From: Terry Reilly

Sent: Thursday, August 09, 2018 8:17:41 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/09/18

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Sun 5-20% daily cvg of up

to 0.30” and locally

more each day

Thu-Sat 20-40% daily cvg of

up to 0.40” and locally

more each day

Sun-Mon 10-25% daily cvg of

up to 0.25” and locally

more each day

Mon-Tue 25% cvg of up to 0.60”

and local amts to 1.30”;

far south wettest

Tue-Aug 15 50% cvg of up to 0.60”

and local amts to 1.30”;

wettest south

Aug 15-17 60% cvg of up to 0.70”

and local amts to 1.40”;

far NW driest

Aug 16-18 75% cvg of up to 0.75”

and local amts to 1.50”

Aug 18-20 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 19-21 10-25% daily cvg of

up to 0.25” and locally

more each day

Aug 21-22 60% cvg of up to 0.65”

and locally more

Aug 22-23 65% cvg of up to 0.65”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri 50% cvg of up to 0.75”

and local amts to 2.0”;

east Ms. and Ala.

wettest

Thu-Fri 85% cvg of up to 0.75”

and local amts to 1.50”

Sat-Mon 80% cvg of up to 0.75”

and local amts to 2.0”;

driest west

Sat-Sun 20-40% daily cvg of

up to 0.50” and locally

more each day

Mon-Aug 16 5-20% daily cvg of up

to 0.25” and locally

more each day

Tue-Aug 16 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 17-20 10-25% daily cvg of 10-25% daily cvg of

up to 0.35” and locally up to 0.35” and locally

more each day more each day

Aug 21-22 5-20% daily cvg of up 5-20% daily cvg of up

to 0.30” and locally to 0.30” and locally

more each day more each day

Source: World Weather and FI

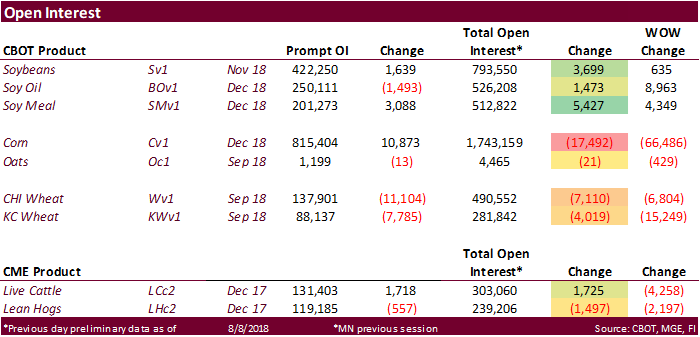

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Brazil’s crop agency Conab updates its forecast on 2017-18 grain and oilseed crop, 8am ET (9am Sao Paulo)

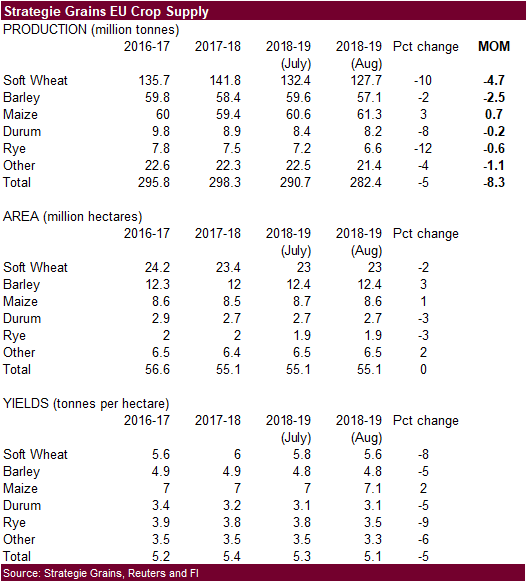

- Strategie Grains monthly report on European market outlook

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: BayWa

FRIDAY, AUG. 10:

- USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for August, noon

- China’s Ministry of Agriculture publishes China Agricultural Supply & Demand Estimates (CASDE) report

- Malaysian Palm Oil Board (MPOB) releases data on palm oil stockpiles, exports, production as of end-July, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-10 palm oil exports, 11pm ET Thursday (11am Kuala Lumpur Friday)

- SGS data during same period, 3am ET Friday (3pm Kuala Lumpur Friday)

- Unica’s bi- weekly Brazil Center-South sugar output, 9am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: BRF

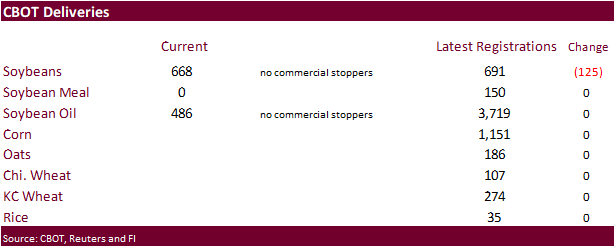

- Soybeans down 125 to 691. Cofco Chicago

· US stocks are higher, USD higher, WTI crude higher, and gold higher, at the time this was written.

· Canada New Housing Price Index (M/M) Jun: 0.1% (est 0.1%, prev 0.0%)

Canada New Housing Price Index (Y/Y) Jun: 0.8% (est 0.8%, prev 0.9%)

· US Initial Jobless Claims (Aug 4): 213K (est 220K, prevR 219K)

· US Continuing Claims (Jul 28): 1755K (est 1730K, prevR 1726K)

· PPI Final Demand (M/M) (Jul): 0.0% (est 0.2%, prev 0.3%)

– PPI Ex Food And Energy (M/M) (Jul): 0.1% (est 0.2%, prev 0.3%)

– PPI Ex Food, Energy Trade (M/M (Jul): 0.3% (est 0.2%, prev 0.3%)

– PPI Final Demand (Y/Y) (Jul):3.3% (est 3.4%, prev 3.4%)

– PPI Ex Food And Energy (Y/Y) (Jul): 2.7% (est 2.8%, prev 2.8%)

– PPI Ex Food, Energy, Trade (Y/Y) (Jul): 2.8% (prev 2.7%)

· US Producer Price Index News Release summary – Full Report

The Producer Price Index for final demand was unchanged in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.3 percent in June and 0.5 percent in May. (See table A.) On an unadjusted basis, the final demand index increased 3.3 percent for the 12 months ended in July.

Corn.

- Corn is higher on good global demand.

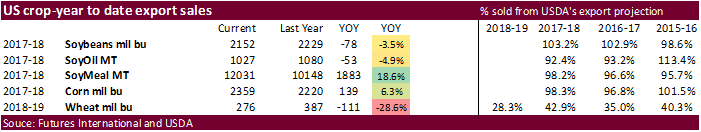

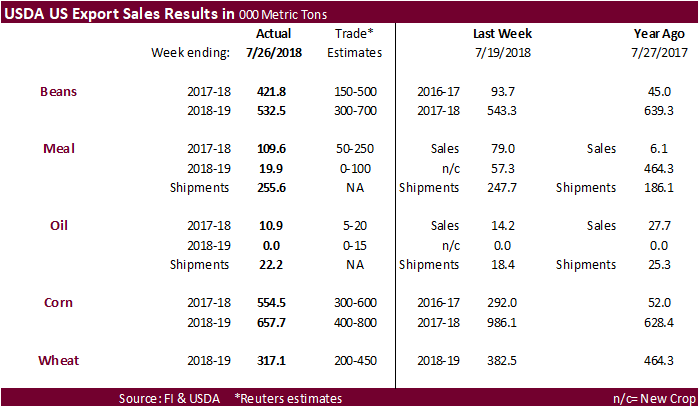

- USDA export sales were within expectations for old and new-crop.

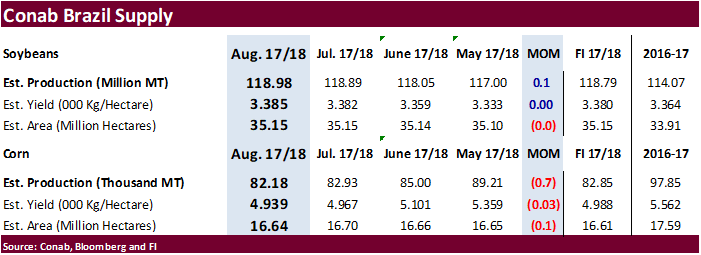

- Conab reported the 2017-18 Brazil corn crop at 82.18 million tons, down 700,000 tons from the previous month.

- USDA is due out Friday with updated S&D’s and their initial surveys on corn and soybean production for the US. If we are correct on our US corn supply and ending stocks estimates for US corn, and are right on our soybean estimates, we look for soybean/corn spreading post USDA report.

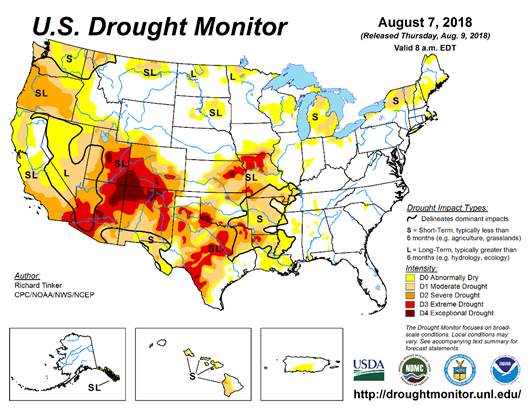

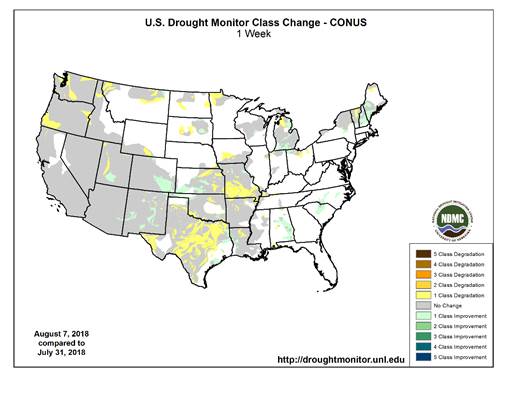

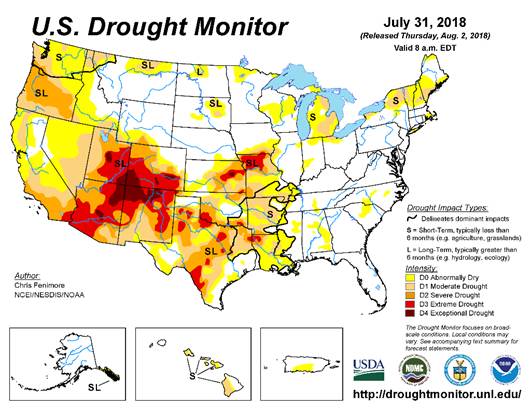

- The US WCB will trend drier over the next 10 days while much of the ECB will be wetter than normal.

- Baltic Dry Index fell 0.6 percent to 1694 points.

- Today was day 3 of the Goldman Roll.

· The USDA Broiler report showed eggs set up 1 percent and chicks placed up slightly. Cumulative placements from the week ending January 6, 2018 through August 4, 2018 for the United States were 5.70 billion. Cumulative placements were up 2 percent from the same period a year earlier.

· US ethanol production was up 36,000 barrels per day to 1.100 million barrels, second largest in our weekly history, behind 1.108 million for the week ending 12/1/17. Traders were looking for a slight increase.

· US ethanol stocks increased 956,000 barrels to 22.923 million, highest since 3/16/18. Traders were looking for a small increase in stocks.

· September 2017 through August 3, 2018 US ethanol production is running 2.9% above the same period a year ago.

· We are using 5.635 billion bushels for corn for ethanol usage, above USDA’s 5.600 current estimate for 2017-18, and for 2018-19 we are at 5.750 billion, 125 million above USDA.

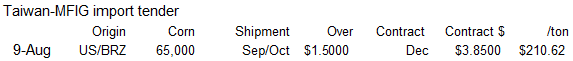

· South Korea’s MFG group bought 68,000 tons of corn, optional origin, at $210.39/ton for arrival around mid-Jan.

· South Korea’s NOFI group passed on 69,000 tons of corn, optional origin. Lowest price was $213.88/ton for LH Jan arrival.

· Taiwan’s MFIG bought 65,000 tons of optional origin corn from the US or Brazil at 150 cents over the December contract for shipment between October 21 and November 9, later if from the US PNW.

· China sold 1.176,420 tons of corn at auction at an average price of 1541 yuan/ton ($225.93/ton), 29.5% of what was offered.

· China sold about 60.6 million tons of corn out of reserves this season.

· Another 4 million tons will be offered on Friday.

Soybean complex.

· Soybeans are mixed at the electronic close. Look for a two-sided trade. US exporters reported 135k soybean meal was sold to the Philippines.

· USDA export sales were on the low side for the products. Soybean export sales on a combined basis were ok. Shipments of soybeans topped 1 million tons and were above USDA export inspections.

- Conab reported the 2017-18 Brazil soybean crop at 118.98 million tons, up 100,000 tons from the previous month.

· USDA’s US August Crop Production and S&D’s are due out Friday. If we are correct on our US ending stocks estimates for soybeans and corn, soybeans could be friendly after the release of the report and gain on corn.

· Brazil is offering soybeans through mid-November.

· China cash margins improved this week to 89 cents/bu on our analysis, up from 42 cents late last week.

· China’s soybean complex traded higher led by a 2.1% increase in soybean meal and 1.7% increase in soybeans.

· Offshore values were suggesting a higher lead for US soybean meal by $0.50 and higher lead for soybean oil by 31 points.

· Malaysian palm was lower overnight by 12 ringgit and leading SBO 5 points higher.

· Rotterdam meal was higher and Rotterdam oils higher.

- Under the 24-hour announcement system, US exporters sold 135k soybean meal to the Philippines for 2018-19 delivery.

· We are hearing China bought 5 cargoes of soybeans out of Brazil for October and Vietnam has been in for Argentina soybean meal.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- Results awaited: South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- Results awaited: USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- China sold 1.091 million tons of soybeans out of reserves so far, this season.

· US wheat futures are lower following a decline in Matif and selling ahead of the US report due out on Friday.

· USDA export sales were within expectations.

· FranceAgriMer reported the average protein content for 11.5 percent soft wheat was above average.

o Test weights, another important measure of milling quality, were above 76 kg per hectolitre (hl) in all regions and often above 77 kg/hl

o Winter and spring malting barley were showing good protein and calibration results

o Durum wheat was showing good protein levels but varied results for other criteria including test weights (Reuters)

· APK-Inform noted Ukraine may have an opportunity to export grain to Saudi Arabia. Poor weather in Germany and Poland and Canada’s political dispute with the country could open the door for other exporters.

· India’s government approved to release 3.5 million tons of pulses to states for welfare schemes.

· Denmark’s grain crop could decline 40 percent from average from drought.

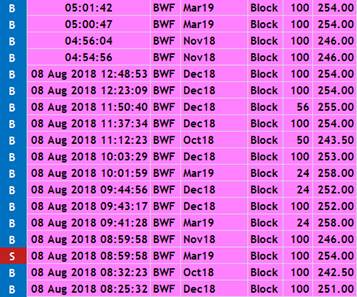

BLACK SEA WEDNESDAY/THURSDAY MORNING BLOCKS

*MARCH SETTLED 258 AND ITS BLOCKED THIS MORNING @ 254, THOUGH EARLIER NOV WASBLOCKED @ SETTLE PRICE

· South Korea’s NOFI group bought 63,000 tons of feed wheat, optional origin, at $256.55/ton for late Oct., or Nov/Dec shipment.

· Results awaited: Three offers. Jordan issued an import tender for 120,000 tons of hard milling wheat on August 9.

· China sold 3,000 tons of imported wheat at auction at an average price of 2327 yuan/ton ($340.85/ton), 0.2% of what was offered.

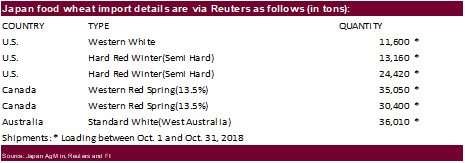

· Japan bought 150,640 tons of milling wheat.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

· Results awaited: Jordan issued an import tender for 120,000 tons of feed barley on August 8.

Rice/Other

· Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.