower, USD lower, WTI crude lower, and gold higher, at the time this was written.

・ US International Trade Balance (USD) Jul: -50.1B (est -50.3B; prev R -45.7B)

・ Canadian Trade Balance (CAD) Jul: -0.11B (est -1.13B; prev R -0.74B)

・ Canada Total Crude Oil Imports Rose 96K Bpd To 611K Bpd In July (Vs 515K Bpd In June)

– Total Crude Oil Exports Fell 70K Bpd To 3.52M Bpd In July (Vs 3.59M Bpd In June)

– Crude Oil Imports From US Rose 103K Bpd To 393K Bpd In July (Vs 290K Bpd In June)

– Crude Oil Exports To US Fell 210K Bpd To 3.33M Bpd In July (Vs 3.54M Bpd In June)

Corn.

- Corn prices eased Wednesday after hitting a two-week high on Tuesday. WTI crude oil is sharply lower. Traders are anticipating some deterioration in US crop quality this week from heavy rainfall across the Delta and Midwest. Price declines should be limited.

・ Look for US harvest progress to slow this week especially across the Delta and lower Midwest.

・ Baltic Dry Index is last 1,477, down 36 points or 2.4% from last session.

- We hear Informa is due out Thursday.

- USDA US corn export inspections as of August 30, 2018 were 1,334,565 tons, above a range of trade expectations, above 1,264,787 tons previous week and compares to 828,036 tons year ago. Major countries included Mexico for 423,316 tons, Japan for 345,103 tons, and Korea Rep for 137,516 tons.

- 9th outbreak confirmed. China reported African swine fever outbreak in Jiamusi city in northeast Heilongjiang province, killing 12 pigs and infected another 39 animals.

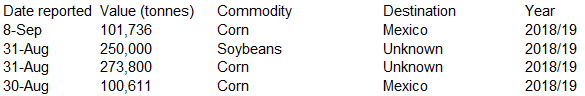

・ Under the 24-hour reporting system, USDA reported private exporters sold 101,736 tons of corn for delivery to Mexico during the 2018-19 marketing year.

・ China sold about 71 million tons of corn out of reserves this season. Another 8 million tons of China corn reserves will be offered next week.

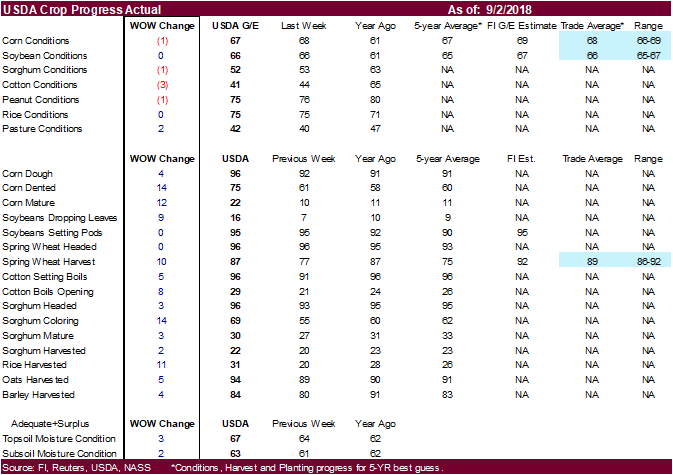

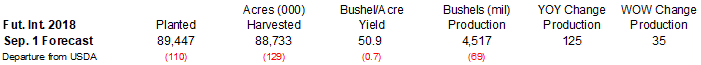

USDA crop progress. Corn conditions decreased one point to 67 for the combined good/excellent categories. Trader were looking for unchanged. Corn harvesting will be reported next week. For the purpose of the September USDA report, we are using 175.5 bu/ac, unchanged from the previous week.

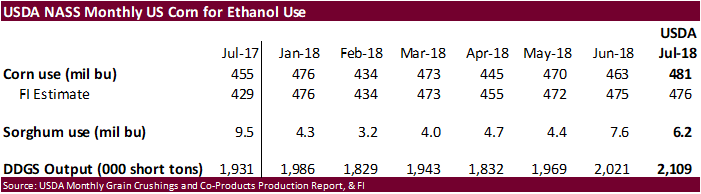

USDA reported July corn for ethanol production at 481 million bushels, above our expectations, above 463 million last month and 455 million bushels in July 2017. Sorghum use ended up at 6.2 million bushels, below 9.5 million in July 2017. DDGS production increased to 2.109 million short tons from 2.021 million in June and above 1.931 million short tons in July 2017. We are using 5.603 billion bushels for corn for ethanol usage during 2017-18, 3 million bushels above USDA.

Soybean complex.

- The soybean complex is lower as traders access heavy Midwestern rainfall. The USDA combined good/excellent rating for soybeans was unchanged from the previous week at 66 percent.

・ Look for US harvest progress to slow this week especially across the Delta and lower Midwest.

・ Weaker mineral oil pressured Malaysian palm oil overnight.

・ MPOB is due out September 12. Reuters poll estimated August end-stocks may increase 9 percent month-on-month to 2.41 million tons and production rising 9.9 percent to 1.65 million tons. August exports are seen up 2.3 percent to 1.23 million tons from the previous month.

・ Canada’s PM Justin Trudeau said he will not back down to the US when they resume NAFTA talks.

・ Malaysia futures traded 7 lower and cash was down $3.75/ton.

・ Rotterdam oils were higher and SA soybean meal when imported into Rotterdam $2-11/ton higher.

・ Offshore values were suggesting a higher lead for US soybean meal by $1.10 and higher lead for soybean oil by 8 points.

- USDA US soybean export inspections as of August 30, 2018 were 769,357 tons, within a range of trade expectations, below 907,945 tons previous week and compares to 712,121 tons year ago. Major countries included Spain for 120,486 tons, China T for 78,374 tons, and China Main for 65,999 tons.

・ Argentina started talks with the IMF for part of a $50 billion standby loan.

・ The USDA Attaché estimates a higher 2018-19 Argentina (2019-20 local crop-year) soybean production estimate than USDA official by 1.5MMT. 2018-19 ending stocks are projected over 13 million tons, high in our opinion.

・ Indiana sent their producers an update on the 50%, commodity payment assistance USDA rolled out. Producers will have to wait until production ended. Indiana FSA Update: USDA Launches Trade Mitigation Programs https://content.govdelivery.com/accounts/USFSA/bulletins/20ada0d

- China sold 33,748 tons of 2013 soybean at auction at an average price of 3,002 yuan ($438.72) per ton, 31.25 percent of total soybean available for the auction.

- China sold about 1.69 MMT of soybeans out of reserves this season.

- China failed to sell any of the 29,245 tons of soyoil and 18,151 tons of rapeseed oil offered at auction.

・ China plans to suspend rapeseed oil sales from reserves on September 10. The remaining stocks of imported rapeseed and soybean oil will be auction off through September 6.

・ Results awaited: South Korea seeks 15,000 tons of non-GMO soybeans on September 4 for Nov/Dec arrival.

- Results awaited: USDA seeks 5,000 tons of refined oil for the export program on September 5 for October shipment.

- Iran seeks 30,000 tons of sunflower oil on September 24.

USDA crop progress. Soybean conditions were unchanged at 66 for the combined good/excellent categories. Trader were looking for unchanged. Soybean harvesting should be reported in two weeks. We are using 50.9 bu/ac for the purpose of the USDA report, 0.7/bu below USDA August.

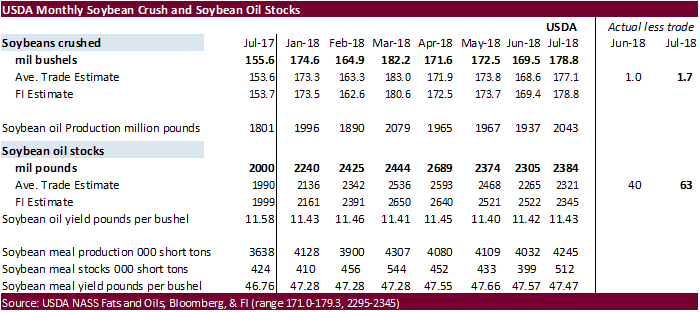

USDA reported July soybean crush at 178.8 million bushels, 1.7 million bushels above a Bloomberg trade guess, above 169.5 million in June, and well above 155.6 million a year earlier. We are using 2.058 billion bushels for the 2017-18 US crush, above USDA’s 2.040 billion estimate. On a product year basis, the crush is pegged at 2.072 billion bushels, above 2.050 billion USDA projected in August. End of July soybean oil stocks were reported at 2.384 billion pounds, up from 2.305 billion at the end of June and above 2.000 billion at the end of July 2017. USDA end of July soybean meal stocks were a high 512,000 short tons, up from 399,000 short tons for June and 412,000 short tons a year earlier.

Wheat

・ Australia’s Bureau of Meteorology mentioned the drought across eastern has intensified and forecast it will continue to experience dry weather for at least the next three months.

- US Wheat Associates (USW) will soon close its office in Moscow after 26 years. They closed their office in Egypt late last year.

- USDA US all-wheat export inspections as of August 30, 2018 were 391,920 tons, within a range of trade expectations, below 488,750 tons previous week and compares to 291,266 tons year ago. Major countries included Mexico for 90,923 tons, Philippines for 66,102 tons, and Indonesia for 39,474 tons.

- US spring wheat harvesting progress was reported at 87 percent complete, 2 points below expectations, and compare to 87 percent a year ago and 75 percent average.

・ Egypt’s GASC seeks wheat for October 21-30 shipment and lowest offer is $217.90 for Russian wheat.

・ Jordan bought 60,000 tons of wheat at $257.00/ton.

- Japan in a SBS import tender bought 9,500 tons of feed wheat and passed on barley for arrival by late February.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 12 for arrival by late February.

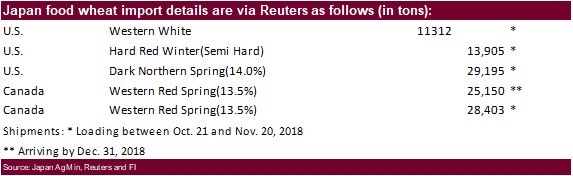

・ Japan bought 107,965 tons of food wheat. Original details as follows:

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

Rice/Other

・ The Philippines seeks an extra 250k tons of rice for Q4 and Q1 2019 shipment.

・ Results awaited: South Korea seeks 92,783 tons of rice on Aug. 31 for Nov/Dec arrival.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

10,000 Brown medium Nov 30/Gwangyang

10,000 Brown medium Dec 31/Busan

20,000 Brown medium Dec 31/Gunsan

20,000 Brown medium Dec 31/Mokpo

20,000 Brown medium Dec 31/Donghae

12,783 Brown long Nov 30/Masan

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.